The Democratic contender for president, Vice President Kamala Harris, has promised to support developments in the fields of artificial intelligence and cryptocurrency.

Speaking to fundraisers in New York City, she outlined her economic platform, which attempts to protect investors and consumers while advancing America’s innovation industry. With this promise, Harris is endorsing cryptocurrencies directly for the first time during her presidential campaign.

Kamala Harris wants to encourage crypto developments

During a gala in Manhattan, Harris revealed ambitions to work with people in several industries.

“We will partner together to invest in America’s competitiveness, to invest in America’s future. We will encourage innovative technologies like AI and digital assets, while protecting our consumers and investors,” Harris explained.

Moreover, earlier this month, Harris garnered noteworthy support from the cryptocurrency community. Co-founder of Ripple Chris Larsen has endorsed her, joining a growing number of corporate titans who are in favor of her candidacy for president.

Larsen is well-known for supporting innovative and efficient blockchain legislation. His endorsement demonstrates his faith in Harris’ ability to take the lead on matters pertaining to finance, technology, and economic expansion.

Brad Garlinghouse, the CEO of Ripple, also mentioned how Republicans are becoming more supportive of cryptocurrencies. He did point out that a number of prominent Democrats, such as Harris, recognize the importance of these technologies in preserving US dominance in the IT industry.

Crypto becomes a major focus in the US presidential election

In the meantime, Republican contender and former president Donald Trump has been heavily involved in the cryptocurrency space. He has pledged to nominate pro-industry regulators and remove US Securities and Exchange Commission (SEC) Chair Gary Gensler.

In addition, he suggested developing a stablecoin architecture. Trump showed his support for digital assets last week when he paid for hamburgers at a New York bar with a crypto theme using Bitcoin.

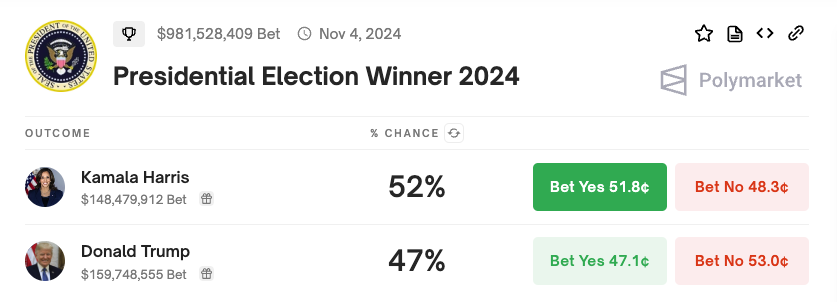

In prediction markets, Trump is behind Harris despite these actions. Harris has a 52% chance of winning, compared to Trump’s 47%, according to Polymarket. After their discussion on September 10, when Trump omitted to bring up cryptocurrencies, surprising some industry fans, this disparity grew.

The political clout of the cryptocurrency business is now a major factor in the 2024 elections. Over $119 million has been invested by businesses like Coinbase and Ripple to support candidates who embrace cryptocurrencies and advocate for clear laws.

Since 2010, cryptocurrency firms have contributed $129 million to politics, making them notable donors. This is 15% of the $884 million in documented corporate political spending. When it comes to election-related spending, only the fossil fuel business has more financial clout than them.

Super PACs supported by cryptocurrency have impacted 42 political primary contests, with their preferred candidates emerging victorious 36 times. This success rate is influencing political strategies in a substantial way and shows how the crypto industry is becoming more and more powerful in American politics.

AAVE price surge continues, analyst sees more gains ahead

This year has seen great success for AAVE, the second player in decentralized finance, which has surged to its highest level since 2022.

From its lowest point this year, AAVE has increased by about 120% to a high of $160, valuing the company at over $2.5 billion.

AAVE’s DeFi TVL has jumped

The notable rise in network assets has contributed to the token’s success. According to data, the total wealth that is locked up in the ecosystem has increased to more than $12.1 billion.

With approximately $25 billion in staked assets, Lido is the largest player in DeFi, making it the second largest player thanks to its expansion. JustLend, EigenLayer, and Ether.fi come next.

AAVE’s expansion has resulted in significant network expenses as well. TokenTerminal claims that with over $287 million in fees collected so far this year, the ecosystem is the third most profitable player in DeFi, behind only Uniswap and Lido.

Over the previous few months, AAVE’s price increased due to an increase in whale activity. For instance, a few of whales have made large acquisitions and now make up the majority of holdings, followed by retail and investors.

Although the quantity of smart money has somewhat decreased recently, according to Nansen data, it is still far higher than the June low of 71. These investors’ total balance has remained constant at 439,000.

The wealthiest investors own almost 25,000 AAVE tokens, valued at $4 million, in addition to other cryptocurrencies including Beam, Ethereum (ETH), Pepe (PEPE), Ondo Finance.

As the Federal Reserve begins to reduce interest rates, AAVE has also increased. The bank opted to lower interest rates by 0.50% during its meeting on Wednesday, and it made hints that further cuts would follow. More money could come into lending platforms like AAVE and JustLend as a result of lower interest rates.

AAVE forms golden cross in July

The coin created a golden cross pattern in July when the 50-day and 200-day exponential moving averages crossed, which also coincided with AAVE’s spike.

It has persisted in creating a sequence of rising lows and highs. The coin has also turned a crucial resistance level of $150 into a support level. Additionally, it has surged past the significant mark of $153.68, which was its peak in March of this year.

The most significant formation made by AAVE is a handle and cup design, a well-liked continuation sign.

As a result, it’s possible that the token will keep climbing as the DeFi resurgence continues, as the analyst below pointed out. The next level to keep an eye on will be at $170 if this occurs.

$AAVE is trading at the highest level since May 2022 and seems to be breaking out from a 2 year consolidation pattern.

Expect ATH reclaim to further solidify DeFi Renaissance. pic.twitter.com/pn29UsBMes

— Arthur (@Arthur_0x) September 22, 2024

Australia to require crypto firms to hold financial services licenses

Australia will expand the licensing criteria for cryptocurrency exchanges beyond those pertaining to digital currency exchanges.

It has been claimed that new laws requiring bitcoin exchanges to obtain financial services licenses are being prepared by Australian regulators.

According to The Australian Financial Review (AFR), licensing regulations for cryptocurrency exchanges in Australia are about to expand beyond those pertaining to digital currency exchanges.

Commissioner of the Australian Securities and Investments Commission (ASIC), Alan Kirkland, states that the regulator believes the Corporations Act covers the majority of significant cryptocurrency assets, such as Bitcoin (BTC) and Ethereum (ETH). For this reason, the new rules are required.

On September 23, during the AFR Crypto Crypto and Digital Assets summit in Sydney, the commissioner revealed the authority’s plans.

New regulatory guidance to be released in November

Before making his presentation at the event, Kirkland allegedly stated that the ASIC is getting ready to revise the Corporations Act’s Information Sheet 225 to provide more clarification on how specific crypto coins and certain products should be considered from a regulatory standpoint.

“ASIC’s message is that a significant number of crypto asset firms in the Australian market are likely to need a license under the current law,” the commissioner stated. “This is because we think many widely traded crypto assets are a financial product,” Kirkland noted.

The revised laws are anticipated to be released by November 2024, per the report.