On December 24, spot Bitcoin ETFs saw a total daily net outflow of $340 million.

US-based spot Bitcoin ETFs have seen a significant reversal in inflows, losing more than $1.5 billion over a four-day outflow run.

This is the longest outflow sequence since Donald Trump’s re-election, which offered much-needed support to the market.

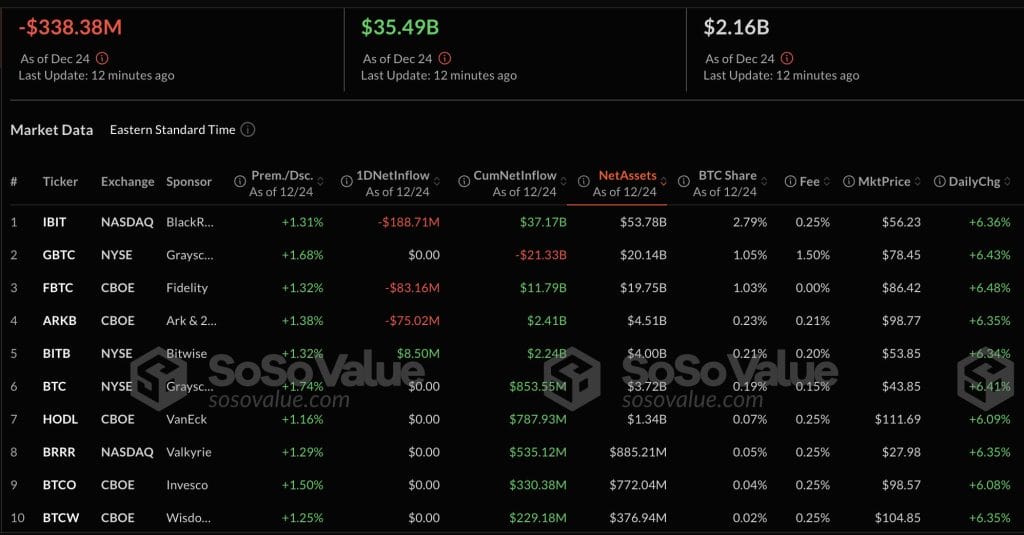

On December 24, spot Bitcoin (BTC) ETFs saw a total daily net outflow of $338 million, according to SoSoValue statistics.

BlackRock’s IBIT lead in terms of outflows

Among the 12 funds, BlackRock’s IBIT topped the day’s losses with -$188 million, followed by Fidelity’s FBTC with -$83.16 million and ARK Invest’s ARKB with -$75.02 million.

Bitwise’s BITB was the only fund to see a positive daily inflow of $8.50 million, while Grayscale’s GBTC, VanEck’s HODL, Valkyrie’s BRRR, and WisdomTree’s BTCW all stayed level, with no major inflows or outflows.

Despite the net outflows, total assets held by all Bitcoin ETFs were $107.53 billion, aided by a day of exceptional price performance, with funds reporting daily gains of up to +6.48%.

The four-day streak has reduced cumulative net inflows to $35.68 billion as of December 24.

The total net assets owned by spot Bitcoin ETFs fell to $107.53 billion, a decline from their December 16 record of $121.7 billion.

During this period, the funds had their largest single-day outflow of $680 million on December 19.

It is worth mentioning that on December 23, spot Ethereum (ETH) ETFs saw a net inflow of $130.76 million, increasing the total net inflows to $2.46 billion.

Total net assets across Ethereum ETFs were $12.05 billion, accounting for 2.94% of Ethereum’s market capitalization. The total value transacted for the day was $494.25 million.

Among the outstanding results, BlackRock’s ETHA led the market with a daily net inflow of $89.51 million, bringing its total net asset value to $3.51 billion.

Fidelity’s FETH also had a significant influx of $46.37 million, bringing its total net assets to $1.46 billion.

In contrast, Grayscale’s ETH had a $6.09 million daily outflow, despite the fact that its overall net assets remained at $1.61 billion.

Data for spot Ethereum ETF flows on December 24 are not yet available.

Digital asset investment products saw $308M inflows last week

Last week, digital asset investment products had net inflows of $308 million, although this figure excludes a substantial single-day outflow of $576 million on December 19.

The week finished with a cumulative outflow of $1 billion over the last two days, owing mostly to market responses to the Federal Reserve’s aggressive dot plot statement.

According to a CoinShares analysis, these changes resulted in a $17.7 billion loss in total assets under management (AuM) for digital asset ETPs, or a 0.37% decline.

While troubling, this outflow is little in comparison to the highest single-day outflow of 2.3% in mid-2022, which occurred following a FOMC interest rate increase.

Bitcoin remained resilient, with net inflows of $375 million for the week, while multi-asset investment products suffered losses of $121 million.

Ethereum’s streak continues with $51 million in inflows, countered by Solana’s $8.7 million losses.

Altcoins like XRP, Horizen, and Polkadot had lesser but significant inflows.

Shiba Inu news: Will SHIB breakout above $0.000045?

Discover the latest Shiba Inu news, as SHIB on-chain measures indicate a potential breakout over $0.000045. Investigate the major patterns that are fueling bullish momentum.

Shiba Inu News: The most recent on-chain data indicates a positive trend for Shiba Inu (SHIB), with analysts anticipating a surge to $0.000045. Here’s what the numbers show, and why investors are enthusiastic about SHIB’s prospects.

Shiba Inu news: Shiba Inu gains momentm amid market volatility

Shiba Inu has been a notable performance in the meme coin sector, drawing attention despite recent turbulence in the overall cryptocurrency market. The coin’s recent performance of more than 6% has restored investor trust.

Meanwhile, SHIB on-chain measures show a strong market momentum. According to Santiment statistics, the Shiba Inu exchange supply has decreased dramatically, indicating that funds are moving out of the major cryptocurrency exchange. Notably, the diminishing exchange supply suggests that investors are withdrawing cash from exchanges, which might dramatically increase the asset’s price.

However, whale activity has recently increased significantly, signaling a bullish trend ahead. According to Santiment statistics, whale transactions have lately increased significantly, following a period of low activity in the previous weeks.

Given all of these factors, the future of the top dog-themed meme currency is good. So, let’s see at how the SHIB price is doing and how the meme currency may do in the following days.

SHIB breakout ahead?

The favorable Shiba Inu news, particularly on-chain measures, looked to bolster market confidence. Shiba Inu (SHIB) was up more than 6% today, trading at $0.00002284, but its one-day trading volume fell 9% to $610 million. Furthermore, Shiba Inu Futures Open Interest increased by approximately 10%, signaling positive market momentum.

Against this backdrop, the most recent technical Shiba Inu price chart suggests a breakthrough ahead. For context, the inverse head and shoulder pattern suggests that the cryptocurrency may reach $0.000035 in the near future. Once this goal is met, the cryptocurrency will surge to around $0.000045 ahead.

Meanwhile, a new SHIB price study suggests that the cryptocurrency might reach $0.000035 in the near term. Considering all of the coin’s favorable tendencies, it looks like SHIB is on track for a breakthrough shortly.

Aave and Lido surpass $70B in combined net deposits, leads the DeFi ecosystem

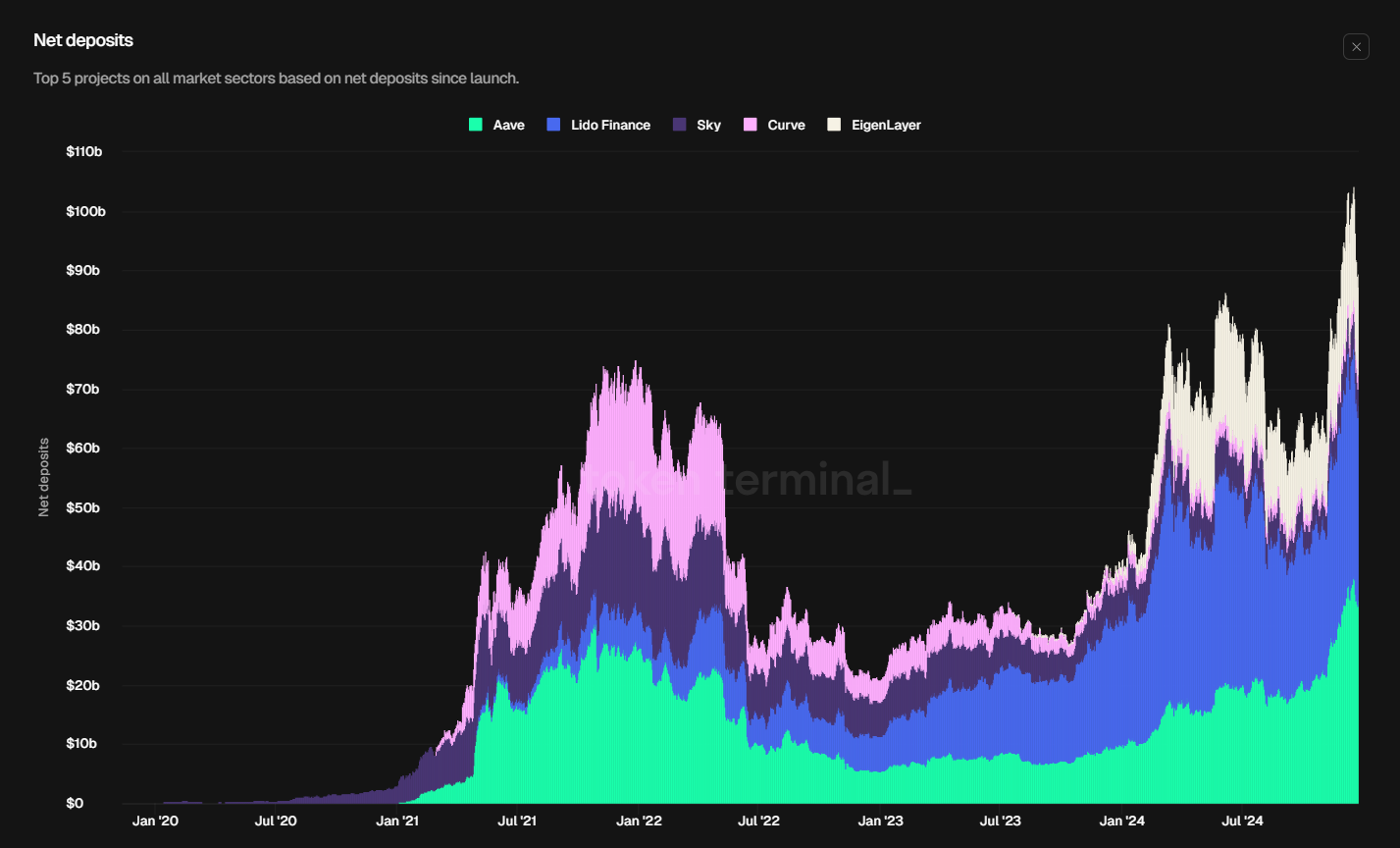

Token Terminal reports that Aave and Lido have combined net deposits of more over $70 billion for the first time in history.

Aave (AAVE) leads with $34.3 billion, barely ahead of Lido Finance LDO ($33.4 billion). The two protocols account for 75.25% of the $89.52 billion granted to the top five Decentralized apps in December 2024, the greatest amount ever. The two initiatives account for 45.5% of the total money granted to the top 20 DeFi apps, or $67.42 billion out of the sector’s total net deposits of $148 billion. LDO has the highest overall value, at $33.8 billion, followed by AAVE at $20.6 billion.

Overall, the DeFi sector grew, with year-to-date TVL reaching 107%, peaking on December 16 at $212 billion, the first time this value exceeded $200 billion.

The revenue performance also demonstrates the power of these processes. Over the previous 30 days, AAVE earned $12.5 million, a 27.5% increase, while LDO earned $9.6 million, thanks to 24% platform growth.

Beyond deposits, the DeFi ecosystem set a record for decentralized exchange trade volumes in November, hitting around $380 billion, according to TheBlock. In reality, the percentage of trading volume conducted on DEXes rather than centralized exchanges reached 13.86% in October, the second highest ever recorded, after only the 14.18% witnessed in May 2023.

The DeFi lending sector also expanded dramatically, with current loans totaling $21 billion in December. This is the highest monthly total to date. Yield farming and staking are important DeFi methods, accounting for a $200 billion stablecoin industry. The tools enable users to earn incentives or borrow using stablecoins. They are reinforced by DEXs and liquidity pools, resulting in little price slippage in high-activity markets. Stablecoins may also move across multiple blockchain networks, increasing their versatility and simplicity of use.