In the last day, Bitcoin has increased by 8%, regaining its losses from the previous month. It is trying to set $93,625 as support at its current price of $93,202. Bullish enthusiasm has been rekindled by this strong bounce, although prudence is urged.

As Bitcoin continues to grow, traders and market trends continue to diverge, which raises the potential of volatility.

Bitcoin sentiment-driven trades are risky

Santiment data reveals a recurrent pattern: traders frequently miscalculate changes in the price of bitcoin. The market often declines when traders anticipate a rise. On the other hand, Bitcoin frequently shocks them with an ascent when they expect a decline. This pattern indicates that sentiment-driven trading is dangerous because market unpredictability is still high.

Bitcoin is trying to break $100,000, so investors should keep a careful eye on volatility today. Contrarian tactics have historically outperformed following trader mood. When there is a lot of uncertainty, market players could think about acting contrary to popular belief in order to successfully negotiate the current circumstances.

With its 60.74% domination, Bitcoin is constructing a fractal resembling the 2020–2021 period, when it had a rapid rise followed by a decline. The emergence of a comparable trend raises the possibility that past trends may recur. During times of diminishing dominance, Bitcoin’s price has occasionally displayed indications of recovery; however, the intensity and durability of these movements rely on the state of the market as a whole.

Altcoins gain popularity when supremacy wanes, but Bitcoin frequently reaps the long-term rewards. The current state of the market indicates a period of change, and there may be further upside for Bitcoin. Bitcoin’s current price spike might continue if this fractal holds, boosting the upward trend.

BTC price needs to secure support

The price of Bitcoin has increased by 8% to $93,202. BTC is anticipated to rise to $97,696 if it maintains $93,625 as support. By maintaining this level, positive momentum would be strengthened and Bitcoin’s recovery would be strengthened.

To maintain gains, the 50-day EMA must be flipped into support. This action would make up for February’s losses and lay the groundwork for future gains. If this trend continues, Bitcoin may be ready to revisit greater resistance levels.

Bullish momentum, however, may be invalidated if it fails to hold above $95,761, which would cause a decline toward $92,005. Losing this crucial level might lead to more drops, which would impede Bitcoin’s upward trend.

Analyst reveals XRP price rally to $70, here’s the timeline

As the Ripple community’s wagers on a US XRP Reserve increase, a leading analyst offers a possible timescale for the price of XRP to reach $70, igniting market confidence.

The price of XRP has increased by around 25% during the past day, suggesting that the market has regained trust in Ripple’s asset. The recent suggestion of a US XRP Reserve by US President Donald Trump is perhaps one of the main causes of the current spike. But in the midst of this, a prominent market analyst projects that the asset’s value will rise beyond $70 with a possible date.

XRP price soars 25% as US crypto reserve gains momentum

Today, the price of XRP increased by about 25% to $2.79, and its one-day trading volume surged to $19.09 billion. Notably, the cryptocurrency hit a 24-hour high of $2.97 and a low of $2.23. Additionally, XRP Futures Open Interest increased by about 40% to $4.33 billion, the biggest level since early February, suggesting that traders are becoming more confident.

The surge, meantime, takes place in the context of Donald Trump’s most recent remarks on the US Crypto Reserve. Notably, the social media battle between the Bitcoin and Ripple communities has lately gathered momentum, particularly in light of reports that the US may soon have an XRP Reserve rather than only a BTC-focused Reserve. However, Trump stated on his Truth Social platform that in addition to Bitcoin and Ethereum, the US is thinking about including XRP, ADA, and SOL in the US Crypto Reserve.

What does the future hold for Ripple’s native asset? Here, we discuss the experts’ level of optimism over the coin’s future course.

Ripple targets $70 rally, here’s when

Renowned market analyst Dark Defender recently issued a daring forecast for the price of XRP, establishing a short- to medium-term aim of $77.7 in an X article. Dark Defender described a potential scenario in which the cryptocurrency may reach $18 “with the third wave” in a recent X post.

The expert saw resistances at $5.85, $8.03, and $18.22, as well as important supports at $2.60 and $2.77. As shown in a shared price chart, Dark Defender’s study suggests that XRP may hit the $77.7 level by 2027.

In the meanwhile, cryptocurrency aficionados are quite interested in this forecast and are closely monitoring changes in the asset’s price. Even though market forecasts are subject to change, Dark Defender’s experience and performance history make this one worth taking into account.

I shared an update on XRP’s short-midterm target of $77.7 on X, setting $5.85 and $18.22 as short-term possibilities. You might recall that historical pattern scenario.

As we discussed many times with the third wave, $XRP can extend towards $18; after the fourth wave correction,… pic.twitter.com/49ih6wZXAs

— Dark Defender (@DefendDark) March 2, 2025

Levels to watch for short-term

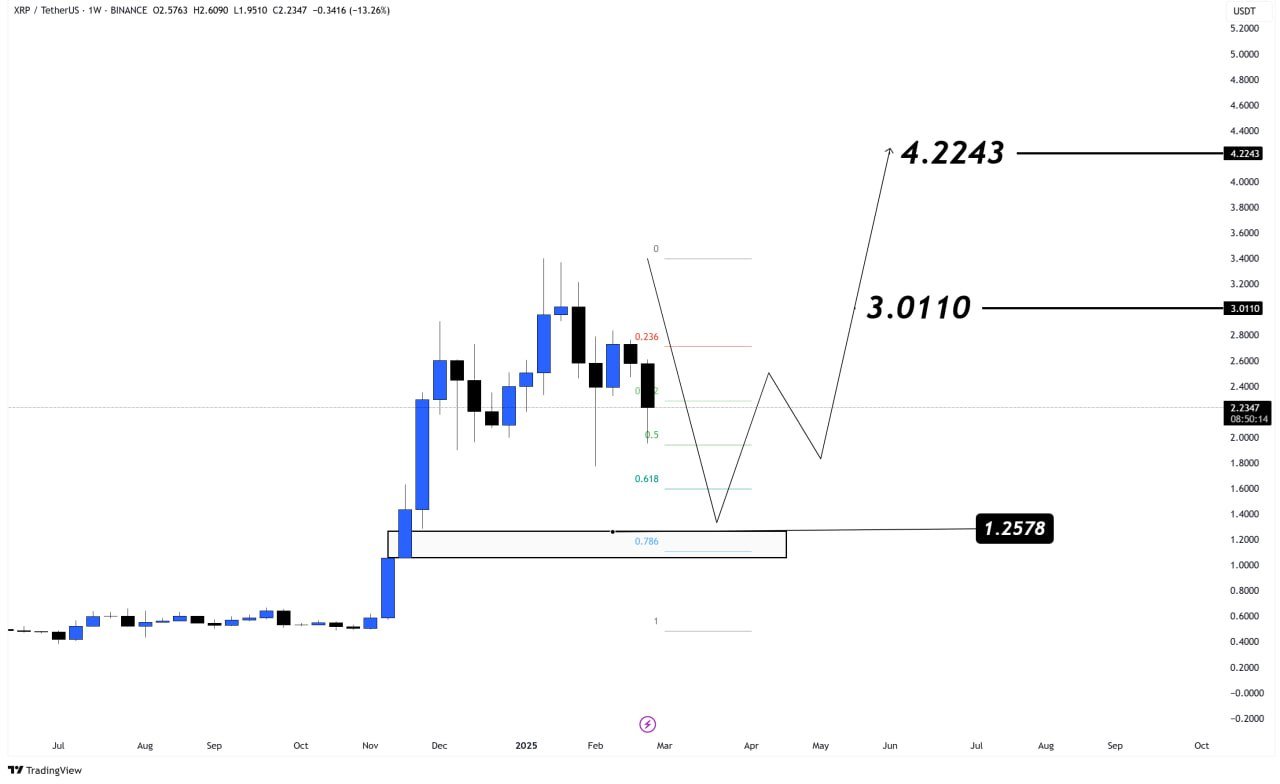

Other market analysts continued to express optimism about the coin’s future course, echoing optimistic comments. According to a recent study by CasiTrades, the price of XRP is expected to continue its upward trend and reach a new high if it maintains the $2.92 support.

At the same time, Rose Premium Signals, another specialist, had a similar opinion. The analyst believes that $3, $4.2, and $5 are the next objectives for Ripple’s currencies. Nevertheless, the price of XRP may rise above $5 in the near future if it surpasses the first two objectives.

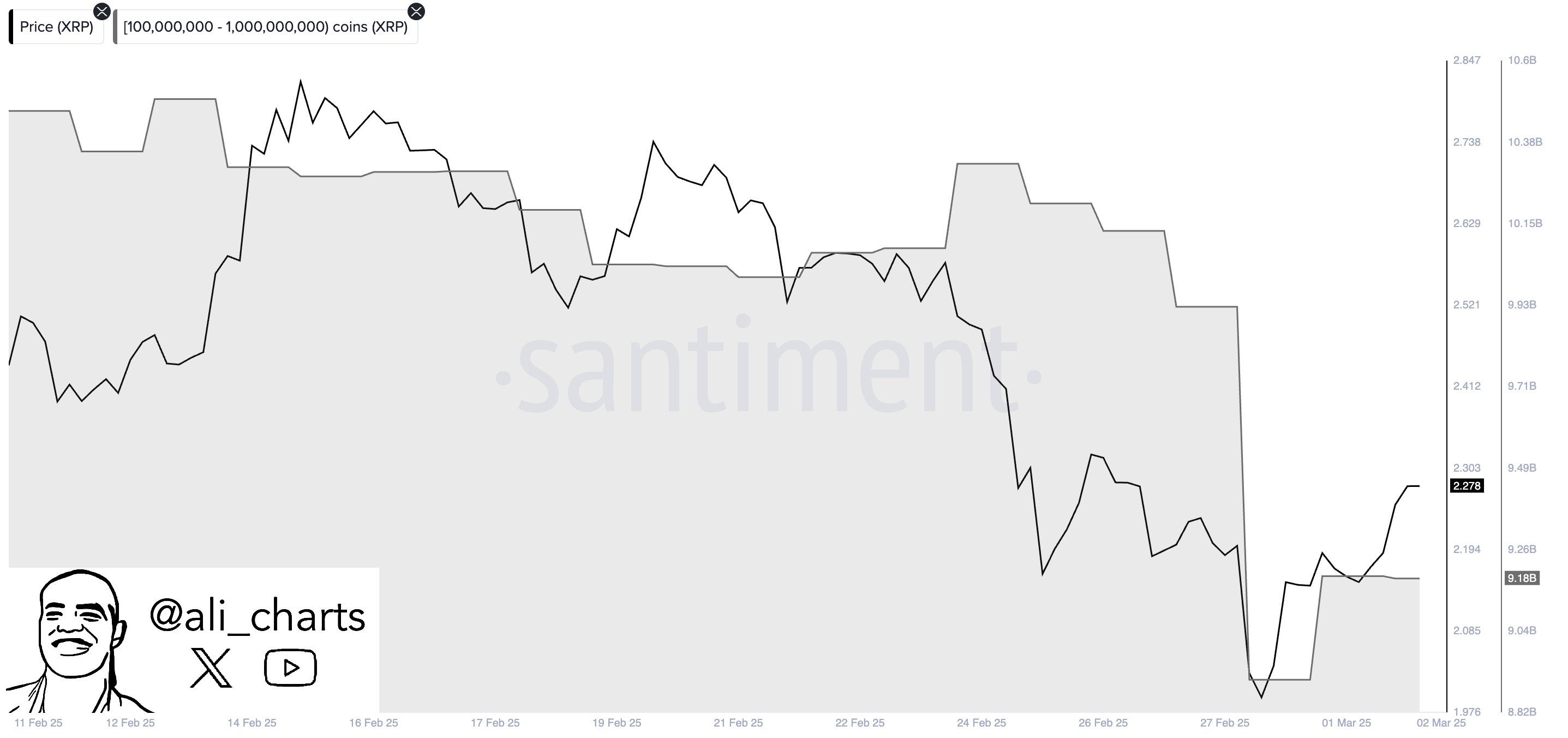

Additionally, the market trends show that there is now a positive attitude in the market. Renowned market analyst Ali Martinez provided perspective by pointing out the recent intense purchasing demand from the XRP whales. Martinez said that big investors bought 270 million bitcoin over the weekend in a recent X post.

However, rising wagers that the Ripple v. SEC lawsuit would probably be dismissed have further improved market mood. It’s important to remember, though, that a specialist recently denied rumors that the Ripple SEC lawsuit will affect the price of the cryptocurrency in the future.

Crypto leaders push back on Donald Trump’s altcoin-backed reserve

Leaders in the sector are debating President Donald Trump’s announcement of a US crypto strategic reserve made up of a variety of digital assets. Bitcoin (BTC) ought to be the only reserve asset, according to many.

This discussion comes after the Presidential Working Group was instructed to create the reserve by Trump’s executive order on digital assets.

A divisive selection? Experts debate Trump’s US crypto reserve

The official statement said that digital assets such as Bitcoin (BTC), Ethereum (ETH), XRP (XRP), Solana (SOL), Cardano (ADA), and others will be part of the planned crypto reserve. Strengthening the US as a worldwide leader in crypto is the initiative’s goal.

Notably, the statement caused the coins to rise significantly. However, there is still a great deal of disagreement among specialists over the selection of assets for the reserve.

Coinbase CEO Brian Armstrong offered his thoughts on Trump’s strategic proposal for a cryptocurrency reserve. He expressed his opinions on asset allocation in his most recent post on X (previously Twitter).

Excited to learn more. Still forming an opinion on asset allocation, but my current thinking is:

1. Just Bitcoin would probably be the best option – simplest, and clear story as successor to gold

2. If folks wanted more variety, you could do a market cap weighted index of crypto… https://t.co/jv8Gcn8N2S— Brian Armstrong (@brian_armstrong) March 3, 2025

However, he recommended employing a market cap-weighted index of cryptocurrency assets to maintain neutrality if diversification is required. Armstrong stressed that a Bitcoin-only reserve would be the simplest course of action, even after taking into account both possibilities.

A market-weighted strategy for the planned crypto reserve was also endorsed by author and investor Fred Krueger.

“The Strategic Crypto Reserve should be Market Weighted, like the SP500,” he stated.

Excluding international assets and stablecoins, he presented a recommended allocation that places Bitcoin (BTC) at 75%, Ethereum (ETH) at 12.4%, XRP at 5.7%, Solana at 3.1%, Dogecoin (DOGE) at 1.4%, and Cardano (ADA) at 1.0%. Avalanche (AVAX), Polkadot (DOT), Cosmos (ATOM), and Litecoin (LTC) received smaller allotments.

In the meanwhile, displeasure was expressed by many in the crypto world. The head of Bitwise’s Alpha Strategies, Jeff Park, was one of the proponents of a reserve that would exclusively accept Bitcoin.

“Huge political miscalculation by Trump in underestimating just how crucial it was for the Strategic Reserve to focus solely on Bitcoin,” Park posted.

He cautioned that adding cryptocurrencies with ambiguous national importance might lead to accusations of insider trade, even if they are unjustified. Park said that although Bitcoin ought to be the sole strategic reserve asset, there are still ways to encourage wider cryptocurrency use from an investing standpoint.

Peter Schiff, a longtime Bitcoin critic, agreed that a BTC reserve made sense. Despite his disagreement, he acknowledged Bitcoin as “digital gold” and likened it to the gold reserve. He questioned XRP’s need in the cryptocurrency reserve, though, and attacked its inclusion.

I get the rationale for a Bitcoin reserve. I don’t agree with it, but I get it. We have a gold reserve. Bitcoin is digital gold, which is better than analog gold. So let’s create a Bitcoin reserve too. But what’s the rationale for an XRP reserve? Why the hell would we need that?

— Peter Schiff (@PeterSchiff) March 2, 2025

According to Alex Xu, a research partner at Mint Ventures, Trump chose to give incentives to projects that supported him politically. He referred to the action as a “advertising slot” in Trump’s presidential authority.

“However, in the long run, pushing assets like ADA and XRP as reserve holdings is absurd. It undermines the legitimacy of BTC as a strategic reserve and further reduces the chances of passing a BTC reserve bill at the federal level,” he said.

Additionally, he cited the Republicans’ slim House majority. As a result, he said, it is doubtful that laws involving SOL, ADA, and XRP in national reserves would be passed.

According to Xu, a Treasury-managed sovereign wealth fund would be the only practical choice. This would enable Trump to purchase these properties without the consent of Congress.

“But how likely is that? How much would SOL, XRP, and ADA need to funnel into Trump’s circle for him to issue an executive order using taxpayer money to buy them? Trump’s style is about making big headlines with minimal effort. He won’t invest heavily or take on major risks without significant personal gain,” he questioned.

Former BitMEX CEO Arthur Hayes adopted a more critical stance, calling Trump’s idea for a cryptocurrency reserve mere bluster.

“Nothing new here. Just words,” he claimed.

He contended that the government lacked the resources to purchase Bitcoin or other cryptocurrencies in the absence of congressional consent to borrow money or revalue gold.