Today marks the expiration of more than $3.3 billion of Ethereum (ETH) and Bitcoin (BTC) options. It follows colder PPI (Producer Price Index) and lower-than-expected US CPI (Consumer Price Index) statistics.

What effects will today’s expiring options have on the pricing of these digital assets and the volatility of the larger cryptocurrency market?

Over $3 billion in options expiring – crypto market reaction

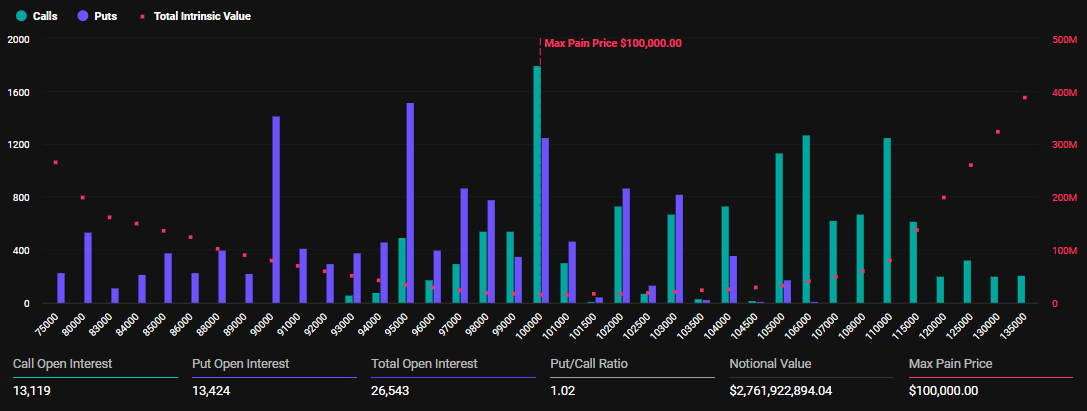

Deribit reports that over $2.76 billion worth of Bitcoin options are about to expire, with a $100,000 maximum pain threshold. There are 26,543 contracts in this batch of options, which is more than the 25,925 open interest from the prior week.

A pessimistic market mood is reflected in the put-to-call ratio of 1.02, which indicates that traders are purchasing more puts (rights to sell) than calls (rights to purchase).

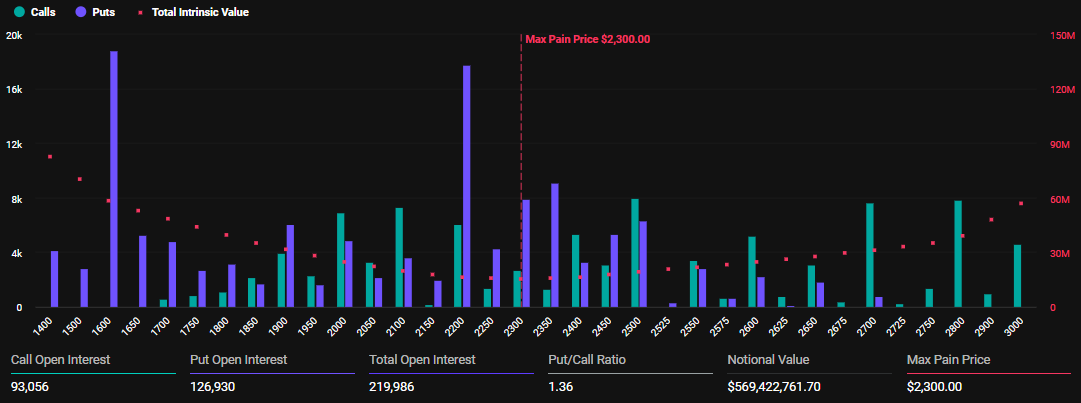

219,986 contracts totaling $569.42 million in Ethereum options are expiring; this is a significant increase over the 164,591 contracts that expired last week. A put-to-call ratio of 1.36 and a maximal pain point of $2,300 indicate a gloomy market outlook for ETH.

In cryptocurrency options, the “maximum pain point” is essential. It stands for the price range where option holders feel the most uncomfortable about their financial situation.

At the time of writing, Ethereum was trading for $2,572, while Bitcoin was trading for $103,912. This indicates that the market mood is primarily pessimistic and that both digital assets are over strike prices.

Notably, in an effort to reduce payments, markets frequently move toward the strike price or maximum pain level after expiration.

🚨 Options Expiry Alert 🚨

Tomorrow 08:00 UTC: Over $3.1B in BTC & ETH options expire on Deribit.$BTC: $2.66B notional | Put/Call: 0.99 | Max Pain: $100K

$ETH: $525M notional | Put/Call: 1.24 | Max Pain: $2,200BTC skew is neutral, ETH puts slightly outweigh calls. Price… pic.twitter.com/jBj4C4tMvX

— Deribit (@DeribitOfficial) May 15, 2025

According to Greeks.live experts, the market was overextended when Bitcoin was rejected from the $105,000 barrier. The experts also observe that traders are choosing to sell rather than follow momentum, defensive tactics are starting to emerge, and the market is cautious.

“Several traders are taking profits on long calls and rotating into more defensive positions as they feel everybody rushed in,” Greeks.live notes.

How does the recent US CPI and PPI affect the crypto options market?

These expiration options follow the release of US CPI data for April, which revealed that inflation had dropped to 2.3%, the lowest level since February 2021. In a similar vein, April PPI inflation dropped to 2.4% from 2.5% forecasts.

Analysts claim that although the April statistics changed the story, the markets could not be responding appropriately to this change. Despite prior Fed indications of keeping rates stable amid tariff concerns and a 2% inflation objective, lower inflation and waning retail might put pressure on the Fed to lower rates sooner.

APRIL DATA JUST FLIPPED THE NARRATIVE.

PPI crashed. Retail faded.

No inflation spike. No consumer heat.

Rate cuts are back in play markets aren’t ready for what’s coming. pic.twitter.com/VwTJIAgrS2

— Merlijn The Trader (@MerlijnTrader) May 15, 2025

As investors look for leveraged exposure, this usually increases demand for cryptocurrency choices by boosting riskier assets like Bitcoin and Ethereum. Call option premiums rise as market liquidity improves due to less pressure on monetary tightening brought on by lower inflation.

But after the CPI and PPI, there was some short-term volatility in cryptocurrency values, and options traders noticed more activity, higher volumes, and tighter spreads.

Although option expirations can result in significant price changes, these effects are often transient. After early volatility, the market usually stabilizes the next day.

However, before making an investment in this unstable environment, traders should thoroughly examine technical indications and market mood.

Coinbase stock drops 7% amid cyber attack and SEC probe

Following a cyberattack and an SEC investigation regarding user analytics, Coinbase’s price falls. The corporation is under inquiry and risks $400 million in consequences.

Days before its S&P 500 launch, Coinbase, the biggest publicly traded cryptocurrency exchange in the world, was rocked by a severe cyberattack and ongoing probe from its SEC complaint. The price of Coinbase’s shares has plummeted due to the consecutive defeats; during one trading session on Thursday, it fell more than 7%.

Coinbase stock takes massive hit

Even though the exchange is set to join the S&P 500 index next week, the Coinbase cyberattack and the SEC inquiry sent COIN shares down. Although it was anticipated that this milestone would increase credibility, the story has been eclipsed by subsequent developments.

Within ninety minutes of the opening bell on Wednesday, Coinbase’s stock price dropped by more than nine percent. After a slow recovery during the session, they fell once again and closed at $244.4, down over $19 or 7.2% from the previous close.

Cybersecurity experts warn that cryptocurrency services are becoming more and more popular targets, particularly American leaders like Coinbase. According to a Chainalysis analysis, cryptocurrency companies lost more than $2.2 billion in 2024 alone.

Coinbase cyber attack hits ahead of S&P 500 entry

Days before Coinbase is set to enter the S&P 500 index, the business disclosed a cyberattack that exposed client data on Thursday and resulted in a $20 million ransom demand. In order to get access to internal networks, hackers paid rogue foreign contractors.

In his response to the event on X, CEO Brian Armstrong disclosed that hackers had bought access to Coinbase’s internal tools by bribing its foreign support employees. A few insiders caved and released private client information, including names, home addresses, email addresses, and dates of birth.

Armstrong stated,

“The attackers’ intent was to use the user’s personal information clandestinely, and to social engineer unique scams impersonating Coinbase support,”

Attackers were able to get names, contact information, masked bank information, government ID photos, and partial Social Security numbers, even though passwords and cryptocurrency wallets were not stolen.

All of the workers implicated were dismissed by Coinbase, which also promised not to engage in negotiations with the perpetrators and offered a $20 million reward for information that led to the attackers’ capture. Additionally, the CEO stated that:

“Any customers that were socially engineered as a result of this incident, we’re going to reimburse them.”

The incident’s estimated expenses, which include tech remediation, legal risks, and consumer refunds, might total $400 million.

The Coinbase stock was directly impacted by the attack. However, Coinbase has had other setbacks in the past twelve hours.

SEC investigates Coinbase over inflated user claims

Coinbase is also under investigation by the SEC for allegedly misrepresenting user counts in previous statements. The investigation focuses on the company’s prior claim of “verified users” exceeding 100 million and was initiated under the Biden administration and maintained during the Trump administration.

The legal team for Coinbase contends that the statistic, which was terminated more than two years ago, was always declared as including anyone who had their phone number or email validated. For a more precise metric, the business now concentrates on “monthly transacting users.”

“This investigation should not continue,” said Chief Legal Officer Paul Grewal, but he did affirm that Coinbase is working with the SEC to find a solution.

Dogecoin on-chain metrics hint at DOGE mega rally ahead

As commentators allude to the DOGE Super Cycle, Dogecoin is demonstrating strength with increasing active addresses, transaction volumes, and whale activity.

Dogecoin’s on-chain indicators are still strong, paving the way for a huge surge in the future. Despite the DOGE price’s ongoing flirtation at $0.2250, market analysts are optimistic about its future direction. According to well-known cryptocurrency expert “Trader Tardigrade,” the memecoin chart resembles the setup from 2014 to 2018, which may lead to a parabolic rise to $18.

Dogecoin on-chain metrics and whale activity

Dogecoin is seeing a spike in important on-chain measures, such as DOGE active addresses, transaction volumes, and whale activity, according to well-known cryptocurrency expert Ali Martínez. Therefore, the memecoin is now making significant progress on a number of fronts, which may provide the groundwork for a DOGE rise in the future.

Whales have bought over 1 billion #Dogecoin $DOGE in the past month! pic.twitter.com/VVzwO7yLnM

— Ali (@ali_charts) May 16, 2025

However, within the last month, there has been a significant amount of whale purchasing for memecoin. The fact that Dogecoin (DOGE) whales have accumulated more than 1 billion DOGE tokens in the last month is a noteworthy development that indicates increased activity and interest from major investors.

The data was given by cryptocurrency expert Ali Martinez, who emphasized the buildup as an optimistic sign. Increased whale activity may be a sign of future price fluctuations and is frequently correlated with market optimism.

DOGE price action moving ahead

The price of DOGE now appears to be building a solid base at $0.22 levels. When the $0.27 immediate barrier on the upside is crossed, a fresh bull movement will begin.

The memecoin is also getting ready for the next big super cycle, according to well-known cryptocurrency expert Trader Tardigrade. Prominent cryptocurrency expert Trader Tardigrade has spotted indications that the memecoin may be about to enter a “Super Cycle 2.”

Comparing the current Dogecoin price levels to its initial rapid development phase, the trader emphasized that they may provide investors a substantial opportunity. In the upcoming months, $DOGE may increase quickly if the pattern resembles Cycle 1, according to Tardigrade.

The analyst also notes that there are notable parallels between two significant market cycles—2014–2018 and 2021–2025—that are shown by the DOGEUSD chart patterns. The memecoin is presently in a strong accumulation period and may see notable price movement upward in the later half of 2025, according to the chart layout below.

The chart’s right side displays a logarithmic pricing scale that ranges from less than a penny to more than $17. To enjoy the upcoming massive rise, retail investors will need to be more patient.