Only 4.9% of the whole Ethereum supply is still available on exchanges, according to on-chain data, with one million ETH being deleted just last month.

The Ethereum (ETH) exchange supply has reached its lowest point ever, according to on-chain data, indicating a decrease in selling pressure and a rise in long-term holdings. As a result, the price of ETH has increased by 7% today, surpassing $2,550, and its market capitalization has surpassed $300 billion. With a 58% increase in the last month, the general market attitude for ETH has been very bullish.

Ethereum exchange supply hits lowest in 10 years

According to a significant statistic released by blockchain analytics company Santiment, less than 4.9% of the Ethereum network’s entire supply is now held on exchanges. Since its debut more than ten years ago, this is the lowest percentage of ETH on exchanges.

Santiment added that the amount of ETH stored on the exchange had dropped by an astounding 15.3 million ETH in the last ten years. This indicates that investors are increasingly choosing decentralized storage and long-term holding solutions.

During the last month, the ETH exchange supply has rapidly depleted despite gains of 60%. Crypto expert Ali Martinez clarified that about 1 million ETH have been taken out of exchanges in the last month, citing data from Glassnode.

A decrease in possible selling pressure is frequently indicated by a decrease in exchange-held ETH. Long-term bullish mood and increased ETH price stability would also result from this. Arthur Hayes, a well-known market veteran, thinks Ethereum will dominate the altcoin season this summer.

ETH rally to continue from here?

The price of Ethereum is once again displaying significant resilience after falling below $2,400. It has increased by 8.83% over the past day and is now trading at $2,573 with a market valuation of $310 billion. The Ethereum futures open interest is up 7% to over $31.24 billion, according to Coinglass statistics, highlighting traders’ strong positive enthusiasm. However, the 24-hour liquidations have increased to $91.6 million, with short liquidations accounting for $59.6 million of that total.

On a 12-hour ETH chart, well-known analyst Crypto Patel also pointed out the development of a “Golden-Cross” pattern. When a short-term moving average crosses over a long-term moving average, a Golden Cross is created. The analyst’s current target price for ETH is therefore between $3,800 and $5,000 or more.

The bulls can extend the ETH price climb to $3,000 and higher in the near future if the price stays above the critical resistance level of $2,500.

Cardano holds key support amid ADA misappropriation claims – Will ADA crash when audit results are released?

Cardano is remaining stable around the $0.74 support despite the uproar surrounding recent allegations of embezzlement.

The token is still down 5.6% over the last week, but it has increased 1.4% in the last day. The market activity has decreased but is still stable, with a 24-hour trading volume of $856 million, which is 15% less than the previous day. Cardano (ADA) is currently down about 75% from its peak of $3.09, which was reached in September 2021.

The latest events take place against the backdrop of grave charges made against Charles Hoskinson, the founder of Cardano, who has been under fire for allegedly abusing his access to the Cardano network. According to allegations filed on May 7 by NFT artist Masato Alexander, Hoskinson allegedly exploited privileged access to transfer over 318 million ADA during the 2021 Allegra hard fork, which was valued at approximately $619 million at the time.

Alexander cited a two-step procedure that included transferring cash under the authority of Hoskinson or Input Output Global, the firm that created Cardano, using a unique Move Instantaneous Rewards transaction after wiping away unclaimed ADA from the 2017 initial coin offering.

In 2021, Charles Hoskinson unilaterally used his genesis keys to REWRITE the Cardano ledger and take control of ₳318m ($619m)

By comparison, when the DAO hack happened in 2016, the Ethereum community forked over $60m.

One of the largest ledger reorgs in blockchain history: 🧵

— masato_alexander (@masatoalexander) May 7, 2025

The fact that only a little sum—roughly $7 million—was publicly granted to the Cardano governance organization Intersect further raised doubts about the transparency of these movements. Alexander claimed Cardano lacked the same degree of community monitoring as Ethereum, but he compared the situation to the 2016 Ethereum DAO hack.

Hoskinson has vehemently refuted the allegations, describing them as harmful and untrue. The remaining unclaimed cash, approximately 18 to 24 million ADA, were subsequently donated to Intersect, he said, after more than 99.8% of the ADA from the 2017 token sale was redeemed.

The October 2021 transaction, according to Hoskinson, was a component of an automatic procedure designed to keep unredeemed tokens from losing their usability. Additionally, he pledged that the Cardano Foundation would release a thorough audit of the treasury transactions.

Hoskinson claimed he was “deeply hurt” by the community’s response to the backlash and said he would probably take a break from social media.

The one advantage in a crisis or an event that tests people is that you rapidly get to see who your friends truly are and who’s fairweather. I’d like to thank all the support and kind words both privately and publicly.

The downside is that I believe there will be a cold…

— Charles Hoskinson (@IOHK_Charles) May 18, 2025

Technical evidence suggest that ADA is currently in a consolidation period, notwithstanding the debate. The relative strength measure shows neutral momentum at 51.7. The MACD is a tad gloomy due to its negative crossing and lack of upward pressure.

The 10-day, 20-day, and SMA moving averages are currently serving as resistance, indicating short-term selling pressure. The 30-, 50-, 100-, and 200-day moving averages continue their upward trend and provide longer-term support.

The ability of ADA to hold its position above its 100-day EMA, which is at $0.73, might be crucial to preventing further losses. If bulls retake the 10-day EMA close at $0.76, the ADA can advance toward $0.78 or higher.

Should the present levels of support not be upheld, the price can fall below $0.72 and potentially hit $0.70 or even $0.68. The outlook is neutral because both sides are presently looking for a catalyst.

SEC pushed back decision on 5 Solana ETFs, approval chances drop for July

The regulatory assessment procedure for investment products associated with Solana (SOL) has been extended after the US Securities and Exchange Commission (SEC) postponed its decision on five Solana exchange-traded funds (ETFs) for a second time.

The Canary Solana Trust, Fidelity Solana Fund, VanEck Solana ETF, Bitwise Solana ETF, and 21Shares Core Solana ETF are all impacted by the delay.

Why is the SEC delaying Solana ETF decisions?

The initial deadline for the SEC’s ruling on the filings of Bitwise, VanEck, Canary Capital, and 21Shares was April 4. The regulatory authority did, however, extend its assessment period on March 11 and now has until May 19 to decide whether to adopt or reject the recommendations or to start additional procedures to decide whether to approve the rule modifications.

The SEC did not issue a final ruling on May 19. Rather, the agency declared that before making a decision, it will solicit public feedback on each application.

“Institution of proceedings does not indicate that the Commission has reached any conclusions with respect to any of the issues involved. Rather, the Commission seeks and encourages interested persons to provide comments on the proposed rule change,” the SEC noted.

In addition to the four filings, the SEC has extended the Fidelity Solana Fund deadline. On April 9, the plan was made available for public feedback. The initial deadline for a decision was May 24.

However, in order to give itself more time to review the application, the SEC has chosen to extend the examination period until July 8.

“The Commission finds it appropriate to designate a longer period within which to take action on the proposed rule change so that it has sufficient time to consider the proposed rule change and the issues raised therein,” the statement read.

For ETF applications, this is the most recent in a string of delays. The SEC previously delayed its ruling on a comparable Grayscale plan to introduce an ETF with a Solana concentration.

Furthermore, a number of applications for Dogecoin (DOGE), Litecoin (LTC), and XRP (XRP) ETFs have had a similar outcome. Despite the new pro-crypto administration, the SEC has taken a cautious approach to financial products based on altcoins, as evidenced by the pattern of deferrals.

The approval probabilities on Polymarket have also been impacted by the delay. According to the prediction platform, the chances of a Solana ETF being approved by July 31 have dropped to only sixteen percent. The long-term outlook is still positive, though, with an 85% chance of approval by December.

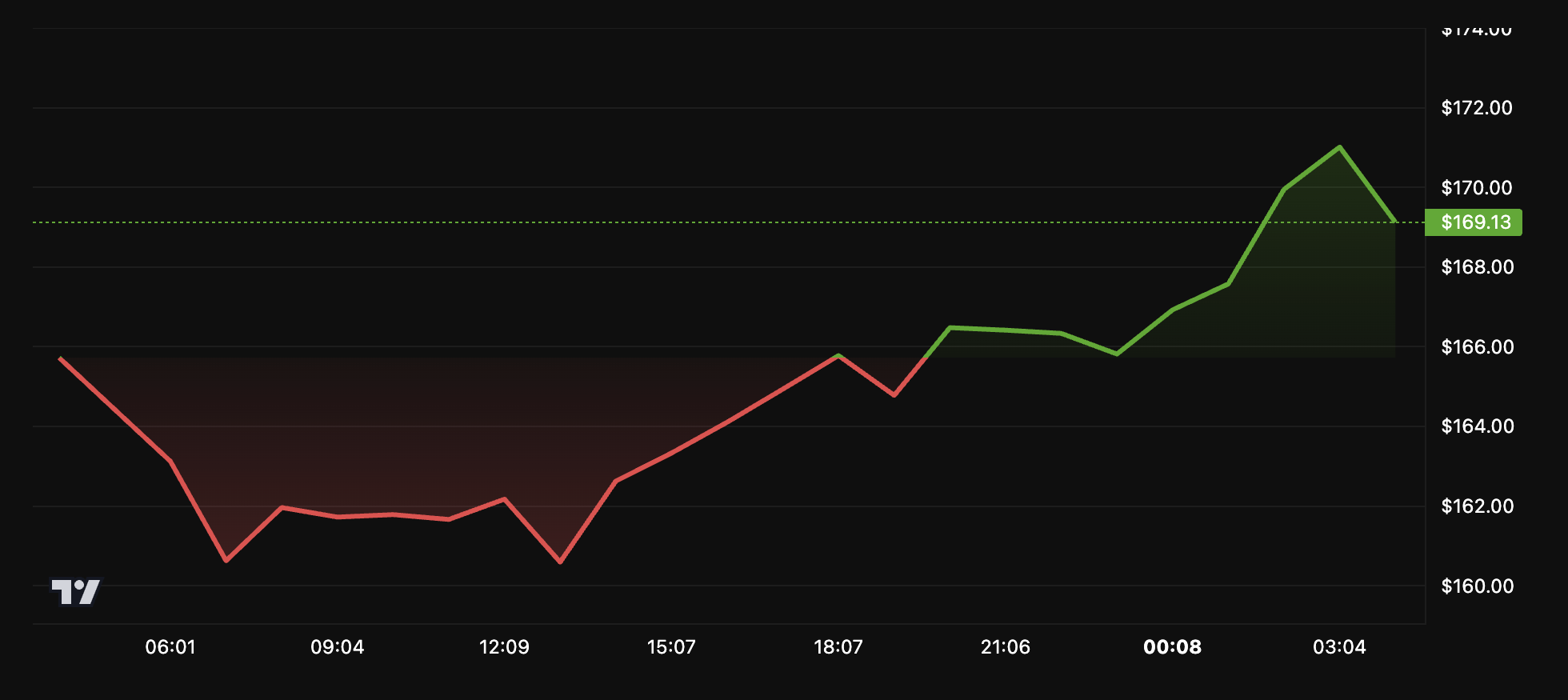

The price of Solana, meanwhile, was unaffected by the change. Over the previous day, the altcoin enjoyed a 2.7% increase. The trading price of SOL was $169 at the time of writing.