Amazon shareholders are encouraging the company to invest some of its $88 billion in cash and short-term assets to Bitcoin. The initiative comes in response to a recommendation by the National Center for Public Policy Research (NCPPR).

This move comes as Bitcoin (BTC) develops popularity among businesses as a hedge against inflation.

Amazon shareholders advocate for Bitcoin treasury

The NCPPR noted in their suggestion that Amazon’s significant cash reserves might lose buying power due to inflation. It challenged the Consumer Price Index (CPI) as an inaccurate indicator, implying that the true inflation rate may be closer to 10%. The letter stressed that, despite its short-term volatility, Bitcoin has traditionally outperformed traditional corporate bonds.

“Amazon should – and perhaps has a fiduciary duty to – consider adding assets to its treasury that appreciate more than bonds, even if those assets are more volatile short term,” the NCPPR wrote in the proposal.

Podcaster Tim Kotzman, who published the suggestion on X (previously Twitter), emphasized the rising business interest in Bitcoin adoption. The NCPPR also included firms like MicroStrategy and Tesla. MicroStrategy has led the effort, with approximately 402,000 Bitcoin—currently worth more than $40 billion—serving as its principal treasury reserve asset, according to Bitcoin Treasuries statistics.

Amazon has experimented with blockchain technology by offering managed services and job postings for blockchain and cryptocurrency expertise. However, it has yet to accept bitcoin payments or include digital assets on its balance sheet. Analysts believe that Amazon’s Bitcoin treasury move might mark a seismic change, perhaps influencing other business giants like as Apple.

BREAKING: Amazon shareholders request the company explores adds #Bitcoin to its treasury.

First Microsoft, now Amazon.

Apple is next…then every single boardroom. pic.twitter.com/ynTsJWNcwF

— Bitcoin Archive (@BTC_Archive) December 8, 2024

Binance co-founder Changpeng Zhao (CZ) joined the argument, asking Amazon to accept Bitcoin payments. Nonetheless, a person on X (Twitter) has expressed a contrary viewpoint.

Some $AMZN shareholders have asked the company to add #bitcoin to its Treasury. What most don’t realize is that $AMZN has $88bn of cash, but also has $67bn in debt and $87bn of lease liabilities. It requires cash to run its daily operations. The company’s NET cash is minimal… pic.twitter.com/PRJYSHX2Mm

— Special Situations 🌐 Research Newsletter (Jay) (@SpecialSitsNews) December 9, 2024

They expect a lukewarm or frigid reception to the board’s plan, which will be debated at the 2025 annual shareholder meeting.

Microsoft is also in the Bitcoin treasury spotlight

Meanwhile, Amazon isn’t the only large technology business under pressure to accept Bitcoin. Microsoft shareholders will vote on a similar proposal at their annual meeting on December 10. However, Microsoft executives have recommended shareholders to oppose the idea.

The board clarified its recommendation against the idea, claiming that it is “unnecessary.” It stated that financial measures, including government asset allocations, are already under review. Nonetheless, many anticipate the plan to pass, noting BlackRock’s position as Microsoft’s second-largest investor behind Vanguard.

Guess who Microsoft’s second largest shareholder is?

Guess who made the Bitcoin ETFs happen?

— Terence Michael (@ProofOfMoney) October 25, 2024

Michael Saylor, MicroStrategy’s executive chair, also made a daring suggestion to Microsoft. He believed that a good Bitcoin strategy might increase the market valuation by approximately $5 trillion. Meanwhile, multimedia site Rumble recently gained attention for establishing a Bitcoin treasury.

The decision was apparently prompted by MicroStrategy’s Michael Saylor, who has been an outspoken supporter for institutional Bitcoin adoption.

NEW: It took just 6 days for Rumble to adopt #Bitcoin as a reserve asset after talking with Michael Saylor.

Saylor is the 🐐 pic.twitter.com/NpxL7tPjgW

— Nikolaus Hoffman (@NikolausHoff) November 25, 2024

These developments coincide with a rising support for Bitcoin’s potential as a treasury reserve asset. Concerns about inflation and fiat currency depreciation motivate this.

Tesla’s high-profile Bitcoin acquisition in 2021, together with MicroStrategy’s ongoing purchases, have established a precedent. The timing of these suggestions reflects larger macroeconomic worries, as the Federal Reserve indicates continuing monetary tightening.

Cardano Foundation X account compromised, ADA slips

The Cardano Foundation X account was hacked, resulting in a fraudulent token promotion and the announcement that ADA withdrawals were halted.

In an extraordinary turn of events, the Cardano Foundation’s X account was hacked on Sunday. Notably, the yet-to-be-identified hacker marketed a bogus token and claimed that ADA withdrawals will be halted due to a crackdown by the US Securities and Exchange Commission. As a result, the larger market experienced a surge of worries, with even the native coin’s price displaying diminishing intraday movement.

Cardano Foundation X account faces hack raising market concerns

According to an X post from the coin’s community account on December 8, “the Cardano Foundation X account @Cardano_CF has been compromised.” Furthermore, the crypto team advised users to disregard any messages from this account while the team resolved the issue.

Following the X account intrusion, users on the social networking site saw a bogus advertising for a coin called ADAsol. This deceptive marketing boasted of a groundbreaking bridge built in collaboration with the aforementioned company and Solana.

Additionally, users on the network noticed an X post indicating that ADA withdrawals had been halted as the US SEC tightened its grasp on the cryptocurrency initiative. Nonetheless, the post appears to have been removed. Overall, the X account breach saga drew significant attention, highlighting the complexity of cyber security and its importance in the cryptocurrency world. Furthermore, the project’s native token, one of the top cryptocurrencies by market capitalization, saw significant market volatility as a result of the attack.

ADA price wanes amid concerns

The ADA price fell roughly 3% intraday and is now trading at $1.16 following the Cardano Foundation issue. The intraday low and high were $1.15 and $1.22, respectively. Notably, the sinking intraday action coincides with mounting market fears following the aforementioned attack.

However, it’s worth noting that the monthly chart showed increases of 166%, inspiring hope amid a strong Q4. Market observers are concerned that if the X account theft is not resolved, it would lead to negative market sentiment. However, a recent pricing study indicated that Cardano whales are on a collecting frenzy, adding to the optimism about the hack. Surprisingly, the study reveals that a $2 objective for the currency lurks ahead despite heightened interest in the crypto market in the fourth quarter.

Dogecoin (DOGE) active addresses soar to record high, yet $1 still out of reach

Active addresses on the Dogecoin (DOGE) network have achieved a new all-time high as the joke coin’s price has risen significantly in the previous 30 days. This milestone has generated renewed anticipation that DOGE may soon reach $1.

While the currency has the ability to achieve that value this cycle, our on-chain study illustrates why it may not happen as quickly as planned.

Dogecoin sees rising adoption, decline elsewhere

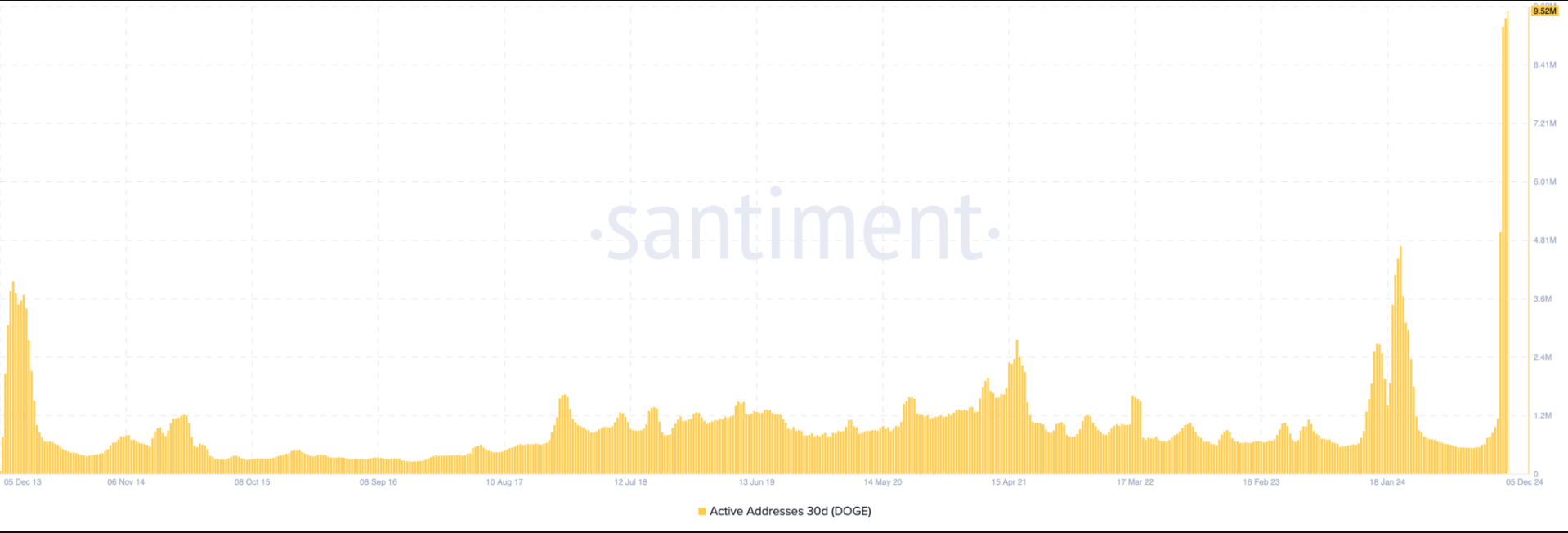

According to Santiment data, the number of active Dogecoin addresses was fewer than one million on October 31. As of this writing, the metric had reached a new all-time high of 9.52 million.

Active addresses are commonly used to estimate the number of people participating with a network. It provides significant insights about the network’s overall activity and user engagement, acting as a vital indicator of blockchain adoption and interaction with cryptocurrencies.

When the readings grow, it indicates that more people are interacting with the cryptocurrency. In contrast, a decline suggests less traction. However, unlike November, when this measure reached a record high and the signal was bullish, this significant increase may not result in a higher value for DOGE.

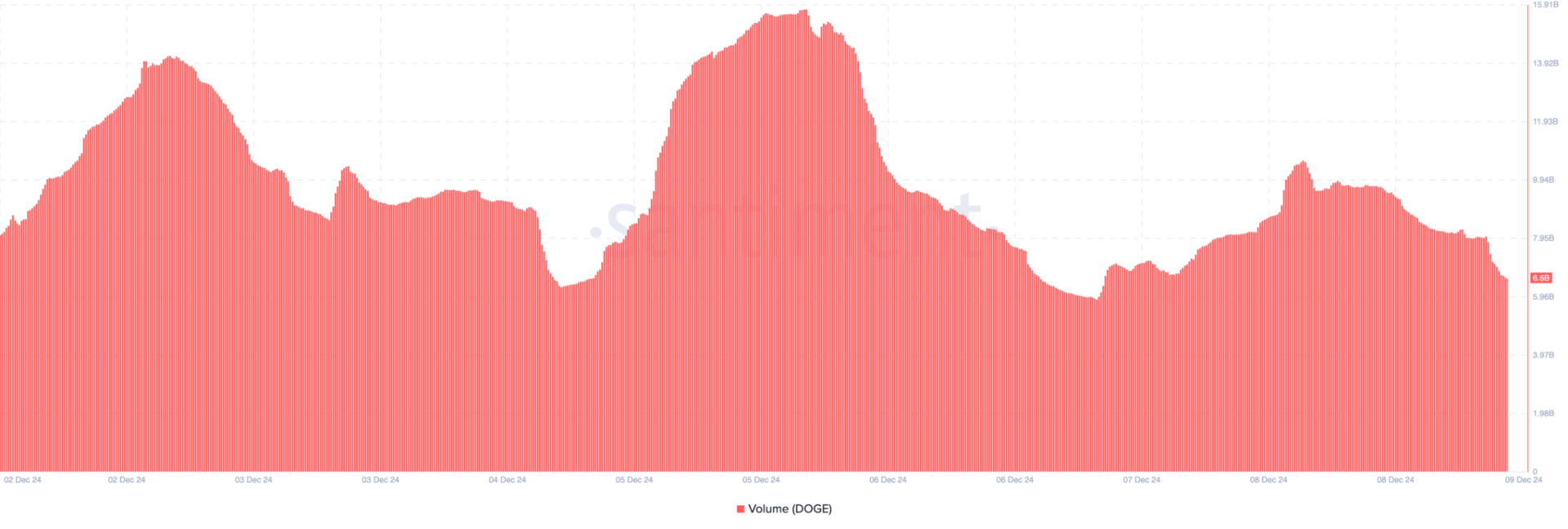

One basis for this claim is Dogecoin’s volume. On December 5, the coin’s volume topped $15 billion, suggesting a significant amount of buying and trading.

When volume rises in tandem with price, it usually implies that the uptrend is gaining momentum. As a result, the DOGE price rose to $0.48. However, as of this writing, the volume has reduced to $6.60 billion, showing that general interest in the meme coin has waned.

If this trend continues, Dogecoin’s value may struggle to grow swiftly approaching the $1 threshold. Instead, it might go below $0.45.

DOGE price prediction: time to cool off

Technically, the 4-hour DOGE/USD chart reveals that the cryptocurrency’s price has fallen below the 20-period Exponential Moving Average (EMA).

The EMA detects cryptocurrency trends by studying price movements. When the price increases but remains below the EMA, the trend is positive. On the other hand, if the price falls below the indications, the price is bearish, and the downtrend may intensify.

According to the graphic below, Dogecoin (DOGE) price of $0.45 is below the 20 EMA (blue). Given this situation, the coin’s price might fall, with the Fibonacci retracement sign indicating a drop to $0.42.

However, if DOGE rises above the EMA, the trend may shift. In that case, the price may rise over $0.48 and approach $1.