According to renowned on-chain expert Willy Woo, Bitcoin (BTC) may reach its previous highs if the present capital inflows continue.

He said that rather than signs of a market meltdown, investors should see price declines as constructive corrections and chances for purchases.

Will Bitcoin reclaim its all-time high again?

In a thorough post on X (previously Twitter), Woo offered his observations. He thinks that Bitcoin’s positive trajectory is supported by solid fundamentals.

Speculative and total capital flows have just bottomed out, indicating a growing input of capital into the Bitcoin network. When these flows line up, the asset is in a strong, bullish situation.

BTC fundamentals have turned bullish, not a bad setup to break all time highs.

I took a break from X to enjoy the NZ summer but every week I put out a series of analysis to my subscribers (this is a hobby, NOT a long term project).

Thought I’d post this update publicly.

— Willy Woo (@woonomic) April 27, 2025

Woo also pointed out that his downward-trending Risk Model shows that Bitcoin’s liquidity is increasing. It appears that market liquidity has restored based on this downward trend. Consequently, there will probably be fewer and milder price declines in the future, which lowers the possibility of abrupt sell-offs.

“All dips are for buying under the present regime. In the very short term, there’s good chances of dips,” Woo asserted.

Our Risk Model has started its trend back down. This means liquidity has returned to the market.

Downside pull backs will be muted in this enviroment. pic.twitter.com/fIQbvnmtRd

— Willy Woo (@woonomic) April 27, 2025

Bitcoin has already recovered its medium-term price expectations of $90,000 and $93,000, the analyst added. Furthermore, a new intermediate goal of $103,000 has emerged, indicating that Bitcoin is probably going to hit this level before advancing toward the all-time high of $108,000.

He made it clear that these goals are backed by consistent capital inflows rather than just speculative trading, which makes the case for a long-term rising trend stronger.

Woo warned that short-term difficulties might occur despite the positive long-term outlook. The Volume Weighted Average Price (VWAP) of Bitcoin on the chain is at +3 standard deviations.

This suggests that the price of the coin is significantly higher than it usually is. An asset is said to be overextended when it rises this far above its average.

“It’ll be hard to move upwards with decent momentum due to overextension,” Woo explained.

This measure suggests that rising momentum could be constrained in the near future, according to Woo. Rather than a quick rise, the most likely outcomes are sideways movement or a steady, progressive climb.

Three key indicators that support the argument for Bitcoin’s recovery were previously described. In April, Bitcoin separated from the NASDAQ and resumed its negative correlation with the declining US Dollar Index (DXY).

Long-term investors are actively collecting coins in the meanwhile. All three of these divergences point to a possible significant Bitcoin rise and indicate rising market confidence. Actually, the current performance of the Bitcoin market supports this prediction as well.

FMCPAY data showed that the coin’s value has recovered by 7% over the past week. At the time of writing, Bitcoin traded at $94,749, representing a minor downtick of 0.07% over the past day.

World Liberty Financial founders meet Binance’s CZ to discuss global crypto expansion

Changpeng Zhao, a co-founder of Binance, met with the founders of World Liberty Financial to talk about strategies to increase the use of cryptocurrencies and establish new benchmarks for the sector.

WLFI claimed in a post on X on April 27 that its founders, Chase Herro, Zak Folkman, and Zach Witkoff, met with CZ in Abu Dhabi to talk about the future of crypto innovation and its increasing worldwide popularity.

The gathering is a component of WLFI’s continuous market expansion strategy. The meeting’s immediate outcomes are still uncertain because neither fresh coin issuances nor direct financing announcements have been made public.

WLFI’s founders @ZachWitkoff @zakfolkman @WatcherChase met with @cz_binance, the founder of Binance, to talk about growing global adoption, setting new standards, and pushing crypto to the next level.

This is just the beginning.https://t.co/I7r5w4JWQq

— WLFI (@worldlibertyfi) April 27, 2025

Another relevant development was the announcement on April 27 by Pakistani news source Profit that WLFI and the Pakistan Crypto Council had inked a Letter of Intent to encourage the use of stablecoins, blockchain, and decentralized finance in Pakistan. Senior Pakistani officials, including the prime minister and the ministries of communication, defense, and finance, were also met by the WLFI delegation.

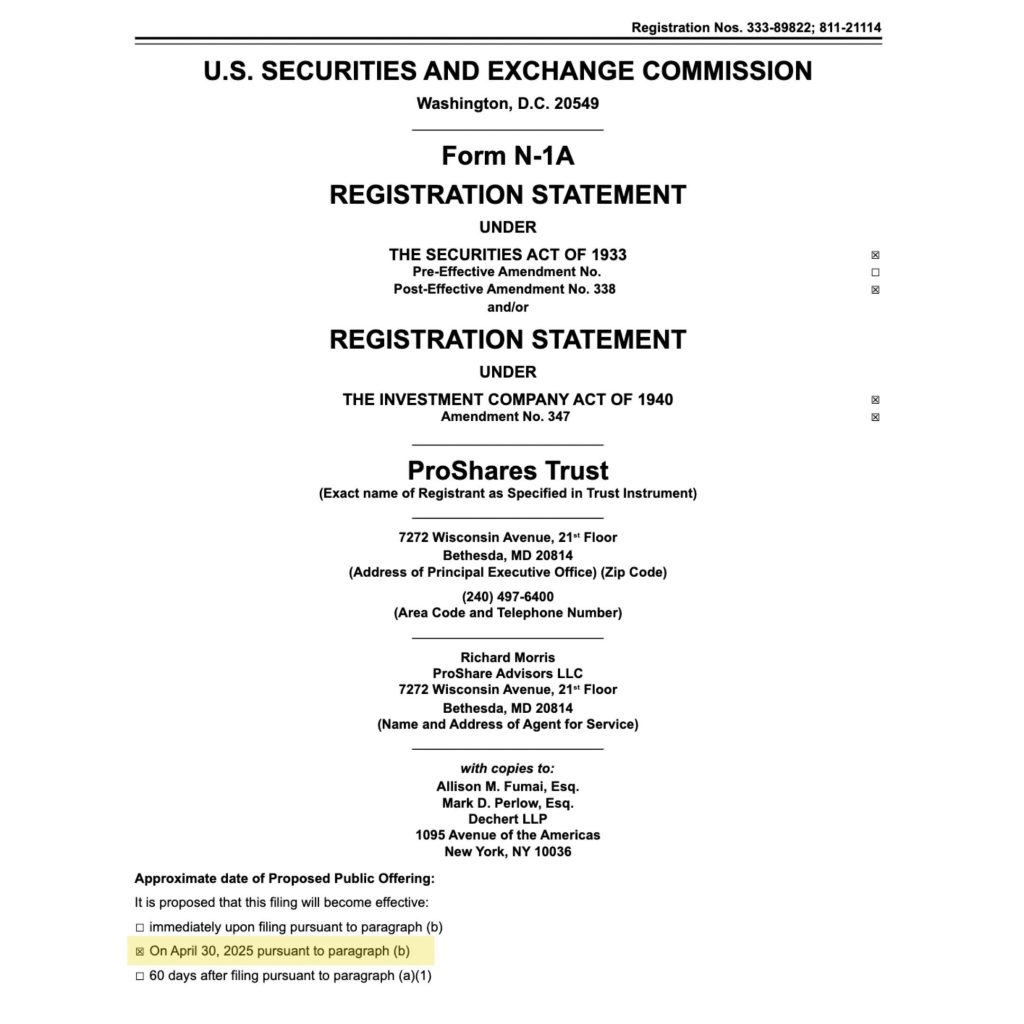

SEC clears ProShares XRP futures ETFs to launch on April 30

While spot XRP ETFs are currently pending regulatory clearance, three XRP futures ETFs are scheduled to begin on April 30.

ProShares just received clearance from the US Securities and Exchange Commission (SEC) to launch three exchange-traded funds connected to XRP this week.

According to regulatory filings, the new products comprise an Ultra XRP ETF with 2x leveraged exposure, a Short XRP ETF, and an Ultra Short XRP ETF with -2x leverage.

While a -2x leveraged ETF strives to give twice the negative of XRP’s daily returns, a 2x leveraged ETF wants to deliver twice the daily performance of XRP prices, possibly allowing investors to profit when the token’s price declines.

ProShares readies XRP ETFs as spot approval remains elusive

Another significant milestone for XRP-related financial products in the US will be reached when the ETFs launch on April 30, 2025. However, a spot XRP ETF has not yet received approved.

With a crucial SEC decision deadline approaching on May 22, a number of petitions, including one from fund manager Grayscale, are still being reviewed.

ProShares’ action follows Teucrium’s earlier this month creation of the first-ever XRP futures ETF. Teucrium’s 2x XRP fund was the company’s most successful launch to date, with over $5 million in trading volume on its first day.

New XRP listings signal softer regulatory stance after court victory

A changing regulatory environment is reflected in the recent explosion of financial products with an XRP focus.

The CME Group declared last week that it will shortly launch XRP futures on its derivatives exchange. Together with Bitcoin, Ether, and Solana items, the new offerings will be available. As a result, interest in XRP investment products is growing.

This spike comes after the SEC and Ripple Labs’ years-long legal dispute was settled. Ripple achieved a last court win in March. As a result, major regulatory barriers to XRP’s use and listing on financial markets have been eliminated.

A spot XRP ETF has long been anticipated by issuers and investors. Instead of using futures contracts, such a product would directly track the price of the token. Regulators have, however, traditionally been more hostile to spot cryptocurrency ETFs. However, recent approvals of spot Bitcoin ETFs have sparked optimism that more tokens may follow.

For the time being, investors have another option to be exposed to the price fluctuations of XRP through ProShares’ futures-based products. The market’s reaction in the upcoming weeks will thus be carefully monitored. As the SEC gets closer to making its next significant ruling regarding Grayscale’s spot XRP proposal, there will be a lot of attention.