The Floki Inu community suggested burning 15,246,000,000 FLOKI, which is equivalent to $2.8 million at the moment.

15.2B FLOKI burn

According to Floki Inu (FLOKI), a referendum in 2022 approved the burning of 15,246,000,000 FLOKI, with the community agreeing to burn any extra retrieved tokens. The community has made it clear that the only thing you can do with tokens once a wallet is blacklisted is to transmit them to the Floki multisig.

Stated differently, the community believes it is appropriate to permanently remove these tokens from the market.

“As such, we feel it is only fair to burn the returned token to permanently remove it from circulation, in line with the expectations the community has about these tokens,” Floki Inu community explained.

Even more, Floki DAO assured voters that as a “goodwill gesture,” they would give 154 million FLOKI, or 1% of the value of the returned tokens, to the impacted parties. This could incentivize more wallets to burn their extra tokens. In any case, 232 votes have been cast in favor of the plan.

The community has already decided to burn FLOKI tokens. They decided to destroy 190.9 billion tokens that were retrieved from the multi-chain bridge in February.

“In each of these cases, the decision of the Floki DAO was swiftly executed, making it clear that Floki is a completely decentralized cryptocurrency and the Floki DAO ultimately determines the direction of the project,” the Floki Inu community said.

FLOKI increased by almost 11% after the news, from $0.0001872 to $0.0002025. Its trade volume increased by 235.29% over the previous day.

Check Out the Latest Prices, Charts, and Data of FLOKI/USDT

Sonne Finance and BlockTower Capital hacked: combined losses exceed $20M

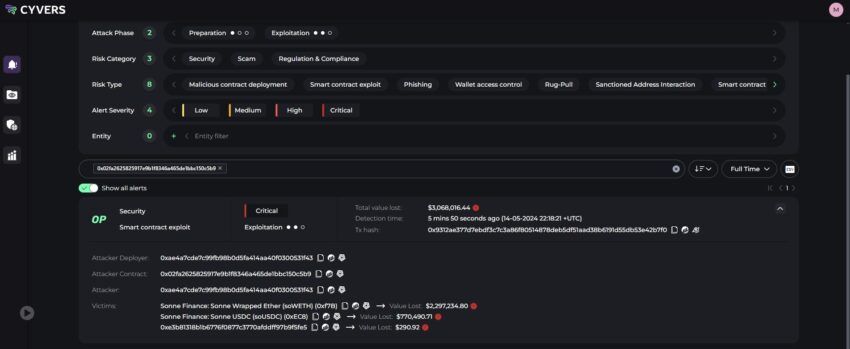

A large-scale cyberattack has affected Sonne Finance, a decentralized liquidity market protocol running on Base and Optimism.

Sonne Finance’s Optimism market suspended following the incident

Initially, Cyvers reported that $3 million had been stolen from Sonne’s USD Coin (USDC) and Wrapped Ethereum (WETH) contracts on its Optimism chain. However, the situation quickly worsened. Within 30 minutes, Cyvers updated the loss estimate to $20 million.

“Sonne Finance, please take immediate action,” Cyvers warned.

Sonne Finance addressed the situation on X (Twitter) approximately one hour after the warning. Additionally, the team pledged to offer additional details in the future.

“All markets on Optimism have been paused. Markets on Base are safe,” it stated.

After the event, BeInCrypto found that con artists were trying to take advantage of the circumstances. Imitating Sonne Finance, a phony X account advised customers to cancel all approvals in order to avoid losing money.

In order to “check exposure to the exploit” and revoke approvals, it posted a dubious link. The tweet was later removed, though.

In a different event, the cryptocurrency investment firm BlockTower Capital was also the victim of a cyberattack. The primary hedge fund of BlockTower Capital was largely depleted by fraudsters, according to unnamed sources reported by Bloomberg. The hacker is still at large, and the money is still gone.

The insider added that in order to locate the stolen funds, the company used blockchain forensics researchers. They just sent their restricted partners an update on the theft as well. BlockTower Capital has not yet released an official statement on the issue.

Indeed, the cryptocurrency industry is still plagued by hacking attacks. As of April 2024, BeInCrypto has already recorded a reduction in hacking event frequency of over 65%.

The lost amounts are still substantial, though. From April 28 to May 4, 2024, $71.39 million was lost overall due to crypto-related security events, according to the SlowMist Weekly Security Report.

The weaknesses in the decentralized finance (DeFi) industry are brought to light by this attack against Sonne Finance. It also demonstrates the necessity of robust security protocols to safeguard digital assets.

Layer-3 network Degen Chain hasn’t produced a block in 53 hours

Degen Chain reports that it has been attempting to fix a problem that has caused its network to cease generating blocks for over a couple of days.

Blockchain layer three for Ethereum For more than 53 hours, Degen Chain has been unable to authenticate a transaction or create a new block, which has rendered the network and its apps totally useless.

The last time the network generated a new block on May 12, at 8:15 p.m. UTC, Degen Chain came to a halt, as indicated by its block explorer.

It is one of the few layer-3 blockchains that uses a layer-2 network to settle transactions. For data availability tasks, it makes use of the AnyTrust protocol and the Ethereum layer 2 chain Base.

The official Degen Chain account stated on May 14th, X, that it was collaborating with its development partner, rollup infrastructure platform Conduit, to address the outage.

According to Conduit, the disruption was caused by a “custom config change” that caused Degen Chain and the gaming network Apex to halt block production.

Degen Chain’s newly added nodes are resynchronizing with the network’s genesis block.

“We’re working with both teams and Offchain Labs to restore service and minimize impact to users,” Conduit wrote on X.

According to Degen Chain, current projections indicate that the network will resume operations following the “resync,” which is scheduled for May 15 at 1:00 pm UTC (6:00 am PST).

Originally created for its native memecoin Degen (DEGEN), Degen Chain is now home to a number of decentralized apps, such as DegenSwap, Mint Club, and the bridging service Relay bridge, all of which are presently unavailable due to blockchain outages.

According to CoinGecko statistics, the native DEGEN coin of the network has dropped 24% from its seven-day peak of $0.02 on May 13 to $0.015.

Within the cryptocurrency business, layer 3 blockchains have been a controversial subject. Layer 3s “exist only to take value away from Ethereum and onto the [layer 2s] on which the L3s are built,” according to Polygon CEO Marc Boiron’s argument last month.

Proponents of Layer 3 networks, including Patrick McCorry of the Arbitrum Foundation, claim that it “seems like a no-brainer” for Layer 2 networks to serve as the settlement layer and lower transaction costs.