With $13.5 million in inflows, spot Ethereum ETFs saw a notable increase, as Abraxas Capital acquired $500 million worth of ETH in a week.

As the price of Ethereum continues to show tremendous momentum, with another 9% gain in the previous day, Ethereum ETF inflows have increased once more. Furthermore, Abraxas Capital’s purchase of more than $500 million worth of Ethereum in a single week indicates that institutional interest in the cryptocurrency has increased again, indicating the possibility of significant future gains. According to market analysts, there will be at least another 20% increase to $3,200 and maybe much more to $4,000.

Ethereum ETF inflows surge again

With a total of $13.5 million flowing in on Tuesday, inflows into the Ether ETF have increased once more. According to statistics from Farside Investors, the largest inflows were $7.4 million into Grayscale’s mini-Ether ETF, $3.0 million into VanEck’s ETHV, and $3.1 million into Franlink’s EZET.

Asset manager BlackRock proposed an in-kind creation and redemption procedure in an update to its spot Ethereum ETF last week. This action indicates increased institutional interest in Ethereum and comes after a meeting with the SEC’s Crypto Task Force. Authorized participants will be able to immediately trade Ethereum for ETF shares throughout the formation and redemption procedure if the amendment is accepted. This will make it simple for money to move between ETH and its corresponding ETFs.

Institutional inflows into Ethereum gather pace

Institutional investments in Ethereum, spearheaded by Abraxas Capital, have increased dramatically in the past week. According to Arkham Intelligence’s on-chain data, yesterday, when the price of Ethereum (ETH) was trading at about $2,460, the company borrowed USDT to enhance its holdings of ETH. The asset has since increased by 10%, reaching a valuation of $2,700.

Abraxas Capital has amassed 242,652 ETH, or $561 million, during the last week, indicating a resurgence of market bullishness.

Where’s ETH price heading next?

The price of Ethereum is continuing its relentless rise, rising 9.5% over the past day to $2,700. Additionally, the daily trading volume has increased by 19% to $36.75 billion, indicating that traders are quite interested. Additionally, according to Coinglass statistics, open interest in ETH futures has increased by 14% to $32.61 billion.

As seen by the green zone below, Ethereum (ETH) has completely closed its Daily CME gaps at the ~$2,530 and ~$2,630 levels, according to cryptocurrency analyst Rekt Capital.

A daily closing above this range would enable Ethereum to turn the gap into a new dynamic support zone if Ethereum ETF inflows persist. According to Rekt Capital, this development might provide a basis for the continuation of the rising trend. According to the above picture, ETH will move to close the next gap between $2,900 and $3,033, after which it may rise to $3,200. Analysts set $3,600 as the next price objective amid significant ETH accumulation.

Aave and Uniswap break records as ETH surges past $2,500. Is DeFi back?

Amidst indications of a rebound in the bitcoin market, the Aave and Uniswap protocols recently set new milestones.

Aave and Uniswap’s record-breaking accomplishments in the midst of a rebounding cryptocurrency market beg the question: Is this a temporary upswing or are we seeing the beginning of a new DeFi boom?

Whale activity signals confidence in Aave

The decentralized finance (DeFi) ecosystem is depicted by whale activity on Aave and milestones from Uniswap, with Ethereum (ETH) hitting $2,500, a significant milestone in a volatile cryptocurrency market.

Recently, a wallet associated with WLFI borrowed 400 million USDC and deposited 50 WBTC into Aave V3 to buy 1,590 WETH at an average price of $2,515. There are now $15.11 million worth of assets in this wallet, including 50 WBTC ($5.19 million) and 3,924 WETH ($9.91 million). Its strong position on Aave (Health Rate of 2.0) indicates that investors are confident in ETH’s prospects for growth.

Nemorino, a whale, was born that same day. At an average price of $2,488, eth purchased 3,088 WETH, securing an unrealized profit of over $124,000. As big investors pile up around the $2,500 mark, this strengthens the bullish attitude around ETH. Not all whales, though, are hopeful.

Divergent investing tactics were highlighted on May 12, 2025, when EmberCN claimed that a whale borrowed 5,000 ETH from Aave in 50 minutes and shorted it for $2,491.

Is DeFi poised for a boom?

The notable DeFi milestones coincide with the increase in whale activity on Aave. On May 11, 2025, Stani Kulechov, the founder of Aave, declared that Aave has one of the biggest DeFi protocols, with a record Total Value Locked (TVL) of $25 billion.

New ATH for @aave. $25B TVL.

See you next at $50B. pic.twitter.com/6ZjejGam0F

— Stani.eth (@StaniKulechov) May 11, 2025

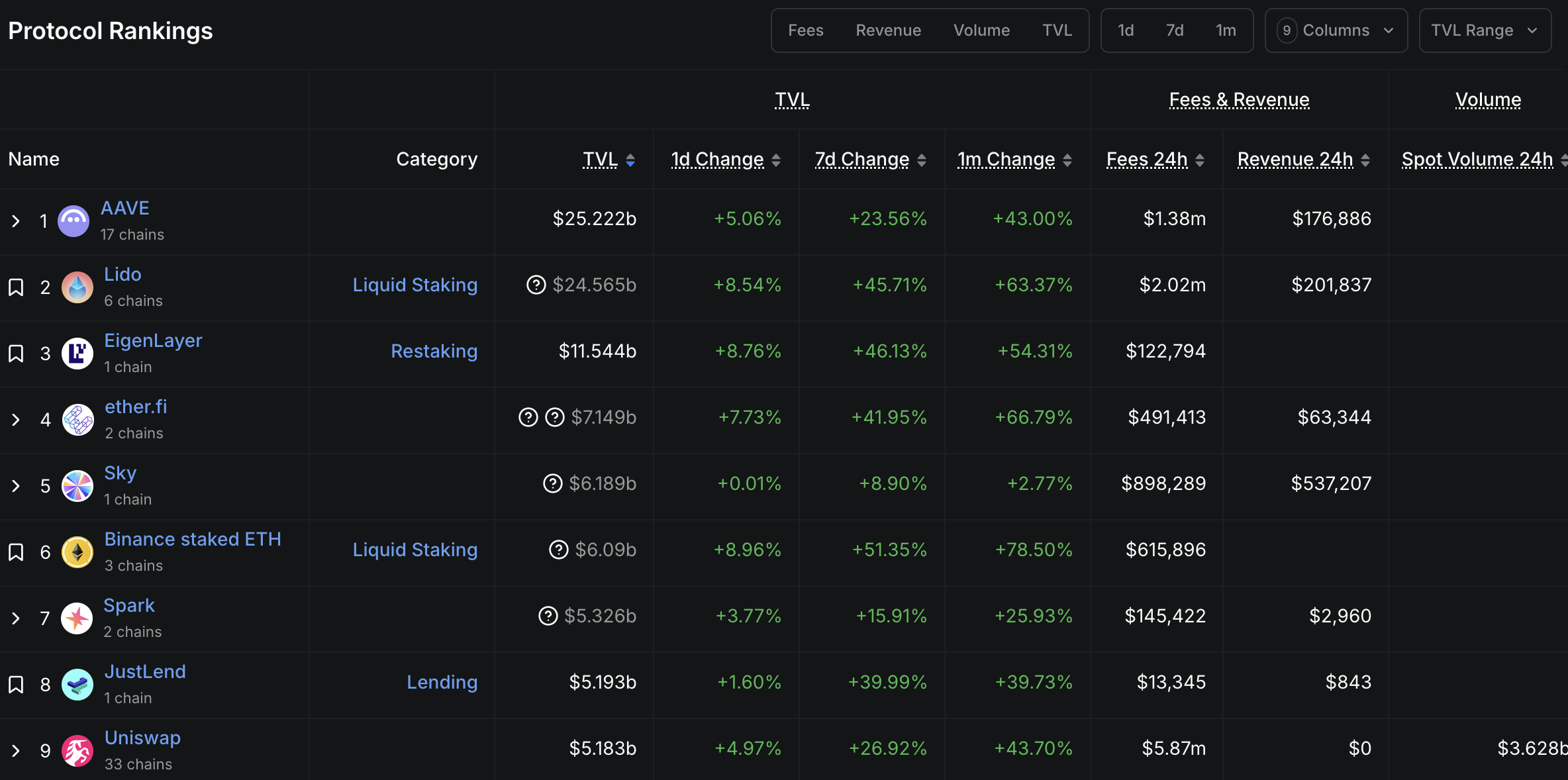

DeFiLlama statistics from May 14, 2025, shows that Aave has more than 21% of the TVL of the DeFi market, outperforming rivals like EigenLayer (EIGEN) and Lido (LDO). Large investors’ significant asset deposits into the protocol are primarily responsible for this expansion.

A significant milestone was reached by Uniswap, a prominent decentralized exchange (DEX). DeFi’s popularity was demonstrated on May 12, 2025, when Uniswap announced that its total trade volume had topped $3 trillion.

SEC advances spot Dogecoin ETF to review stage; DOGE price reacts

As the SEC accepts the 21Shares Dogecoin ETF registration, the price of DOGE rises 6%, raising expectations that it will be approved later this year.

When the US Securities and Exchange Commission (SEC) formally recognized 21Shares’ spot Dogecoin ETF filing on Tuesday evening, the Dogecoin community responded favorably. The action is noteworthy because it adds the 21Shares DOGE ETF product on the commission’s approval timeline. Since the news broke, DOGE prices have increased by more than 6%.

21Shares Dogecoin ETF under SEC review

The 21Shares offering has been acknowledged by the SEC, joining Grayscale Investments, which is also awaiting a response from the US SEC. Notably, it may take the commission up to 240 days to decide whether to accept or reject the ETF request.

The recognition implies that a review procedure for the new ETF has begun, even if it is doubtful that the commission would approve the fund anytime soon. The fund could be authorized and introduced later this year in light of the US SEC’s regulatory reform. The new SEC leadership is expected to speed up the assessment process, according to several cryptocurrency aficionados.

21Shares submitted an application on April 9 for the DOGE ETF. With institutional investors as its target market, the company intends to introduce the instrument to offer exposure to the Dogecoin price. Massive institutional interest in the Bitcoin and Ethereum ETFs has fueled their recent surge to all-time highs.

The SEC has become more open to cryptocurrency after Paul Atkins was confirmed as its chair and Donald Trump’s administration became more pro-crypto. The Dogecoin ETF registration by 21Shares may be impacted by this “benevolence.”

Market momentum shifts in favor of DOGE price

The price of DOGE increased 6.29% in the last day to $0.2404 after the US SEC acknowledged the 21Shares spot Dogecoin ETF registration. Despite the turbulence seen earlier in the trading day, this rally has occurred. However, with a 7-day price gain of 42.19%, the currency has erased both short- and long-term losses.

The price increase is consistent with a recent research by Rekt Capital about the future of the memecoin with a dog theme. Rekt Capital pointed out that the coin might rise to $0.27 in accordance with the previous DOGE price analysis as it can maintain support at the $0.22 price level in the midst of a continuous positive market movement.

Other asset management companies are awaiting market authorities’ recognition of their ETF applications in addition to the Dogecoin ETF effort. Bitwise submitted its application to launch a spot NEAR ETF with the US SEC around a week ago, as previously reported.

Market analysts have pointed out that there is a good chance that other popular cryptocurrencies like Binance Coin, XRP, and Cardano may be listed in ETFs due to the present trend.