Ethereum has not crossed the $4,000 threshold, even if the US Securities and Exchange Commission (SEC) has approved eight Ethereum-based exchange-traded funds (ETFs) in a historic manner.

Ethereum’s (ETH) price rose to about $3,900 after the SEC’s ruling, but it soon fell to about $3,720. The price has fairly steadied as of this writing, averaging $3,800.

Ethereum ETFs: Sell the news?

Ethereum, the cryptocurrency with the second-highest market capitalization, had a little gain of 0.65% over the previous day. However, it increased by more than 28% over the prior week, indicating some confidence in the market. The expected push over the $4,000 barrier has not yet materialized, despite recent advances.

Jason Pizzino, a cryptocurrency expert, commented on the events.

“The Ethereum ETF has been approved. However, that wasn’t enough to pump the price past $4,000. The ETH/BTC pair also saw a weaker than expected rally,” Pizzino said.

The #Ethereum ETF has been approved. However, that wasn’t enough to pump the price past $4000. The #ETHBTC pair also saw a weaker than expected rally.#Bitcoin continues to correct after getting rejected at $72k again but is still in a strong position above $65,000, at least for… pic.twitter.com/OLmxW9hjuV

— Jason Pizzino 🌞 (@jasonpizzino) May 24, 2024

The traders’ cautious stance implies that they may consider the latest news to be a “sell-the-news” occurrence. This phenomenon happens when investors profit from the news rise and prices decline following significant announcements.

Check Out the Latest Prices, Charts, and Data of ETH/USDT

There was a mixed response from the larger Ethereum community. For example, after the ETF approvals, Pepe surged to a new all-time high of $0.00001576, but it then fell by more than 8%. Arbitrum (ARB) had a decline of almost 3% subsequent to its first surge. Lido DAO (LDO), on the other hand, defied the trend and increased by more than 12% in the previous day.

This “sell-the-news” trend has been seen before, most notably following the SEC’s approval of spot Bitcoin ETFs. Following the revelation, the price of Bitcoin fell by more than 20%, reaching a low of about $38,000 before rising again.

The SEC’s latest approvals signaled a substantial change from its previous hesitation. Fund managers rapidly amended their applications and made critical revisions, hoping for a positive ruling amid circulating reports of imminent approvals.

Check Out the Latest Prices, Charts, and Data of ARB/USDT

By enabling regular investors to buy shares that trade on stock exchanges and follow the price of the underlying assets, exchange-traded funds (ETFs) streamline the investment process for them. These funds provide traditional investors a controlled, simple way to enter the cryptocurrency market. They do away with the requirement for technical expertise in order to directly buy, sell, and store cryptocurrency assets.

Local ether ETFs were flat with no fresh inflows, while Hong Kong’s spot bitcoin ETFs experienced daily outflows

On Thursday, there were no inflows into any of Hong Kong’s three spot ether ETFs, while there was a net outflow of 25.63 BTC from the spot bitcoin ETFs.

On Thursday, the three spot bitcoin exchange-traded funds in Hong Kong showed a net outflow of 25.63 BTC, whereas the spot ether exchange-traded funds in the area showed no movements.

According to statistics from SosoValue, the product managed by China Asset Management was the only one responsible for the outflow of spot bitcoin ETFs, with 25.63 BTC leaving the fund. The combined net worth of the three spot bitcoin exchange-traded funds (ETFs) was $254.74 million as of Thursday.

Following their Wednesday inflow of 62.8 ETH, the three spot ether ETFs in the city experienced no flows on Thursday. As of Thursday, the three products’ combined net assets were valued at $50.83 million.

On Thursday, the eleven spot bitcoin ETFs in the United States reported receiving $107.91 million in inflows for the ninth day in a row.

“Admitedly, the ETH spot ETF in Hong Kong is about 15% of the total local spot ETF AUM (the rest being allocated to BTC), and so one might expect a similar ratio in the US or abroad,” Justin d’Anethan, head of APAC business development of crypto market maker Keyrock, told The Block. “This is probably due to the fact that, so far, no staking reward is offered and so the spot ETH ETFs are essentially an inferior investment product relative to native tokens.”

Bitcoin traded down 3% over the past 24 hours at $66,959 at the time of publication, while ether edged down 0.51% to change hands at $3,746.

After a decade, the dormant Dogecoin whale becomes active again

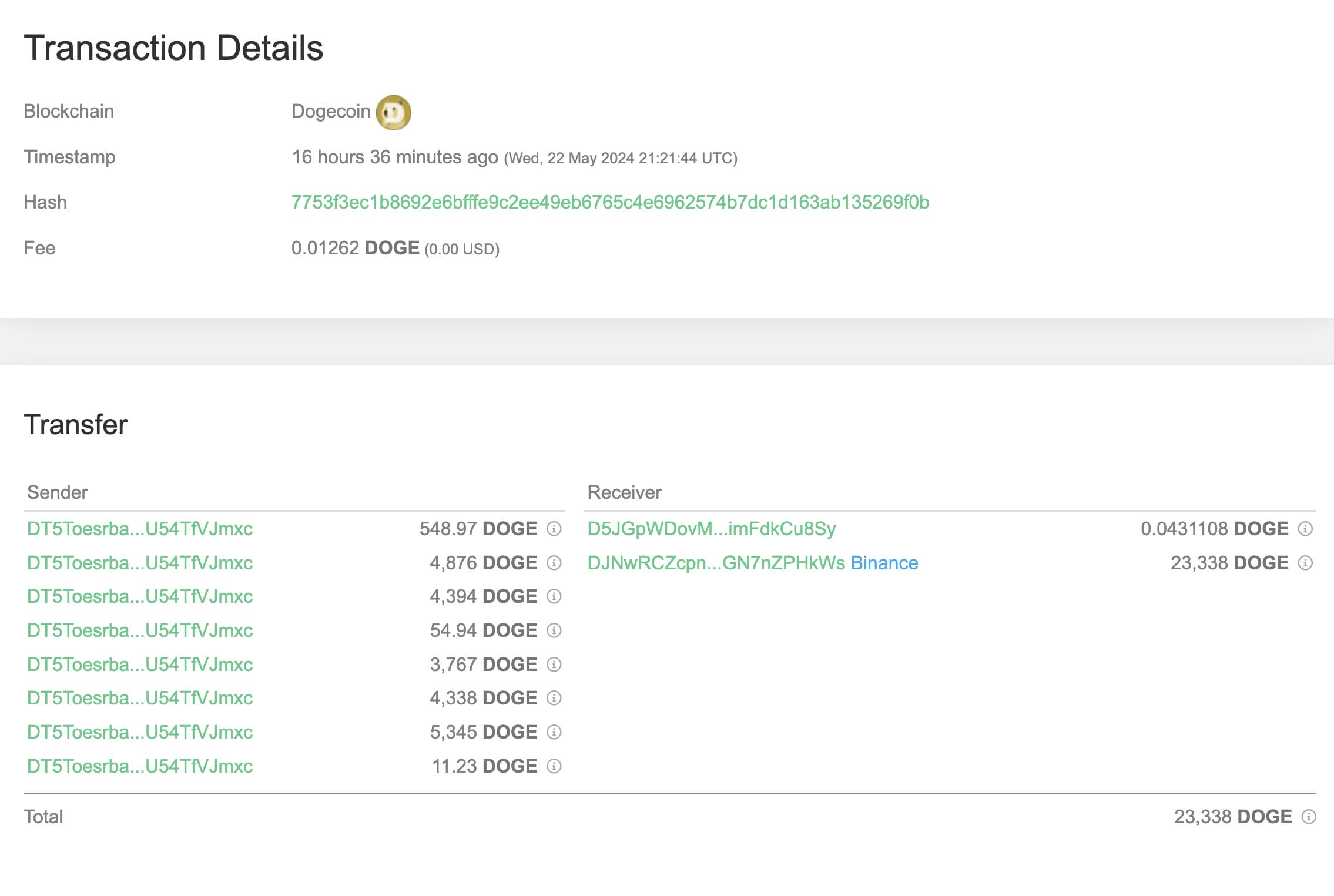

After more than a decade of inactivity, a dormant Dogecoin (DOGE) whale with a wallet balance of 893,303 DOGE (about $145,101) regained activity on May 22. It was the first transaction made by the account since May 2014. Concerns over how such a transaction might affect Dogecoin’s price trend have arisen as a result of its unexpected revival.

The largest cryptocurrency exchange in the world, Binance, received 23,338 DOGE, or almost $4,000. This information was reported by Whale Alert.

Check Out the Latest Prices, Charts, and Data of DOGE/USDT

DOGE whale owns 869,964 DOGE despite huge transfer

Despite the big transfer, the whale still holds over 869,964 DOGE, worth about $141,101.

The most recent reawakening is not a unique instance. A Dogecoin Whale moved $60 million in DOGE to Robinhood earlier last month. Robinhood has recently gotten a Wells Notice from the Securities and Exchange Commission (SEC).

Whale Alert disclosed another significant transaction on May 21. A 600 million DOGE, or almost $100 million, was exchanged between two unidentified wallet addresses in this transaction. To be precise, each wallet received 300 million DOGE from the Dogecoin whale.

🚨 🚨 🚨 300,000,000 #DOGE (50,359,625 USD) transferred from unknown wallet to unknown wallethttps://t.co/b7XUeTZ5J2

— Whale Alert (@whale_alert) May 21, 2024

Although a lot of emphasis has been focused on these transactions, it is unclear what the intentions and consequences of these transfers are.

But DOGE’s price increased by 13.08% as a result of the action.

DOGE reported a 13.08% rise in pricing.Additional data from Coinglass shows increased investor interest in the asset. The derivatives data shows that DOGE’s open interest (OI) rose by 27.05% to $1.05 billion, while the volume jumped by 212.27% to $3.73 billion.

The discussion around Dogecoin price forecast is being driven by the most recent activity as well as the earlier Dogecoin whale transactions. Market experts and investors are keeping a close eye on these fluctuations and making predictions about the likelihood of more price spikes as well as the overall impact of whale activity on the future of cryptocurrencies.