CEO of BlackRock Larry Fink has been a prominent supporter of Bitcoin. Fink explained on CNBC’s “Squawk on the Street” why investors ought to think of Bitcoin as a crucial part of their investment portfolio.

Given the prominence of BlackRock—which manages more than $10 trillion in assets—Fink’s support is significant.

Why Larry Fink believes in Bitcoin’s potential

In his presentation on CNBC, Fink highlighted the distinctive features of Bitcoin. He emphasized how important it is for granting financial independence, especially in shaky economic times.

“I’m a major believer that there is a role for Bitcoin in portfolios. I believe you’re going to see that as one of the asset classes that we all look at. I look at it as digital gold, as I said before,” he stated.

At first sceptical, Fink acknowledged his previous opinions were incorrect. Bitcoin is now crucial in his opinion for portfolio diversification and risk mitigation.

“I studied it, learned about it. And I came away saying, ‘OK, you know, my opinion five years ago was wrong.’ Here’s my opinion. Say this is what I believe in today. I believe in the opportunity today. I believe Bitcoin is legitimate,” Fink stated.

Fink’s support has not escaped attention. Renowned individuals such as Anthony Pompliano and Dan Held have applauded Fink’s position and acknowledged its importance.

Larry Fink continues to be the best CMO of bitcoin.

The messenger matters more than the message now. pic.twitter.com/jcgYuRODFy

— Anthony Pompliano 🌪 (@APompliano) July 15, 2024

The price of Bitcoin (BTC) likewise increased in response to Fink’s remarks. As of this writing, Bitcoin is trading at $63,215 – a rise of 5.63% over the previous day.

Fink’s transition from advocacy to skepticism is similar to the institutional adoption of Bitcoin. For example, since April, the Japanese investment company Metaplanet has been consistently buying Bitcoin.

The corporation uses Bitcoin as a reserve asset in an effort to lower risks associated with Japan’s economic climate. The problems facing the yen include its large level of public debt and its sustained negative real interest rate environment.

Metaplanet’s fresh Bitcoin purchase sends stock soaring by 25%

On Tuesday, the price of Metaplanet’s shares increased by 25%, outpacing that of Bitcoin. Currently, the firm has more than 225 BTC in total holdings.

Japan’s publicly traded company Metaplanet has not stopped accumulating Bitcoin, purchasing an additional 21.88 BTC earlier today for an estimated total investment of $1.26 million. This news coincides with Monday’s 4.5% increase in the price of Bitcoin, which sent it all the way to $65,000.

Metaplanet builds its Bitcoin stack

During the past two months, Metaplanet has been gradually increasing its Bitcoin stack, taking a cue from MicroStrategy. Throughout the current Bitcoin slump, the Japanese company has been steadily buying Bitcoin each week by employing the successful Dollar-cost-averaging (DCA) technique.

With today’s purchase, Metaplanet now holds more than 225 BTC in total, valued at $14.55 million at the current BTC price. Like MicroStrategy, Metaplanet has been raising money for Bitcoin purchases by selling bonds.

*Metaplanet purchases additional 21.88 $BTC* pic.twitter.com/zCXzKFudog

— Metaplanet Inc. (@Metaplanet_JP) July 16, 2024

The news made today has caused the share price of Metaplanet to jump by almost 25.81%; it is presently trading at 117 JPY. The company’s plan for embracing Bitcoin has given its stock, which has increased by more than 631% since the year’s beginning, a strong boost.

With 2.25 billion JPY in Bitcoin assets on its balance sheet, Metaplanet presently has a market capitalization of 17.5 billion JPY. The proportion of Bitcoin in Metaplanet’s total assets is rising fast, and some market observers believe it may soon surpass 100%.

BTC price recovery

The price of Bitcoin (BTC) has made a strong comeback over the last week, rising by a healthy 13.3% and getting closer to $65,000. This recuperation has mostly occurred in the last weekend following the narrow escape of former President Donald Trump from an attempted assassination during an election campaign event.

However, there has also been a significant institutional interest in Bitcoin, which has helped to propel the price of the cryptocurrency upward. Over the past week, the market has seen strong inflows into spot Bitcoin ETFs, indicating a resurgence of institutional interest in the asset class.

However, experts anticipate a parabolic bitcoin price surge in the near future as a result of the global liquidity index’s upward shift.

Global Liquidity Index reflects #Bitcoin price.

We are about to go parabolic 🚀 pic.twitter.com/wb6wkjYR2Y

— Vivek⚡️ (@Vivek4real_) July 15, 2024

Check Out the Latest Prices, Charts, and Data of BTC/USDT

XRP bullish sentiment surges, whale activity doubles

The seventh-largest cryptocurrency, XRP, is receiving favorable feedback from investors despite a notable increase in whale transactions.

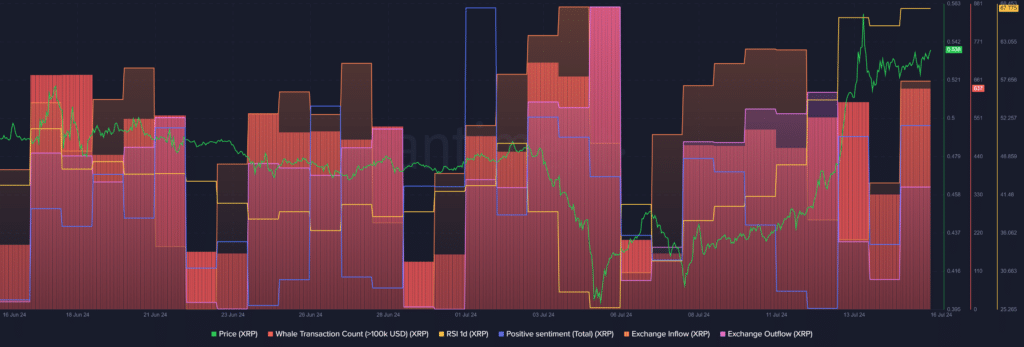

The amount of whale transactions with at least $100,000 worth of XRP rose by 92% in the last day, from 332 to 637 unique transactions per day, according to statistics from Santiment.

The increase in XRP whale activity coincides with investor expectations of a possible price increase. Positive sentiment surrounding XRP rose by 65% in the past day, according to Santiment.

According to a source on crypto.news, speculators began amassing XRP on July 2 at a price of about $0.478.

With greater exchange activity, data from the market intelligence platform suggests that the accumulation period may be coming to a conclusion. Santiment data shows that throughout the course of the previous day, the quantity of XRP tokens entering the exchanges increased from around 55.1 million to 92.9 million coins.

There was also a noticeable increase in the quantity of XRP leaving exchanges, going from 25.3 million to 69.7 million tokens.

The 23.2 million token discrepancy indicates that more XRP holders are seeking to profit from the asset’s short-term appreciation than are investors who are building it up.

Furthermore, according to Santiment, the XRP Relative Strength Index (RSI) is circling the 67 level. According to the indicator, XRP is currently a little bit overbought, and a price correction is reasonable.

As of this writing, XRP is trading at $0.544, up 2.8% over the last 24 hours. With $2.2 billion in trading activity every day, the asset’s market capitalization is currently $30.3 billion.

Notably, earlier today, XRP had a short spike to a three-month high of $0.568.