Highlights on Daily News, 17 May 2024

- Solana DEX drift launches 120M token airdrop.

- GameStop (GME) down 30%. What happened to the meme stock frenzy?

- US Senate approves legislation to remove the SEC’s accounting bulletin.

The DRIFT token launch and airdrop were announced by the Drift Foundation, the organization behind the Solana-based DEX Drift.

120M token airdrop on Solana

Commencing on May 16, the airdrop featured a special 2% bonus component worth 20 million tokens.

At launch, eligible users will get an initial token allocation, and over the course of six hours, a bonus token allocation will unlock. But they lose the benefit if they use the first 100 tokens right away. This program aims to reduce network congestion and discourage early selling.

Co-founder of Drift Cindy Leow believes that this strategy demonstrates a dedication to enhancing user experience.

“Historically, airdrop claims have caused network congestion, resulting in a suboptimal user experience as tens of thousands of users and bots rush to claim their airdrop,” Leow said.

The Foundation described its distribution strategy and tokenomics in depth. The purpose of the airdrop is to acknowledge user engagement and encourage participation in on-chain governance. This ensures a fair and inclusive distribution and includes allocations based on early Drift v2 usage, trading activity, and participation in certain projects.

Major cryptocurrency exchanges have expressed a great deal of interest in the token airdrop. For example, Bybit has announced plans to sell the coin, while Coinbase has included it in its roadmap. The token’s potential and worth are attested to by the leaders in the industry’s early recognition.

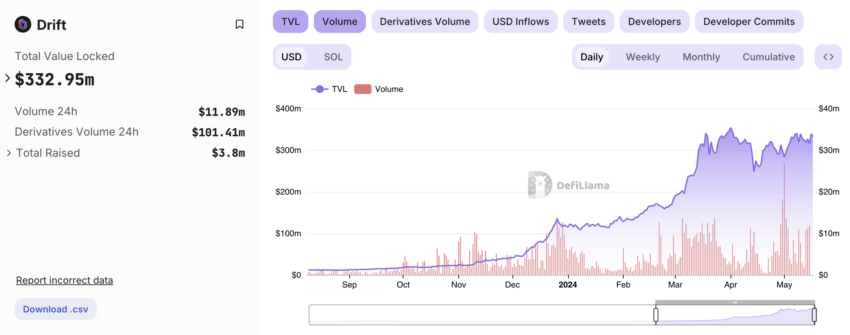

It is noteworthy that, according to DeFiLlama, Drift has enabled over $20 billion in cumulative trade volume and presently has over $333 million in total value locked (TVL).

GameStop (GME) down 30%. What happened to the meme stock frenzy?

A far cry from the more than 100% spike it has seen as the meme craze settles down, GameStop has dropped as much as 30%.

The share price of GameStop Corp., an American retailer of video games, consumer electronics, and gaming accessories, has dropped by as much as thirty percent. The price of the game retailer’s shares after the Thursday trading session is $27.67.

GameStop in knockout mode

This week, GameStop’s optimistic mood was rekindled when Keith Gill, a.k.a. The Roaring Kitty, made a reappearance on X. Gill was one of the main architects of the 2021 short squeeze. Gill, though, disappeared for a while before making a comeback early this week.

Retail investors were able to resume their investments in 2021 based on his rise to prominence. AMC Entertainment and other equities that Wall Street firms have been massively shorting have also seen a surge. As a result of this week’s price activity, GameStop’s stock has risen to an 18-month high of $64.83.

The stock has gained more than 53% over the last five days, despite the most recent decline in the GME trading ecosystem. Several market participants cautioned against having too much exposure to GameStop due to speculative trading.

Gregory Davis, the Chief Investment Officer (CIO) of Vanguard, reiterated the caution that Coingape had earlier expressed. He stated that the market had already witnessed the much-hyped GameStop trend to fizzle out. Although GameStop has experienced tremendous growth, its accounts, financials, and fundamentals have not changed, he added.

He forewarned his followers that wagering on assets like GameStop typically results in negative outcomes. The one-day collapse raises serious concerns, even if it’s still difficult to say whether the GameStop negative flip signifies the end of the hype cycle or not.

Market shifting away from risk assets

The broad trend in the volatile asset category is likewise mirrored by the negative reversal in GameStop’s share price. Bitcoin (BTC), Ethereum (ETH), and equities with a concentration on cryptocurrencies, such as Coinbase, also had a sharp decline a few hours ago.

This decline was seen in spite of the significant victory in the US Senate to eliminate a significant accounting regulation. The US SEC introduced SAB 121, a rule that aimed to forbid banks from storing Bitcoin. Investors have demonstrated that they are not yet excited about the triumph, even with a significant Veto conceivable.

Other significant risk assets like GameStop, whose shares have fallen by an additional 2.89% in after-hours trade, have also been affected by this pessimistic mood.

Related: After the GameStop rally, memecoin party starts and adds $5B to index

US Senate approves legislation to remove the SEC’s accounting bulletin

In a vote on a resolution to repeal SAB 121 of the SEC, which sets forth specific accounting guidelines for companies that hold cryptocurrency, the Senate voted 60 to 38 on Thursday.

A bill to reverse a Securities and Exchange Commission bulletin that sets specific accounting guidelines for companies that hold cryptocurrency was approved by the U.S. Senate on Thursday. Now that the bill is in the hands of President Joe Biden, a veto is most certainly in store.

There were not enough votes in the Senate (60 to 38) to overcome the veto of the president. On Thursday, a number of Democrats, including Senate Majority Leader Charles Schumer of New York, voted in favor of the bill. Sens. Cory Booker of New York and Jon Tester of Montana were among the few other Democrats who voted in favor of repealing the bulletin.

The identical bill, which overturned SAB 121, was passed by the House last week by a vote of 228–182, with 21 Democrats and the majority of Republicans voting in favor. This vote total is less than the two-thirds majority required in the House to overturn a veto from the president.

First released in 2022, the SEC Staff Accounting Bulletin, or SAB 121, has generated controversy in the cryptocurrency space in the last year due to worries that it may prohibit banks from protecting digital assets. Cryptocurrency custody companies are required to list customer holdings as liabilities on their balance sheets.

In the meanwhile, President Biden would veto it, according to a “statement of administration policy” released by the White House last week.

The administration stated that “limiting the SEC’s ability to maintain a comprehensive and effective financial regulatory framework for crypto-assets would introduce substantial financial instability and market uncertainty.”

Naturally, a lot of people in the business are against the Biden Administration’s attempts to maintain SAB 121. A veto, according to Chamber of Digital Commerce vice president of policy Cody Carbone, would be “nonsensical.”

“I hope the President looks at the bipartisan support of this Resolution not as a rebuke on the administration, but as consensus that no independent regulator is above the law and consumer protection should always trump personal vendettas against a disfavored industry,” Carbone said in a statement to The Block.

Sen. Elizabeth Warren, D-Mass., who voted against the bill, said that cryptocurrency has different dangers than other assets during the discussions held before the vote.

“We have seen multiple hacks of crypto platforms,” Warren said. “The unique risks of crypto can create liabilities that seriously impact a company’s financial condition. SAB 121 simply clarifies how companies should account for those risks in their financial disclosures. That’s all it’s doing.”

Under the Congressional Review Act

The Government Accountability Office stated last year that SAB 121 is subject to the Congressional Review Act, which mandates that agencies provide Congress with a report on the rule. Enacted in 1996, the CRA seeks to strengthen legislative control over agency rulemaking.

According to the GAO, the bulletin qualified as a rule, and the SEC was required by the CRA to provide a report on the rule to Congress. The GAO report states that the SEC has said that the bulletin does not fall within the definition of a regulation and is not governed by the CRA.

According to a research issued on Wednesday by the Congressional Research Service, the SEC’s capacity to issue comparable regulations is affected in the long run by the disapproval of a rule under the Congressional Review Act, which instantly overturns it.

“If the SEC were to reissue the bulletin, provided that it met the CRA’s definition of rule, Congress could again use the CRA to overturn the bulletin on the basis that it was too similar to the disapproved SAB-121 (or for any other reason). Congress could also use its legislative powers in other ways, not just through the CRA, to respond to any subsequent SEC bulletin or other action,” according to the report.

An SEC representative told The Block that SAB 121 is “non-binding staff guidance” that improves investor disclosures.

“Time and again, we have seen crypto firms fail and watched as their customers lined up at the bankruptcy court in hopes of getting what they thought was legally theirs,” the SEC spokesperson said. “We’ve also seen the risks to investors in firms that safeguard these assets when they are hidden off the balance sheet. These disclosures provide investors an important line of sight into the level of risk taken by crypto custodians.”

What’s next?

The Blockchain Association’s head of government affairs, Ron Hammond, stated that a veto of the Senate-passed resolution is “guaranteed”.

“This isn’t shocking though as a number of CRAs during Biden’s tenure have made it to his desk on a bipartisan basis and received a veto,” Hammond said in a statement to The Block. “To override that veto, it will require a 2/3 majority, which is a steep hill to climb.”

For instance, according to Bloomberg Law, Biden vetoed a bill earlier this month that sought to repeal a joint employer regulation that had been approved by both the Senate and the House with strong bipartisan support.

“One thing the fight on SAB 121 has shown in DC is that there is a large constituency of grassroots and industry engaged,” Hammond said. “This is also the first time many in Congress are hearing about the number of people passionate about this issue. With the major market structure vote looming next week in the full House, there are a lot of folks in DC hearing about crypto.”