Since June 8, the Ethereum ICO Wallet 0xdb3 has deposited 17,886 ETH ($65 million) to several exchanges. Prior to ETF, anticipate volatility.

Ethereum whales have woken up and are making huge moves across exchanges as the approval of the spot Ethereum (ETH) ETF approaches. Two Ethereum wallets from the ICO era have transferred 3,631 ETH in total to the cryptocurrency exchange Kraken, according to on-chain statistics.

Ethereum ICO Wallets make huge deposits

Notable activity has been observed from Ethereum Foundation and ICO-related wallets, according to on-chain data source Spot On Chain. In the past two days, the two wallets have combined to deposit 3,631 ETH, or almost $12.5 million, to the cryptocurrency exchange Kraken.

To be precise, Wallet 0xdb3 released 2,631 ETH, which is valued at $9.01 million. In the past, 0xAb0, an ICO participant, and the Ethereum Foundation have both sent Ethereum to this wallet.

It’s interesting to note that, starting June 8, Wallet 0xdb3 has deposited a significant 17,886 ETH—or $65 million—to several controlled exchanges (CEX) in the previous month.

Recently, Wallet 0xbf5 dumped 1,000 ETH, which is worth $3.46 million. Ethereum was sent to this wallet by ICO participant 0x510. 0x510 had previously purchased 100,000 ETH during the 2015 Genesis event.

This Ethereum wallet still has 49,000 ETH in total—worth an incredible $171 million—spread over four separate wallets, according to Spot on Chain.

Two #Ethereum Foundation/ICO-related wallets deposited 3,631 $ETH ($12.5M) to #Kraken in the past 2 days as the market rebounded:

1️⃣ Wallet 0xdb3 unloaded 2,631 $ETH ($9.01M).

• It received $ETH from the Ethereum Foundation and Ethereum ICO participant 0xAb0.

• Since June 8,… pic.twitter.com/rpEC1Fe4jj

— Spot On Chain (@spotonchain) July 17, 2024

ETH ETF approval sparks excitement

Players in the cryptocurrency market are already celebrating the spot Ethereum ETF’s impending approval on July 23rd. A significant spike in price of ETH has occurred leading up to $3,500 in anticipation of the debut. Data from Kaiko shows that for Ethereum near-term contracts, the implied volatility has increased dramatically. Analysts do anticipate that this ETH price rise might reach $4,500 before the ETF approval period ends.

Over the weekend $ETH implied volatility spiked on near term contracts. pic.twitter.com/GyHgSWkApH

— Kaiko (@KaikoData) July 16, 2024

The Kaiko Research study from the day before also predicted that ETH would do better than Bitcoin when the ETF was approved.

Before the SEC grants the final approval for the ETFs to begin trading, investors can anticipate some volatility in ETH. A “sell the news” incident might occur before Ethereum starts its significant bull run.

Check Out the Latest Prices, Charts, and Data of ETH/USDT

Worldcoin will unlock 2M WLD tokens daily from July 24

The company that created Worldcoin, Tools for Humanity (TFH), has decided to prolong the lock-up period for WLD tokens that have been distributed to investors and team members. The distribution schedule for tokens has changed as a result of this strategic choice; starting on July 24, 2024, 2 million tokens will be distributed every day.

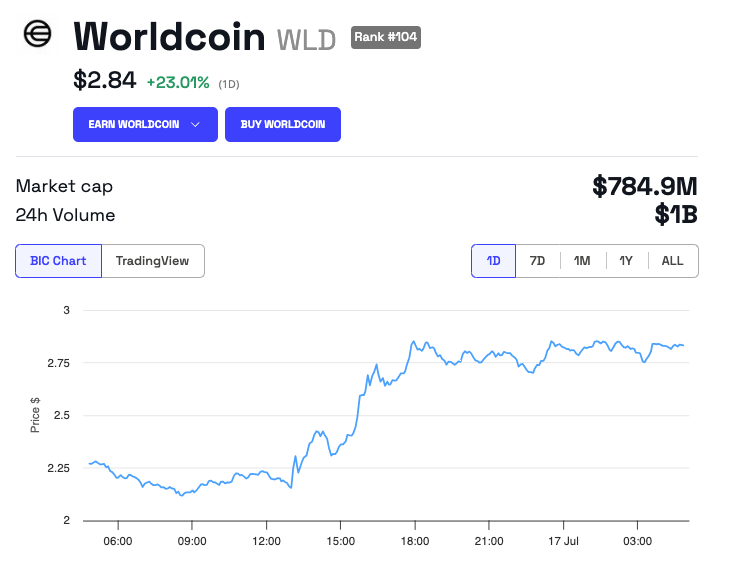

Worldcoin soars over 23%

Reducing market saturation and bolstering the token’s worth are the objectives of the updated approach. As a result, this modification aims to control the flow of tokens into the market and enable a more gradual rise in the quantity in circulation.

WLD’s stock rose 23% in the previous day in response to this announcement, indicating investor excitement. Currently valued at $784.9 million, WLD has a market capitalization of $2.84 as of this writing.

Still, there’s a chance that selling pressure may arise as early investors may be encouraged to sell due to the higher supply.

Looks like WLD is getting shorted hard after the news that token unlocks will be spread out over a longer time period.https://t.co/QZgjrcQF1j pic.twitter.com/V0MO5FIRUu

— Huma (@HumaCapital) July 16, 2024

To strengthen the stability of the Worldcoin ecosystem, the lock-up term for 80% of the tokens has been extended from three to five years. It will now take four years to unlock, finishing in July 2028, and the vesting schedule will last until 2029.

The importance of unlock schedules is emphasized by Vincent Maliepaard, Marketing Director at IntoTheBlock, in an exclusive report.

“Token unlocks, whether linear or cliff, play a crucial role in asset prices. Linear unlocks tend to diffuse market impact over time, while cliff unlocks can cause abrupt shifts. By closely monitoring unlock schedules, investors can better understand growth potential and adjust their strategies accordingly,” Maliepaard said.

The tokenomics of Worldcoin have come under fire, especially in light of its low float ratio. According to a CoinGecko research, Worldcoin has the lowest float ratio (0.02) out of the top 300 cryptocurrencies by market value. This low ratio implies that there aren’t many tokens in use, which might increase volatility as more tokens are unlocked in the future.

However, Worldcoin’s network continues to draw new users. More than 6 million people currently own an orb-verified World ID. This digital passport makes it easier for users to access the network and validates their humanity.

With over 211 million tokens claimed to far, the distribution of WLD tokens among confirmed World ID holders remains unchanged. Out of the 275 million WLD in circulation, this makes up more than 77%.

BlackRock’s IBIT draws $260M as Bitcoin ETFs notch 8th day of inflows

Tuesday was the best trading day for US spot Bitcoin ETFs in over a month, with net inflows of $422.5 million.

On July 16, investors in Bitcoin brought in $260 million to BlackRock’s iShares Bitcoin Trust, accounting for over half of all net inflows into spot Bitcoin ETFs that day.

For the ninth day in a row, there were positive net inflows for the US spot price of Bitcoin (BTC).

ETFs, hitting $422.5 million, marking the greatest day since June 5 in terms of performance, according Farside Investors data.

With $61.1 million, the Fidelity Wise Origin Bitcoin Fund had the second-highest inflows among US spot Bitcoin ETF issuers, with ARK 21Shares Bitcoin ETF coming in third with $29.8 million.

While the spot Bitcoin ETFs offered by WisdomTree, Hashdex, and Grayscale failed to record an inflow, the VanEck and Invesco Galaxy Bitcoin ETFs received inflows above $20 million.

After BlackRock’s most recent acquisition of 4,004 Bitcoin and the cryptocurrency’s 3% price increase since Monday’s closing trading hours, the value of BlackRock’s Bitcoin holdings is once again above $20 billion.

The fund became the largest Bitcoin ETF in the world when its assets under management surpassed $20 billion for the first time in late May, when the price of Bitcoin was rapidly nearing $70,000.

The ETF Store’s president, Nate Geraci, complimented BlackRock for their recent recovery of a milestone but criticized the idea that only “degen retail” investors would purchase Bitcoin ETFs.

iShares Bitcoin ETF now over $20bil in assets & taking in a quarter bil on a random Tuesday…

*$20bil*.

*6mos* after launch.

I think we can safely put the “degen retail” narrative to bed.

Advisors & inst’l investors clearly showing up to this party. https://t.co/FkkBUlPHQz

— Nate Geraci (@NateGeraci) July 17, 2024

It happens two days after Larry Fink, the CEO of BlackRock, described Bitcoin as a “legitimate” financial tool that may protect against depreciation of value.

As of right now, the price of bitcoin is $65,470, up 13.1% from the previous week when it was trading at $53,600, almost five months ago.

Concerns about the German government selling about 50,000 Bitcoins and the announcement that Mt. Gox is finally getting ready to pay back creditors for almost $9 billion are the main causes of the price decline.