With a 224% increase in value over the last month, Metaplanet’s shares closed at 1,116 JPY today, 447% more than the price of Bitcoin.

With a further 15% rally, Metaplanet’s stock reached 1,116 JPY levels on the Tokyo Stock Exchange, bringing its monthly gains to almost 224%. Because the stock price is currently trading at a 447% premium to Bitcoin, as if each BTC were worth $596,154, or more than five times its real price, this huge rise attracted investors’ attention. This valuation disparity has raised red flags for analysts at 10x Research.

Is Metaplanet stock a risky bet from here?

Even though the price of Bitcoin has increased by $15,000, or more than 16%, in the last month, the Japanese stock has experienced a massive surge, rising 224% in the same time frame. The Metaplanet stock was trading as if Bitcoin were worth $596,154, which is over five times its current price, according to analysts at 10x Research. As a result, the stock price is currently trading at a staggering 447% premium over Bitcoin.

A worrying Net Asset Value (NAV) distortion that may indicate underlying problems has been noticed by analysts. Additionally, analysts think that the stock is currently approaching an inflection point due to declining volatility and a realignment of the flows of individual investors. The picture below compares the prices of Bitcoin, Metaplanet, and Strategy (MSTR) over one year, highlighting the disparity in valuation.

The unpredictability of the Japanese bond market, currency fluctuations, rising rates, etc., all contribute to the market’s uneasiness. According to 10x Research, notwithstanding these uncertainty, Metaplanet has garnered further investor interest and demand.

High Bitcoin taxes in Japan raise demand for proxies

Despite being one of the most crypto-friendly countries in the world, Japan taxes Bitcoin earnings at up to 55% due to its classification as “miscellaneous income.” Compared to the ordinary capital gains tax of 20%, this is a substantial increase. As a result, rather than using Bitcoin directly, investors have been searching for Bitcoin proxy bets like Metaplanet.

The more advantageous 20% capital gains rate is applied to gains from Metaplanet shares. Furthermore, Metaplanet stock dividends and capital gains are completely tax-exempt for investors who use Japan’s NISA (Nippon Individual Savings Account). For Japanese investors looking to gain exposure to Bitcoin, Metaplanet is a desirable choice because to its effective tax treatment.

The Metaplanet surge may continue if the price of Bitcoin rises to new all-time highs and breaks through the crucial $110,000 resistance level.

BNB Chain closes speed gap with Ethereum as Maxwell Hard Fork hits testnet

The eagerly awaited Maxwell Hard Fork has been successfully deployed on the testnet by BNB Chain. High-speed, low-latency blockchain performance is provided by this launch.

The planned date of Maxwell’s mainnet activation is June 30, 2025. However, this implementation puts BNB Chain in a position to compete with the Ethereum and Solana blockchains on some parameters.

BNB Chain’s Maxwell upgrade: What users need to know

The update, which was turned on at block 5,255,2978, is a fundamental redesign of the networking and consensus systems of the BNB Chain. Block timings are greatly shortened, validator communication is improved, and sync efficiency is increased—all of which are critical for growing developer and user experiences on-chain.

Maxwell HardFork Successfully Activated on BNB Chain Testnet✨

The Maxwell upgrade is now live on BNB Chain testnet, activated at block 5,255,2978.

Key Technical Specifications:

🔶Block time: 0.75 seconds

🔶Consecutive block production: 16 blocks

🔶Enhanced network scalability… pic.twitter.com/lG8VLUiUUR— BNB Chain (@BNBCHAIN) May 26, 2025

In honor of James Clerk Maxwell, the physicist who brought electricity and magnetism together, the network dubbed its Maxwell Hard Fork. Similar to this, BNB Chain’s update attempts to balance speed and stability, two frequently conflicting blockchain priorities.

Block time is reduced by half, from 1.5 seconds to 0.75 seconds. This significant acceleration is accompanied by new technical improvements to preserve validator and node synchronization. This would guarantee that decentralization and network health are not sacrificed for quicker blocks.

Modifications to network propagation and consensus cadence are two of the main changes made. Validators now hold the lead for 16 blocks per turn, and the epoch length has been increased from 500 to 1,000 blocks. As a result, proposer durations remain constant as the number of blocks increases.

In order to maintain a constant throughput and avoid state bloat and network congestion, the per-block gas limit has also been cut in half, from 70 million to 35 million.

Within 400 milliseconds, blocks can spread among validators thanks to improved networking layer methods. In a similar vein, enhanced range sync capabilities enable lagging nodes to remain current despite the quicker cadence.

Implications for users and rival blockchains

There are significant ramifications for end consumers. BNB Chain is getting closer to a Web2-like experience with block timings of less than a second and finality presently reaching 1.9 seconds.

Instant confirmation is available for transactions like swaps, mints, and gameplay activities. This improved responsiveness provides consumers with a seamless and instantaneous experience, reducing the psychological gap between Web2 and Web3.

Additionally, the update gives developers new design possibilities. High-frequency trading dApps, prediction markets, and real-time games can all function directly on Layer-1 without the need for independent fast chains.

The BNB Chain, meantime, is already gaining significant traction. With a 24-hour trade volume of over $13 billion, which is about six times more than Solana’s, DefiLlama is presently leading the decentralized exchange (DEX) industry, according to data.

Additionally, according to data from Chainspect, the transaction throughput per second has increased by 37%, with BNB Chain processing 12 times as many transactions as Ethereum.

Nonetheless, BNB Chain continues to lag behind Ethereum by 87.5% and 99.21%, respectively, on block time and finality metrics.

Industry watchers are hopeful. Elja, a DeFi advocate, said that the previous Lorentz Hard Fork from BNB Chain tenfold reduced gas prices.

Elja described Maxwell’s promises of significantly quicker speeds, improved validator coordination, and smarter syncing as “even more bullish” for the future of BNB Chain.

Lorentz Hardfork resulted in 10x gas fees reduction and increased TPS.

The upcoming Maxwell Hardfork will be even more bullish for @BNBChain.

➺ BEP-524 for block time reduction to 0.75 sec, which means higher TPS

➺ BEP-563 for improved validator coordination, ensuring faster… pic.twitter.com/0MtMOGxUdl

— Elja (@Eljaboom) May 26, 2025

Another user agreed, stating that the update should fix the high failure rates they had previously encountered while selling wallets.

The Maxwell Hard Fork puts BNB Chain at the forefront of high-performance Layer-1 blockchains as the mainnet countdown goes on. It combines stability of the infrastructure, interoperability with the Ethereum Virtual Machine (EVM), and lightning-fast execution.

XRP price suffers downtrend as overvaluation delays recovery to $2.50

Over the past few weeks, XRP has been steadily declining, resulting in losses for numerous investors. Some important investors are aggressively attempting to halt the bearish momentum despite the price decline.

Their work may be crucial in stabilizing and even reversing the downward trend of XRP.

XRP investors are optimistic

In just one month, XRP’s Network Value to Transactions (NVT) Ratio has risen to its greatest level. An approaching price correction is frequently indicated by a rising NVT Ratio, which usually means that the network’s valuation is higher than its transaction activity. This indicator suggests that XRP may be overpriced in relation to its present usage.

However, by recovering from moments of overvaluation, XRP has previously demonstrated resiliency. This time, investors and holders anticipate a comparable recovery driven by rekindled buying demand.

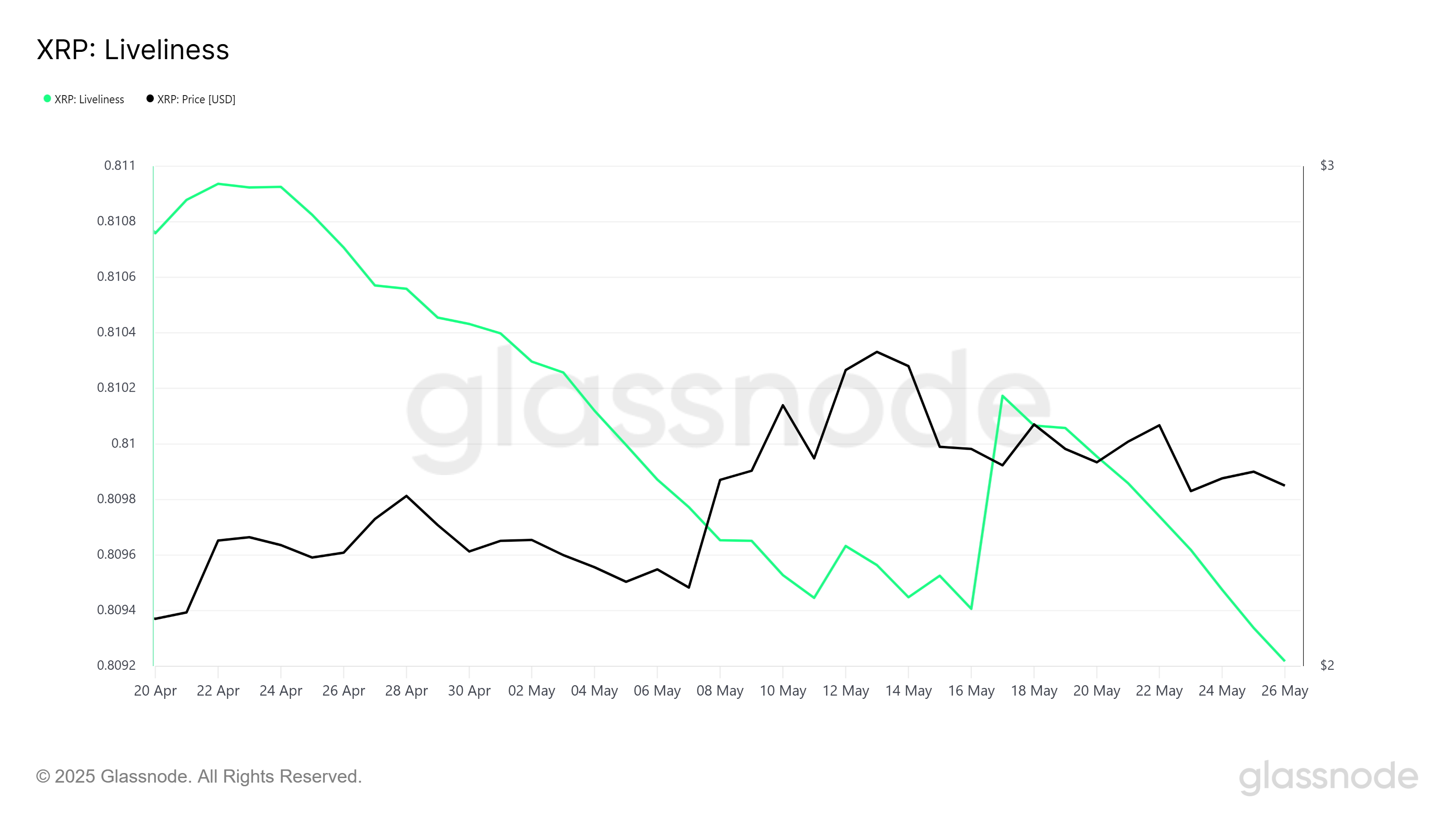

The declining trend of XRP’s Liveliness indicator indicates that long-term holders (LTHs) are actively accumulating the cryptocurrency. A dip in Liveliness indicates that these investors are trying to stabilize the market by holding onto their tokens in spite of price declines. In contrast to this pattern, an upsurge would suggest more selling pressure.

Confidence in XRP’s long-term prospects is demonstrated by LTH accumulation during a price decline. By absorbing selling pressure and putting themselves in a position to profit when the price recovers, these holders are reversing bearish trends and offering a crucial support layer.

XRP price nears losing key support

At $2.30, XRP is currently showing a two-week downward trend. At $2.27, it is holding barely above a crucial support level. To stop additional drops and keep a foothold for future gains, the altcoin must secure this support.

If the bullish reasons keep becoming stronger, XRP can recover from the $2.27 support level. If the downtrend is broken, XRP may be able to turn $2.38 into fresh support, opening the door for a rally to $2.56. Investor trust would be restored as a result of this recovery.

On the other hand, XRP can fall further lower to $2.12 if it loses support at $2.27. Increased investor losses and continuous bearish pressure would result from such a collapse, which would invalidate the bullish view and prolong the current downtrend.