A cryptocurrency analyst is hopeful that Ethereum’s protracted fall is about to finish due to rising open interest in the cryptocurrency and a “positive” taker-buy-sell ratio.

Two onchain measures indicate that Ether’s 13% decline below the crucial $3,000 mark since early August may be coming to a stop shortly.

In a report published on August 19, confirmed CryptoQuant contributor Burak Kesmeci stated, “Buyers are starting to regain strength in Ether.”

Kesmeci said that Ethereum (ETH) would strengthen in the near future by citing two well-known onchain metrics: the Taker Buy Sell ratio and Open Interest (OI).

The taker-buy ratio, which determines the proportion of purchasers to sellers of Ether across all significant cryptocurrency exchanges, is “positive again,” he said.

While the broader 24-hour period indicates a slight advantage for Ether short sellers, the most recent 12-hour period up to publishing has turned positive, with 50.37% of positions being long, according to CoinGlass statistics.

According to CoinMarketCap statistics, Ether is now trading at $2,679, down 23.57% since July 23.

Ether OI, or the total amount of outstanding options contracts traders have at any given moment, is $10.69 billion as of August 19, up around 10% from August 18.

Leveraged participants will need to reenter the market in order for there to be a “significant upward movement in price,” according to Kesmeci. Future traders usually get more comfortable entering bets when the price of an asset rises.

Ether’s OI was $13.67 billion on March 12, the day it hit its all-time high of $4,066 for the year. OI, however, shot much higher than $15 billion when it hit those levels once more in June, at $3,800.

“This indicated a market correction was likely, and indeed, the correction occurred,” Kesmeci added.

The much-awaited introduction of the first spot Ether exchange-traded funds (ETFs) on July 23 did not boost the price of Ether, according to a recent Cointelegraph story.

Since the US ETH ETFs have had net outflows of $434 million since its inception, there is a good chance that the ETFs are a major factor contributing to Ether’s price fall.

The items were introduced 28 days ago. In contrast, during the first 28 days following the introduction of spot Bitcoin ETFs, the price of Bitcoin (BTC) decreased by around 15% before rising back to the $69,000 mark.

DOGS pre-market price hints at $550 million FDV on launch: Bitget

Bitget reported approximately $4 million in pre-marketing trade for the Telegram-based TON memecoin prior to the DOGS IPO on August 23.

Pre-marketing trading is getting more and more traction in the cryptocurrency world. Speculative investors can trade ahead of the main listing on platforms that market derivatives of tokens that have not yet been launched. With other sites, like Bitget, KuCoin, and Gate, releasing pre-market items for the coin, DOGS has seen a comparable kind of buzz.

ICYDK: $DOGS is now available for pre-market trading on #Bitget! 🐶

👉 Trade now: https://t.co/6uvxvazhAp pic.twitter.com/6NWkZ5dq7W

— Bitget (@bitgetglobal) July 12, 2024

Volumes in Tether (USDT) on Bitget alone almost exceeded $4 million, a Bitget spokesman emailed crypto.news on August 19. Many predict that at launch, the token may easily reach a fully diluted worth of $550 million. Between less than a penny and around $0.001, DOGS traded on Bitget’s pre-market facility and other platforms.

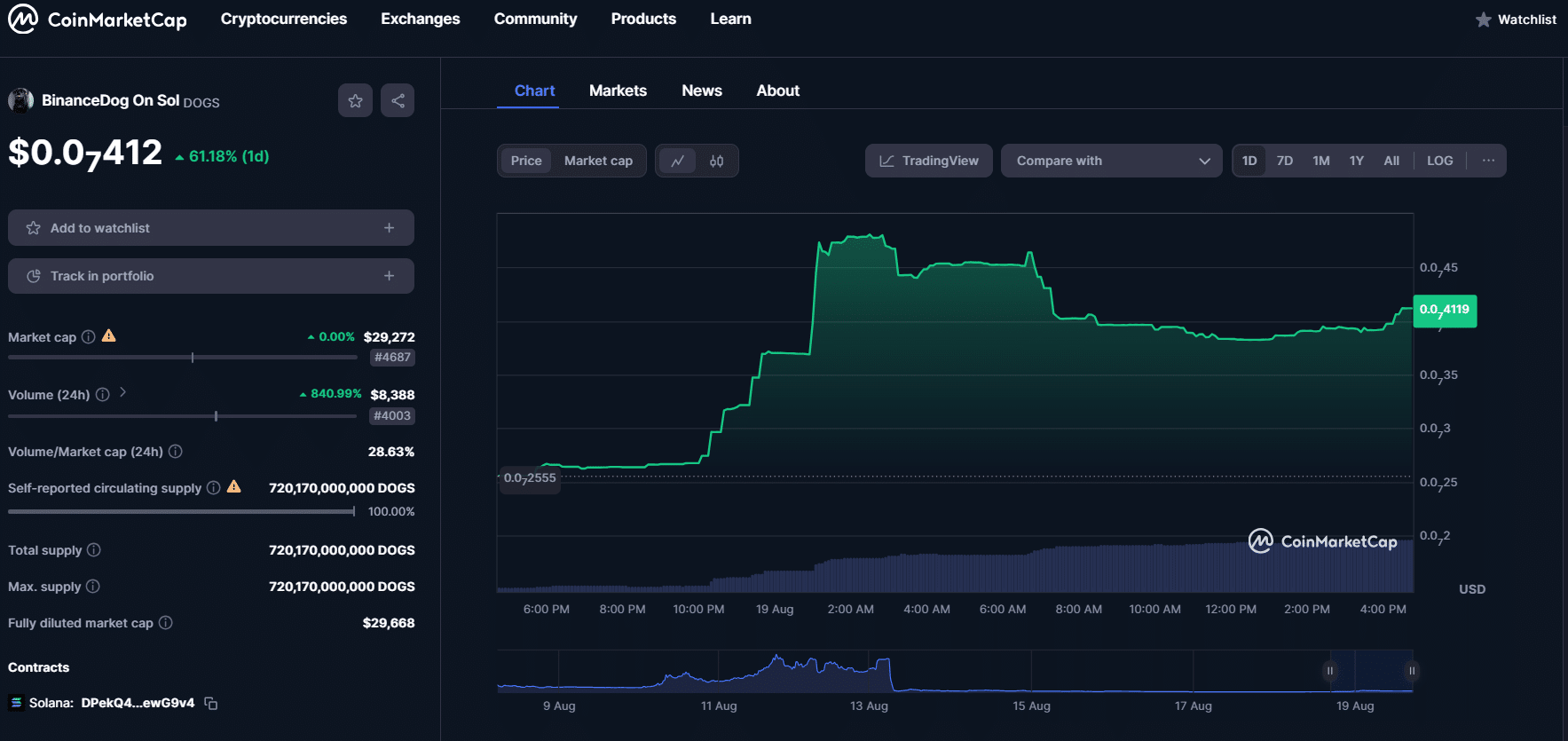

As airdrop activity increased, BinanceDog On Sol (DOGS) surged over 60%, defying a general market decline. It is important to distinguish this currency from the TON-based DOGS.

Over 6m verified DOGS users claim 30% of 440b airdrop

Over six million confirmed mini-app users have asked to receive the airdrop via supported exchanges, according to the DOGS community on Telegram. The main emphasis of Telegram’s built-in wallet software is The Open Network.

On August 21, claimants can wait in line for airdrop deposits on exchanges and the Telegram Wallet until 6 p.m. UTC. For non-custodial wallet claims, DOGS has set a deadline of 8 am UTC on August 23. The coin is expected to be listed by noon UTC on the same day.

The Telegram founder Pavel Durov’s mascot, Spotty, served as the model for the mini-app token called DOGS. Since its inception last month, the initiative has attracted over 53 million users, 42.2 million of whom are qualified for the airdrop.

Users received just under 82% of the 550 billion DOGS token supply, with 10% reserved for the team and further improvements. Tokens cannot be liquidated by the project until August 2025 due to a 12-month lockup term. Furthermore, 8.5% was set aside for liquidity.

TON-powered Telegram mini-games, like DOGS, are becoming popular in the web3 market. Early adopters received billions from projects like Notcoin (NOT), while organizations like Hamster Kombat have promised to give “the largest airdrop in crypto history.”

Just-in: Metaplanet stock price shoots 13% as firm buys more Bitcoin

With 500 million Japanese yen, “Japan’s MicroStrategy” Metaplanet purchased further bitcoin. The price of Metaplanet’s stock surged 13% in a single day.

The newest Bitcoin investment strategy of Japan-based Metaplanet has been completed with the purchase of 500 million Japanese yen worth of bitcoins. Following the news of CEO Simon Gerovich’s most recent Bitcoin acquisition, the price of Metaplanet’s shares shot up by about 13% on Tuesday.

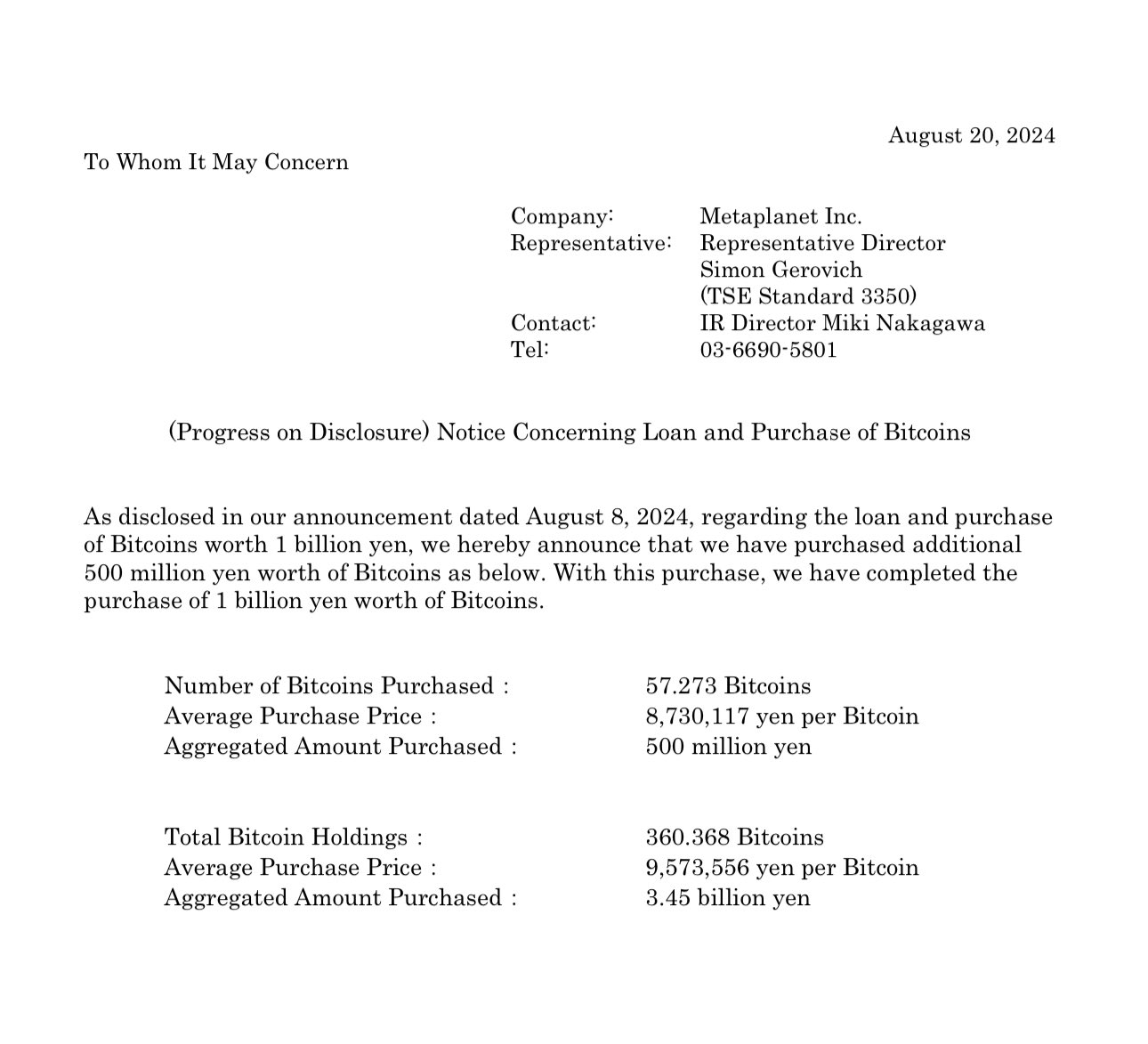

Metaplanet Inc buying additional Bitcoins

Metaplanet Inc. revealed in an official statement on August 20 that it had an extra 57.273 BTC, valued at 500 million Japanese yen ($3.39 million). These were acquired by the corporation for an average of 8,730,117 ($59,317) per Bitcoin.

According to Gerovich, the corporation now has 360.368 BTC in its possession. These were purchased by “Japan’s MicroStrategy,” a corporation, for 3.45 billion Japanese yen, or 9,573,556 yen per Bitcoin on average. The price of Metaplanet’s shares rose as a result of this.

Metaplanet said last week that it had purchased 57.103 BTC for 500 million Yen, or $3.3 million. The average cost per Bitcoin that the corporation paid for it was 8,756,107 yen. The business borrowed one billion Japanese yen at an interest rate of about 0.1%.

After taking out loans, the corporation is able to purchase more bitcoins because of Japan’s cheap interest rates. Buying high-yield assets on the international market and acquiring the Yen at a lower rate is the optimal usage of Japanese Yen carry trades.

Metaplanet stock price jumps 13%

After the corporation included Bitcoin in its balance sheet, its shares kept rising. Tuesday saw a 13% increase in the price of Metaplanet’s shares following CEO Simon Gerovich’s announcement of the company’s most recent Bitcoin acquisition on X.

In response to the aggressive BTC buying plan, the Tokyo Stock Exchange-listed company has increased in value by more than 645% year to far. As of this writing, the price of Metaplanet’s shares is 1,193 yen, up more than 10%. It reached a high of 1,295 JPY during the day.

In the meanwhile, the price of Bitcoin (BTC) increased by more than 4% over the previous day, and it is presently trading at $61,065. The 24-hour totals are $61,396 for the peak and $57,864 for the low. Additionally, there has been a 40% rise in trading volume during the past 24 hours, showing high trader interest.