In an unprecedented move, a cryptocurrency whale has injected a whopping $10.4 million into Pepe (PEPE) tokens. This big investment, which is taking place in the midst of increased market activity, has prompted intense conjecture about the future course of this cryptocurrency that was inspired by memes.

The striking transaction was originally made public by the well-known cryptocurrency monitoring site Spot On Chain, which provided information via X about a multisignature wallet with the code 0x323, which was used to withdraw a staggering 915.85 billion PEPE tokens from the Binance exchange.

This inaugural withdrawal, which was valued at about $7.75 million, was made at a cost of $0.000008466 per token. Surprisingly, in just two days, the same wallet managed to arrange for more withdrawals from the centralized exchange (CEX) totaling 1.238 trillion PEPE tokens, which resulted in the historic PEPE deal of $10.4 million.

A multisign wallet 0x323 withdrew 915.85B $PEPE ($7.75M) from #Binance at $0.000008466 ~ 10 mins ago.

In the past 28 hours, the wallet has withdrawn 1.238T $PEPE ($10.4M) from the CEX for the first $PEPE trade.

Set the alerts for the wallet via our @spotonchain platform at… pic.twitter.com/tcmCKxqMdn

— Spot On Chain (@spotonchain) May 5, 2024

PEPE sees positive market development

This large investment coincides with a wave of growing excitement about Pepe’s performance in the market. Though it has dropped by a little 1.2% in the last day, memecoin has proven to be incredibly resilient, having increased by an astounding 29.70% in the previous 30 days.

Pepe is presently trading at $0.000008532, which supports this positive mood even more according to technical indicators. Notably, the memecoin’s price trend continues to comfortably hover above the 50-day Simple Moving Average (SMA), bolstering investor confidence. Meanwhile, the Relative Strength Index (RSI) sits at a robust 62.78, indicating neutral sentiment among traders.

The investment in Pepe is indicative of a larger trend of increased interest in alternative cryptocurrencies, especially ones with vibrant communities and meme-centric appeal. With its unique frog-themed branding, Pepe has garnered a devoted fan base inside the ecosystem. Fans credit its success to its status as a meme and active community involvement.

Analysts in the industry surmise that investors could be taking advantage of memecoins like Pepe to diversify their holdings and profit from new market movements, even though the identity and intentions of the whale driving this enormous investment are still unknown.

As cryptocurrencies continue to gain traction in the public eye, investment in non-traditional assets such as PEPE coin may indicate a more general trend towards market acceptance and adoption. The noteworthy increase in Pepe’s value, together with the substantial interest from investors, highlights the changing nature of digital assets.

It remains to be seen if Pepe’s newly found momentum will result in further growth or run into difficulties along the road. Still, everyone’s eyes are glued to the mysterious whale and Pepe’s next moves in the volatile cryptocurrency market.

As Bitcoin transacts $1B, what comes next for scalability?

By performing its one billionth transaction, Bitcoin (BTC), the biggest cryptocurrency by market capitalization, has achieved a noteworthy milestone. This accomplishment demonstrates how active and widely accepted Bitcoin is in spite of the volatile market conditions.

The future of Bitcoin following 1 billion transactions

On-chain data verified this momentous occasion for Bitcoin. According to the Clark Moody dashboard, there have been 1,000,193,647 transactions on the Bitcoin network overall. Furthermore, Swan data shows that at block height of 842,241, the 1 billion transaction milestone was reached.

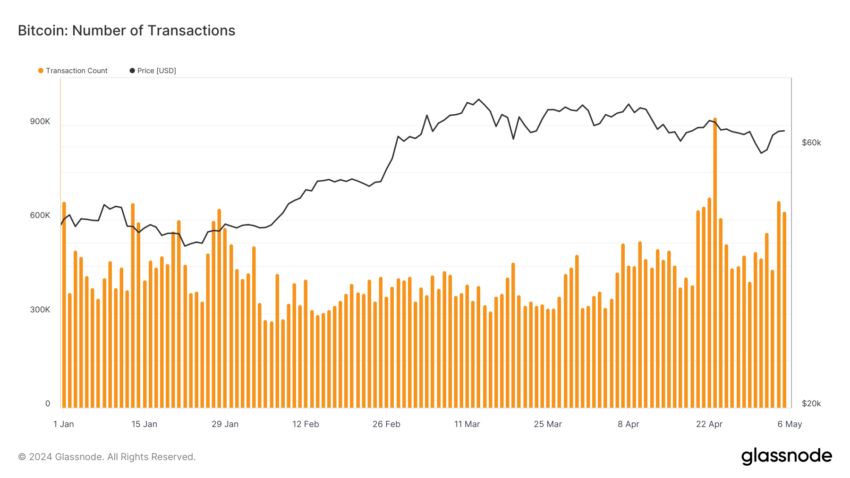

According to current data from Glassnode, April 23 will have seen the most Bitcoin transactions of 2024 thus far. When Bitcoin was trading at $66,403, 926,842 transactions were registered on that day. On the other hand, there were 625,859 transactions the day before, and Bitcoin was trading for about $64,000.

Even with this achievement, there is still debate over how scalable Bitcoin can be. Colin Talks Crypto, a crypto analyst, offered his observations. He observes that as Bitcoin grows, the difficulties and possible scalability problems still exist.

According to his prediction, there may be a “euphoric blow off tops” in the price of Bitcoin, which would cause severe congestion and a sharp rise in transaction costs. In such cases, many people could find it too expensive to transact. In more than 90% of Bitcoin addresses, fees might be greater than the sum, rendering these balances practically unspendable.

“It could also mean weeks or even months of waiting for the backlog of transactions to clear from the mempool. This is when I think things have a chance of changing. […] Only when congestion and fees have gotten bad enough that most people are priced out of using the system, will there be enough outcry to finally increase the block size. In my opinion, it could take things getting worse than the 2015-2017 transaction backlog and high fees to cause the shift,” Colin added.

Colin’s viewpoint sheds light on a crucial discussion between “big blockers” and “small blockers” within the Bitcoin community. The major blockers support increasing the block size in order to accommodate more transactions and lower costs. On the other hand, the latter oppose these modifications and prioritize preserving security and decentralization.

In addition, Colin questions the Lightning Network’s efficacy as a suggested remedy for Bitcoin’s scalability problems. He contends that it doesn’t deal with fundamental problems.

The community continues to disagree on the right course of action as Bitcoin works through these difficulties. Some contend that substantial protocol modifications are necessary to improve scalability, while others think that the present infrastructure—which includes additional layers like the Lightning Network—will adapt to suit demand. This evolution is anticipated to take place without undermining the fundamental tenets of Bitcoin, preserving the system’s essential foundations.

Coinbase is being sued again for allegedly misleading investors

The Solana, Polygon, Near, Decentraland, Algorand, Uniswap, Tezos, and Stellar Lumens tokens are allegedly securities, according to the lawsuit.

A new class-action complaint has been filed against Coinbase, the cryptocurrency exchange, and its CEO, Brian Armstrong. The lawsuit argues the company’s business model is unlawful and that investors were tricked into purchasing securities.

The lawsuit claims that Coinbase’s sales of digital assets have been willfully breaking state securities laws since the company’s founding. It was filed in the United States District Court for the Northern District of California, San Francisco Division, on behalf of plaintiffs Gerardo Aceves, Thomas Fan, Edwin Martinez, Tiffany Smoot, Edouard Cordi, and Brett Maggard from California and Florida.

The lawsuit claims that Solana’s, Polygon’s. Near Protocol’s, Decentraland’s, Algorand’s, Uniswap’s, Tezo’s and Stellar Lumens’ tokens are securities.

According to the plaintiffs, Coinbase acknowledged in its user agreement that it is a “Securities Broker,” selling digital asset securities as investment contracts or other securities. Coinbase Prime brokerage is also described as a securities broker by them.

In addition to statutory damages under state law and injunctive remedy through a jury trial, the plaintiffs demand full rescission. This case is similar to another class-action lawsuit that claims Coinbase’s selling of securities caused injury to consumers.

Coinbase has contested the applicability of securities laws and maintained that secondary sales of cryptocurrency assets do not fulfill the requirements for securities transactions.

This new complaint is not related to Coinbase’s well-known legal dispute with the Securities and Exchange Commission of the United States, which also raises concerns about the classification of tokens sold on Coinbase as securities. Coinbase has responded to a judge’s ruling for the lawsuit to proceed by filing an interlocutory appeal.

John Deaton, the cryptocurrency attorney spearheading an effort to unseat Senator Elizabeth Warren, filed an amicus brief in support of a motion for interlocutory appeal on behalf of 4,701 Coinbase customers on April 26 in the U.S. District Court for the Southern District of New York.

The introduction of spot Bitcoin (BTC) exchange-traded funds and an improvement in market performance were the main drivers of Coinbase’s impressive comeback in the first quarter of 2024. The exchange achieved $1 billion in adjusted earnings before interest, taxes, depreciation, and amortization for the first quarter, reporting $1.6 billion in total revenue and $1.2 billion in net income.