The U.S. Spot Bitcoin ETF saw a withdrawal of around $190 million on June 14, demonstrating that there is still a looming danger associated with the price of bitcoin. Analysts have provided important insights into this price trend.

After a wild week, the U.S. Spot Bitcoin (BTC) ETF had a significant outflow on June 14 of around $200 million. With an outflow of $80.1 million, Fidelity’s FBTC topped the flight, followed by Grayscale’s GBTC at $52.3 million.

Notably, experts discuss the possible ramifications for the cryptocurrency industry as Bitcoin’s price exhibits volatility in the face of the dismal U.S. Spot Bitcoin ETF trading.

Bitcoin ETF records $200M outflow

The U.S. Spot Bitcoin ETF had a difficult week due to consistent withdrawals that over the previous five days totaled $581.4 million. Outflows were $189.9 million on Friday alone, primarily coming from Grayscale’s GBTC and Fidelity’s FBTC.

Notably, the highest single withdrawal, totaling $80.1 million, was from Fidelity’s ETF. The ETF for Grayscale lost $52.3 million in assets in quick succession.

In the meanwhile, it appears from this week’s trend that investor interest in Bitcoin ETFs is waning. Four of the last five trading days saw outflows, indicating a change in the mood of the market. It’s important to keep in mind, though, that these withdrawals represent an abrupt change in investor behavior because they follow a period of strong inflows.

Furthermore, the swift withdrawals are indicative of wider market apprehensions and heightened fluctuations in the value of Bitcoin. Investor caution has intensified as a result of this shift in mood, which has affected their willingness to take on risk. The question at hand, though, is whether the market will react to the recent price swings and these patterns will hold or stabilize.

What’s next for Bitcoin price?

Even if the market has been showing indications of improvement recently, Bitcoin has been declining significantly over the past several days. Put otherwise, the noteworthy withdrawals from ETFs have correlated with a noticeable fluctuation in the value of Bitcoin. Bitcoin has had difficulty remaining stable, bouncing around important levels.

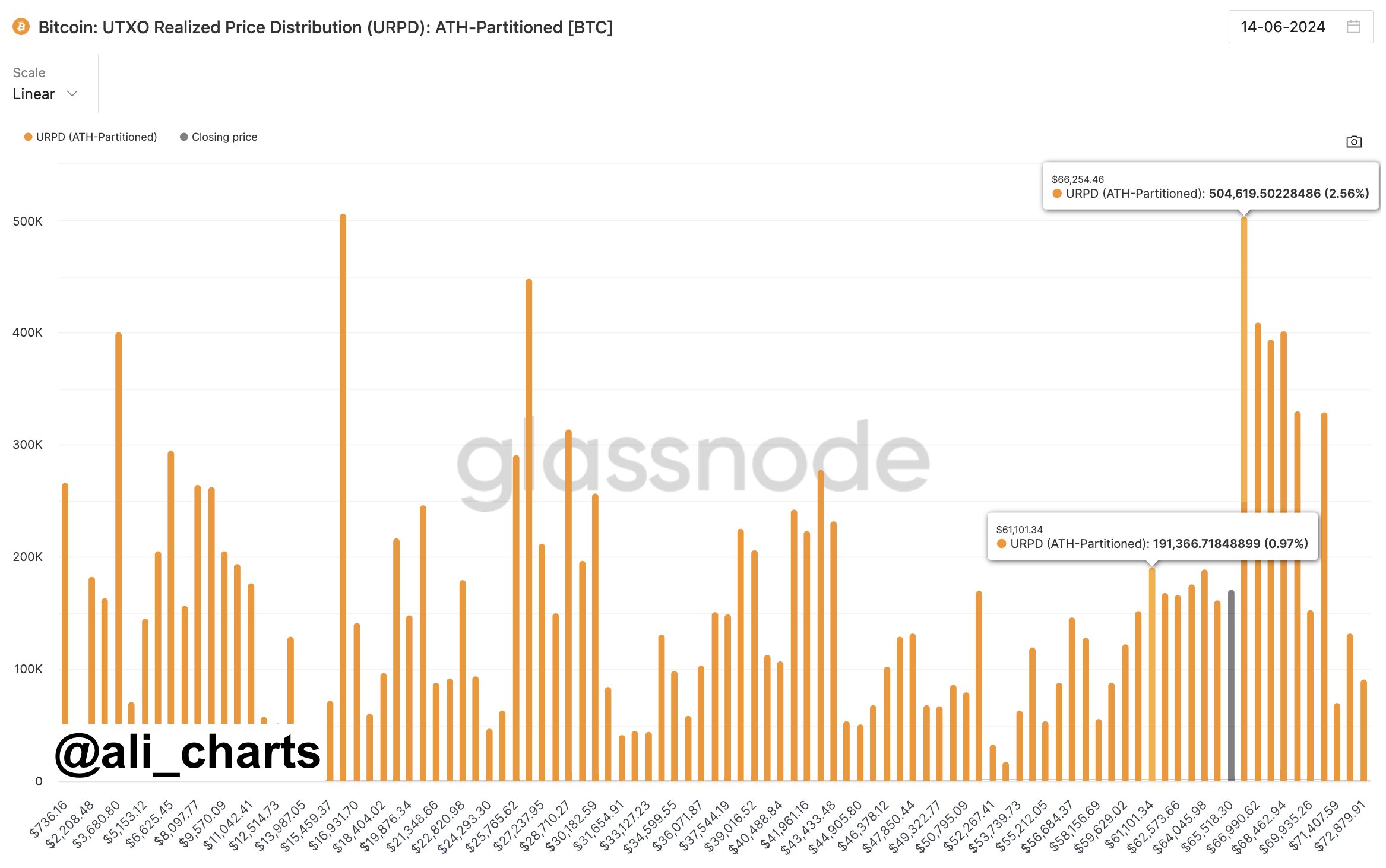

Popular analysts covering the cryptocurrency market emphasized that Bitcoin has to maintain a certain level in order to prevent a decline to $61,000. Martinez stated that, according to a recent study posted on the X platform, Bitcoin must continue to trade above $66,254 in order to avoid a possible decline in price to $61,100.

At the time of writing, the price of Bitcoin was trading at $66,242.59, indicating a 1.01% decrease over the previous day. In addition, there was a modest decline in trading volume and a 24-hour low in price of $65,049.23.

Bitcoin Futures Open Interest had a minor comeback during the previous four hours, although it fell more than 2% over the course of the 24-hour period, according to CoinGlass data, notwithstanding the recent decline.

Check Out the Latest Prices, Charts, and Data of BTC/USDT

Notcoin surges 11% nearly flips VET, MKR and OP

Notcoin (NOT) has risen over 11% over the last day, surpassing $0.021 as bulls reached a two-week peak.

The associated Toncoin (TON) cryptocurrency, which reached a new all-time high on Friday to propel 100% of addresses into profitability, is expected to gain more traction, which will likely boost the price of the Telegram-based game token.

Notcoin, the newly released coin of the popular tap-to-earn game, is now ranked 49th among the top cryptocurrencies by market size, having surged double-digits to reach $1.9 billion in market cap. Comparatively, throughout the last 24 hours, VeChain (VET), Maker (MKR), and Optimism (OP) have all decreased, falling by 6%, 2%, and 7%, respectively.

It’s probable that Notcoin overtakes VET, MKR, and OP by market capitalization since NOT is indicating the possibility of more growth. Based on CoinMarketCap statistics, the combined market capitalization of the three cryptocurrencies is somewhat more than $2 billion.

Notcoin’s $1.2 billion 24-hour trading volume only trails behind stablecoins USDT, USDC, and FDUSD as well as Bitcoin (BTC), Ethereum (ETH), BNB, and Solana.

On June 2, the price of NOT reached an all-time high of $0.028; however, it later dropped to $0.019 due to downward pressure on the whole cryptocurrency market.

Check Out the Latest Prices, Charts, and Data of ETH/USDT

Notcoin’s surge amid new Tap2Earn trend

Notcoin’s price has recently increased in tandem with the industry’s surge in “Tap2Earn” and related tokens. Right now, Yescoin and Hamster Kombat are the most popular options.

The primary attraction of Notcoin is its early adopter advantage within the Telegram network. The Open Network’s (TON) recent expansion has also been seen in Notcoin, as interest and growth have been fueled by Telegram’s 900 million users and the platform’s growing support for cryptocurrencies.

In the last three months, metrics like the number of daily active addresses for TON have increased significantly. Similar tendencies are probably going to be driven by this trajectory for Notcoin, which is aiming for expansion outside of Tap2Earn.

Check Out the Latest Prices, Charts, and Data of BNB/USDT

Australian securities exchange approves its first spot Bitcoin ETF

The VanEck Bitcoin ETF will begin trading on June 20 after receiving approval from the Australian Securities Exchange.

The Australian Securities Exchange (ASX), the country’s biggest stock market, has authorized the first spot Bitcoin exchange-traded fund (ETF), which is scheduled to go live on June 20.

According to a VanEck news statement shared with Cointelegraph, investment company VanEck will be the issuer of the first Bitcoin ETF, known as the VanEck Bitcoin ETF (VBTC). It occurs only a few months after the company was given permission to begin trading spot Bitcoin ETFs on January 11 in the US, through the VanEck Bitcoin Trust (HODL).

The desire for exposure to Bitcoin in Australia is increasing, according to Arian Neiron, chief executive officer of VanEck in the Asia-Pacific region, particularly through a “regulated, transparent and familiar investment vehicle.”

“We recognize Bitcoin is an emerging asset class that many advisers and investors want to access,” Neiron said.

“VBTC also makes bitcoin more accessible by managing all the back-end complexity. Understanding the technical aspects of acquiring, storing and securing digital assets is no longer necessary,” he added.

In the last two years, there have been two prior launches of Bitcoin ETFs in Australia, despite the fact that this is the first time a spot ETF has been licensed by the ASX.

Recently, the Cboe Australia exchange, Australia’s second-largest stock market, approved and opened trading for the Monochrome Bitcoin ETF (IBTC).

On June 4, the markets opened on the Cboe Australia platform, and the Monochrome Bitcoin ETF began trading.

🇦🇺 Australia’s new #Bitcoin ETF (IBTC) has accumulated 46 BTC since launch pic.twitter.com/ywdSwdLH4c

— Julian Fahrer (@Julian__Fahrer) June 14, 2024

According to Monochrome, IBTC assets are kept offline using a crypto custody solution that complies with “Australian institutional custody regulatory standards” on a device that isn’t linked to the internet.

The Global X 21 Shares Bitcoin ETF (EBTC) had its Australian debut in April 2022, making it the first Bitcoin ETF product.