The cryptocurrency market had a major collapse, wiping off almost $850 million due to liquidations. This occurred following the Federal Reserve’s announcement of a 25 basis point cut in its benchmark interest rate.

Although the markets had expected a minor rate drop, Federal Reserve Chair Jerome Powell’s warnings of a cautious approach to future rate changes in 2025 sparked market confusion and massive sell-off.

Bitcoin dip liquidates nearly 300,000 crypto traders

During a news conference, Powell stated that while inflation has been “steadily” declining, it has been “slower than hoped.” As a result, the Fed raised its inflation prediction for 2025 to 2.5%, indicating a potential tightening of economic circumstances that might limit liquidity in financial markets, including cryptocurrency.

“Inflation has made progress toward the Committee’s 2 percent objective but remains somewhat elevated. The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate,” Federal Reserve said in a press release.

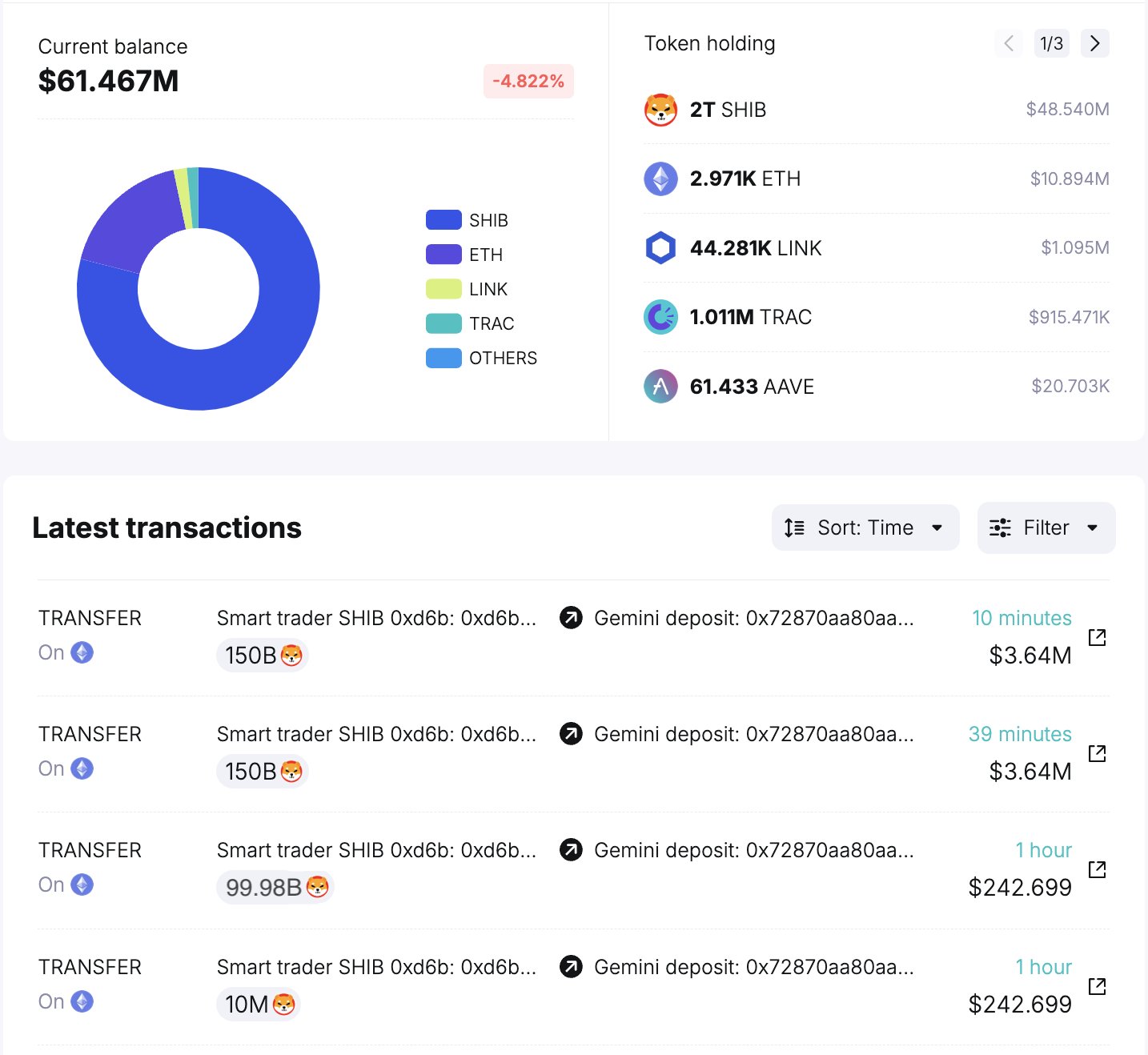

This adjustment in monetary policy caused a dramatic decrease in Bitcoin, which plummeted below $99,000, a more than 8% loss from its all-time high of $108. Similarly, the larger crypto market, which includes major currencies such as Ethereum (ETH), saw huge losses.

According to Coinglass, liquidations have wiped away a remarkable $869.39 million in the last 24 hours, with $749.59 million from long holdings and $119.80 million from shorts. Notably, cryptocurrencies absorbed the brunt of the hit, accounting for more over $222 million in liquidated assets.

During these market moves, 299,335 traders were taken off guard. The greatest single liquidation order on Binance was for an Ethereum deal worth $7 million.

Despite these setbacks, optimism among cryptocurrency traders remains remarkably strong. The cryptocurrency fear and greed index is now at 75, indicating a strong positive outlook amidst market volatility. This opinion demonstrates the enduring attractiveness of cryptocurrencies as an investment, especially during stressful times.

This confidence was reinforced by significant inflows into Bitcoin-related investment instruments. The iShares Bitcoin Trust by BlackRock, for example, received $359.6 million in fresh investments on Wednesday alone. Meanwhile, the total inflow for all spot Bitcoin (BTC) ETFs hit $275.3 million.

These events, which represent a cautious Federal Reserve and an enthusiastic crypto market, highlight the intricate relationship between macroeconomic policy and cryptocurrency markets. Investors appear to be hedging against economic uncertainty by increasing their holdings in digital assets, which, despite their inherent volatility, are regarded as a credible method for portfolio diversification.

The latest market action demonstrates the impact of US monetary policy on the cryptocurrency sector. As the Federal Reserve navigates inflationary problems, the cryptocurrency market’s response remains rapid and pronounced.