After a brutal sell-off triggered by U.S. President Donald Trump’s tariff announcement on February 1, the crypto market has staged a strong comeback. Bitcoin (BTC) and Ethereum (ETH), along with the broader digital asset market, faced sharp declines following the imposition of new tariffs on Canada, Mexico, and China. However, Trump’s decision to temporarily pause trade restrictions on Canada and Mexico has rekindled investor optimism.

Crypto Market Rebounds Strongly

Bitcoin rebounded sharply after plunging to $91,200 on February 3, now trading around $101,000—a 7% gain in 24 hours. However, it remains down 2% for the week.

Ethereum saw an even stronger recovery, jumping 10% to $2,800 after falling to $2,460. Despite the surge, ETH is still 12% lower than a week ago.

The broader crypto market followed suit, with total market cap rising 8.5% to $3.43 trillion, according to CoinGecko.

Investor sentiment improved as the Crypto Fear & Greed Index climbed to 72 (“greed”), up from a fear-driven low of 44 during the sell-off.

Tariff Fears and Ongoing Market Jitters

The initial crash was sparked by Trump’s announcement of a 10% tariff on China and 25% duties on Canada and Mexico. However, swift diplomatic efforts led to temporary 30-day pauses for Canada and Mexico, following negotiations involving Canadian Prime Minister Justin Trudeau and Mexican President Claudia Sheinbaum.

I just had a good call with President Trump. Canada is implementing our $1.3 billion border plan — reinforcing the border with new choppers, technology and personnel, enhanced coordination with our American partners, and increased resources to stop the flow of fentanyl. Nearly…

— Justin Trudeau (@JustinTrudeau) February 3, 2025

This is absolutely insane:

Just 48 hours after the trade war began, President Trump has reached a deal with BOTH Canada and Mexico.

This includes both countries deploying 10,000 personnel to monitor the border and reduce drug trade.

US tariffs on Canada and Mexico will be… pic.twitter.com/dodrli66VS

— The Kobeissi Letter (@KobeissiLetter) February 3, 2025

Despite these developments, uncertainty lingers. Trump has stated that tariffs on Mexico could still take effect, while China remains subject to the new tariffs. Adding to the volatility, concerns over China-based DeepSeek’s new AI model have impacted global tech markets, contributing to crypto’s recent turbulence.

President Trump says the US and Mexico have not agreed on tariffs and they could still go into effect. He says Mexico agreed to send 10,000 National Guard officers to guard the border and stem the flow of fentanyl. He says talks with Canada are ongoing https://t.co/wALUHcJRMC pic.twitter.com/mRPKp4PqIJ

— Bloomberg TV (@BloombergTV) February 3, 2025

While the tariff pause has provided temporary relief, the crypto market remains sensitive to geopolitical shifts, with potential for renewed volatility in the weeks ahead.

Powell’s Shift on Crypto: The Fed and Institutions rally behind Bitcoin

In a surprising turn following its January 28-29 meeting, the Federal Reserve kept interest rates unchanged but delivered a major shift in its stance on digital assets. Fed Chair Jerome Powell acknowledged the role of cryptocurrencies in the financial system, marking his most accommodating position to date.

Regulatory Green Light for Crypto

Powell emphasized that U.S. banks are permitted to serve crypto clients, provided they manage risks effectively. “Banks are perfectly able to serve crypto customers as long as they understand and can manage the risks,” he stated. This regulatory signal triggered a Bitcoin (BTC) price surge, pushing it to an all-time high of $105,000 before stabilizing.

From Skepticism to Mainstream Acceptance

Just a year ago, Powell described crypto as rife with “turmoil” and fraud. His shift reflects growing institutional acceptance, with Bitcoin now seen as a legitimate macroeconomic asset.

Bitcoin’s Rise Amid Institutional Adoption

Bitcoin’s growth isn’t solely due to regulatory shifts. Institutional adoption is booming, with Bitcoin ETFs attracting $16.6 billion in Q4 2024, pushing assets under management past $105 billion. Open interest in Bitcoin derivatives surged 60%, while monthly trading volumes exceeded $3 trillion.

A Hedge Against Economic Uncertainty

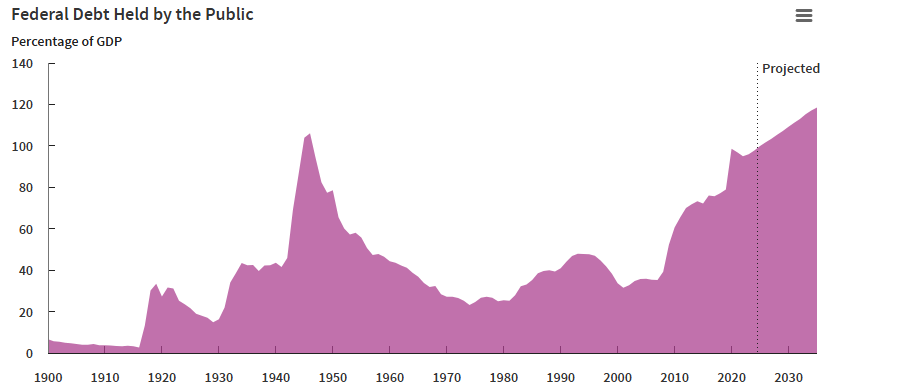

Macroeconomic concerns further boost Bitcoin’s appeal. The U.S. budget deficit is projected to hit $1.9 trillion in 2025, with public debt surpassing 118% of GDP by 2035. As fiat currency stability wavers, Bitcoin’s scarcity and independence from government policy position it as a strong hedge.

A New Era for Bitcoin

With potential rate cuts through 2026 and Bitcoin’s growing role in traditional finance, the digital asset is evolving beyond speculation into a key player in the global economy.

Centralization Falls Short, Decentralization Emerges as the Solution: Crypto Expert

Traditional Regulations Miss the Mark

Miles Jennings, General Counsel for venture capital giant a16z, has raised concerns over traditional regulatory approaches, arguing that measures like antitrust laws often fail to tackle the root issues of centralization. In a recent blog post, Jennings highlighted how centralized control in sectors such as technology, finance, and artificial intelligence limits public discourse, restricts financial access, and curtails the free flow of information.

The Dominance of Centralized Power

“Big Tech, Big Banks, and Big AI dominate these industries, leaving users with little influence over platforms that shape their daily lives,” Jennings wrote. While decentralization offers a promising solution, he noted that it requires robust incentives to become truly viable.

Centralization vs. Decentralization Efficiency

Centralization, Jennings acknowledged, brings efficiency—allowing for quick decision-making, streamlined resource management, and rapid scaling. However, this concentration of power stifles competition, fosters arbitrary rule-setting, and limits financial inclusion. Historically, decentralization struggled to operate at scale due to technological limitations.

Blockchain Networks Prove the Potential

That narrative is shifting with the rise of blockchain networks like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), which have demonstrated that decentralized ecosystems can manage trillions of dollars in value effectively.

The Challenge: Incentivizing True Decentralization

The current challenge, Jennings argued, is incentivizing projects to embrace true decentralization. He criticized regulatory frameworks for creating hurdles, pushing many blockchain projects toward centralized models under the guise of decentralization.

A Call for Evolving Regulations

Jennings called for regulatory evolution—reducing compliance burdens for decentralized systems and fostering legal and economic incentives. “Decentralization drives competition, creativity, and fairness,” he asserted, emphasizing its potential to reshape industries sustainably.