According to BlackRock’s head of digital assets, there is virtually no link between Bitcoin and stocks, unemployment, job figures, or manufacturing.

Robbie Mitchnick, head of digital assets at BlackRock, claims that Bitcoin has been incorrectly categorized as a “risk-on” investment.

“What’s happened a little bit in the crypto industry is a bit of an own goal,” said Mitchnick in an interview with Bloomberg on Sept. 24.

“Some of the crypto research type publications and daily commentaries have taken the fact that Bitcoin, which is obviously a risky asset and extrapolated it to say therefore it is a risk-on asset and should trade like equities,” he said.

“When you look at it fundamentally, the drivers of Bitcoin long term are very different from what’s going to drive equities and other so-called risk assets, and in some cases, they may actually even be inverted,” Mitchnick continued.

The asset management BlackRock described Bitcoin (BTC) as a “unique diversifier” in its most recent white paper on the cryptocurrency, emphasizing its ability to function as a buffer against financial and geopolitical risks.

“When we think about Bitcoin, we think of it primarily as an emerging global money alternative right,” Mitchnick said. “It is a scarce, global, decentralized non-sovereign asset and it is an asset which has no country-specific risk, has no traditional counterparty risk.”

“It confuses investors when people talk about it as risk-on because based on the properties I just described, you would think of it as risk-off.”

Generally speaking, a risk-on asset is one that maximizes returns in a positive economic environment. Examples of such assets include growth and tech companies, numerous cryptocurrencies, and some commodities.

Conversely, risk-off assets, which include gold, silver, government bonds, and the US dollar, are a class of investments that do well in times of increased market turbulence or economic downturns.

“The reality is, there’s probably two or three things a year that happen typically that actually impact the fundamental value of Bitcoin,” he added.

iShares Bitcoin Trust (IBIT), a spot Bitcoin exchange-traded fund (ETF) offered by BlackRock, enables investors to make direct Bitcoin investments through a regulated investment vehicle.

Mitchnick played down a recent change to its Bitcoin ETF that required withdrawals within 12 hours from Coinbase, the ETF’s custodian.

“Frankly, nothing of significance has changed here,” said Mitchnick. “What we do constantly with Coinbase, just like all our other service providers, is there is an operational fine-tuning and optimization of models as you get into [..] these crypto ETFs. So this is really just a normal course update as we refine things,” he said.

PlanB dreams up a scenario that would see Bitcoin hit $1 million

The recent uproar over Bitcoin and BlackRock’s ETF coincides with the release of a new “scenario” fantasy by PlanB, a cryptocurrency analyst and the man behind the contentious Bitcoin stock-to-flow (S2F) model.

By the end of 2025, Bitcoin is expected to surpass $1 million as its all-time high.

PlanB outlined a scenario in a post on X on September 24th, in which Trump wins in November, putting an end to the “war on crypto” and driving Bitcoin to a new record high of $100,000.

PlanB predicted that cryptocurrency businesses will reappear in the US by January 2025, driving up the price of Bitcoin to $200,000.

Trump is going to start accumulating a strategic Bitcoin reserve in April, which will push the price to $400,000 right before the “face-melting FOMO” that is expected to push prices to $1 million between July and December.

The majority of those who left comments on the post said that it could be a little too “optimistic.”

“If all of this will be true, I will run naked in the streets,” said crypto trader Mr. Moontastic.

SEC reveals 99% of TUSD stablecoin’s reserves were invested in risky fund

The TrueUSD (TUSD) stablecoin’s creators, TrueCoin LLC and TrustToken Inc., fraudulently put almost all of their reserves in a speculative offshore fund, according to information released by the Securities and Exchange Commission (SEC) on Tuesday. Charges against the corporations for the fraudulent and unregistered sales of investment contracts were settled as a result of this discovery.

In a comprehensive complaint submitted to the US District Court for the Northern District of California, the SEC states that between November 2020 and April 2023, TrueCoin and TrustToken used their TrueFi lending protocol to conduct unregistered offers and sales of TUSD as investment contracts.

They misrepresented these services as safe, US dollar-backed investments. Actually, they used this money for extremely risky ventures that seriously jeopardized investors’ wealth.

TrueCoin and TrustToken settled with the SEC

By March 2022, TrueCoin and a related offshore corporation had spent almost half a billion dollars supporting TUSD in the hazardous fund. The SEC claims that both organizations persisted in deceiving investors regarding TUSD’s complete US dollar backing, even after redemption issues were discovered by autumn 2022. A startling 99% of TUSD’s deposits were linked to this speculative fund by September 2024.

Acting Chief of the SEC’s Crypto Assets & Cyber Unit Jorge G. Tenreiro underlined the seriousness of the misbehavior.

“TrueCoin and TrustToken sought profits for themselves by exposing investors to substantial, undisclosed risks through misrepresentations about the safety of the investment. This case is a prime example of why registration matters, as investors in these products continue to be deprived of the key information needed to make fully informed decisions,” Tenreiro said.

In response to the SEC’s conclusions, TrueCoin and TrustToken decided to resolve the legal dispute without confirming or refuting the claims. They agreed to final rulings that bar them from breaking the federal securities laws in the future.

Additionally, they shall each pay civil penalties of $163,766. Furthermore, subject to court approval, the SEC ordered TrueCoin to disgorge $340,930 plus $31,538 in prejudgment interest.

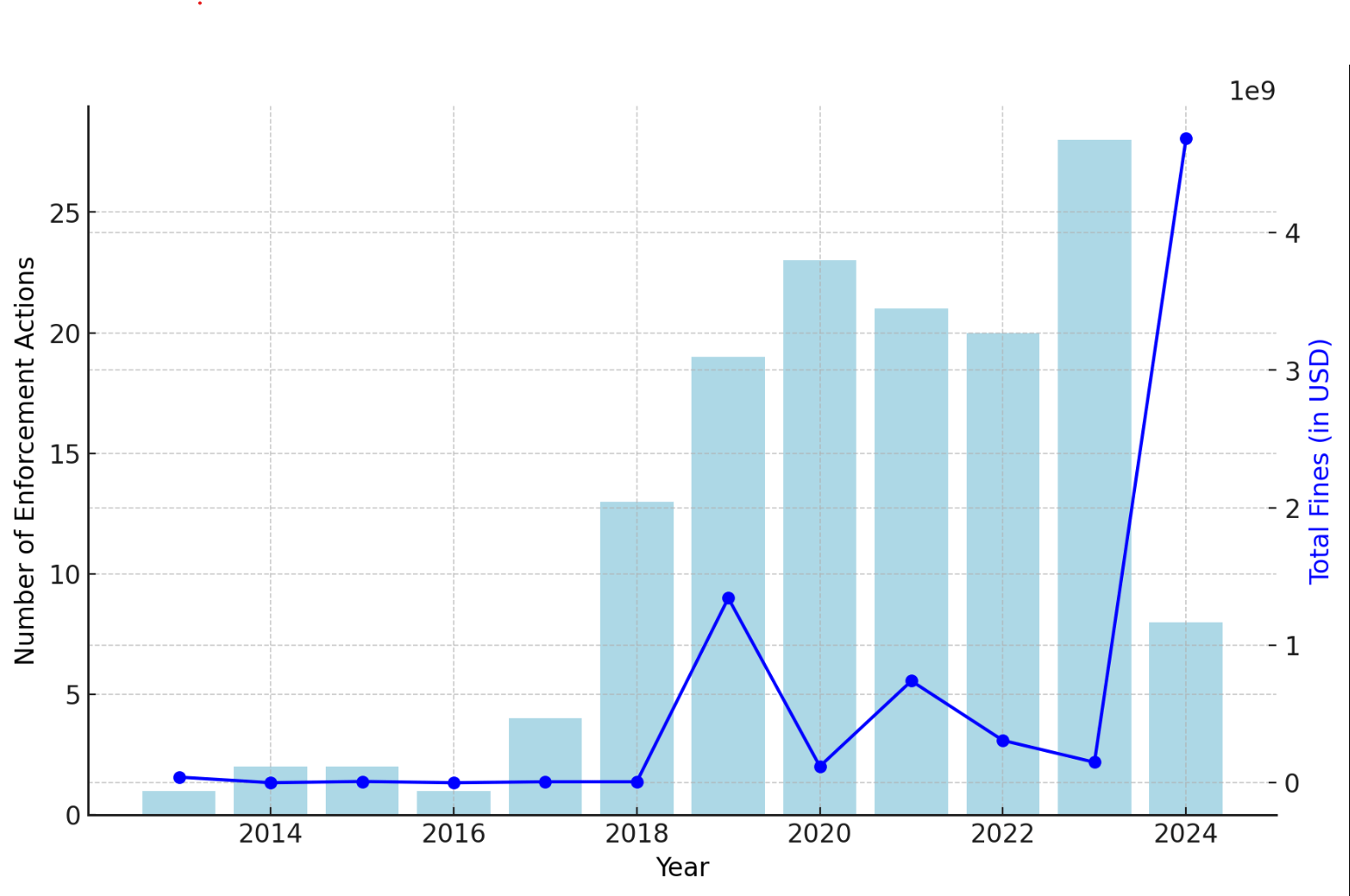

It is noteworthy that the SEC collected a record $4.68 billion in fines from the cryptocurrency industry in 2024. Thus, the SEC’s approach to regulating digital assets was subjected to a rigorous examination during Tuesday’s congressional hearing.

The congressmen extensively questioned SEC Chairman Gary Gensler and his other commissioners about their regulatory techniques. Deep disagreements over the SEC’s approach were brought to light throughout the hearing, with claims that it went too far in regulating cryptocurrencies.

Chairman of the Committee Patrick McHenry chastised Chairman Gensler for regulatory overreach at the hearing. He further charged that the SEC was imposing rules without providing sufficient explanations, conducting economic studies, or consulting the public.

“Chair Gensler’s legacy will be defined by turning the once proud institution of the SEC into a rogue agency,” McHenry said.

ZKsync price skyrockets as Coinbase rolls out trading support

The price of ZKsync surges as Coinbase extends trading support, hitting a 30-day high in the midst of increasing market interest and acceptance.

ZKsync (ZK) has been added to Coinbase’s cryptocurrency exchange, a move that has caused the price of ZKsync to reach a 30-day high as optimistic traders offset the current bearish trend.

According to the release, customers in areas where trading is allowed can now transfer ZKsync assets on Coinbase and Coinbase Exchange. The exchange did, however, caution customers against moving the commodity across unapproved networks since this might lead to money loss.

Coinbase rolls out trading support for ZKsync

The cryptocurrency exchange stated in a recent X post that, if liquidity requirements are satisfied, trading for ZKsync is anticipated to start on September 25, 2024, at or after 9 AM PT. On the ZK-USD trading pair, the trade will first be introduced gradually.

Coinbase said that owing to regional compliance regulations, trading support for ZKsync may be limited in some locations. ZKsync, which has been gaining popularity in the blockchain ecosystem, is expected to benefit from increased awareness and acceptance as a result of this listing.

Coinbase will add support for ZKsync (ZK) on the ZKsync network. Do not send this asset over other networks or your funds may be lost. Transfers for this asset are available on @Coinbase & @CoinbaseExch in the regions where trading is supported.

— Coinbase Assets 🛡️ (@CoinbaseAssets) September 24, 2024

ZKsync’s acquisition is in line with the exchange’s continuous plan to diversify the assets it supports and meet the growing need for Layer 2 scaling solutions, which provide faster transaction times and more affordable prices than conventional Layer 1 blockchains.

Coinbase has revealed intentions to market a number of other digital assets across its platforms in addition to supporting ZKsync. These include Zetachain (ZETA) trade, Catizen (CATI) perpetual futures on Coinbase International Exchange, Moonwell (WELL) on the Base network, and CoW Protocol (COW) on the Ethereum network.

Treasure DAO migrates to ZKsyns for enhanced performance

Treasure DAO, a decentralized gaming ecosystem, has announced moving from the Arbitrum blockchain to ZKsync concurrently with the exchange listing. The DAO community voted “overwhelmingly,” with 99.5% of members supporting the choice.

It’s official.

Treasure will be bringing the decentralized game console to the Elastic Chain! (∎, ✨)!

The community has voted overwhelmingly in favor (99.5%) to launch the Treasure L2 as part of the @ZKsync ecosystem.

Here’s what this means 👇 pic.twitter.com/ieNKM8RVgw

— Treasure (@Treasure_DAO) September 23, 2024

The move is a component of Treasure’s plan to take use of ZKsync’s cutting-edge ZK Stack technology, which should enhance the games’ scalability, security, and compatibility.

Treasure DAO eventually discovered that ZKsync’s infrastructure was a better fit for its long-term goals than Arbitrum Orbit, which it had originally planned to adopt for scalability reasons. This migration is to improve the DAO’s platform’s attractiveness to the increasing number of blockchain-based games, in addition to increasing the DAO’s performance and interoperability.

ZKsync price jumps to 30-day high

Following the news, the price of ZKsync rose from a low point of $0.1215 to a high point of $0.1343 for the month before encountering resistance.

However, as at the time of writing, ZKsync was still trading at $0.1333, up 6.50% over the previous day and 20% over the previous week.

ZK’s market capitalization and 24-hour trading volume increased by 6.5% and 33%, respectively, to $489,990,341 and $75,692,687, in tandem with the rise.