Coinbase intends to provide perpetual futures that will replicate the global market for perpetual futures. In light of this announcement, the COIN stock is rising.

Coinbase has announced plans to introduce a “perpetual-style” futures product for Bitcoin and Ethereum, aiming to close a gap in the US derivatives market. The release date of this product is July 21. Amid this revelation, the COIN stock has surged to a new four-year high.

Coinbase to launch “perpetual-style” futures product on July 21

The cryptocurrency exchange said in a blog post that on July 21, its derivatives division will introduce US “Perpetual-Style” futures. This future product will be fully compliance with CFTC requirements, provide consumers with leverage, and continuously monitor spot prices.

Since a perpetual futures market isn’t yet well-established in the US, Coinbase stated that this will be one of the first products of its kind in the country and that it intends to close a significant gap in the derivatives market there. The leading cryptocurrency exchange also disclosed that, in accordance with US legislation, the futures product will function similarly to global perpetual futures.

By doing this, the company hopes to remove the requirement that customers use offshore markets to access these perpetual futures. Perpetual futures are said to make over 90% of all cryptocurrency trading activity globally, therefore it also aims to enter this sector.

On July 21, Coinbase intends to open two contracts for trading. The nano Ether Perpetual-Style Futures and the nano Bitcoin Perpetual-Style Futures are examples of this. Additionally, according to the exchange, these contracts would allow flexible position sizing and capital efficiency together with controlled exposure to the cryptocurrency market.

Only a few days have passed since the exchange declared that it has obtained a MiCA authorization in Luxembourg. 450 million consumers in all 27 EU member states will now be able to access the company’s cryptocurrency services.

COIN stock rallies

In the meanwhile, this most recent announcement has caused the COIN stock to rise. The Coinbase stock is currently trading at about $366, up more than 3% during today’s trading session, according to TradingView data. The stock is up 42% year-to-date (YTD) and 20% over the last five days.

Bernstein analysts recently increased their objectives for Coinbase shares from $310 to $510, as previously reported. They also listed a number of potential causes for this spike, including the stablecoin bill, the exchange’s hegemony in the US, and its ownership of the Ethereum layer-2 base.

In the meantime, after its most recent rise, the COIN stock has reached a four-year high. The stock is still below the $429 peak it hit during its first public offering in 2021. It has already, however, eclipsed its prior peak close of $357.

GameStop reloads $450M war chest – next stop: More Bitcoin on the balance sheet?

The announcement that GameStop has raised an extra $450 million through a convertible bond sale has the cryptocurrency market aflutter. More Bitcoin (BTC) is probably going to be purchased with this money.

Along with GameStop, other publicly traded businesses are attempting to put Bitcoin on their balance sheets, including Metaplanet, H100 Group AB, Nano Labs, and others.

GameStop & Metaplanet continue to ramp up BTC accumulation

With this most recent bond selling, GameStop has raised a total of $2.7 billion since its mid-June 2025 offering, according to SEC filings. The 2032-maturity zero-interest bonds can be converted into shares at a price 32.5% over the June 12 average.

GameStop may have a lot of chances as a result to diversify its holdings, including Bitcoin. This action was taken in response to ProCap, a fierce rival in the race to accumulate Bitcoin, claiming to have overtaken GameStop in terms of holdings.

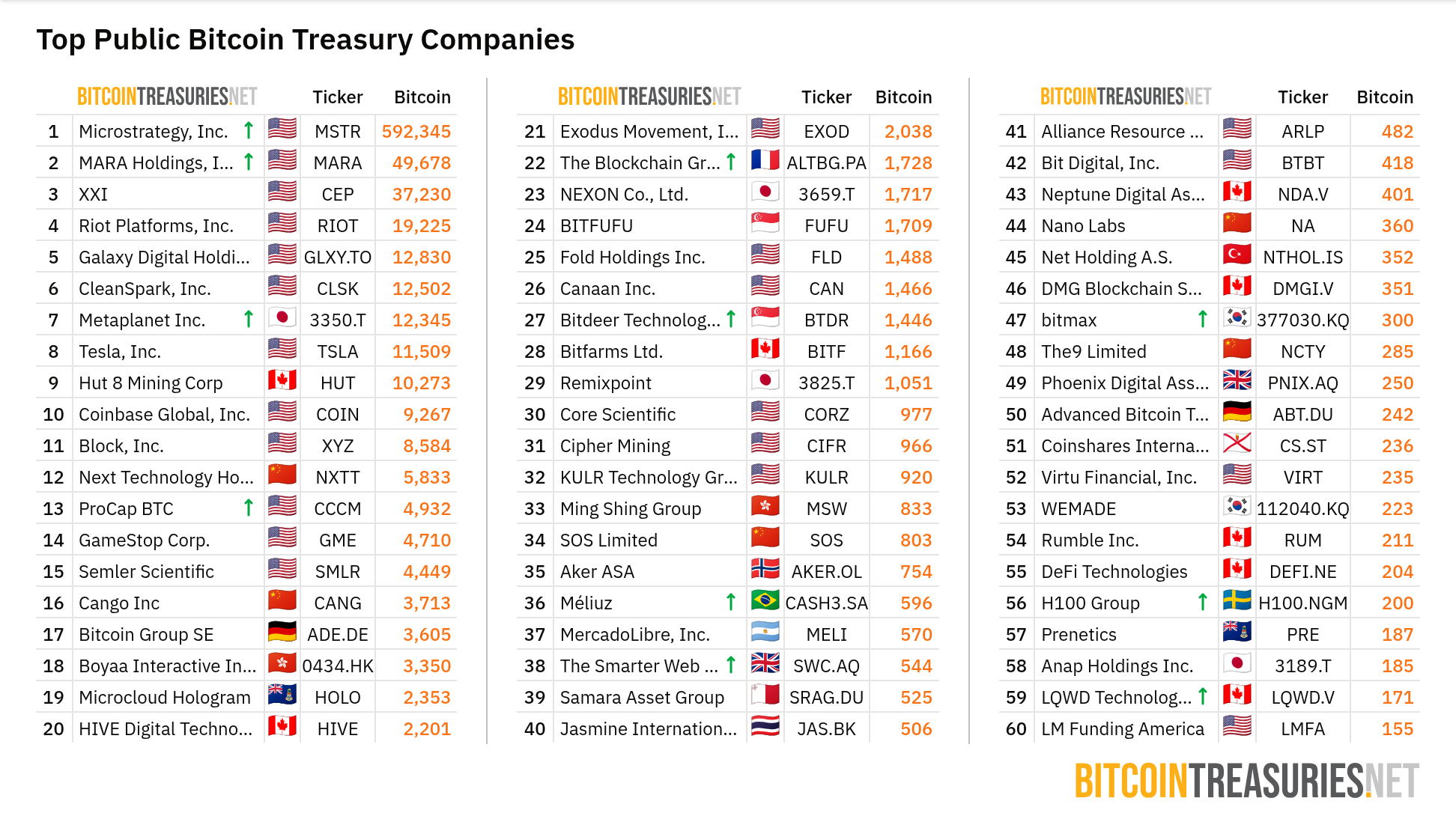

GameStop is currently ranked 14th with an estimated 4,710 BTC holdings, according to data from BitcoinTreasuries. Metaplanet, Asia’s “Strategy,” is currently in seventh place with 12,345 BTC after recently acquiring an extra 1,234 BTC at an average price of $107,557.

Supercycle wouldn’t be a supercycle without GameStop

— Portal (@PortaltoBitcoin) May 28, 2025

Bitcoin as the future of corporate treasuries

Several additional publicly traded corporations are stepping up their efforts to purchase and hold Bitcoin, in addition to GameStop, Metaplanet, and ProCap.

The purchase of 12 Bitcoin was just revealed by Mega Matrix, a US-listed firm. To reach 200.21 BTC, H100 Group AB expanded its holdings. 18.2 BTC was added by Sixty Six Capital, which also intends to raise more money to purchase more. In the meantime, real-world asset (RWA) tokenization startup Unitronix pledged to invest $2 million in Bitcoin.

Nano Labs issued $500 million, raising 600 BTC. KaJ Labs made a $160 million Bitcoin investment to fund AI infrastructure.

Other businesses have started investing in Bitcoin as a result of Strategy’s involvement. Strategy now has the most Bitcoin (592,345 BTC), followed by MARA Holdings (49,678 BTC), according to data from BitcoinTreasuries. These industry leaders’ participation shows that this methodology may increase shareholder value.

However, their ambitions can be impacted by SEC restrictions and price volatility issues. The decisions made by GameStop and other businesses will have a significant impact on how Bitcoin is used in corporate treasuries going forward, especially since the July 2025 CPI is about to be revealed.

Trump’s World Liberty Financial secures $100M to fuel DeFi expansion

In order to strengthen governance, RWA tokenization, and grow its USD1 stablecoin ecosystem, World Liberty Financial has secured $100 million from Aqua 1.

A $100 million strategic acquisition of governance tokens from Donald Trump-affiliated World Liberty Financial (WLFI) has been disclosed by Aqua 1, a Web3 investment fund established in the United Arab Emirates. The action is meant to encourage more people to participate in WLFI’s governance structure and to help blockchain-based financial services expand more widely.

The investment is a component of Aqua 1’s broader objective to develop decentralized infrastructure and tokenized real-world assets that facilitate financial innovation in international markets.

World Liberty Financial collaboration with Aqua

Aqua 1 will be able to play a key part in the governance of WLFI, a decentralized finance (DeFi) network, thanks to the $100 million token acquisition. The Donald Trump family is linked to WLFI, which was launched in 2024. They recently reduced their ownership position in the platform from 60% to 40%.

The goal of WLFI is to facilitate the global transition to stablecoin integration and tokenization of conventional assets. Its partnership with Aqua 1 is a component of a larger strategy to develop an institutional-grade marketplace that blends blockchain technology with conventional banking.

According to World Liberty Financial co-founder Zak Folkman,

“Aligning with Aqua 1 validates our blueprint for global financial innovation, as we have a joint mission to bring digital assets to the masses.”

By combining blockchain technology with conventional financial institutions, Aqua 1 has positioned this collaboration as a driving force behind the widespread adoption of real-world asset tokenization.

Tokenized assets and the USD1 ecosystem in focus

Prior to the US house vote on the GENIUS Act, the two groups will collaborate to expand WLFI’s USD1 ecosystem and encourage stablecoin use in payment systems. Additionally, they plan to include blockchain into the infrastructure for business transactions and treasury management.

According to Aqua 1’s founding partner Dave Lee,

“WLFI’s USD1 ecosystem and RWA pipeline embody the trillion-dollar structural pivot opportunity we seek to catalyze.”

In addition to growing WLFI’s infrastructure across several geographies, they seek to find and assist emerging blockchain firms. In order to assist its worldwide initiatives, the collaboration will also investigate methods of luring financial and technological talent from other geographical areas.

Through this partnership, Aqua 1 intends to support WLFI’s global expansion, encompassing Europe, Asia, South America, and other emerging areas, by leveraging its investment and compliance teams.

New blockchain projects and middle east digital economy initiatives

Donald Trump’s WLFI and Aqua 1 located in the United Arab Emirates will also launch new projects like Aqua Fund. Blockchain infrastructure, AI integration, and regional Web3 adoption will all be financed with this investment. It is expected to make a substantial contribution to the Middle East’s digital economy agenda following the Israel-Iran conflict.

Aqua Fund intends to list on the Abu Dhabi Global Market (ADGM), a secondary trading platform. This would attract institutional interest in blockchain investment products and give investors better access to liquidity.

Additionally, the two partners are working together to develop BlockRock, a platform that focuses on tokenizing traditional financial assets at the institutional level. BlockRock will provide all the resources needed to securely move valuable assets to blockchain networks while adhering to current banking regulations.