According to a Standard Chartered expert, the price of Bitcoin is expected to break away from the typical halving cycle and hit $200K by Q4 2025.

With its forecast for the price of Bitcoin in Q3 and Q4 2025, the multinational banking behemoth Standard Chartered is creating a stir in the cryptocurrency world. Geoff Kendrick, the head of the bank’s cryptocurrency research, predicts that Bitcoin will reach $ 135,000 by the end of the third quarter and possibly surpass $ 200,000 by the end of the year. Will Bitcoin reach this lofty peak?

StanChart foresees Bitcoin price’s exponential growth in 2025

Building on its continuously optimistic price forecasts, Standard Chartered has suggested that Bitcoin may see an increase in the upcoming months. Standard Chartered’s head of digital assets, Geoff Kendrick, predicts that the price of bitcoin will reach $135,000 in the third quarter and an incredible $200,000 by December. Reporter Wu Blockchain disclosed the financial behemoth’s audacious Bitcoin price forecast in an X post earlier today.

Standard Chartered predicts that, driven by ETF inflows and corporate demand, Bitcoin may reach $135,000 in Q3 and potentially hit $200,000 by year-end. Some short-term volatility could still emerge between late Q3 and early Q4.https://t.co/oHA6XrAOYN

— Wu Blockchain (@WuBlockchain) July 2, 2025

Importantly, the bank’s forecast is based on its evaluation of the state of the market and the possibility of further institutional involvement in cryptocurrencies. The bank feels that the cryptocurrency’s basic characteristics position it for potential development, even though this forecast coincides with increased volatility in the price of BTC. Kendrick made the prediction earlier this year that Bitcoin would hit $500k before the end of Donald Trump’s administration.

Bitcoin is worth $107,468 at the time of writing, up 0.8% over the previous day. The pioneer cryptocurrency has had slight growth of 0.21% and 0.25% over the past week and month, respectively.

BTC diverges from past halving cycle patterns

It’s interesting to note that Kendrick examines the potential effects on the price of the cryptocurrency of the Bitcoin halving. Every four years, the Bitcoin halving, which lowers the block reward by 50%, is a noteworthy event. The price of Bitcoin typically plummets after roughly 18 months, although it experiences a noticeable spike right after the halving event.

Kendrick added that the Bitcoin trend for this year is anticipated to deviate from previous trends. In the past, price declines in September or October 2025 would have been anticipated by the halving trend. But he said, “We think Bitcoin has moved past the previous dynamic where prices fell 18 months after a ‘halving’ cycle, thanks to increased investor flows.”

Furthermore, the Standard Chartered analyst expressed his optimism in light of the growing institutional acceptance of Bitcoin and the favorable mood surrounding ETFs. Nine corporate firms have purchased 6000 Bitcoin for treasuries in the last week, as CoinGape previously revealed. “We anticipate that prices will resume their upward trajectory, bolstered by sustained robust ETF and Bitcoin treasury purchases,” Kendrick said.

Ripple mints 14 million RLUSD amid OpenPayd partnership

In an effort to compete with Tether and Circle, Ripple mints 14 million RLUSD and collaborates with OpenPayd to streamline fiat-stablecoin conversions.

The issuance of 14 million RLUSD tokens at its treasury on July 2, 2025, marked a significant advancement for Ripple’s stablecoin ecosystem. Strong liquidity demand and a larger drive to increase stablecoin use cases internationally are indicated by the transfer of 14 million RLUSD to a new wallet.

Ripple expands RLUSD utility with new minting

This new issuance was verified on Ethereum and disseminated via Etherscan, demonstrating a priority on trust and transparency, according to the X post made by the Ripple Stablecoin tracker. The goal of the dollar-backed stablecoin RLUSD is to keep its value at a 1:1 ratio to the US dollar.

💵💵💵💵💵💵💵 14,000,000 #RLUSD minted at RLUSD Treasury.https://t.co/qPEePmOjuY

— Ripple Stablecoin Tracker (@RL_Tracker) July 2, 2025

It enables people and companies to transfer funds internationally without being concerned about volatility. Ripple’s objective to promote global financial access, expedite payments, and enhance liquidity is in line with this new minting.

In a blog post, Ripple also revealed a strategic alliance with OpenPayd, a significant supplier of financial infrastructure. Through this collaboration, OpenPayd’s fiat network—which includes virtual IBANs, multi-currency accounts, and real-time payment rails—is combined with blockchain-powered payment solutions.

Direct RLUSD minting and burning will now be available on OpenPayd. OpenPayd’s single API allows businesses to convert between fiat and RLUSD with ease, streamlining operational and treasury processes.

The OpenPayd partnership will enable RLUSD to compete with USDT and USDC

This partnership gives RLUSD new opportunities in international treasury management, cross-border payments, and quick access to US dollar liquidity. Businesses want dependable and compliant infrastructure to handle money globally as the demand for stablecoins increases.

Together, Ripple and OpenPayd are building a single system that combines blockchain technology with traditional banking to provide quicker, less expensive, and more transparent money transfers.

Over 90 payout markets are currently served by Ripple’s payments network, which handles over $70 billion in transactions annually. The ecosystem is positioned to better service banks, cryptocurrency enterprises, and FinTech firms thanks to the most recent RLUSD mint and OpenPayd’s infrastructure.

It helps businesses future-proof their payment methods, facilitates near-instant settlement, and streamlines international cash flows. There is more to the 14 million RLUSD minting event than merely a rise in supply.

It signals a significant entry into the cutthroat stablecoin sector, where Ripple hopes to take on established firms like Circle and Tether. Ripple and OpenPayd are redefining enterprise payments by fusing blockchain innovation with reliable fiat infrastructure.

In order to rebalance its holdings, Ripple previously liberated 500 million XRP tokens from escrow and relocked 400 million tokens.

BNB price 17% below all-tỉm high despite chain performance surge

With remarkable data including daily revenue, DEX trading volume, and block processing speed, BNB Chain is causing a stir in the first half of 2025.

These accomplishments, meanwhile, don’t seem to be enough to cause BNB’s stock to soar.

BNB Chain’s performance

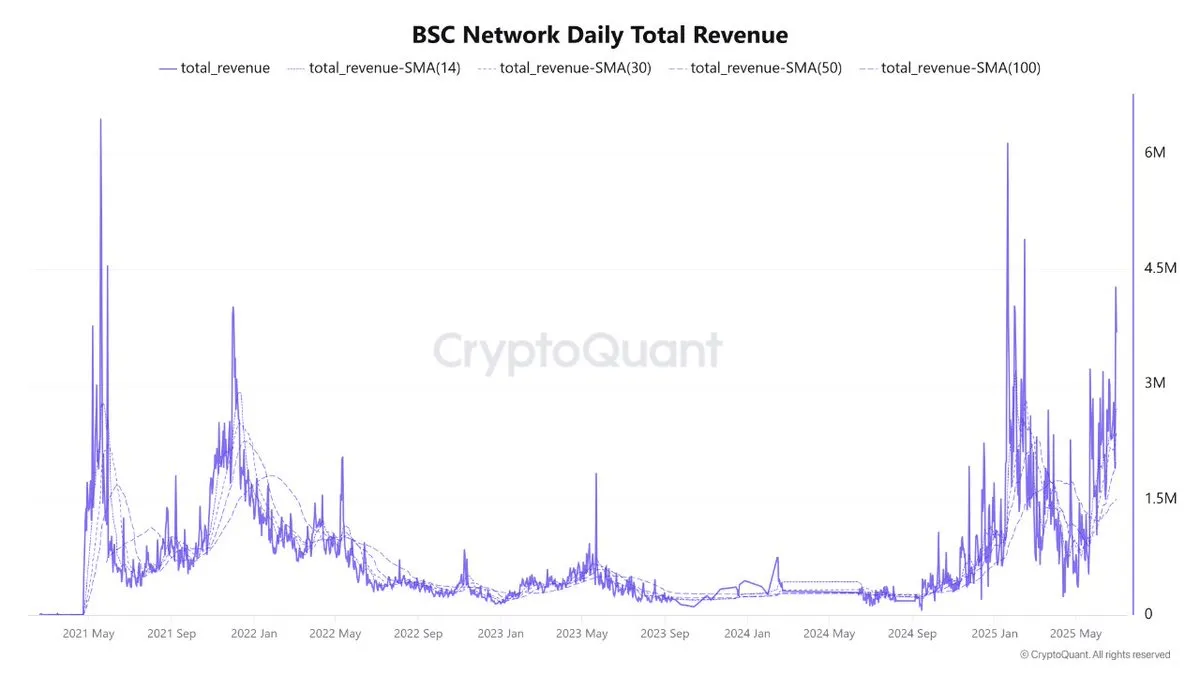

In the middle of 2025, the cryptocurrency market is seeing a noteworthy development with BNB Chain. The network’s popularity is amply demonstrated by its explosive revenue. With notable peaks in January and late June 2025, it hit its highest level since 2021.

This expansion can be the result of new initiatives, additional users, and heightened network activity. But as CZ pointed out, the network’s low-fee approach might also be to blame for this outcome.

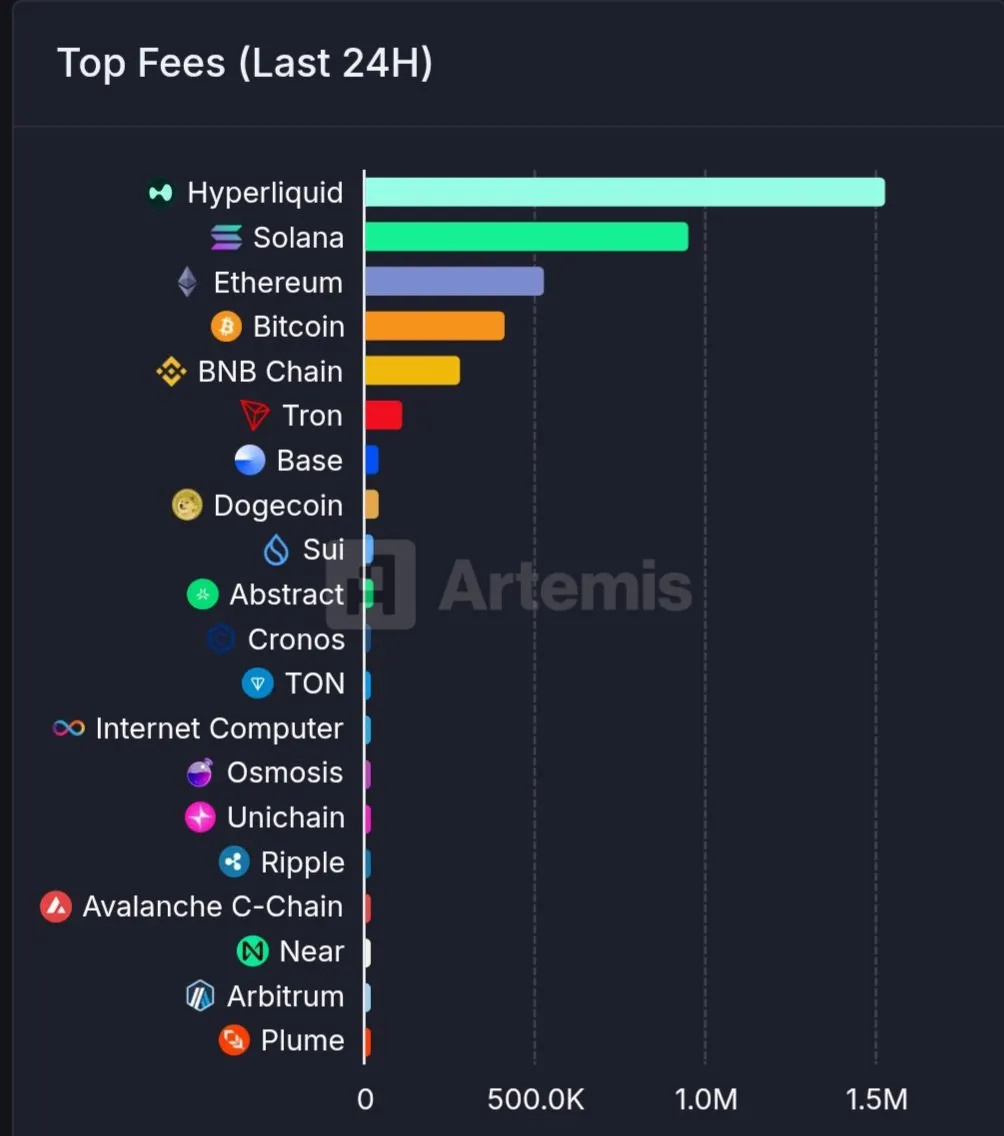

BNB Chain ranks fifth in terms of fees earned among all Layer-1 and Layer-2 networks, according to X user TCC, even though its fees are incredibly low or nonexistent.

This is because it has the biggest amount of transactions of any network, which generates substantial income despite low expenses per transaction. User Ucan claims that the monthly DEX trade volume on BNB Chain reached an all-time high of more than $157 billion in June. This indicates how active the network’s DeFi ecosystem and decentralized applications are, which helps it keep its trading advantage over other chains.

Maxwell Hardfork upgrade

The successful completion of the Maxwell Hardfork update in late June, which decreased block time from 1.5 seconds to 0.75 seconds, is another noteworthy accomplishment. In addition to improving user experience, this sub-second processing speed enables developers to create high-performance apps.

BNB Chain has improved its competitive position by striking a balance between speed and cost when compared to chains like Solana (0.4 seconds) or Ethereum (12–15 seconds).

Officially, @BNBCHAIN is now achieving sub-second block times.

The Maxwell Hardfork has reduced BNB Chain block times to just 0.75s.

This is not merely a performance tweak. Here’s why loyal users on BNB Chain should pay attention:

+ Instant swaps and mints

+ Seamless GameFi… https://t.co/UHZcE854Ve pic.twitter.com/in8RITemKl— andrew.moh (@0xAndrewMoh) July 1, 2025

BNB price still 17% below ATH

The discrepancy between revenue and BNB’s price is still a significant concern, though. CoinGecko reports that BNB’s price is currently 17% below its all-time high, which is odd considering the network’s “record-breaking” achievements, especially in June.

This might be the result of cautious market attitude in the wake of earlier bearish cycles, as well as more general market movements brought on by recent tariffs and geopolitical unrest. Furthermore, BNB may lose focus due to competition from Layer-2 chains like Arbitrum.

BNB Chain has a great chance to overcome this obstacle in the future. The network may draw in additional users and developers due to its large transaction volume and fast processing speed, particularly if global liquidity keeps increasing. Additionally, some businesses think about hoarding BNB, which can help with price momentum.