Despite the crypto market meltdown, the BlackRock Bitcoin ETF (IBIT) saw $597 million in inflows, marking the third straight net inflows for the Bitcoin ETF.

BlackRock’s iShares Bitcoin ETF (IBIT) received more than $597 million in inflows on Tuesday. The BlackRock Bitcoin ETF rescues the day for the struggling cryptocurrency market after investors were concerned about high US JOLTS job vacancies and ISM Services PMI data.

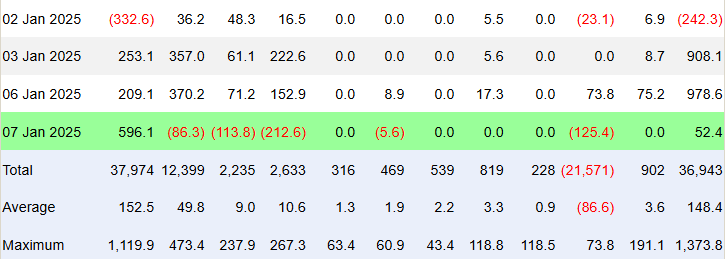

The spot Bitcoin ETF in the United States saw a net inflow of $53.46. Fidelity, Bitwise, Ark 21Shares, Franklin Templeton, and Grayscale all reported withdrawals from their Bitcoin ETFs.

BlackRock Bitcoin ETF saw inflow despite crypto market crash

On January 7, BlackRock’s iShares Bitcoin ETF (IBIT) acquired 6,078 BTC for $208.7, while miners mined just 450 additional BTCs. According to Trader T statistics, IBIT saw an inflow of $597.18 million.

This is the third consecutive influx into IBIT, despite a significant selloff in the cryptocurrency market. Notably, the US Bitcoin ETF had an influx of $978.6 million on Monday, boosting confidence as the flagship cryptocurrency surpassed the $102K milestone.

Meanwhile, Fidelity’s FBTC, Bitwise’s BITB, and Ark Invest’s ARKB had outflows of $86.29 million, $113.85 million, and $212.55 million, respectively. Also, Franklin EZBC saw a $5.58 million outflow.

Grayscale’s GBTC also had an outflow of $125.45 million. Flows were nil for Invesco, Valkyrie, VanEck, and Grayscale Mini.

According to Farside Investors, the total net inflow to Bitcoin spot ETFs was $52.4 million. The iShares Bitcoin Trust by BlackRock saw a net inflow of $596.1 million. Other ETFs had varied levels of outflow.

Bitcoin and crypto market crash on macro concerns

According to the United States Bureau of Labor Statistics, JOLTS job vacancies climbed by 259,000 to 8,098 million in November 2024. Additionally, ISM Services PMI came in stronger than predicted, demonstrating the durability of the U.S. economy now. This led the Bitcoin price to plummet by more than 5%.

In reality, the US dollar index (DXY) remains above 108.50 today, following a two-day low move that resulted in a recovery in the Bitcoin price. The 10-year US Treasury yield rose to a 35-week high of 4.68%. The robust US economic statistics decreased prospects of more Fed rate reduction.

However, despite the higher performance of the BlackRock Bitcoin ETF, the Bitcoin (BTC) price continues to decrease. The price is presently trading at $96,259. The current 24-hour low and high are $96,132 and $102,022, respectively. Furthermore, trade volume has declined by 23% during the previous 24 hours.

AI agents in 2025: Multicoin Capital predicts zero-employee companies, Alpha Hunters

As AI agents become the talk of the town, venture company Multicoin Capital has announced its forecasts for the coming year. The business believes that 2025 will be a watershed moment for AI.

In a January 7 study titled “Frontier Ideas For 2025,” Multicoin Capital outlined the major topics to monitor in 2025.

The rise of zero-employee companies

As AI models grow capable of thinking, planning, executing, and self-correcting without human intervention, Multicoin Capital predicts that ‘zero-employee’ businesses will become popular by 2025.

The concept behind zero-employee organizations stems from their capacity to function with little human supervision. AI agents are becoming more capable of doing difficult tasks independently thanks to tools such as OpenAI’s o3 and other powerful chain-of-thought reasoning models.

“In order for a Zero-Employee Company to function, it will need human guidance as inevitably the AI will make mistakes and probably exceed its context window. Over time, I expect the degree of human guidance to decrease as AIs continue to improve self-correction and expand context windows,” Multicoin Capital analyst Kyle Samani wrote.

He also stated that decentralized autonomous organizations (DAOs), which would control their operations, will be a critical facilitator of zero-employee businesses. Crypto capital markets will also play an important role in funding these companies and supplying the required funds.

Furthermore, Multicoin Capital’s estimates reflect Sam Altman’s claim that AI agents will enter the workforce by 2025. Nvidia CEO Jensen Huang even described AI agents as the next important step in workforce transformation.

AI agents to transform crypto trading in 2025?

Another trend that might characterize 2025 is the rapid development of AI agents in cryptocurrency trading. In 2024, AI agents were mostly utilized to garner attention through content production and social media participation.

However, as cryptocurrency and decentralized finance expand, AI agents’ roles will become more specialized.

One of the most intriguing trends to watch in 2025 will be the rise of “Alpha Hunters.” These are artificial intelligence agents whose main mission is to detect and capitalize on trading opportunities (or “alpha”).

With additional currencies entering the market, centralized exchanges (CEXes) will struggle to stay up by 2025. This might be due to sluggish listing processes at CEXes. As a result, traders will rely on decentralized exchanges (DEXes) for trading.

“Consequently, DEXes will gain market share on CEXes in the year ahead. As the number of tokens and DEX activity explodes, active traders will need more robust tools and models to identify emergent tokens, analyze sentiment and on-chain metrics,” Multicoin Capital analyst Vishal Kankani, said.

In such a case, Alpha hunters will acquire popularity. These AI bots will search the DEXes for and reduce hazards, such as rug pulls, while executing trades autonomously.

Arbitrum awards record developer grant to South Korea’s Lotte Group

Arbitrum, an Ethereum Layer-2 network, has teamed with the Lotte Group of South Korea to advance its metaverse goals.

In its largest-ever developer award, the Arbitrum Foundation has picked Lotte to spearhead blockchain development for Caliverse, Lotte’s metaverse gaming platform.

Lotte Group secures funding from Arbitrum

The Lotte Caliverse will be a blockchain-based, AI-driven 3D entertainment experience. This news happened during CES 2025 in Las Vegas, Nevada, when Offchain Labs, the inventors of Arbitrum, confirmed the donation without releasing the precise amount.

It’s worth noting that the reward was granted in Arbitrum’s native token, ARB. This is common procedure for the Arbitrum Foundation, which strives to promote growth throughout its ecosystem.

“Lotte is Arbitrum Foundation’s largest grant recipient to date. We’re proud to collaborate with partners closely aligned with our vision,” said John Park, Head of Korea at the Arbitrum Foundation.

Lotte’s inaugural venture into the metaverse began in 2022, with the first announcement of its relationship with Arbitrum made last year. The decision to incorporate Arbitrum’s blockchain into Caliverse is an important step toward connecting existing enterprises with innovative blockchain technology.

Caliverse is a testing environment for cutting-edge technologies such as artificial intelligence, virtual reality, and cryptocurrency. Users of the site may explore immersive virtual worlds, take part in futuristic retail experiences, and engage with sponsored content from worldwide brands like 7-Eleven and Tomorrowland.

With Arbitrum’s integration, Caliverse customers will soon be able to pay for services in cryptocurrency. On the other side, in-game transactions will use on-chain methods. As a result, the cooperation might reignite corporate interest in metaverse enterprises. This notion peaked in popularity some years ago, but has failed to retain momentum.

“Arbitrum’s blockchain is the ideal home ground for Lotte Caliverse, delivering industry-leading 250ms block times that ensure high-quality performance within virtual worlds and gaming experiences. With Arbitrum now powering Lotte Caliverse, in-game transactions will be seamlessly integrated on-chain, eliminating latency and providing users with a smooth, consumer-friendly experience,” Steven Goldfeder, CEO of Offchain Labs, commented.

While Lotte’s gift is a significant milestone, the Arbitrum Foundation has a history of supporting creative enterprises. On January 11, 2024, the Foundation made a donation to AOFverse, another metaverse-focused portal.

AOFverse’s effort sought to improve on-chain metaverse experiences. Taken together, these initiatives indicate Arbitrum’s larger plan to dominate blockchain-based virtual spaces.

Arbitrum (ARB) versatility has made it a popular candidate for a Layer-2 Ethereum blockchain. Its influence in the gaming business has expanded dramatically, with the network expected to grow by 72% year on year in 2024.

Offchain Labs reports that Arbitrum presently hosts 119 game titles and 23 gaming-focused blockchains via its Arbitrum Orbit stack. This toolkit allows developers to create bespoke blockchains utilizing Arbitrum technology.

The partnership between blockchain and Lotte combines blockchain’s efficiency with Lotte’s entertainment and retail capabilities, ushering in a new era of virtual interactivity. Arbitrum’s agreement strengthens its position as the preferred blockchain infrastructure for gaming and metaverse platforms, with the arrangement aimed at introducing businesses to a metaverse-inspired experience.

Despite the statement, ARB’s stock price has declined over 10% since the start of the Wednesday session. BeInCrypto statistics shows that it is presently trading at $0.827.