A paper by CryptoQuant examines the benefits and drawbacks of trading Bitcoin ETF options, referring to it as a “significant milestone.” Institutional investors and increased liquidity are positive indicators for Bitcoin.

Although there is a chance that IBIT options trading may lead to more people shorting Bitcoin, the advantages much exceed this risk.

Bitcoin ETF options: An institutional milestone

With the SEC’s approval of options trading on BlackRock’s IBIT ETF in late September, the market is now more susceptible to significant volatility. For some months, this regulatory approval has been expected, and the SEC is willing to consider a similar agreement for Ethereum exchange-traded funds. A CryptoQuant exclusive report can assist in elucidating the opportunity.

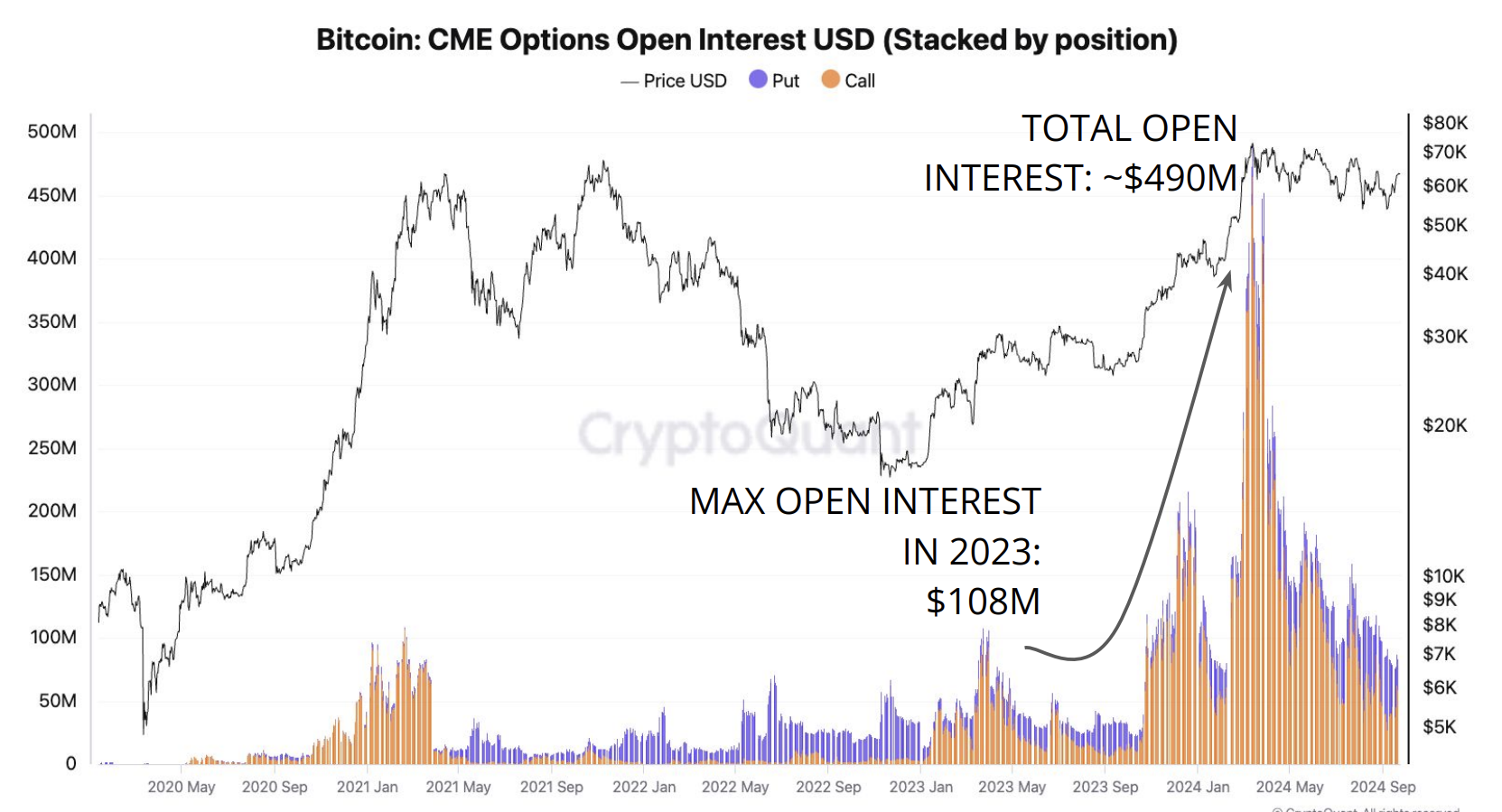

CryptoQuant listed several advantages for the industry and referred to the SEC clearance as a “significant milestone.” For starters, even when viewed as a symbolic win, it still has a lot of power. From March 2023 to the ETF approval one year later, open interest for Bitcoin options trading surged by almost five times, and options trading on IBIT cracks up a flexible new market.

“The decision highlights the increasing integration of cryptocurrency into traditional financial markets, following a growing trend of regulatory acceptance of Bitcoin-related financial products. The approval would increase liquidity and investor participation in the Bitcoin market, marking a further step toward broader institutional adoption”, CryptoQuant claimed.

The majority of CryptoQuant’s analysis, however, is on the actual rather than the figurative advantages of the approvals. To start with, the data indicates that options traders have a tendency to invest with a longer time horizon than futures traders. While most futures deals expire in less than three months, about half of all options in the pre-existing Bitcoin options market have an expiration date of five months or more.

Liquidity and financial instruments

Additionally, by diversifying traders’ financial instruments, the additional options transactions will contribute to an overall rise in market liquidity. This confirms Eric Balchunas’ prediction that more major traders and liquidity will be drawn to these IBIT options. The capacity to sell covered calls is one well-known illustration of these new capabilities.

“Investors that hold spot Bitcoin can sell call options and collect the premium from the call option, getting yield from their Bitcoin holdings in a regulated way”, the report claimed.

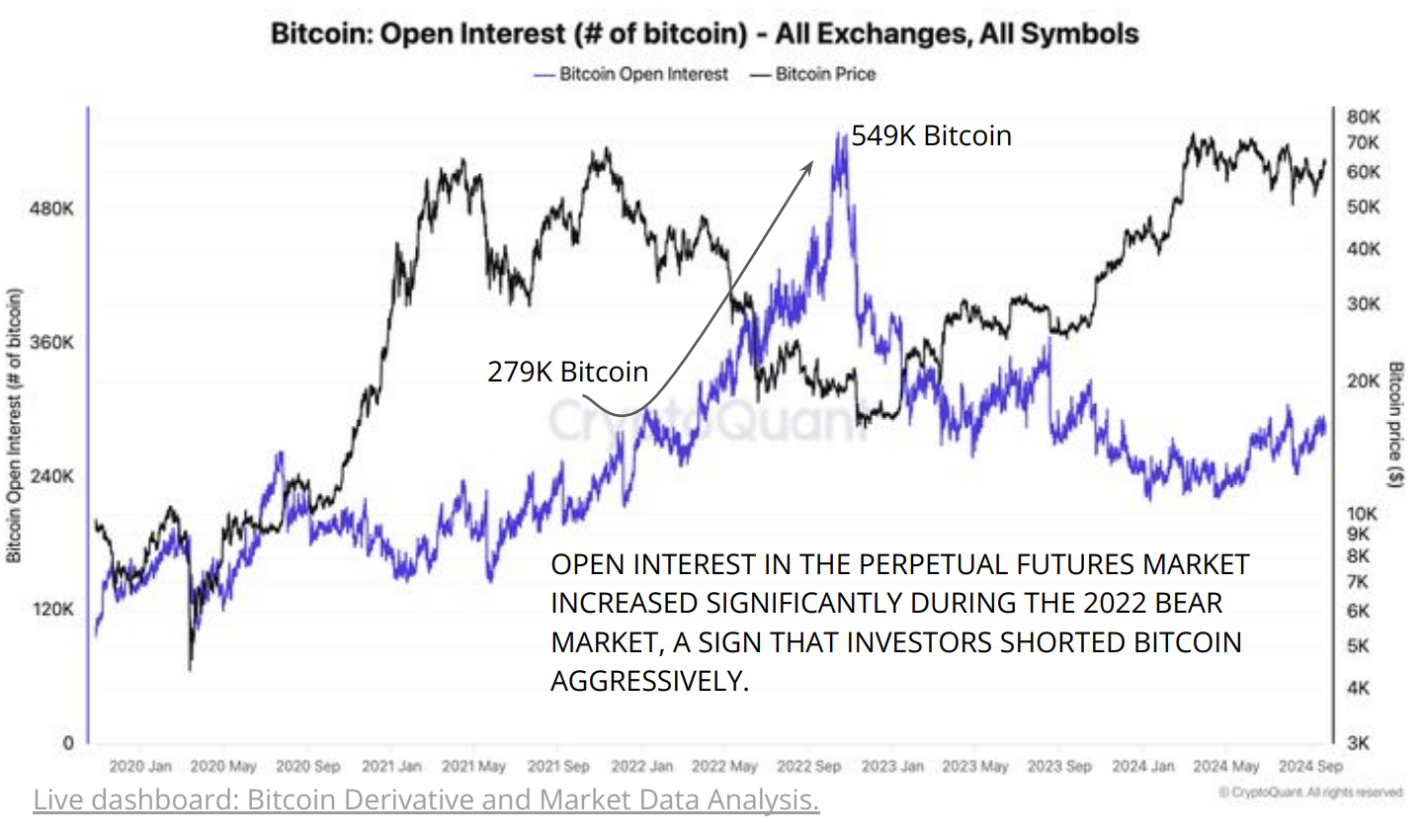

But there’s also a chance that these choices will add to the quantity of Bitcoin “paper.” It’s not necessarily a good thing that more advanced means of exposing Bitcoin don’t require actual Bitcoin (BTC) exchanges. This increasing paper supply has in the past really caused strong shorting of Bitcoin, which is a negative indication.

Worldcoin launches in three more countries; WLD token spikes

Following the expansion of product releases by developers into further nations, Worldcoin had a rise for the third day in a row.

Worldcoin launches in more countries

At $2, Worldcoin (WLD) reached its highest level since August 2 and retested the crucial resistance level. From its August low, the token has increased by more than 54%.

The creators said in a statement that World ID was now available in Guatemala, Malaysia, and Poland. Apart from these nations, other locations where Worldcoin may be found include Argentina, Chile, Austria, Mexico, and the United States.

1 week, 3 World ID verification launches 🇬🇹🇲🇾🇵🇱 pic.twitter.com/CwwNPNUPzh

— Worldcoin (@worldcoin) September 25, 2024

On its website, the creators claim to have verified over 6.7 million World IDs, with 155,000 new users having joined in the last seven days.

Concurrently, there have been 142 million wallet transactions, and per day there are now close to 400,000 wallet transactions.

Sam Altman founded Worldcoin, which is likewise based on the World Chain, a layer-2 Ethereum (ETH) network. Altman is the CEO and co-founder of OpenAI, the business that created ChatGPT.

The chain’s deployment, according to the creators, should reduce gas prices and facilitate scalability. The chain will also use World ID information to thwart artificial bots. Additionally, a portion of the gas fees the network makes will be split with verified users.

Data privacy is a top issue for both consumers and politicians. For instance, as hundreds of individuals waited in line to be verified, World ID registrations were suspended in Kenya for a few months. It also ran into privacy problems in Portugal and Hong Kong.

Worldcoin may have bottomed

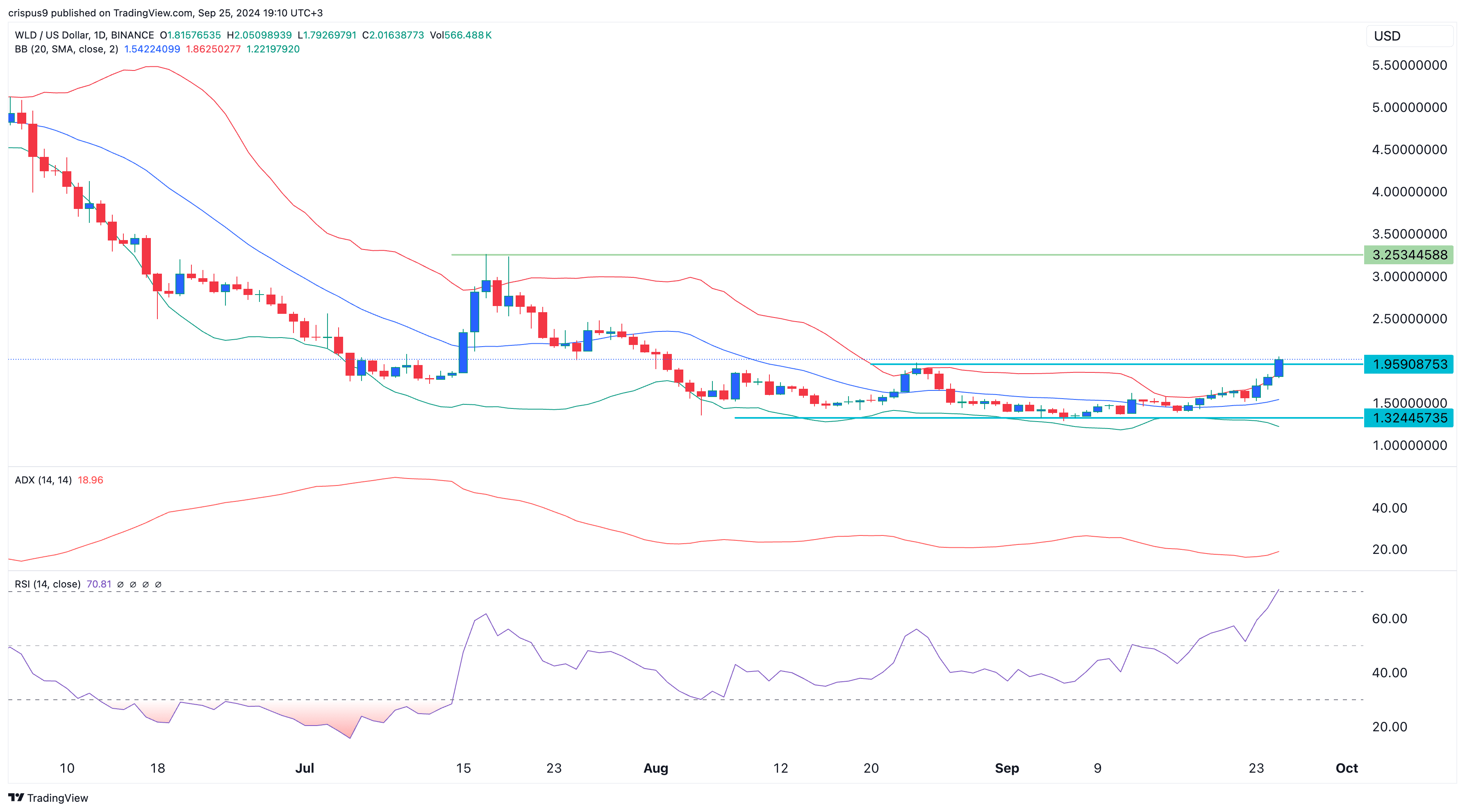

WLD recovered after forming a double-bottom pattern at $1.3245, where it found good support.

At $1.95, the currency has subsequently surged over the neckline of this pattern. While WLD has shifted to the top side of the broad Bollinger Bands indicator, the Average Directional Index has indicated upward. Furthermore, the Relative Strength Index has reached the 70 overbought level.

Worldcoin is probably going to keep going up; the $3.25 mark, which represents its peak swing in July, is the next benchmark to keep an eye on.

This comeback will probably be influenced by how other cryptocurrencies, particularly Bitcoin (BTC), perform. Altcoins like WLD will rise if Polymarket users are correct when they forecast that Bitcoin will hit a record high.

Coinbase-backed Truflation confirms hack, estimated around $5M

There were no client cash taken in the security compromise, according to Truflation’s staff.

Blockchain experts estimate that Truflation, a platform that tracks inflation using blockchain technology, may have lost up to $5.2 million as a result of a virus assault.

“The Truflation team detected some abnormal activity. An attacker launched an attack using malware,” the project said in a Sept. 25 X post.

On September 25th, 2024, the Truflation team detected some abnormal activity. An attacker launched an attack using malware.

We are currently monitoring the situation and are taking measures to protect funds while we are investigating and working with law enforcement. The…

— Truflation (@truflation) September 25, 2024

Along with engaging with “leading industry partners” and law enforcement, Truflation said that it was keeping an eye on the situation and taking precautions to safeguard cash.

Supported by organizations like Chainlink and Coinbase Ventures, the initiative is also attempting to get in touch with the hacker and is willing to negotiate. It further said that white hats who offered help would be compensated.

According to blockchain expert ZachXBT, around $5.23 million was lost from Truflation’s personal wallets and Treasury multisignature on Ethereum, while roughly $100,000 was lost overall on seven other chains.

According to an independent analysis conducted by blockchain security company Cyvers, Truflation lost $4.95 million.

From the team’s Ethereum wallets, about $3.89 million in Truflation (TRUF), $1.07 million in Ethereum (ETH), and $236,000 in the stablecoin were taken.

The staff at Truflation reported that no consumer money was lost. Its stake money was unaffected as well.

In the ninety minutes following Truflation’s X post, the TRUF token dropped 15.6% to $0.068 before somewhat rebounding to $0.073, according to CoinGecko statistics. At the moment, its market capitalization is $12.8 million.

Real-time economic and inflation data is available through the blockchain-powered financial data service Truflation.

Ten months after its December 2021 launch, Truflation also unveiled a data marketplace that monitored a number of commodities indices, including those for wheat, sugar, coffee, cocoa, cattle, and petroleum.