While MSTR’s stock is up double digits today, Strategy, formerly MicroStrategy, is now the first publicly traded business to own 600,000 BTC.

One week after halting its efforts to acquire Bitcoin, Strategy (formerly MicroStrategy) has announced another acquisition. The business’s most recent acquisition makes it the first publicly traded corporation to have more than 600,000 Bitcoin. The MSTR stock, however, has increased from last week’s closing price of $434.

Strategy announces another Bitcoin purchase

According to a press statement, the business paid $472.5 million for 4,225 bitcoins at an average price of $111,827 per, resulting in a 20.2% year-to-date (YTD) bitcoin yield. At an average price of $71,268 per bitcoin, the corporation paid $42.87 billion to buy 601,550 BTC, which it now owns. The 601,550 BTC is equivalent to 2.86% of the whole Bitcoin supply.

According to the SEC filing, Strategy mostly raised money for this Bitcoin purchase through the issuance of common shares. The sale of MSTR shares brought in $330.9 million for the corporation, while the sales of STRK, STRF, and STRD securities brought in $71.1 million, $55.3 million, and $15 million, respectively.

This comes after Michael Saylor alluded to a potential Bitcoin acquisition in his remarks yesterday. A graph showing Strategy’s Bitcoin purchases was shared by Saylor, who said, “Some weeks you don’t just HODL.”

This meant that the business had bought Bitcoin once more. Saylor had said the week before, “Some weeks you just need to HODL,” which proved to be a clue that they didn’t purchase Bitcoin that week.

As mentioned last week, after purchasing the flagship cryptocurrency for twelve weeks in a row, Strategy stopped buying Bitcoin between June 30 and July 6. Now that the business is purchasing Bitcoin once more, this can start a new trend of weekly transactions.

A $4.2 billion STRD offering as part of the company’s at-the-market (ATM) program has previously been announced. It intends to purchase further Bitcoin with the net proceeds from the stock sale.

MSTR stock rises over 3%

Amid the news of this most recent Bitcoin acquisition, MicroStrategy’s stock is rising. According to TradingView data, the price of MSTR’s shares is up more than 2% in premarket trading and is presently trading at about $443.

As the price of Bitcoin soared to new all-time highs (ATH) and broke beyond $123,000 for the first time ever, the Strategy stock also increased in value. Because of the company’s exposure to Bitcoin, both assets are connected.

Notably, Saylor’s business is presently the third-largest Bitcoin holder, after only BlackRock and Satoshi Nakamoto. The largest asset manager in the world has 714,118 Bitcoin, whereas Satoshi owns 1.1 million.

Massive TRUMP token unlock sparks fears as 45% of supply hits market

This week, TRUMP, ZRO, and ARB are scheduled to unlock a significant amount of their token supply. Just TRUMP’s unlock is responsible for 45% of its whole supply.

There may be a sell-off soon as a result of this large increase in supply.

Massive TRUMP unlock fuels sell-off fears

One of the top three coins with the most unlocks this week is TRUMP. According to Tokenomist data, this unlock is scheduled for July 18, 2025, and at current pricing, it is worth about $959.12 million.

Investors are concerned about a possible sell-off that would cause the token’s price to plummet because this amount is almost five times greater than the average monthly unlock of $209.6 million.

Pi Network (PI), another related initiative, has said that a significant unlock is scheduled for July. And when Pi Network reached its lowest point ever, this may be the reason why holders of PI coins kept selling.

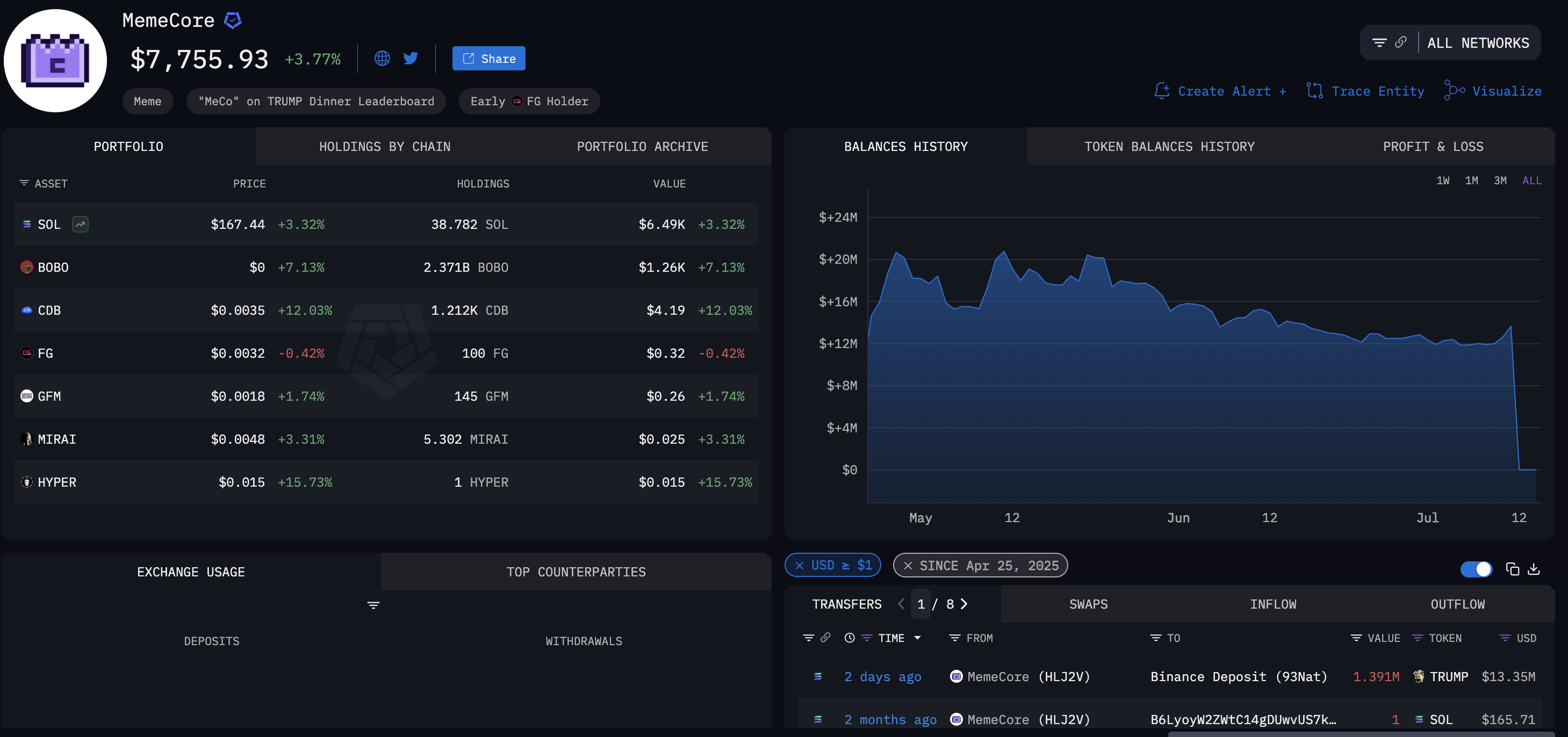

Whales are selling early in the market at the same time as this occurrence. MemeCore moved 1.391 million TRUMP, or $13.35 million, to Binance only hours ago, according to Arkham Intel statistics. Is this the initial indication that big wallets are selling out before being unlocked?

$TRUMP is down 85% from its ATH — and it’s not over yet as a massive $520M worth of tokens are set to unlock on July 18

Volatility incoming pic.twitter.com/aTtXRYQ36K

— Kamil (@KamilShaheen19) June 7, 2025

The recent rebound of the overall market, according to analyst Hoeem, might divert investors’ attention from this important development. But not all feeling is pessimistic.

Some market watchers, like as Sweep, have provided technical analysis that indicates TRUMP’s price is rising due to media interest and political momentum. These elements, together with Justin Sun’s most recent investment of $100 million, may cause TRUMP to drop to $40.

$TRUMP at $10 is pure psychology. Clean number, clean entry.

Politics szn heating up, media going full send on Trump, and this thing hasn’t even moved yet.

I’d rather be in early with solid R:R than chase it at $40 when CT wakes up. pic.twitter.com/mZkKvzaAlk

— Sweep (@0xSweep) July 13, 2025

Data indicates that TRUMP’s market value is currently about $1.9 billion. If demand is unable to absorb the additional supply, unlocking 45% of its circulating supply may result in a price dilution.

However, TRUMP’s political support may act as a cushion against a precipitous drop.

XRP price prediction – analyst forecasts rally to $38 as 7-year pattern signals breakout

Investigate the XRP price forecast as a seven-year double-bottom pattern breakout indicates an impending rise to $38.

After a remarkable 30% increase in the previous seven days to trade at $2.98, XRP is again hovering below $3. After making huge increases over the past seven days, XRP has surpassed Tether (USDT) and won back the third position in the market capitalization ranking of the cryptocurrency market. After the recent advances broke out of a seven-year bullish trend, a leading expert now predicts that the price may be going to $38.

XRP price targets $38 after double bottom breakout

A double-bottomed pattern has been developing on the two-week chart for XRP for the past seven years, according to X analyst Gert van Lagen, suggesting that the cryptocurrency may soon go into a spectacular rebound.

The price first broke out of the neckline resistance of this huge pattern in late 2024, when it rose by triple-digit percentage gains, according to the analyst’s pattern. Although it has now turned this neckline into a firm support level, the absence of a distinct breakout has compelled it to consolidate for seven months.

According to Lagen, the price of XRP may reach $38, which is the height difference between the neckline resistance and the double-bottom support level, provided it can maintain its present bullish momentum.

The market capitalization of XRP would be $2.2 trillion, or almost the same as that of Bitcoin, if the price reached $38. A rise to $38 may therefore take years to occur rather than occurring in a short period of time.

In addition to this analyst’s positive long-term price prediction, bullish traders will also benefit from the short-term prognosis. According to a recent CoinGape research, the price of XRP may soon hit $4 as Bitcoin attempts to hit new all-time highs.

Whales accumulation, ETF success, GENIUS act may fuel gains

Numerous variables will probably contribute to the XRP climb to $38, but the primary one is the continued stockpiling by whale addresses. Whales with over a million coins have purchased 100 million Ripple tokens in the past seven days, according to Santiment data, while whales with at least 100 million coins have purchased an incredible 1.45 billion coins.

The price of XRP may continue to rise if whales carry on with their acquisition binge. Furthermore, as seen by the Teucrium XXRP ETF, which has accumulated more than $248 million in net assets, their purchasing patterns coincide with a sharp rise in institutional demand for this cryptocurrency.

Due to this accomplishment, many investors are speculating that a spot XRP ETF may soon be approved, particularly as US lawmakers are debating a number of crypto-friendly laws this week. Eighty-five percent of investors on Polymarket believe that this product will be approved before the year is over.

Last but not least, the US House of Representatives’ discussion of the GENIUS Act this crypto week is encouraging for the RLUSD stablecoin, and its rise will influence the performance of the XRP price. According to CoinMarketCap statistics, the stablecoin now has a $517 million market capitalization. It may continue to expand if rules are made more lenient, which might also help XRP benefit.

In conclusion, the price of XRP is still following a double-bottom pattern that has been in place for the past seven years. After the 30% weekly gains, there are indications that a breakout is possible, and the price may climb as high as $38.