On October 2, U.S. spot Bitcoin exchange-traded funds saw withdrawals for a second day in a row as the price of the cryptocurrency fell below $61,000 due to growing Middle East tensions.

The 12 U.S.-listed spot Bitcoin (BTC) ETFs had net withdrawals of $91.76 million, which is a continuation of the $242.53 million withdrawal from the previous day, according to statistics from SoSoValue.

With $60.26 million leaving the fund, ARK 21Shares’ ARKB fund topped the withdrawals, marking its third day of losses in a row. With $27.31 million in outflows, Grayscale’s main cryptocurrency brought its total withdrawals since launch to $20.12 billion.

Notably, $13.74 million was taken out of BlackRock’s IBIT ETF, marking the first negative flow in over a month. Even if this is a change from its prior stellar performance, the fund has nevertheless managed to draw $21.52 billion in inflows since its inception. Significant withdrawals were also seen in Bitwise’s BITB, with $11.51 million departing the fund.

On the other hand, the lone exception of the day was Fidelity’s FBTC ETF, which had inflows of $21.08 million, somewhat counteracting the overall market trend of withdrawals.

The 12 Bitcoin ETFs’ combined trading volume decreased dramatically, from $2.53 billion the day before to $1.66 billion on October 2. These funds have drawn a total of $18.53 billion in net inflows since their respective inception, demonstrating the resilience of institutional long-term interest in Bitcoin ETFs despite the current decline.

Among ETFs introduced since 2020, BlackRock’s IBIT and Fidelity’s FBTC have performed best in terms of assets under management, according to Eric Balchunas, Senior ETF Analyst at Bloomberg. Despite the current market volatility, both funds were launched after the 2022 bear market, demonstrating the increased institutional emphasis on Bitcoin.

Bitcoin price under pressure as geopolitical risks mount

The new wave of withdrawals is consistent with the problems of the price of Bitcoin (BTC), which earlier on October 2 dropped to a low of $60,100 before rising to just above $61,300. The market volatility has increased due to the increasing tensions between Israel and Iran, particularly in light of Israel’s anticipated retaliation to an Iranian strike, which has put more negative pressure on Bitcoin.

Experts in the market have voiced worries about potential negative consequences.

According to analyst Ali, there might be a 15% correction in Bitcoin prices. If the market is unable to hold its current level of support around $60,900, then a further decline toward $52,000 is possible.

#Bitcoin could drop to $52,000 if the governing pattern behind the recent price action is a descending parallel channel! pic.twitter.com/CEAbdWXCrB

— Ali (@ali_charts) October 2, 2024

Another well-known market analyst, Crypto Capo, cautioned that if Bitcoin hits this level, Ethereum would drop below $1,800, indicating more weakness in the cryptocurrency industry as a whole.

Ether ETFs buck the trend with inflows

U.S. spot Ether ETFs had a reversal in flows on October 2, reporting $14.45 million in net inflows following two days of outflows, while Bitcoin ETFs continued to struggle.

After a day without activity, BlackRock’s ETHA fund led the comeback with $18.04 million in inflows, and Franklin Templeton’s EZET ETF had its first inflow since mid-August with $1.81 million.

Nevertheless, Grayscale’s ETHE continued to see withdrawals; in one day, $5.4 million was taken out. There were no daily flows seen in the other Ether ETFs.

Ethereum (ETH) was down 3.8% at the time of writing, trading at about $2,386. Investor concern and geopolitical developments continued to put pressure on the larger cryptocurrency market.

Ripple dragged to court again: SEC challenges XRP’s non-security status

The important court decision that classifies XRP tokens as non-security has been chosen to be appealed by the US Securities and Exchange Commission (SEC). The cost of XRP tokens was directly impacted by this appeal.

The Court of Appeals’ ruling has the potential to alter the legal landscape around digital assets.

Ripple CEO criticizes SEC’s appeal

The security requirements outlined by the SEC’s Howey test are not met by XRP, a coin released by Ripple Labs, according to a ruling made in July 2023 by US District Judge Analisa Torres. This verdict directly affected Ripple Labs, exempting $757 million in transactions from rigorous securities restrictions.

At the Manhattan-based 2nd US Circuit Court of Appeals, the SEC is contesting this decision. The government is trying to overturn the ruling, which may have a significant impact on how cryptocurrencies are regulated and traded.

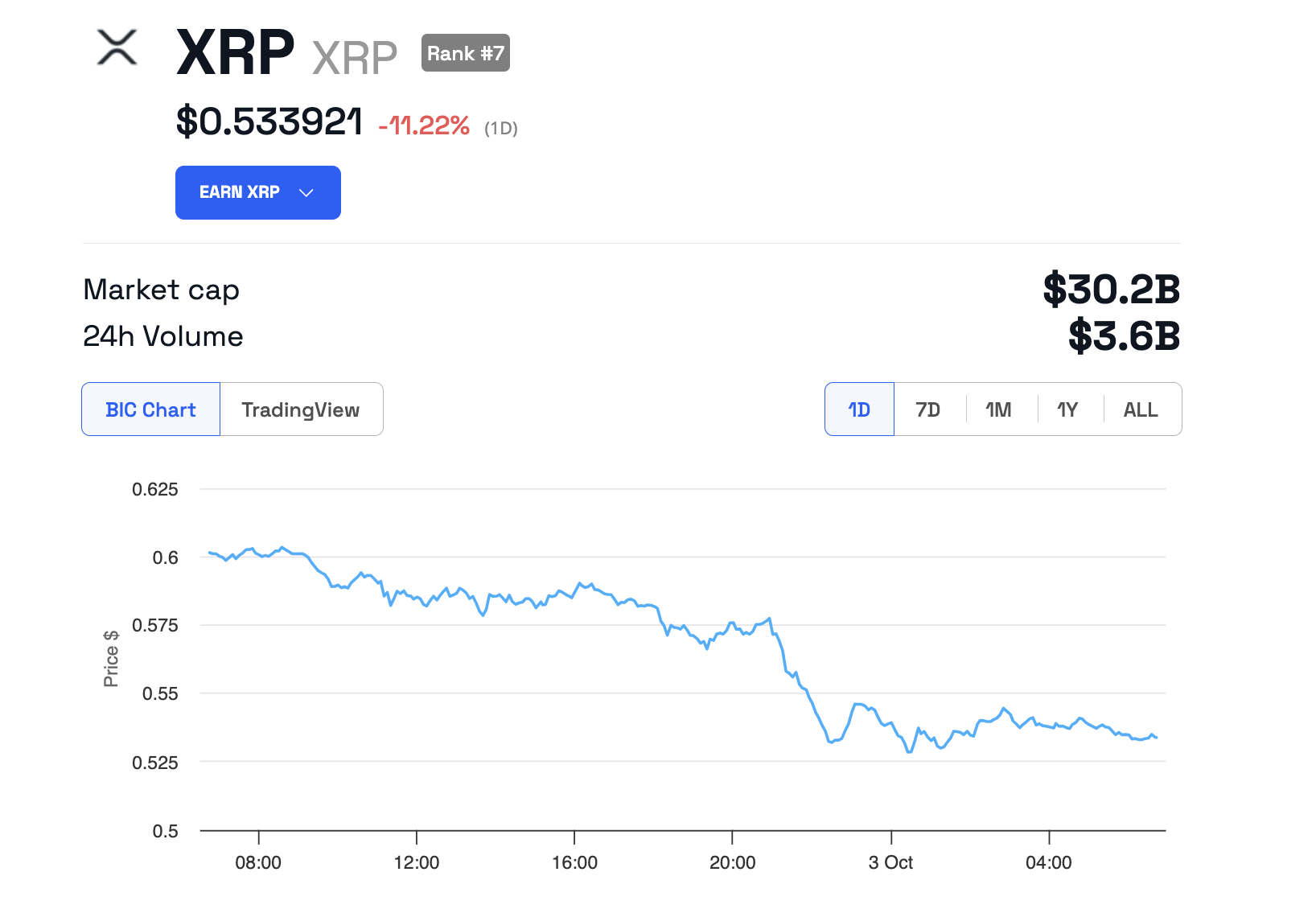

This development caused the XRP token’s price to plummet. In the past 24 hours, XRP has decreased by 11.22%, presently trading at $0.5339.

The SEC was also partially successful in Judge Torres’ decision, which held that institutional investors’ $728 million purchase of XRP should have complied with securities regulations. After that, in August 2024, Ripple was hit with a $125 million punishment; however, this fine was suspended while the appeal was being processed.

Brad Garlinghouse, the CEO of Ripple, has openly questioned the SEC’s choice to file an appeal. He maintained that the first decision ought to have settled the matter, charging the SEC of squandering tax payer dollars in its ongoing legal battle with Ripple.

“While we’ll fight in court for as long as we need, let’s be clear: XRP’s status as a non-security is the law of the land today – and that does not change even in the face of this misguided – and infuriating – appeal,” Garlinghouse stated.

This protracted legal dispute goes beyond XRP or Ripple. It is representative of a larger discussion about how to categorize cryptocurrencies and what laws apply to them. Future rulings by the 2nd Circuit may have an effect on Ripple’s business practices and may establish a precedent for how other cryptocurrencies are regarded under US law.

Separately, the SEC said that Gurbir S. Grewal, the Director of the Division of Enforcement, will be leaving his position on October 11, 2024. Acting Deputy Director Sam Waldon will take over from Sanjay Wadhwa as Acting Director.

Targeting big firms like Binance and Coinbase, the SEC launched more than 100 enforcement actions in the cryptocurrency space under Grewal’s direction. As a result, SEC Chair Gary Gensler highlighted Grewal’s efforts in upholding securities rules and praised his accomplishments.

“Every day, [Grewal] has thought about how to best protect investors and help ensure market participants comply with our time-tested securities laws. He has led a Division that has acted without fear or favor, following the facts and the law wherever they may lead,” Gensler said.

Tron Network posts record $577M revenue in Q3

The increased use of stablecoins and the network’s attempts to get a piece of the expanding memecoin industry have contributed significantly to the Tron network’s record quarterly income.

In terms of quarterly profitability, the Tron Network has surpassed popular blockchains like Bitcoin (BTC) and Ethereum (ETH) with a record $577 million in revenue for the third quarter.

Tron generated $577.2 million in income in Q3, with 74% of the amount coming from staking and 26% from burning, as to Tronscan statistics. Tron founder Justin Sun also referenced this data in a post on X on October 2.

Tron’s record-breaking quarterly results were mostly caused by the network’s recent foray into the memecoin market and increasing stablecoin activity.

Tron’s total fees and earnings exceeded those of bigger competitor networks like Bitcoin and Ethereum, which reported quarterly profits of about $56.3 million and $256 million, respectively, according to statistics from Token Terminal.

It’s important to note that blockchain networks make money in many different ways; these generally involve a complicated combination of fees, revenue, and other more technical sources. It’s possible that comparisons based only on sales or fees don’t accurately depict a blockchain’s overall earnings.

Based on data from DefiLlama, Tron is presently the second-largest stablecoin blockchain, after Ethereum, with around 35% of the $172 billion stablecoin market valuation.

Users in emerging regions in South America and Africa, where there is a huge demand for more stable assets like the US dollar-pegged stablecoin Tether because to rising inflation and fears about their own currencies, are fond of the Tron network.

As of this writing, 98.3% of stablecoin deposits and activity on the Tron network are attributed to Tether.

The network had a little income bump as a result of Justin Sun’s entry into the memecoin space, with his self-described memecoin deployer SunPump launching to a minor degree of success.

An copycat of the pump.fun memecoin launchpad situated in Solana, SunPump made $1 million in income in just 11 days after coming online and has already made $5.4 million since its August 9 launch.

Tron earned its greatest day of income on Aug. 21, when it raked in little over $5.4 million in the period of 24 hours, after a $1 billion infusion of fresh USDT from Tether on Aug. 20, per DefiLlama statistics.