BlackRock has been purchasing Bitcoin declines for the last 16 days, amassing 12,272 BTC at a cost of $740 million, demonstrating unshakable trust.

Since Bitcoin’s recent decline below $60,000, the market has been apprehensive, leading to more than $53 million in liquidations in the past day. Big participants, including Metaplanet and BlackRock, have demonstrated their faith in the asset class by purchasing throughout each of the market cycle’s dips.

BlackRock, Metaplanet buying the Bitcoin dips

Despite the market’s volatility, BlackRock has added an astounding $742 million to its Bitcoin holdings over the previous two weeks. In the last 16 days, the biggest asset manager in the world has amassed 12,272 Bitcoin (BTC).

This big purchase follows a slowdown in purchases between August 27 and September 24, at which time Bitcoin briefly fell below $60,000. But starting on September 24, BlackRock has started buying Bitcoin again, increasing its total holdings to over 369,822 Bitcoin, which is worth over $22.4 billion. Asset managers’ trust in Bitcoin’s long-term worth is rising, as seen by this ongoing acquisition.

BlackRock bought 12,272 $BTC($742M) over the past 16 days.

Between Aug 27 and Sept 24, when $BTC traded below $60K for an extended period, #BlackRock made few accumulations.

Since Sept 24, they’ve resumed buying, adding 12,272 $BTC to their holdings, and currently hold… pic.twitter.com/fnhrI4Ijp8

— Lookonchain (@lookonchain) October 11, 2024

BlackRock recommended purchasing Bitcoins last week as the US Dollar gradually weakens and loses purchasing power. Conversely, Bitcoin presents itself as a powerful substitute for the US currency and an inflation hedge against its depreciating value.

In addition to BlackRock, Metaplanet is purchasing Bitcoin declines. Metaplanet has procured around 108.99 BTC for ¥1 billion, or ¥9,174,396 per Bitcoin, marking yet another noteworthy acquisition for the company. After Metaplanet bought Bitcoins earlier this week, the most recent purchase was made in a span of four days. The corporation now owns 748.50 BTC as of October 11. These were purchased for ¥6.965 billion, or an average price of ¥9,304,655 per Bitcoin.

*Metaplanet purchases additional 108.99 $BTC* pic.twitter.com/b0fDiqcAWv

— Metaplanet Inc. (@Metaplanet_JP) October 11, 2024

BTC Whales panic sell

Given the historical tendencies and the recent volatility in the price of Bitcoin, experts are speculating on the probability of another 75% drop. Crypto whales have been panic selling throughout this current drop, even as BlackRock is purchasing.

According to Lookonchain’s most recent statistics, a crypto whale just panic-sold 800 BTC ($48.5M) as the price of Bitcoin dropped. This whale lost over $26 million after selling 10,345 BTC ($619 million) for $59,847, after having amassed 11,659 BTC ($727 million) at an average price of $62,362 since June 19. The whale still has 8,936 BTC worth $540M despite the losses.

This whale panic-sold 800 $BTC($48.5M) again after the $BTC price dropped!

Since June 19, this whale has accumulated 11,659 $BTC($727M) at $62,362, and sold 10,345 $BTC($619M) at $59,847, losing ~$26M, and still holds 8,936 $BTC($540M).

Address:… pic.twitter.com/5pUzgvSGCr

— Lookonchain (@lookonchain) October 10, 2024

Prior to today, the price of Bitcoin fell below $60,000 in response to the US CPI report for September and the extremely high inflation figures. The way things are going, bulls are losing faith in an impending “Uptober” surge.

Uniswap (UNI) price soars over 10% following Unichain announcement

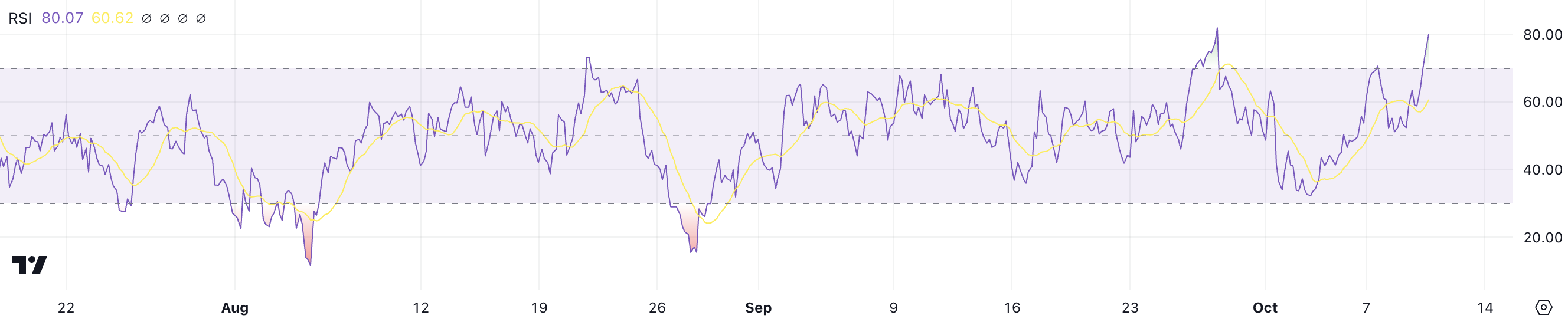

Following the announcement of Uniswap Labs’ own Layer-2, Unichain, debut, the price of Uniswap (UNI) increased by more than 10%. The Relative Strength Index (RSI) has reached overbought levels due to the recent price increase, indicating strong purchasing momentum.

Due to the possibility of a retreat due to overbought conditions, the market has been cautious due to its quick ascent. The upcoming price moves of UNI will be heavily influenced by key resistance and support levels.

UNI RSI suggests overbought conditions

After learning about Unichain, UNI’s RSI quickly increased from 58 to 80 in a matter of hours. The rapid rise indicates robust purchasing momentum, as investors responded favorably to the announcement.

Relative Strength Index, or RSI, gauges the rate and direction of price changes and is used to assess if an asset is overbought or oversold. Values above 70 indicate overbought situations, while values below 30 indicate oversold conditions. The scale runs from 0 to 100.

UNI has reached an overbought condition, indicating that the recent price spike may have temporarily pushed the asset above its fair value, as shown by its RSI of 80. Conditions that are overbought frequently signal that a correction or retreat may be coming soon when the purchasing frenzy wanes.

Investors should exercise caution since if profit-taking starts, prices might become more erratic and vulnerable to declines. The RSI level is now strong, suggesting that resistance may soon be encountered by UNI’s price rise, which might result in a brief fall in price.

Uniswap ADX indicates moderate trend strength

In a matter of hours, UNI’s ADX went from 19 to 28. The fact that the ADX has increased suggests that the intensity of the present trend has been gathering steam. The Average Directional Index, or ADX, gauges a trend’s strength independent of its direction.

Values above 25 often indicate a significant trend, whereas values below 20 reflect a weak or nonexistent trend. The scale goes from 0 to 100.

The levels observed in earlier months, when both uptrends and downtrends were far greater, are still below the ADX, even with it at 28. The price of UNI rose by more than 10% in a single day, but the present ADX indicates that the trend might not be as powerful as it could be.

This suggests that although there is some momentum, it is not strong enough to suggest a prolonged or very strong movement just yet. The strength of the present trend may not be sufficient to avert a possible reversal or considerable volatility in the near future, so traders should exercise caution.

UNI price prediction: EMA lines indicate potential uptrend

With the short-term lines above the long-term ones and a reasonable gap between them, UNI’s EMA lines now indicate a distinct uptrend. Usually, this formation indicates a bullish trend, meaning that the recent price action has been positive.

Exponential moving averages, or EMA lines, are a kind of moving average that responds more quickly to short-term changes by giving recent prices greater weight. By analyzing the correlation between short-term and long-term moving averages, traders may utilize them to spot current trends and possible reversals.

Nevertheless, despite the bullish EMA pattern, the ADX indicates that the present trend is not very powerful. Should the upward trend persist and gain momentum, the price of UNI may encounter resistance levels around $8.65 and $9.52. The price may reach $12, its highest level since June 2024, if these resistances are broken.

On the other side, UNI may challenge support levels around $7.7 and $7.5, with a potential decline below $6, if the fresh news concerning Unichain is insufficient to maintain momentum and the trend reverses. That would imply a possible decrease of 28%.

SEC charges Cumberland as unregistered securities dealer

Cumberland DRW is accused by the Securities and Exchange Commission (SEC) of being an unregistered securities dealer. Cumberland angrily refutes these charges.

A key question for the future of industry regulation is whether the majority of cryptocurrency transactions are subject to securities legislation, which is at the center of the SEC’s lawsuit.

Cumberland: Unregistered securities dealer?

The SEC has charged Cumberland, a cryptocurrency market maker with headquarters in DRW, for acting as an unregistered dealer in the industry. Cumberland was accused by the SEC of providing these services since March 2018 and closing more than $2 billion in unreported deals. The company released a heated statement in response:

“Today we became the latest target of the SEC’s enforcement-first approach to stifling innovation and preventing legitimate companies from engaging in digital assets. We are not making any changes to our business operations…as a result of this action by the SEC,” it read.

Cumberland’s tone was utterly hostile. It made reference to a recent hearing of the House Financial Services Committee, when the SEC was referred to as a “rogue agency” and implied to have overreached its jurisdiction. It also detailed Cumberland’s past struggles with compliance, including altercations with SEC Chair Gary Gensler.

Given the situation, Cumberland’s righteous fury seems justifiable. The company stated that it registered as a broker-dealer in 2019 and has a lengthy history in the industry. But according to Cumberland, the SEC asserted that it could only lawfully trade Ethereum or Bitcoin, which are governed by the CFTC’s more lax regulations.

Put differently, Cumberland referred to the SEC’s requests for registration as a “Catch-22” and a “mirage.” Over the years, it gave the SEC access to data, but all of a sudden, the agency accused them of committing financial crimes for six years straight. This is comparable to what happened two days ago when Crypto.com received a Wells Notice from the SEC.

In its response to the SEC, Crypto.com was as aggressive, suing the organization in advance of any accusations being made. It said that the SEC was acting in desperation to counter the increasing bipartisan consensus in favor of cryptography and accused the agency of “regulation by enforcement.” It’s just not feasible for Gensler to think that the majority of transactions involving crypto assets are securities.

The SEC’s accusations against Cumberland are based mostly on the argument that the industry is incorrect to characterize most cryptocurrency holdings as commodities, with limited reference to particular unregistered securities transactions. This court decision, according to Crypto.com, is a fight for the future of cryptocurrency.