In Q2 2025, Ethereum (ETH) beat Bitcoin by 6%. The study from the on-chain research platform DeFi Report shows strong optimistic signs for ETH.

According to the paper, institutional investment, stablecoin growth, and the possibilities of the GENIUS Act are driving Ethereum’s impending breakthrough.

Ethereum’s Q2 2025

The DeFi Report offers a thorough summary of the network’s progress during the previous quarter, emphasizing its advantages and room for expansion.

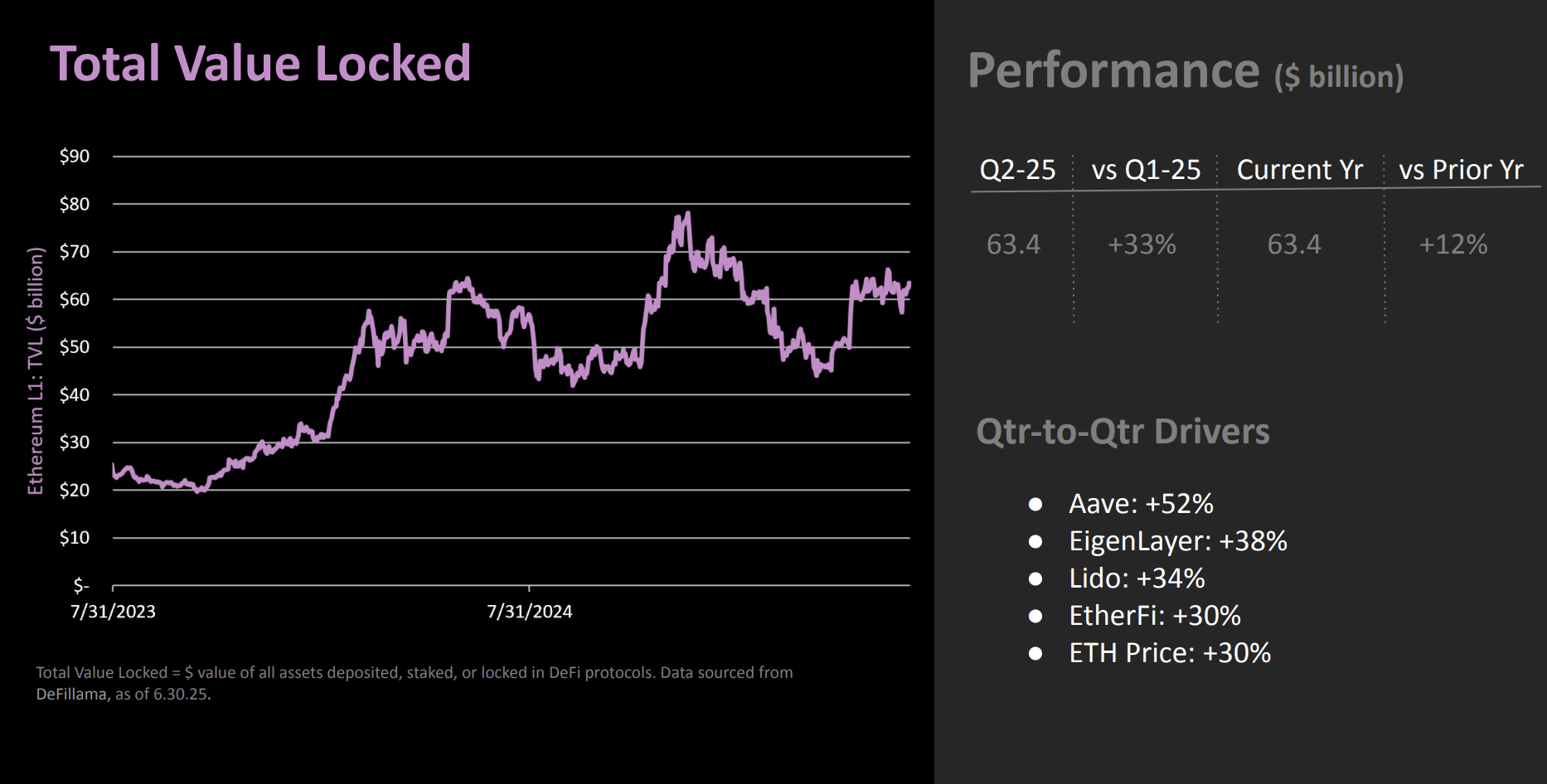

The research claims that Ethereum’s total value locked (TVL) increased to $63.4 billion, a 33% increase from the previous quarter. A notable rise in stablecoins and real-world assets (RWA) drove this expansion.

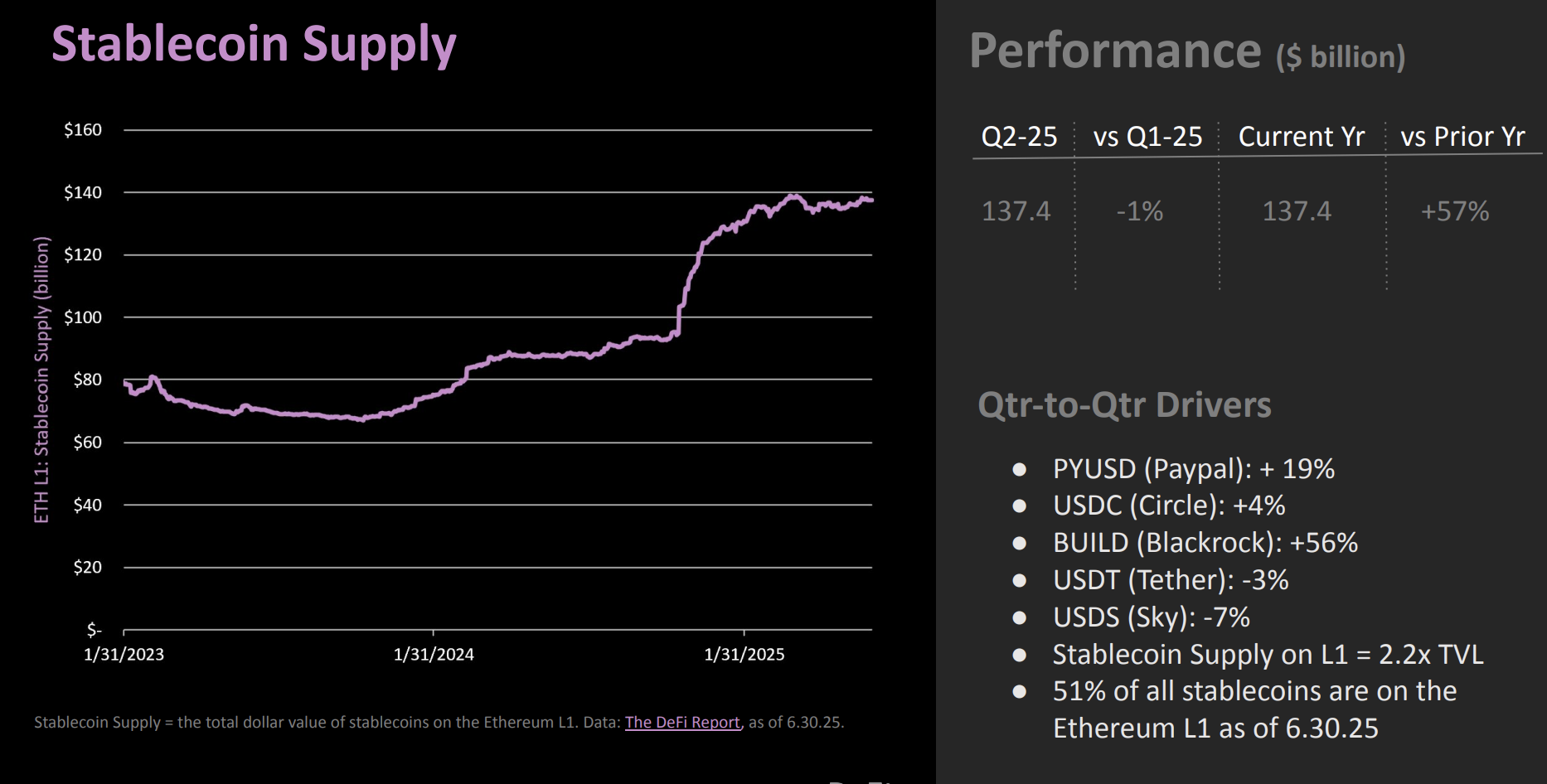

With the bulk of the Layer-1 TVL coming from big institutional participants like PayPal and BlackRock, the stablecoin supply reached $137.4 billion. With active loans on Ethereum and L2s increasing 43% to $23.9 billion, DeFi activity skyrocketed. Maple Finance and Euler Finance had the biggest increases, at 291% and 174%, respectively.

Furthermore, ETH staking demand increased 4% from the previous quarter to reach a record high of 35.6 million ETH in Q2. Deflationary pressure was created when the staked ETH ratio of the total circulating supply hit an all-time high of 29.5%.

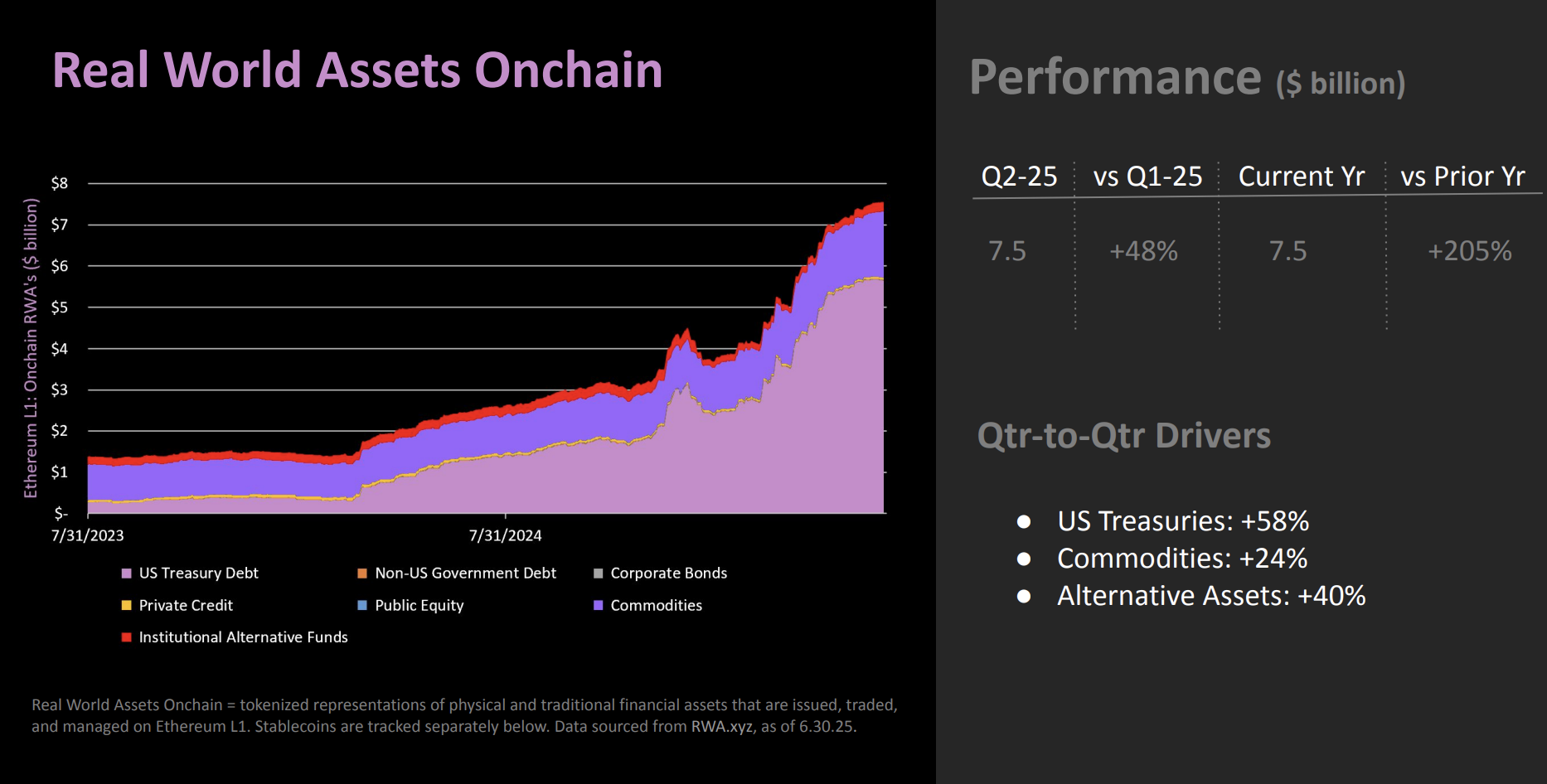

US Treasury bonds (up 58%) and commodities (up 24%) were the main drivers of Ethereum’s real-world assets (RWA), which increased 48% to $7.5 billion. Institutional accumulation was also mentioned in the report, as the amount of ETH held in public treasuries increased by 5.829% in Q2.

With this addition, the total now stands at 216,000 ETH from BitDigital and 100,000 ETH from SharpLink Gaming.

In terms of value, the Market Cap/TVL ratio for ETH rebounded to 1.2, up 19%, suggesting a strong chance for price growth.

Impact of the GENIUS Act

The GENIUS Act’s expected approval this week may spark a notable spike in the price of ETH. The act would increase liquidity and trust in the Ethereum ecosystem by legalizing stablecoins in the US if it is approved.

Polymarket predicts a 95% probability the GENIUS act will pass.

The GENIUS act will bring trillions of stablecoins to Ethereum – all the world’s largest banks will use Ethereum.

If GENIUS act passes ETH goes up.

Ethereum = world ledger

ETH = world reserve asset https://t.co/gF6a6ofziF— RYAN SΞAN ADAMS – rsa.eth 🦄 (@RyanSAdams) July 14, 2025

However, the paper cautions about the dangers posed by international rules, especially the EU’s MiCA framework, which is scheduled to go into force in Q3 2025. This may affect non-compliant stablecoins, as seen by the 7% decline in Sky’s USDS this quarter. Growth of stablecoins is hampered by this, but if Ethereum stays compliant, it has a chance to improve its standing.

BlackRock’s IBIT ETF eyes $100 billion in assets this month

Analysts predict that BlackRock’s IBIT ETF (Exchange-Traded Fund) might hit $100 billion this month due to its steady increase in net assets.

With more revenue than BlackRock’s S&P 500 fund, the financial instrument just overtook it as the asset manager’s most lucrative exchange-traded fund.

Can BlackRock’s IBIT reach $100 billion in assets in July? Analyst says yes

BlackRock’s IBIT ETF may hit $100 billion in net assets in July, according to ETF expert Eric Balchunas. As institutional investors look for indirect exposure to Bitcoin through IBIT, the optimism coincides with steady positive flows into the financial instrument.

I wrote last wk that $IBIT could hit $100b this summer, but hell, could be this month. Thx to recent flows + overnight rally it’s already at $88b. At only 1.5yrs old is now 20th biggest in US, 7th biggest for BlackRock (and their #1 most profitable ETF). Un-freaking-believable. pic.twitter.com/r5FLwKSE7j

— Eric Balchunas (@EricBalchunas) July 14, 2025

This prediction is supported by data from the cryptocurrency investment research tool SoSoValue, which indicates a steady increase in the daily volume of BlackRock’s IBIT ETF.

IBIT’s net assets were $85.96 billion as of July 14 following consistent gains on all trading days since June 9.

Balchunas’ hypothesis that the value of IBIT’s net assets may reach $100 billion this month is supported by the fact that there are very few instances of negative flows, or outflows, and none in July.

According to sources, BlackRock’s most lucrative ETF is IBIT. More precisely, after surpassing the $80 billion milestone, it is the asset manager’s fastest-growing financial instrument in terms of growth measures. Just 374 days after its introduction, on July 11, it achieved this milestone.

In addition to net assets, BlackRock’s IBIT is the largest ETF based on revenue measures, generating $186 million a year, more than the asset manager’s S&P 500 ETF (IVV). This traction is highlighted by a noticeable decrease in IBIT’s volatility, which has made it almost as steady as the S&P 500.

Furthermore, the expansion of IBIT and the rise of Bitcoin are inextricably linked, as the two assets have a mutually beneficial connection. On the one hand, IBIT provides institutional investors with regulated, indirect access to Bitcoin, which leads to a spike in the price of the cryptocurrency.

However, as the value of IBIT increases in tandem with the price of Bitcoin, the asset manager’s net assets immediately benefit from the price increase.

BlackRock’s assets under management (AuM) increase as a result of increased investor interest, which raises fees. Its supremacy in the Bitcoin ETF race grows along with its profitability.

BlackRock buys $386 million worth of Bitcoin

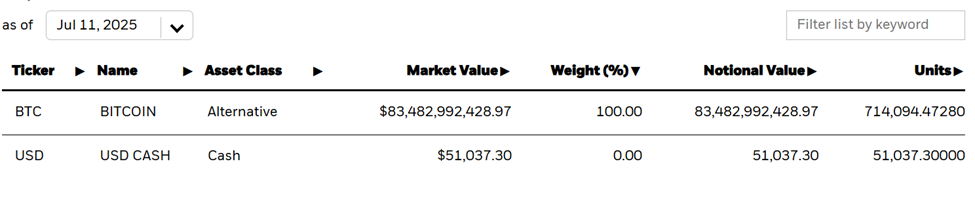

In other news, BlackRock has increased its Bitcoin holdings by purchasing 3,294 more BTC for $386 million.

JUST IN: BlackRock buys 3,294 BTC worth $386 million. pic.twitter.com/rDMN1LMv1q

— Whale Insider (@WhaleInsider) July 15, 2025

With a notional value of $83.86 billion, the asset manager now possesses 717,388 Bitcoin coins.

The asset management is gradually approaching Satoshi Nakamoto’s projected 1.1 million BTC holdings against the backdrop of BlackRock’s Bitcoin hoarding binge.

BlackRock’s IBIT is over 65% there at its present rate, using over 40,000 BTC per month, or 1,300 BTC every day.

Balchunas believes that if BlackRock keeps up this rate, its IBIT ETF may overtake Satoshi by May 2026, only two years after it was introduced.

BlackRock holds 700k btc now, and is 62% of the way there to passing Satoshi as world’s largest single holder of bitcoin (ETFs as gp already there). IBIT has gobbled up 40k btc a month (or 1.3k/day) on pace to hit 1.2m in May ’26 (not bad for 2yr old infant) h/t @EdmondsonShaun pic.twitter.com/hwpHExznF7

— Eric Balchunas (@EricBalchunas) July 8, 2025

However, as of right now, IBIT is the newest member among the top 25 biggest ETFs worldwide in terms of assets under management due to its rapid development. Considering that IBIT was founded 2.1 years ago and has been trading for 1.6 years, this is no small accomplishment.

In addition to Bitcoin, BlackRock is increasing its holdings in Ethereum (ETH); according to sources, the most recent acquisition was 50,970.08 ETH, valued at $150 million.

Dogecoin price forecast as traders shift to PUMP token mania – Is a 130% rally still likely?

Examine the Dogecoin price prediction for today, as traders’ focus is turning to the just released PUMP cryptocurrency, although a 130% gain to $0.45 is still imminent.

As of today, June 15, Dogecoin (DOGE) is down 7.49% over the past day, with $2.45 billion in trading volumes, most likely due to selling activity. The decline coincides with a lot of focus being placed on the recently released token, PUMP, which may be drawing traders’ attention away from meme currencies like DOGE. A bullish trend, however, indicates that the price of Dogecoin may still increase by 130% to $0.45 in spite of the current decline.

Dogecoin price eyes 130% rally as 8-month pattern nears completion

Since December 2024, the price of DOGE has been forming a double bottom over the past eight months, and this pattern is almost ready to be verified. This will occur when the price is able to break through the $0.259 resistance level, which will signal a shift in the current trend from bearish to bullish.

The price of Dogecoin is currently only 30% away from this resistance level, and it might rise to this level if the attitude of the larger cryptocurrency market shifts once more in favor of optimistic traders. This might lead to another rise to $0.47, where traders who purchase now could see returns of 130%.

If purchasing pressure continues to be strong, as it has been for the past week, this pattern may be able to materialize. A failed climb above the $0.259 barrier level will make the Dogecoin price outlook negative if buyers start to hesitate.

Prior to the subsequent bullish phase, the price must clear a significant obstacle at $0.19, according to the RSI indicator. The price of DOGE may be trapped below the neckline resistance level unless the RSI rises over 50.

PUMP token may delay Dogecoin rally

Even though the PUMP token has dropped 12% in the past day, traders are still looking to gain exposure to this new coin. Given the popularity of the Pump.fun meme currency launchpad, traders expect the token to see some increases. This might lead to a decline in purchasing activity for DOGE, which would impact the Dogecoin price performance.

A whale wallet that frequently buys new tokens has bought $2 million worth of PUMP in the past day, according to Lookonchain statistics. Whales have established long bets totaling $20 million on this new coin on Hyperliquid.

As Dogecoin’s ascent pauses, speculative traders may decide to book gains with PUMP, which might reflect the rising interest in the new meme coin-affiliated token.

However, Santiment demonstrates that whales are still continuously accumulating DOGE tokens, even though retail and speculative interest may be diverting liquidity from Dogecoin to other cryptocurrencies. Large addresses with 10 million to 100 million DOGE have purchased 140 million tokens in a single week.

Therefore, as the double-bottom pattern indicates, the price of Dogecoin may have potential to rebound by 130% to $0.47 as long as whales continue to purchase at a time when the majority of traders are trying to benefit from new coins. However, there is still a good chance that additional drops may occur unless buyers continue to be aggressive.