Bitcoin is witnessing a 16-year high in 30-year U.S. government bond yields, and money printing is all but guaranteed, says the ex-BitMEX CEO.

Bitcoin bull could come courtesy of the United States government, a new prediction says.

In an X thread on Oct. 4, Arthur Hayes, former CEO of crypto exchange BitMEX, eyed ballooning yields as a precursor to a new Bitcoin and crypto bull market.

Why do I love these markets right now when yields are screaming higher?

Bank models have no concept of a bear steepener occurring. Take a look at the top right quadrant of historical interest rate regimes.

It’s basically empty. pic.twitter.com/P6MQnCU73N

— Arthur Hayes (@CryptoHayes) October 4, 2023

Hayes: Bitcoin bull should eye U.S. “no way out” moment

U.S. Treasury yields are “screaming higher,” and with that, Hayes believes that a macroeconomic flashpoint is only a matter of time.

The reason comes in the form of a so-called “bear steepener,” a phenomenon that describes long-term interest rates rising more quickly than short-term ones.

“Why do I love these markets right now when yields are screaming higher? Bank models have no concept of a bear steepener occurring,” he argued.

Given the current steep rise in the 2s30s curve — the difference between the 30-year and two-year yields — combined with rising long- and short-term interest rates, the pressure across the economy is rising.

“Due to the leverage and non-linear risks embedded in banks’ portfolios, they will be selling bonds or paying fixed on IRS as rates rise. More selling begets more selling, which is no bueno for bond prices,” Hayes continued.

The result should be clear — a return to mass liquidity injections, counteracting the quantitative tightening seen since late 2021, which has pressured crypto markets.

For Hayes, this cannot come without major casualties along the way. He concluded:

“The faster this bear steepener rises, the faster someone goes belly up, the faster everyone recognises there is no way out other than money printing to save govt bond markets, the faster we get back to the crypto bull market :). The Lord is my Shepherd, I shall not want.”

Separate data from TradingView shows the 30-year U.S. government bond yields hit 5% this week — a first since August 2007 before the Global Financial Crisis.

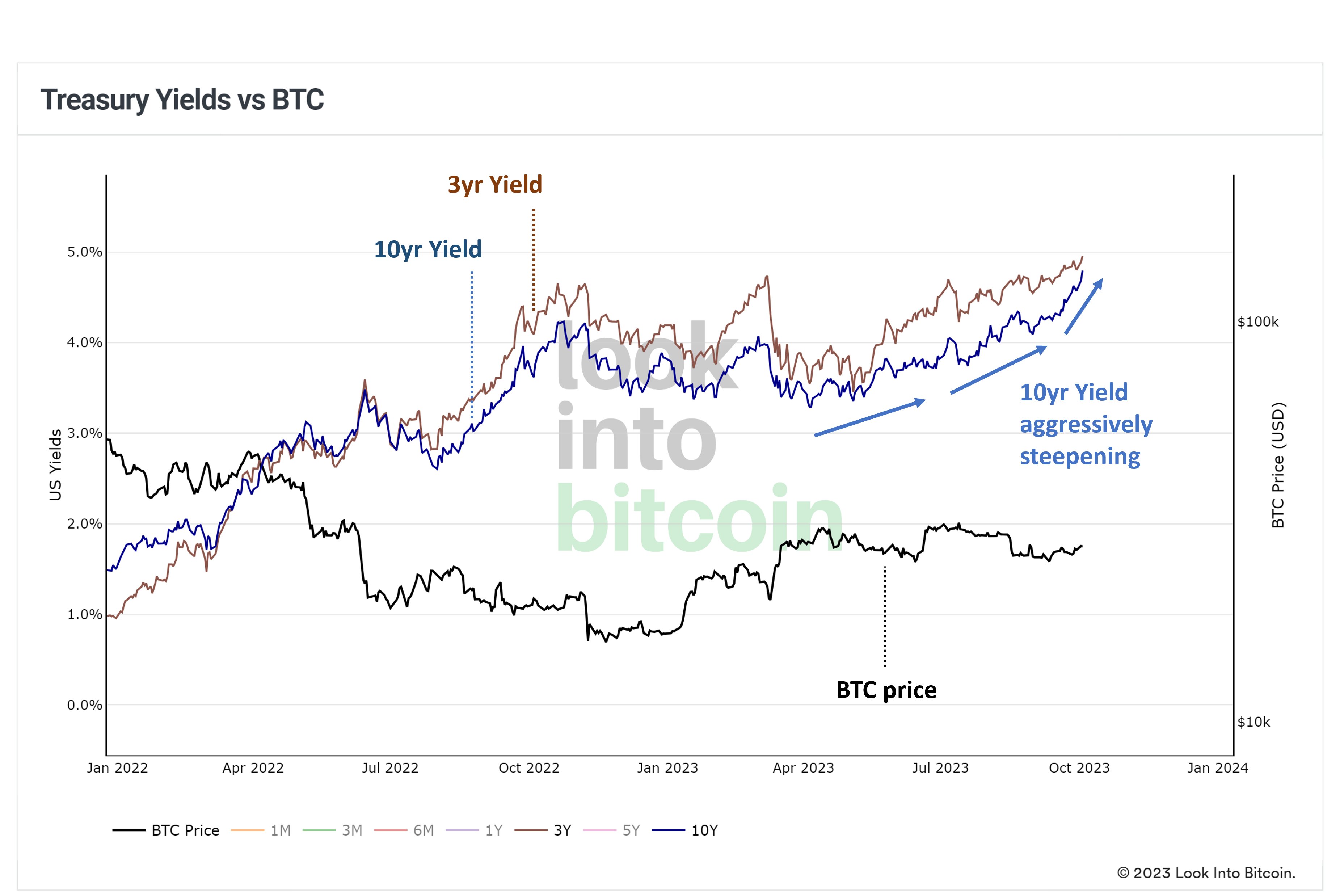

Continuing the discussion, Philip Swift, creator of statistics resource LookIntoBitcoin and co-founder of trading suite DecenTrader, voiced his support for Hayes’ prognosis.

An accompanying chart showed Bitcoin’s relationship with Treasury yields.

“That would be THE major catalyst for the Bitcoin bull market,” he commented about a theoretical return to money supply expansion.

U.S. debt sees its own “Uptober”

Alongside, the U.S. continues to add to its record-high national debt at an astonishing pace.

Two weeks after the debt tally passed $33 trillion for the first time, the government increased its total by $275 billion in just one day.

This did not go unnoticed among financial commentators.

Total US debt just rose $275 billion in one day—the same amount as last month’s total borrowing.

Yet —

• Unskilled military-aged foreign men are invading

• Violent criminals caught & released

• Open-air drug use

• American culture in shamblesThe US doesn’t work for you. pic.twitter.com/03YUxyiQtB

— Joe Consorti ⚡ (@JoeConsorti) October 3, 2023

“In a single day, the US added more than half of Bitcoin’s entire market cap in debt,” Samson Mow, CEO of Bitcoin adoption firm Jan3, responded.

In a single day, the US added more than half of #Bitcoin’s entire market cap in debt. That’s something like 10 million @BTC. And yet there are still people that are unsure if $27k is a good price to buy. pic.twitter.com/RMxdzB01yL

— Samson Mow (@Excellion) October 4, 2023

“That’s something like 10 million BTC . And yet there are still people that are unsure if $27k is a good price to buy.”

BTC/USD traded at around $27,500 at the time of writing.

Check Out the Latest Prices, Charts, and Data of BTC/USDT