Since Bitcoin (BTC) formally crossed the $100,000 threshold, the cryptocurrency market has seen tremendous volatility over the last day. As a result of this price fluctuation, the market saw significant liquidations, reaching about $1 billion, which also caused a change in trader behavior.

Data from the market for Bitcoin futures is also becoming more heated. Now, analysts are worried about the possibility of even bigger waves of liquidation.

Long position liquidations surge as Bitcoin breaks $100,000

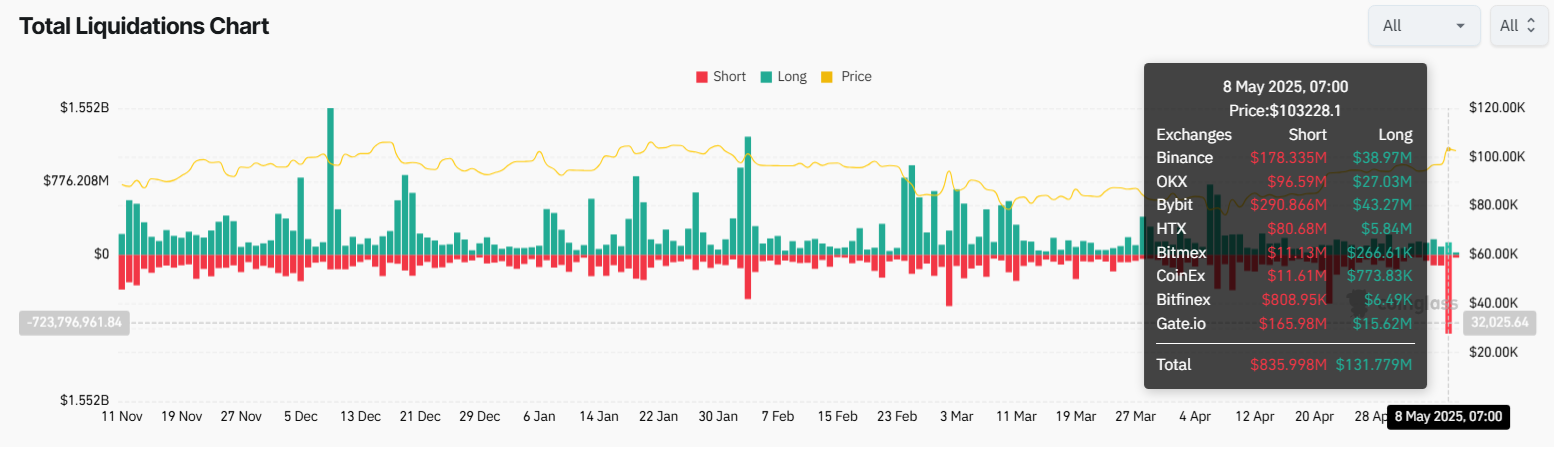

CoinGlass data indicates that around 190,000 dealers were liquidated, resulting in $970 million in total losses. The largest losses, amounting to $836 million, were incurred by short bets. This short liquidation is the biggest since 2021. CoinGlass said that the real figures might be significantly more.

This is the largest short liquidation since 2021.

$837.80M of short positions wiped out in the past 24 hour.

PS:Binance has not fully disclosed its liquidation data, and the actual data is more.https://t.co/C47AgBBF3Mhttps://t.co/7aKXaaUZsv pic.twitter.com/YAvOgAZAEQ

— CoinGlass (@coinglass_com) May 9, 2025

The market now confronts a new risk: a rapid increase in long holdings, even while short positions have been eliminated.

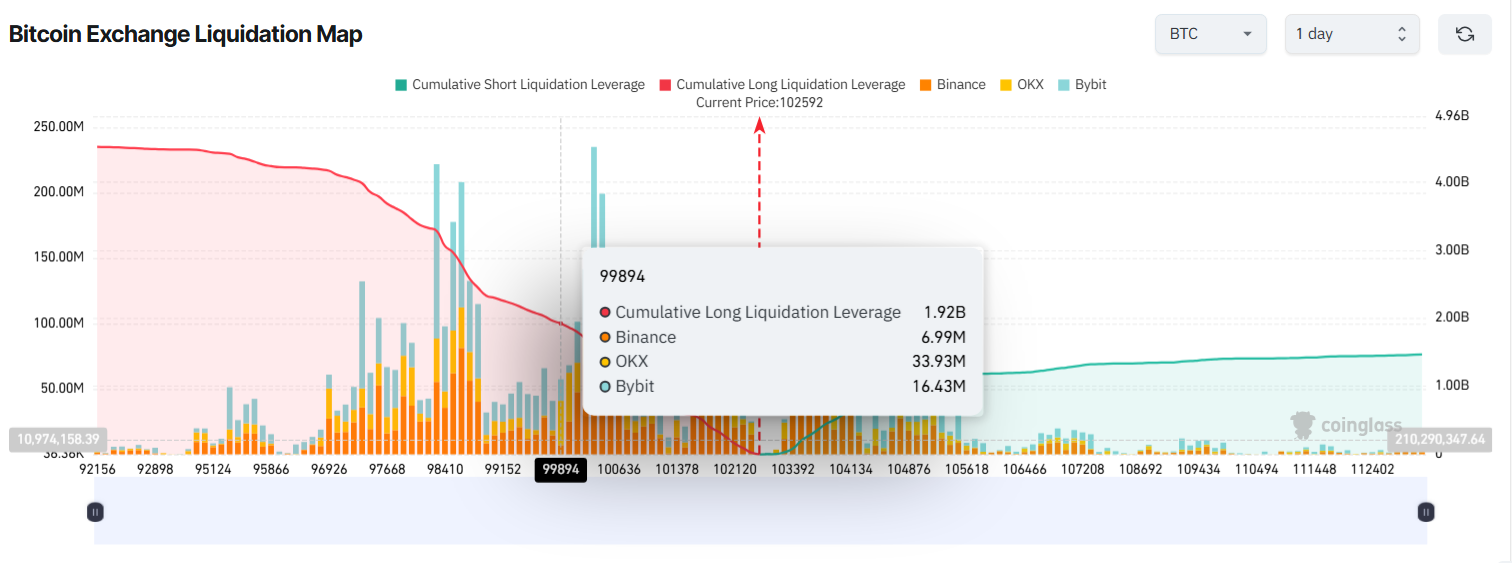

If Bitcoin falls below $100,000, all long holdings across exchanges may be subject to liquidations totaling around $2 billion, according to CoinGlass’s 24-hour Bitcoin liquidation map. This prompts worries about a possible “long squeeze,” a situation in which a large-scale liquidation of long holdings leads to panic selling and quickens a decline in price.

The same map also indicates that the entire amount of liquidations might reach $3.45 billion if Bitcoin drops below $98,000.

A change in trader attitude is indicated by this massive potential liquidation from long holdings. With the expectation that the price of Bitcoin will continue to rise, many are increasing their bets and leverage.

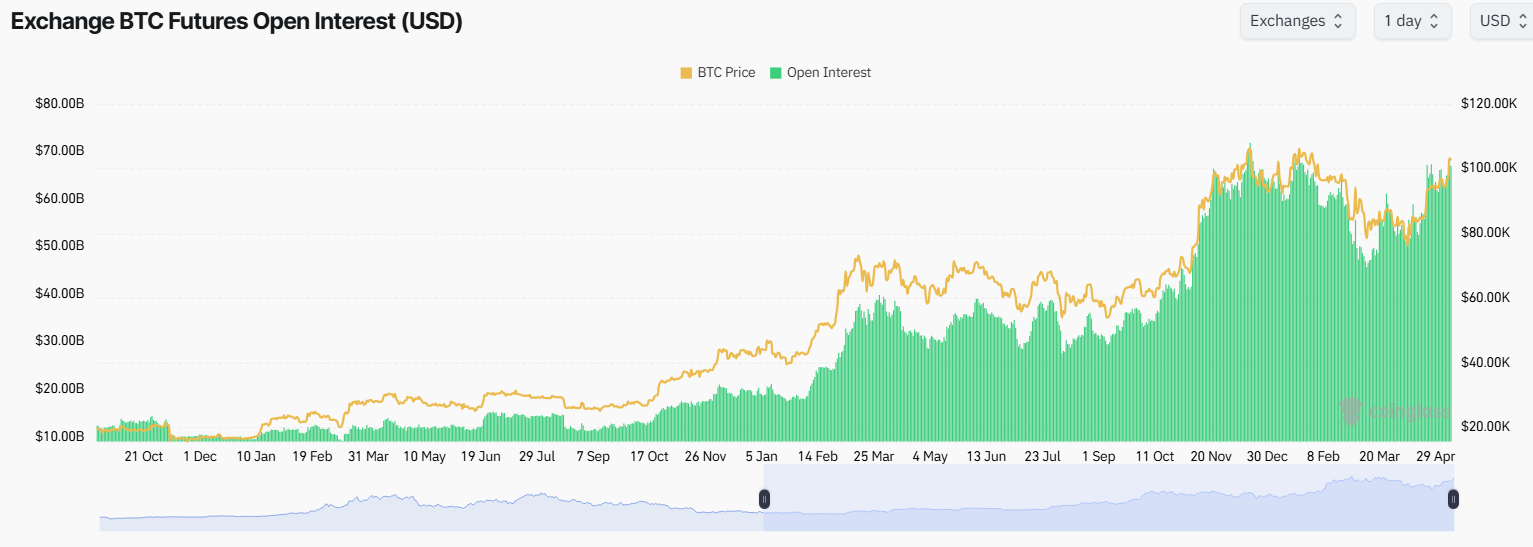

Furthermore, Bitcoin Futures Open Interest (OI) on all exchanges has hit a record $67.4 billion, according to statistics from CoinGlass. This indicates that demand for short-term leveraged trading has increased. Because traders are placing significant wagers on the upward trend, there is a greater chance of a market reversal.

In the past, a market correction has always occurred soon after Bitcoin’s OI has topped $65 billion.

Not only has Bitcoin surpassed $100,000, but it is also becoming more and more significant in the world of money. With a market valuation of $2.05 trillion, Bitcoin even overtook Amazon at one time to rank as the fifth-largest asset globally. In the meanwhile, Standard Chartered projects that Bitcoin may soon surpass its peak and hit $120,000 in the second quarter.

Coinbase Q1 revenue rises despite profit decline

Losses from selling off its cryptocurrency assets caused Coinbase’s net income to fall 94% to $66 million in the first quarter.

As the biggest US cryptocurrency exchange dealt with increased expenses and market volatility brought on by unpredictable macroeconomic signals and continuous instability in digital assets, Coinbase Global released a mixed set of first-quarter results on Thursday, with revenue increasing but profit falling precipitously.

The San Francisco-based business reported a 24% year-over-year increase in revenue to $2 billion. However, according to LSEG statistics, that amount was below analyst projections of $2.1b and down around 10% from the prior quarter.

With a 17.3% increase to $1.26 billion, transaction income continued to be a significant contribution. In the meantime, the company’s expanding subscription and services division saw a 37% increase in sales to $698.1 million. Offerings including custodial and staking services, which are less reliant on trading activity, are included in this segment.

Our Q1 2025 financial results are now live. pic.twitter.com/qyIufvpEvB

— Coinbase 🛡️ (@coinbase) May 8, 2025

Heavy marketing spend and asset losses drag down Coinbase profit

Due to losses incurred by the company as a result of the diminishing value of its cryptocurrency assets, net income for the quarter fell 94% to $66 million, or 24 cents per share.

Every quarter, Coinbase lists these assets for sale, exposing its profits to the erratic fluctuations in bitcoin values. The company’s adjusted net income was $526.6 million, or $1.94 per share, up from $2.53 a year earlier.

Losses on stored cryptocurrency assets and increased marketing expenditures caused operating expenses to jump 51% to $1.3 billion. The stock is down 17% so far this year and fell around 2% in after-hours trade.

Coinbase bets on derivatives as user base grows beyond trading

The platform recorded its second-highest monthly transactional user count in company history in spite of the profit deficit. Many clients are increasingly using a wider range of services outside of trading, according to chief financial officer Alesia Haas. “We are driving utility and gaining share,” she stated. “The products are maturing in a healthy way.”

Additionally, Coinbase said that it has acquired Deribit for $2.9 billion. The action demonstrates the company’s desire to go further into the cryptocurrency derivatives market, where Deribit handled around $1.2 trillion in volume the previous year.

Coinbase stated that it anticipates second-quarter subscription and service revenue to range from $600 million to $680 million. Additionally, the business said that its transaction revenue in April was around $240 million. Although Circle’s USDC stablecoin saw a 32% sequential increase in income to $298 million, lower average interest rates helped to moderate the surge.

Pepe Coin price rallies 35%, 65% of Binance traders expecting 22% further gains

As the price of Pepe coin rises 35%, it aims for $0.000013344. Will Pepe’s boom continue to increase, propelled by bullish patterns and increasing open interest?

On May 8, the price of the Pepe Coin (PEPE) currency increased by about 35% thanks to Bitcoin surpassing the $100,000 threshold. The meme currency’s spectacular surge now foreshadows a new meme coin season as it regains the psychological level of $0.000010. Nearly 65% of Binance traders are now positive as the PEPE open interest approaches a new all-time high after the overnight rise. Will the price of the PEPE coin increase by another 22% in such circumstances?

PEPE price analysis targets $0.000013344

On May 6, the Pepe coin price rise completed a morning star pattern with a long-legged doji candle. On May 8, the reversal pattern produced a strong-bodied bullish candle and a near 35% PEPE surge. Such a pattern is indicative of bigger trend movements in general market sense.

Pepe coin is now trading at $0.00001091, which was its lowest value on February 4. Nevertheless, the meme coin is currently experiencing a slight lull, with an intraday decline of 1.84%.

Pepe suggests a longer rally by crossing over the 200-day Exponential Moving Average (EMA). The bullish perspective is supported by the positive crossing in the MACD and signal lines, which attracts the attention of momentum traders.

The bull run surpasses the 23.60% level at $0.00001025 and targets the 38.20% level at $0.000013344, according to the Fibonacci levels. This supports the optimistic PEPE coin price prediction and anticipates an additional 22% upside from the present price.

A possible retest of the 23.60% level, however, puts the 200-day EMA at 6% danger of decline and loss. These frequent setbacks put investors’ faith to the test. An 18% PEPE drop to the $0.000008832 retest is warned if this support level is not held.

Binance traders are extremely confident as Open Interest nears ATH

Pepe leads the way with a sentiment-driven spike in derivatives as meme coins make a comeback after months of sluggish activity. As a bullish crowd enters, PEPE’s Open Interest (OI) has reached $531 million, getting closer to its record high of $555 million.

The OI weighted financing rate also rises to 0.0118%, reflecting the increase in bullish transaction volume. The confidence is strengthened by the bearish collapse of $5.71M in short holdings.

Hopium causes 65% of traders to maintain long PEPE bets on Binance, pushing the long/short ratio to 1.86. The price of the Pepe currency may find more fuel to reach the next peak if long holdings continue to dominate the derivatives story.