After weeks of pessimism, U.S. spot Ethereum ETF inflows recently reached their largest daily inflows since early February, suggesting a possible recovery.

According to SoSoValue statistics, the nine Ethereum ETFs listed in the United States had net inflows of $38.74 million on April 22, ending a 10-day run of either negative or zero flows. That is the most money they have received per day since February 4, when a staggering $307.77 million was received.

This follows over $910 million in outflows over eight consecutive weeks.

Most of the new funds were invested in Fidelity’s FETH, which generated $32.65 million. Additionally, Bitwise’s ETHW received a respectable $6.09 million.

There were no inflows during the day, and the other funds didn’t move much. These Ethereum ETFs have drawn around $2.26 billion in total since its inception.

The spike in ETF inflows coincided with Ethereum’s own recovery. ETH surged more than 10% on Tuesday, breaking above the $1,700 barrier for the first time since April 6.

Following remarks by U.S. Treasury Secretary Scott Bessent, who suggested that tensions with China over tariffs would soon ease, the surge appears to be motivated by a fresh sense of hope.

Earlier this month, Bitcoin appeared to be decoupling from conventional risk assets after advancing in lockstep with equities. Bitcoin has risen 13.6% so far in April, outpacing gold’s 6.7% gain. Conversely, the U.S. dollar index and the S&P 500 are both down around 5% this month.

These circumstances have led analysts to believe that Ethereum may be preparing for more increases. Ash Crypto, a market expert, wrote on X on April 23 that ETH is “ready to explode,” citing parallels to the setup of Bitcoin in late 2024.

$ETH IS ABOUT TO EXPLODE 🚀 pic.twitter.com/mMiFXpLzzJ

— Ash Crypto (@Ashcryptoreal) April 22, 2025

However, other analysts caution that there is still more work to be done. To prove a complete trend reversal, experts at crypto.news believe ETH must break over the $2,000 barrier and create a higher high. In the absence of such, this rebound may simply be another brief upswing in a longer downward trend.

Analyst predicts Pepe Coin price breakout if it soars past this level

A very positive TA for the price of Pepe Coin was given by a cryptocurrency expert, who predicted that if PEPE breaks over resistance at $0.00001, a massive pump will occur.

According to a well-known cryptocurrency market expert, the price of Pepe Coin (PEPE) is poised for a significant surge on Wednesday, April 23. The frog-themed meme coin is expected to have a bullish breakthrough soon after clearing short-term resistance around $0.00001 and, therefore, $0.00001050, according to analyst James Wynn’s prognosis.

The result? As of early Asian hours on Wednesday, this audacious forecast has investors and traders in the cryptocurrency market giddy with excitement amidst a wider market pump. At the time of publishing, the price of one PEPE token was around $0.000009, and it had increased by almost 15% during the day.

Analyst forecasts bull run for Pepe Coin price

James Wynn, an analyst, highlighted important TA developments for the price of Pepe Coin in a recent article on X. The expert claims that the meme currency is presently encountering psychological barrier in addition to short-term resistance around about $0.000010000.

Since everyone is asking for $PEPE TA updates again, I’ll start them up again.

I see short term resistance around 0.00001000 (psychological resistance).

And clear resistance / take profit zone at 0.00001050.

Here we will see a cup form. Where short term traders take profit,… pic.twitter.com/Bwv3IdZpWD

— James Wynn (@JamesWynnReal) April 23, 2025

There will be another “take profit” zone at the $0.00001050 price level if the meme token breaks this barrier. The meme coin’s price chart is currently set up for a cup formation as short-term traders profit and the price is momentarily dragged down by slight panic.

But the expert emphasizes that “to confirm the breakout, we’ll then rally back quickly to key resistance point 0.00001050, piercing through it and then coming back down for a retest at that level.” For background, Wynn predicted that the price of PEPE will retest this level, which would be its new support, following a successful breakout above 0.00001050.

FOMO will undoubtedly set in among traders and investors once this scenario is underway, which might fuel more price upward momentum. For reference, traders typically view this pattern development as bullish and refer to it as the “Cup and Handle” pattern.

Investor excitement has been maintained overall by the analyst’s audacious price projection, and this optimism has been reinforced by the meme coin’s recent price movement. As previously stated, the price of Pepe Coin is currently up 30% for the week and 15% intraday, ending at $0.000009086. In the last day, it rose from a low of $0.000007841.

According to the recent PEPE price study, which showed the timescale for a possible 7,220% spike, added to the euphoria around the meme coin’s valuation. Interestingly, this optimistic forecast is supported by Ethereum’s historic record, as the price of ETH today surpassed $1,800 in the midst of more general positive tendencies.

Australian Federal Court dismisses ASIC appeal, favoring crypto lender Block Earner

The lawsuit filed by financial regulator ASIC to penalize the digital asset marketplace was rejected by the court.

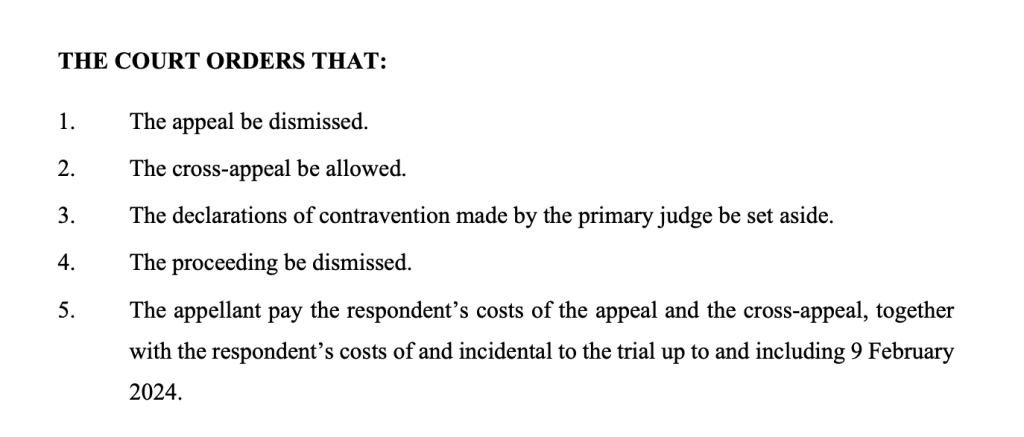

Block Earner, a cryptocurrency lender, has won a case in the Federal Court of Australia, reversing a ruling that it required an Australian financial services license (AFSL) in order to sell its cryptocurrency-linked “Earner” product.

The lawsuit filed by financial regulator ASIC to penalize the digital asset marketplace was rejected by the court.

The court determined in a ruling on Tuesday that the now-canceled “Earner” program was a loan rather than a managed investment plan.

Customers may “loan” certain cryptocurrency in exchange for interest paid at a predetermined rate under the Earner program, which was available from March to November 2022.

Block Earner wins appeal against ASIC, with the Full Court of the Federal Court finding it did not require an AFSL for its Earn product. #CryptoLaw https://t.co/MXLAAl8N3S pic.twitter.com/Nu8BjdTqQ1

— Aaron Lane (@AMLane_au) April 22, 2025

ASIC loses block earner suit

The action was started by the Australian Securities and Investments Commission (ASIC), which claimed that Block Earner’s “Access” and “Earner” programs had violated company regulations.

“ASIC is seeking declarations, injunctions, and pecuniary penalties from the Court,” the notice stated.

In February 2024, the Australian Federal Court rendered a decision that imposed sanctions on the “Earner” product. Judge Ian Jackson’s ruling at the time said that the items needed an AFSL license.

However, because the cryptocurrency company “acted honestly and not carelessly when it offered the Earner product,” another decision in June 2024 exempted Block Earner from paying a penalty in the local financial regulator’s lawsuit.

According to the Tuesday ruling, the regulator thought Block Earner should be fined up to $350,000.

Justices Catherine Button, Wendy Abraham, and David O’Callaghan rejected the ASIC’s appeal from the previous year. The three further mandated that ASIC pay for all legal fees associated with the initial trial and the appeal.

ASIC stated that it is “considering this decision” of the Federal Court in a recent press statement from the agency.

No plans to re-introduce ‘earner’ products

Despite the legal victory, Block Earner noted that it has no plans to re-launch its ‘Earner’ products for Australian customers.

Speaking to local media, Block Earner co-founder James Coombes said the Earner product was voluntarily closed in November 2022. Further, he stressed that there is no intention to reintroduce it.

“This case highlights the importance of ensuring regulations evolve alongside technology,” he said. “Without modernised guidance, Australia risks losing fintech innovation to offshore markets more supportive of responsible crypto entrepreneurship.”

Additionally, Block Earner co-founder Charlie Karaboga said that the ruling “brings closure to a long and difficult process.”