The BlackRocks iShares Bitcoin ETF (IBIT) has already received over $23 billion in inflows since its introduction, marking a noteworthy milestone.

Inflows into spot Bitcoin ETFs have increased over the previous week and are not likely to slow down anytime soon. BlackRock’s iShares BTC ETF (IBIT) reached a significant milestone on Monday, bringing its cumulative inflows since launch to over $23 billion. IBIT, which was introduced in 2024, is now ranked among the top three ETFs by inflows.

BlackRock Bitcoin ETF hits fresh milestone

The US BTC ETF had inflows of almost $2 billion last week, indicating strong institutional interest in the asset class. The overall inflows on Monday, October 21st, were $294 million, with BlackRock’s IBIT taking center stage. IBIT had $329 million in inflows yesterday, while the other ETFs saw either net outflows or $0.

IBIT has recorded inflows of $1.5 billion in only the last six trading days. This has been the strongest week for the BlackRock Bitcoin ETF, according to Bloomberg ETF expert Eric Balchunas. The fund has surpassed VIT to rank among the top three ETFs by inflows in 2024. The top 2% of all ETFs, IBIT assets under management, have already surpassed $26 billion.

$IBIT had one hell of a week, +$1.1b in new cash, best week since March, passed $VTI for 3rd place overall in YTD flows (insane for new launch, esp late in year, the rest of the top 5 is each over 20yrs and old and over $300b. $IBIT‘s aum is $26b which is in top 2% of all ETFs. pic.twitter.com/KX7eD3EzFP

— Eric Balchunas (@EricBalchunas) October 21, 2024

The price of Bitcoin (BTC), however, has not been much impacted by these robust ETF inflows as it has not been able to break through the critical barrier level of $69,000. At press time, the price of Bitcoin was down 2.29% at $67,528.79, indicating that selling pressure was once again present. Nonetheless, the daily trade volume has increased to $37 billion, a 60% increase.

Bitfinex market watchers speculate that the impact of the ETF inflows on Bitcoin may be delayed. They said:

“ETF inflows can have a muted impact for a few days, and then the market reverses lower once the aggression from spot market buyers fades”.

Donald Trump trade in play?

Market commentators claim that the significant inflows into Bitcoin ETFs indicate that the Trump trade is active as the likelihood of Donald Trump winning increases. Trump’s chances of winning versus Kamala Harris have increased to an incredible 63.5%, according to statistics from Polymarket.

Bitget Research’s Chief Analyst, Ryan Lee, said that there is clear institutional interest, with inflows for six days running strongly indicative of momentum. Lee also said:

“The main drivers are Trump’s rising odds of winning the election and a technical rebound in Bitcoin’s price. Trump is a known supporter of Bitcoin, and his increasing odds of winning are seen as a positive signal for the market”.

Additionally, the recent approval of Bitcoin ETF options by US SEC could further boost greater liquidity into ETFs. “With the SEC’s approval of ETF options, we believe this will provide the ETF with the needed liquidity to attract sustainable inflows,” noted QCP Capital.

Asia’s MicroStrategy Metaplanet raises 10B Yen to buy Bitcoin

In order to prepare for their next Bitcoin acquisition, Metaplanet, also known as Asia’s MicroStrategy, raised a total of 10 billion yen through a stock offering.

In anticipation of its upcoming massive Bitcoin acquisition, Asia’s MicroStrategy Metaplanet just raised an additional 10 billion Japanese yen through the sale of its stock. The business wrapped up its eleventh round of stock acquisitions earlier today. The business is raising more funds for its Bitcoin acquisitions, much like MicroStrategy did. As of this writing, the price of Bitcoin is down 2% and is still under selling pressure near $69,000 levels.

Metaplanet raises 10B Yen for Bitcoin buying

13,774 individual shareholders took part in Metaplanet’s most recent stock sale, which was part of the company’s eleventh series of stock acquisition rights. The entire EVO FUND exercise has brought in ¥10 billion in revenue.

*Metaplanet Announces Results of Stock Acquisition Rights Exercise* pic.twitter.com/MquO6JFNEX

— Metaplanet Inc. (@Metaplanet_JP) October 22, 2024

Due to the involvement of major firms like BlackRock, many corporate players have been eager to gain exposure to Bitcoin. Additionally, stock sales are being conducted by market participants in what appears to be the Bitcoinization of conventional securities markets. Somin Gerovich, CEO of Metaplanet, commented on the development:

“The Company has also approved the transfer of unexercised rights to EVO FUND, which has committed to exercising all transferred rights by October 22, 2024. Once completed, the total funds raised via the stock acquisition rights will reach 10 billion yen”.

Even though the Metaplanet share price fell 5.85% below 1,200 JPY after today’s stock sale, it is still up 644% year-to-date.

As is well known, throughout the past month, the Japanese company has been aggressively purchasing Bitcoin. Currently, the company’s balance sheet shows over 850 Bitcoin, all of which were purchased over the last six months since May 2024.

Enhancing the BTC acquisition strategy

Until the price of Bitcoin (BTC) stays below $70,000, Metaplanet is doing all it can to grow its holdings as fast as possible. As a result, the business has started using various strategies to obtain money for its Bitcoin acquisitions.

However, the business has also lately engaged in Bitcoin options trading as part of this strategy in partnership with QCP Capital. The business has also generated solid earnings of more than $2 million using this method.

Long-term investors are taking advantage of the chance to increase their Bitcoin holdings while the price of the cryptocurrency stays rangebound between $60,000 and $70,000. The price of Bitcoin is currently down 2% at $67,389.12 and is under selling pressure near $69,000.

Whale activity around leading assets skyrocketed, showing mixed signals

As the market saw a noticeable drop, there were a lot more big transactions involving some of the top cryptocurrencies.

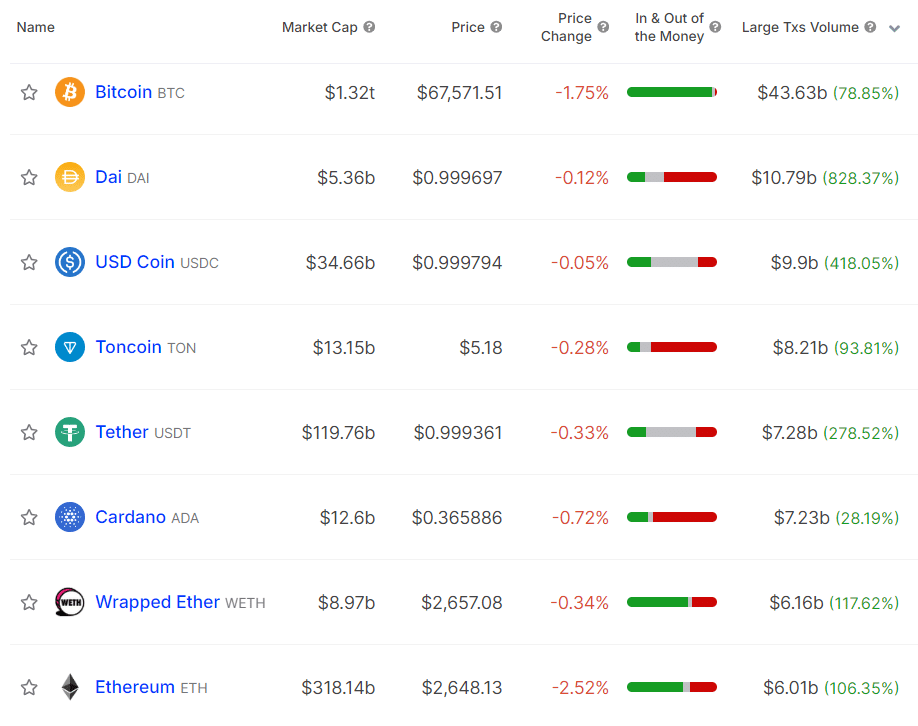

Bitcoin (BTC) is at the top of the leaderboard with a significant transaction volume of $43.63 billion on October 21, according to statistics from IntoTheBlock. As of this writing, the top cryptocurrency asset is trading at $67,500, down 2.2%.

Despite the price decline, addresses that have been holding Bitcoin for more than a year saw a 0.05% gain in their balance, hitting $856.23 billion.

Yesterday, Toncoin’s whale transactions increased by 93% to $8.21 billion. With TON’s $13 billion market capitalization, this level of whale activity may indicate investor fear and anxiety.

Cardano (ADA) whale transactions reached $7.23 billion, a 28% rise. With its whale trades, Wrapped Ether (WETH) saw a 117% increase, hitting $6.16 billion. Holders of WETH and ADA are likewise lost and confused in the midst of the market selloff.

Additionally, Ethereum (ETH) whale activity increased to $6 billion. Like Bitcoin, Ethereum had a 0.04% increase in its long-term holding balance, which is now $288 billion.

According to ITB statistics, stablecoin whale activity has also significantly increased. According to data, there are also more currency outflows from USDC and DAI. Whales typically retreat to search for better deals when they sense an overheated market, which is indicated by this momentum.

The worldwide cryptocurrency market capitalization, which is presently at $2.44 trillion, decreased by 3.1% over the previous day, according to statistics from CoinGecko. However, throughout the same period, the daily trade volume increased from $90 billion to $118 billion.

Given that the “Uptober” trend and avaricious traders were the main causes of the bullish momentum, the current market-wide correction would be seen as normal.