News about Spot Bitcoin ETF inflows. Compiled data from BitMEX Research estimates there are 150 crypto ETPs available today, with $50.3 billion in assets under management.

The data from BitMEX Research underscores the potential impact of United States-approved spot Bitcoin exchange-traded funds (ETFs) on the broader crypto-related ETF market. The current global market for crypto exchange-traded products (ETPs) comprises around 150 products with a combined $50.3 billion in assets under management (AUM). If approved, spot Bitcoin ETFs in the United States could significantly surpass this total, signifying the substantial growth and influence these products might have in the cryptocurrency investment landscape.

Complete List of Cryptocurrency Related ETPs

In anticipation of the SEC approving the spot Bitcoin ETFs, we present what we believe to be a comprehensive list of all the existing crypto related exchange traded products

We have found 150 products with $50.3bn of assets, as at 22… pic.twitter.com/cFUxtuvXgd

— BitMEX Research (@BitMEXResearch) December 25, 2023

The Spot Bitcoin ETF inflows

The list of crypto exchange-traded products (ETPs) includes both spot and futures funds, with a focus on tracking the performance of Bitcoin and Ethereum. Grayscale’s Bitcoin Trust is the largest ETP on the list, and it is currently undergoing an attempt to be converted into a spot ETF product.

Market analysts anticipate that the approval of a spot Bitcoin ETF, expected as early as Jan. 10, could potentially double the total investment in crypto ETPs. Bitwise predicts that spot Bitcoin ETFs could attract around $72 billion in assets under management within the next five years, more than doubling the current market. However, a more conservative estimate from Van Eck suggests that approximately $2.4 billion could flow into spot Bitcoin products in the first quarter of 2024.

While a spot Bitcoin ETF has not been approved in the U.S., such products are not new globally. Several countries, including Canada, Australia, and Germany, already allow investors to buy shares in spot Bitcoin ETFs.

Also read: 2 Risks of Bitcoin ETF launch

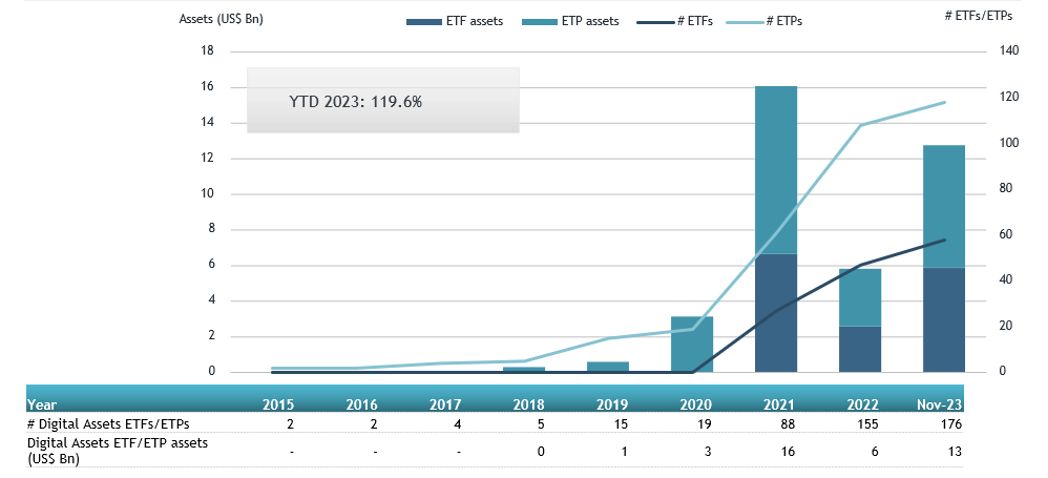

The optimism surrounding spot Bitcoin ETFs reflects a broader trend of increasing institutional investment in crypto investment products over the past few months. According to a report from ETF research firm ETFGI, global crypto ETFs attracted year-to-date net inflows of $1.6 billion, with $1.31 billion added in November alone. This total investment nearly doubles the $750 million net inflows into crypto ETPs in 2022.

Among the 150 crypto funds, the top 20 ETFs have garnered the most significant investment, attracting a total of $1.3 billion throughout 2023. Notably, the ProShares Bitcoin Strategy ETF (BITO), launched during a crypto bull market in October 2021, experienced the largest individual inflows. BITO captured an additional $278.7 million in 2023, reflecting sustained investor interest in this specific Bitcoin-focused ETF.