After accusing the Chinese owners of TikTok of buying $300 million worth of the TRUMP meme coin as a bribe, US Congressman Brad Sherman sparked a heated political dispute.

In response to regulatory hurdles in some places, TikTok has resisted and denied the politicians’ allegations.

Congressman accuses TikTok of $300 million TRUMP coin bribe

Sherman’s remarks coincided with an executive order signed by US President Donald Trump on Thursday that extended TikTok’s US divestment deadline by ninety days. The enforcement date was moved by Trump to September 17, 2025.

With 170 million US users, the Chinese-owned social media platform has until September to find a buyer or risk being banned in the US, according to this decision. The president has now delayed this deadline three times, the last time being on June 19.

Congressman Sherman has claimed that Trump’s choice was motivated by personal gain, which has caused debate.

The law allows only one single extension, so Trump’s failure to enforce it is illegal.

However, the Chinese owners of TikToK have announced they are buying “Trump Coins” for $300 million. Trump creates “Trump Coins” at no cost, meaning this is just a $300 million bribe that goes… https://t.co/kBzCMUcN7t

— Congressman Brad Sherman (@BradSherman) June 19, 2025

Sherman claims that the ruling encouraged TikTok’s Chinese owners to purchase $300 million worth of TRUMP Coins. The Congressman claims that the purchase is only a bribe because token creation is free of charge.

Congressman Sherman argues that the extension is illegal from a legal perspective because the statute only permits one extension. This, he believes, makes Trump’s postponement unlawful.

“The Act permits the President to grant a one-time extension of no more than 90 days with respect to the prohibitions’ 270-day effective date if the President makes certain certifications to Congress regarding progress toward a qualified divestiture,” read an excerpt in a January filing.

In the meantime, some, including Senate intelligence committee vice-chair and Democratic senator Mark Warner, charge the Trump administration with “flouting the law and ignoring its national security findings about the risks posed by a PRC-controlled TikTok.”

TikTok pushes back on bribe allegations

In a prompt response, TikTok’s official policy account vehemently denied the accusations. The group characterized the accusations as untrue and careless, stating that the Congressman’s actions go against a letter he signed in May.

Congressman, claiming that the owners of TikTok are buying “Trump Coins” is patently false and irresponsible and doesn’t even accurately reflect a letter you signed last month. https://t.co/8uxxPrKlzP

— TikTok Policy (@TikTokPolicy) June 19, 2025

The Congressman’s $300 million Trump Coin assertion is currently unsupported by any on-chain evidence as of this writing. Nevertheless, this revelation raises additional questions about TikTok’s ongoing regulatory issues.

It revealed six months ago that TikTok might be the subject of a UK Financial Conduct Authority (FCA) investigation due to claims that it ran an unregistered cryptocurrency exchange.

According to reports, the main focus of the inquiry was whether TikTok’s platform was being used to advertise or enable cryptocurrency transactions without the necessary controls.

Reddit, which was thinking about purchasing TikTok’s US operations, has expressed interest in the platform despite its legal issues. Reddit was investigating a plan to include blockchain technology into the platform, as revealed. This concept emphasizes TikTok’s pivotal position in the expanding convergence of Web2 and Web3 platforms.

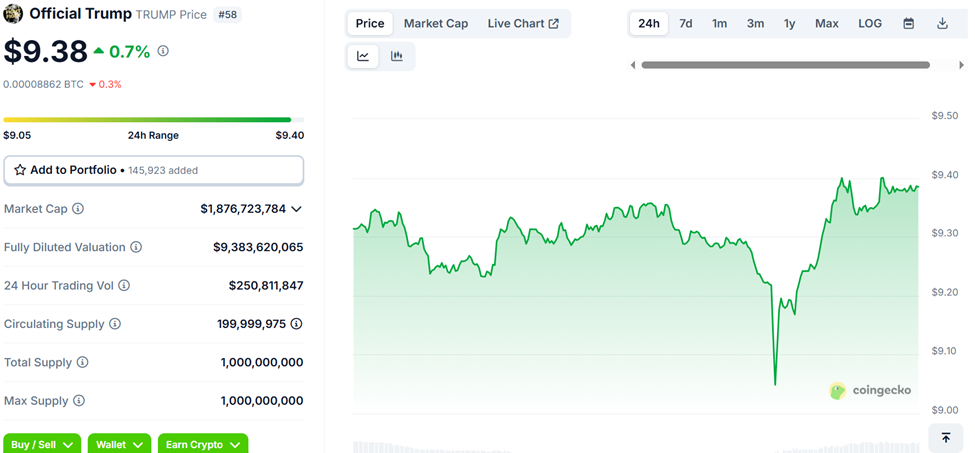

Over the past year, the TRUMP meme currency has gained popularity due to rumors, celebrity support, and connections to the US president. The token has increased by a moderate 0.7% during the past day in spite of these events.

Despite Trump’s official recognition of the token, some contend that its marketing and any insinuation of overseas sales present grave conflicts of interest.

Cardano price risks 30% crash as Hoskinson blasts Chainlink integration delay

A rising spreading wedge chart pattern has been established by the price of cardano, suggesting a 30% decline in the upcoming weeks.

As the cryptocurrency market continues to tumble, the price of Cardano is expected to decline for the sixth week in a row. Today, June 20, ADA is trading at $0.60, which is 55% below its peak for the year and the lowest level since April 25.

As its decentralized finance (DeFi) growth reverses and Charles Hoskinson bemoans the ongoing Chainlink integration, technicals predict another 30% drop.

Cardano price eyes a 30% crash if it loses key support

The weekly timeline indicates that when the cryptocurrency surge picked up speed in December, the price of Cardano reached its highest point at $1.315. Then, when Bitcoin soared to a record high, it turned around.

For six weeks in a row, the price of ADA has fallen below the 50-week Exponential Moving Average (EMA). Confirming the downward trend, oscillators such as the Percentage Price Oscillator (PPO) and the Commodity Channel Index (CCI) have also headed downward.

Cardano is gradually creating the megaphone, a massive rising spreading wedge formation. Two trendlines that are climbing and diverging make up this pattern.

In this instance, the bottom side links the lower lows since September 2023, and the upper side links the higher highs since January 2023. An asset typically bursts upward after repeatedly retesting the channel’s lower side.

In this instance, the bearish outlook will be confirmed with a decline below the crucial support level of $0.516. Since it was the lowest swing in February and April, this level is significant because it represents a bullish double-bottom pattern.

At $0.40, or almost 30% below the present level, a decline below that level will indicate further downside to the lower half of the rising expanding wedge. After falling to that level, it will then rise again and might even reach the high of $1.315 from the previous year

The bullish ADA price prediction will be deemed invalid if the price falls below the lower side of the wedge. Additionally, it will make it possible for the coin to drop to the support level at $0.273, which was the lowest swing on August 5.

Charles Hoskinson laments about Chainlink integration

Charles Hoskinson has been advocating for the delayed Chainlink integration since December of last year, and this could be a trigger for the pessimistic Cardno estimate.

Hoskinson claimed in a video statement that he was still not sure why his chain was not being integrated by Chainlink. He stated:

“There seems to be two factions within Chainlink. There’s the leadership of Chainlink that I am friends with and know very well. And every time we talk, we say that we should do more together. Then there is the business side of Chainlink that say they would like to integrate, and it never goes anywhere.”

As the largest player in the Oracle business, Cardano would be very interested in integrating with Chainlink. The addition of the Cross-Chain Interoperability Protocol (CCIP), which would allow Cardano to integrate with other chains like Ethereum and Base, will also be advantageous.

The price of Cardano is also in jeopardy because its decentralized finance (DeFi) ecosystem’s total value locked (TVL) has dropped by 30% to $330 million in the previous 30 days. Compared to most chains, its stablecoin supply is significantly smaller, at just $30 million.

Coinbase secures coveted MiCA license in Luxembourg, COIN Stock rallies

Following Coinbase’s acquisition of the MiCA authorization to offer cryptocurrency services in the EU, the price of COIN has increased.

After securing the highly sought-after Markets in Crypto-Assets (MiCA) license to conduct business in the European Union (EU), Coinbase has achieved yet another significant milestone. Since this event, the COIN stock has increased by more than 3%.

Coinbase Obtains MiCA License To Operate In EU

The cryptocurrency exchange declared in a blog post that the Luxembourg Commission de Surveillance du Secteur Financier (CSSF) had granted it a MiCA license. This makes it possible for the business to provide its cryptocurrency services to 450 million people in all 27 EU member states.

This comes a few days after the first word that Coinbase was going to receive approval from the EU. This milestone, according to the leading cryptocurrency exchange, is a big step forward and allows it to function in a “unified, regulated crypto environment in one of the largest economic regions in the world.”

The math in Europe is simple. Regulation = clarity = opportunity. We are grateful to work with forward-thinking regulators like the CSSF. https://t.co/5BIZG0nxM0

— paulgrewal.eth (@iampaulgrewal) June 20, 2025

In recent years, the cryptocurrency exchange has obtained licenses in Germany, France, Ireland, Italy, the Netherlands, and Spain. Millions of Europeans will now be able to access “regulated, trusted, and secure crypto services” thanks to the MiCA license, the company announced, which unifies these regulatory initiatives under a single framework.

Amid this statement, the price of COIN’s stock has surged, surpassing $300. The Coinbase stock is currently trading at about $304, up more than 3% during today’s trading session, according to TradingView data.