Trump-supported As Ethereum falls below $1,500, World Liberty Financial seems to be selling the cryptocurrency due to growing losses.

On April 9, a wallet associated with WLFI allegedly sold 5,471 Ethereum for almost $8 million, for $1,465 per coin, according to data posted on X by Lookonchain.

The selling is a significant loss. At an average price of $3,259, WLFI had already purchased 67,498 ETH for over $210 million. The company is sitting on an unrealized loss of about $125 million at current prices.

Has Trump’s World Liberty(@worldlibertyfi) started selling $ETH at a loss?

According to Arkham, a wallet possibly linked to #WorldLiberty sold 5,471 $ETH($8.01M) at $1,465 30 minutes ago.#WorldLiberty previously spent ~$210M to buy 67,498 $ETH at an average price of $3,259,… pic.twitter.com/jPMqCiADvt

— Lookonchain (@lookonchain) April 9, 2025

The business has been aggressively growing its product line in spite of the losses. The introduction of USD1, a stablecoin backed 1:1 by cash, short-term U.S. Treasuries, and equivalents, was verified by WLFI on March 25. With more networks to follow, the coin is now active on Ethereum and BNB Chain.

WLFI asserts With reserves reviewed by third parties and custody managed by BitGo, USD1 is designed for organizations looking for transparency and compliance. Stablecoin is marketed as a secure alternative to undercollateralized or algorithmic tokens.

Bitget burns 30 million BGB tokens in Q1 2025 – What does it mean for BGB prices

By starting extensive token burns, Bitget is intensifying its deflationary approach for the BGB coin.

Could token burning turn into a crucial strategy to raise the intrinsic value of exchange-native tokens in the current, highly competitive centralized exchange market?

Bitget’s token burn Strategy

Bitget just revealed that 30 million BGB tokens were burned in the first quarter of 2025. The number of BGB tokens in circulation dropped by 2.5%, from 1.2 billion to roughly 1.17 billion.

Bitget finished burning 800 million BGB on December 30, 2024, which is 40% of the token’s initial supply. The number of BGB tokens dropped from 2 billion to 1.2 billion as a result of this action.

Bitget has laid out a long-term tokenomics roadmap that will start in 2025. In an effort to increase the long-term value of BGB, the exchange will set aside 20% of its quarterly profits from the Bitget Exchange and Bitget Wallet to purchase back and burn BGB.

Binance is among the most effective token burn cases. Binance has burned more than 59 million BNB thus far, according to BNB Burn Info. BNB has increased from less than $1 in 2017 to more than $600 in 2024 thanks to this deflationary methodology.

BNB is already among the most valuable exchange tokens in the world due to the continuous reduction in its supply and the robust Binance Smart Chain (BSC) ecosystem. Bitget seems to be doing the same, but the crucial question is still whether BGB can duplicate BNB’s success.

Is burning BGB enough to boost price like BNB?

CoinGecko reports that earlier in 2025, BGB hit its all-time high (ATH) of $8.45. This price spike was fueled in part by the sudden scarcity caused by the fire of 800 million tokens at the end of 2024.

Still, this number is insignificant when compared to BNB’s performance. Bitget must greatly raise BGB’s practical utility in addition to cutting supply in order to maintain and boost value.

Beginning in January 2025, Bitget Wallet’s GetGas functionality has made BGB the main token for multi-chain gas payments. This removes the requirement for chain-specific gas tokens by enabling users to pay gas fees on popular blockchains like Ethereum (ETH), Solana, and BNB Chain using BGB, USDT, or USDC.

Furthermore, Bitget uses PayFi and the Bitget Card to incorporate BGB into actual payment situations. The goal of the PayFi effort is to make BGB a useful way to pay for everyday costs like groceries, transit, and shopping.

Echoing Binance’s goals for BNB, this endeavor broadens BGB’s use beyond the blockchain and establishes it as a link between decentralized finance (DeFi) and daily life.

Bitget is headed in the right direction, but there are still a lot of obstacles in the way of reaching BNB-level growth. First off, compared to Binance, Bitget’s ecosystem is smaller and less advanced. Second, the real-world demand for BGB will be directly impacted by the rate at which innovative features like PayFi and multi-chain gas payments are actually adopted.

Lastly, Bitget is still establishing its place in the market, whereas Binance has spent years cultivating a devoted user base and brand trust. Bitget needs to strike a balance between decreasing supply and increasing demand through useful, real-world applications in order to maintain long-term growth.

Dogecoin whales’ 1.3 billion dump fuels concern, DOGE price slips

Due to the market’s continued volatility, Dogecoin whales unloaded 1.3 billion coins, and the price of DOGE fell 4%.

Concerns in the market have been raised by Dogecoin whales in light of the current chaotic situation in the larger cryptocurrency market. As demonstrated by the recent 4% decline, the DOGE price has also been impacted by the recent major dump by the big investors, or whales. Additionally, it indicates investors’ declining risk-bet appetite, which might push the meme coin’s price even lower in the days ahead.

Dogecoin whales offload 1 billion tokens

The cryptocurrency market has been rocked by a big sell-off by Dogecoin whales, raising questions about the price of DOGE going forward. Santiment, a well-known market analytics tool, reports that in the past 48 hours, 1.32 billion Dogecoin have been dumped by big investors.

Citing Santiment data, market analyst Ali Martinez emphasized this concerning trend and cautioned that investors’ declining risk appetite may further push prices lower in the days ahead. The market’s overall volatility is reflected in the sell-off by the Dogecoin whales, as investors appear to have lost faith in the cryptocurrency’s potential for growth.

Whales sold over 1.32 billion #Dogecoin $DOGE in the last 48 hours, as shown by data from @santimentfeed! pic.twitter.com/K3n6sD03Kl

— Ali (@ali_charts) April 9, 2025

The price of DOGE has been severely impacted by this large dump, falling by almost 4% in recent trading sessions. The cryptocurrency is now in a neutral position and may stay there for the remainder of this month, according to a recent DOGE price prediction.

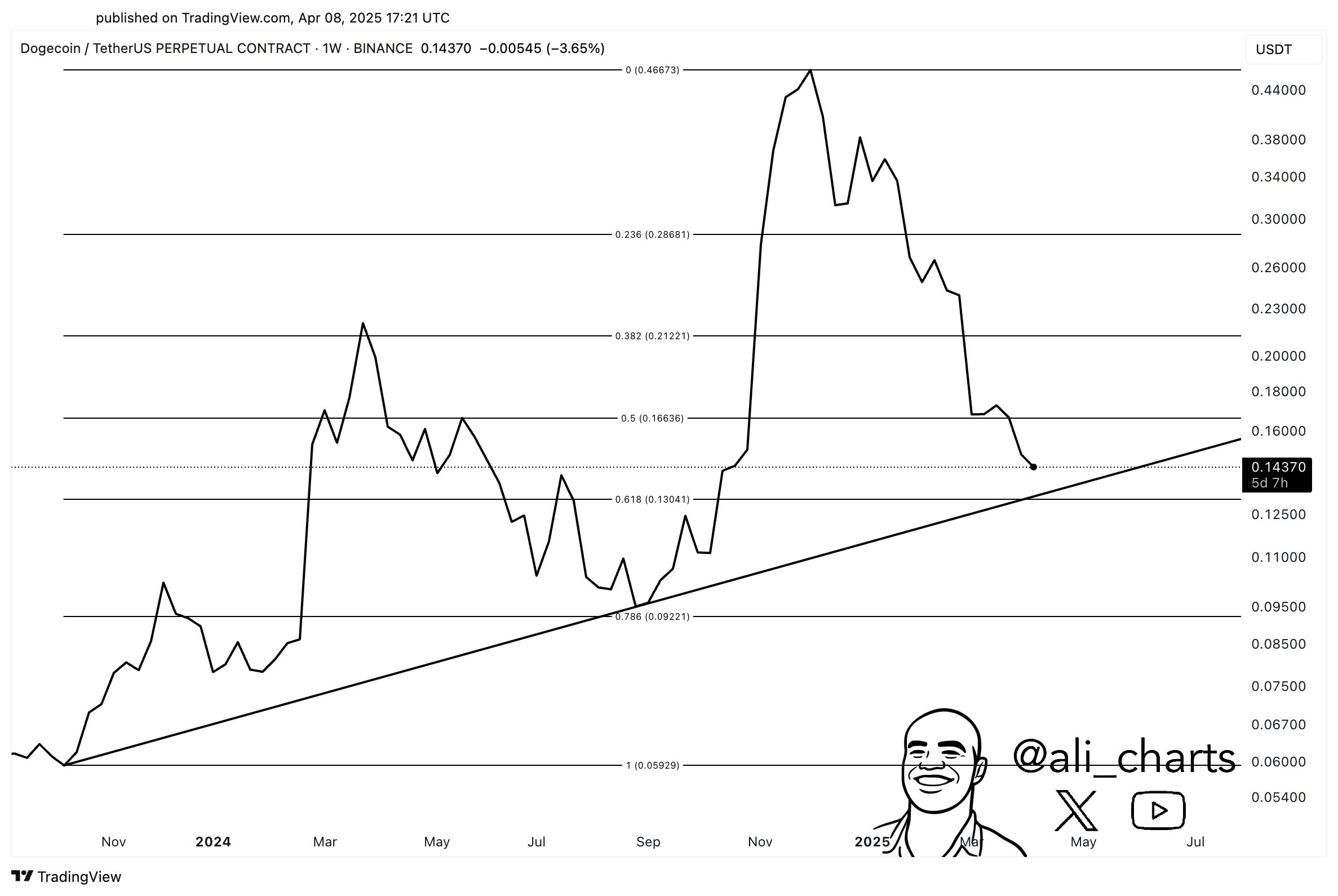

Investors should closely monitor a critical support level for the DOGE price that Ali Martinez has also noted. Martinez claims that since October 2023, the top meme coin has continuously adhered to a rising trendline, which currently converges with the 61.8% Fibonacci retracement at $0.13. Because of the convergence of technical indicators, $0.13 is an important price level to keep an eye on because it may decide DOGE’s short-term course.

Martinez’s insight emphasizes how important this support level is since it may serve as a solid foundation for future price fluctuations. If this level is broken, it may indicate a further drop, but if it remains above it, traders may get more confident.

DOGE price slips: more dip incoming?

Due to the Dogecoin whales dump, the price of Dogecoin dropped more than 4% today and was trading at $0.1467. Its one-day volume dropped to $1.99 billion, a 26% decrease. Notably, during the past day, the cryptocurrency has touched a low of $0.1367 and a high of $0.1567, while momentarily holding onto the $0.13 support.

In addition, Dogecoin Futures Open Interest dropped 1.12%, according to CoinGlass’ derivatives data, which reflected the pessimistic mood that pervaded the market. At the same time, Ali Martinez forecast that if the bears maintain their dominance, the price of DOGE might plummet 59% to the $0.06 level.