Metaplanet’s first quarter FY2025 profits have been made public. The company’s overall sales increased by 8% from quarter to quarter to ¥877 million (~$6.0 million).

Bitcoin (BTC) option premium harvesting generated ¥770 million (~$5.2 million), or 88% of the total earnings. The hotel operations division accounted for the remaining ¥104 million (~$712,200), highlighting a substantial change in the company’s financial priorities.

Bitcoin Strategy powers Metaplanet’s 8% Q1 revenue growth

Launched in Q4 2024, the Bitcoin Income Generation approach is Metaplanet’s main income source. It has made ¥593 million (about $4.0 million) in operational profit thanks to the approach.

This set a new corporate record and was an 11% rise over the previous quarter. Additionally, total assets reached ¥55 billion (~$376.6 million), an 81% increase. In the meanwhile, net assets reached ¥50.4 billion (~$345.1 million), a 197% increase.

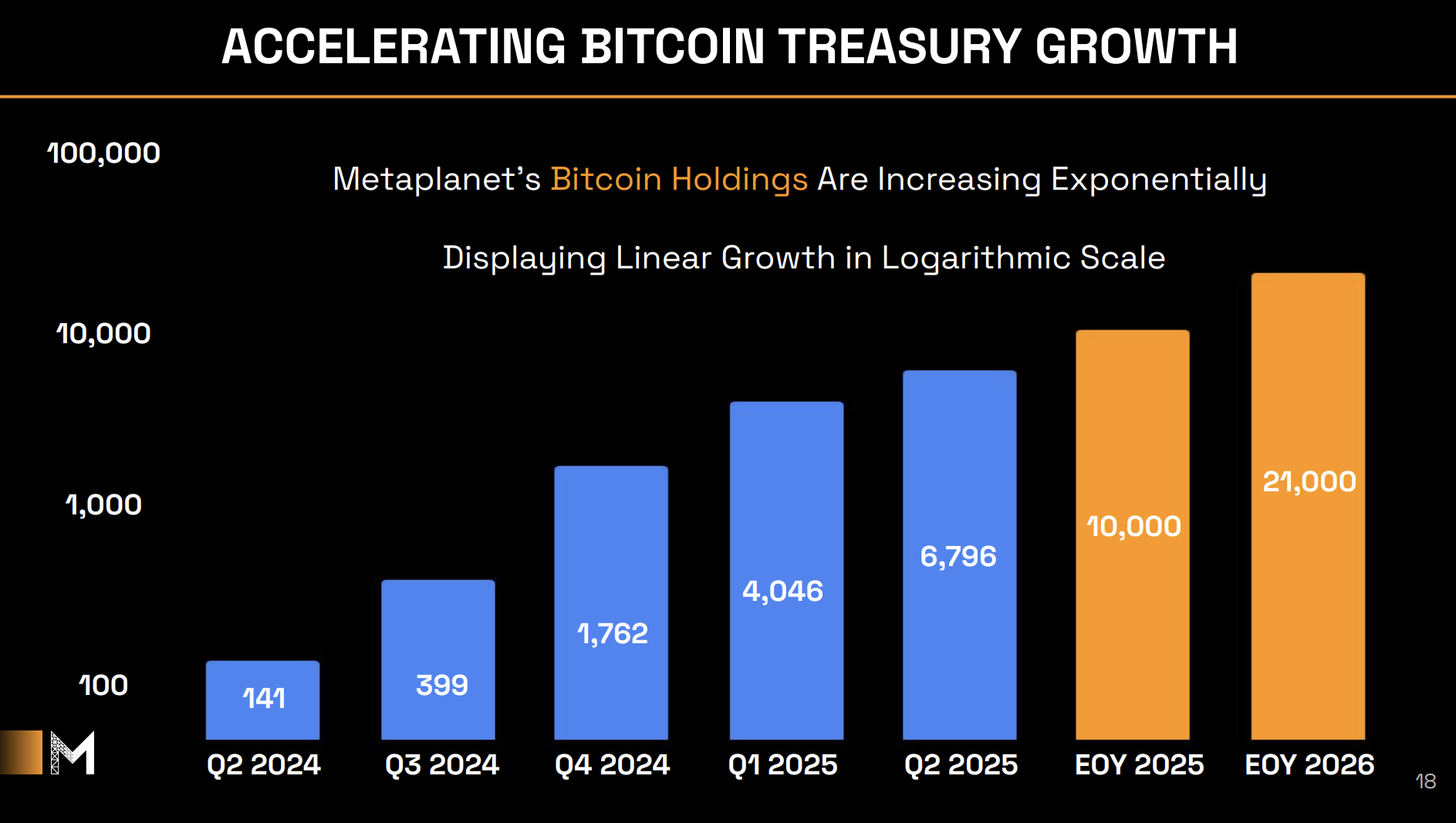

With the last 1,241 BTC acquisition, Metaplanet’s Bitcoin holdings now reach 6,976 BTC, which is more than El Salvador’s government reserves. In less than four months, the company has now reached 68% of its 2025 target of holding 10,000 BTC.

🚨Metaplanet Q1 FY2025 Highlights🚨

🟧 Revenue: ¥877M (+8% QoQ)

🟧 Operating Profit: ¥593M (+11% QoQ) — a new company record

🟧 Net Assets: ¥50.4B (+197%)

🟧 Total Assets: ¥55.0B (+81%)

🟧 We booked a ¥7.4B valuation loss as BTC price at end-March was lower than year-end, but… pic.twitter.com/bsQHvr8wGo— Simon Gerovich (@gerovich) May 14, 2025

The study also noted that the company’s BTC yield increased from 309.8% in Q4 2024 to 95.6% in Q4. The company is aiming for a 232% yield in 2025. The yield objective for Q3 and Q4 of 2025 is also 35%.

Last but not least, Metaplanet’s shareholder count grew by an astounding 500% in only a single year. With 64,000 stockholders in Q1 2025, the company’s investment base has grown significantly.

“This was the strongest quarter in our company’s history,” Gerovich added.

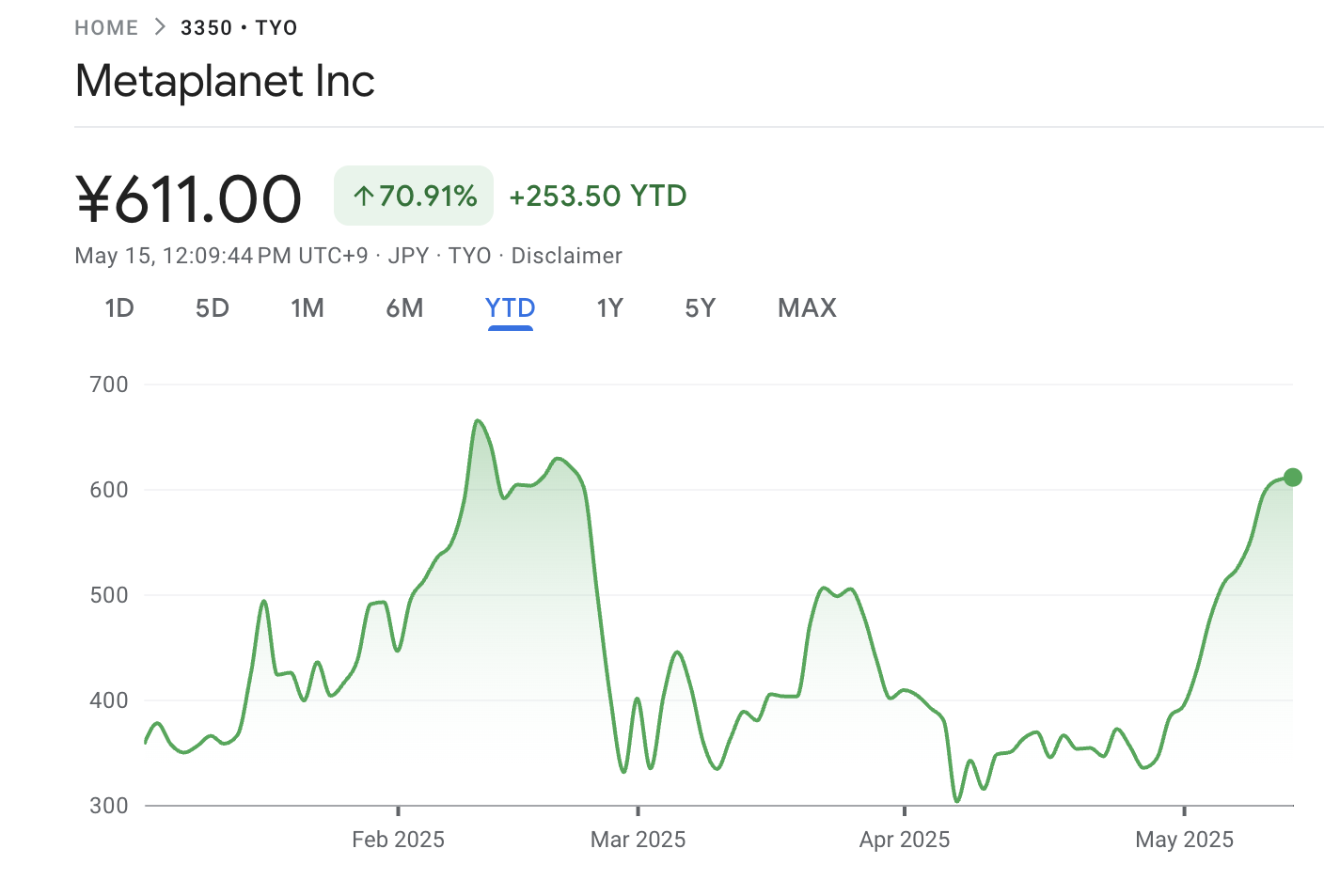

As a result of this expansion, Metaplanet is now the top Bitcoin treasury firm in Asia and the eleventh-largest public Bitcoin holder in the world. There have also been notable increases in the company’s stock price. Data from Google Finance indicates that 3350.T has increased 70.91% so far this year.

Additionally, it stated that since Metaplanet’s initial Bitcoin acquisition in April 2024, the stock price has increased by more than 15 times.

Abraxas Capital bets $561 million on ETH, ditches Bitcoin in strategic power move

With a $561 million total ETH holding value over the last week, Abraxas Capital is emerging as one of the biggest whales in the Ethereum (ETH) market.

The organization’s actions show faith in ETH’s potential and prompt inquiries about how it will affect the cryptocurrency market going forward.

Abraxas Capital aggressively accumulates ETH

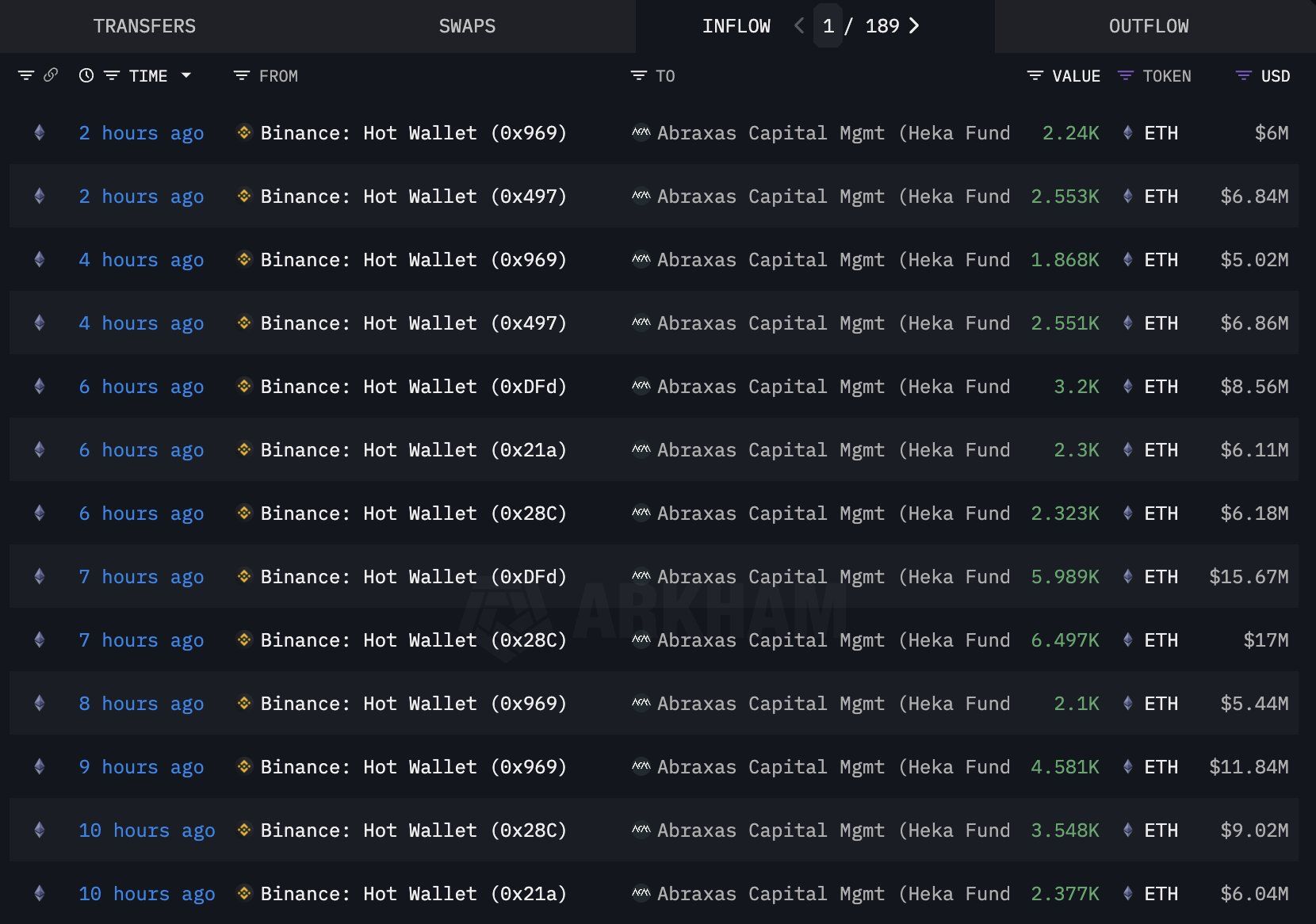

Abraxas Capital has gained attention in the last week due to its consistent and substantial ETH accumulation. On May 14, 2025, the company bought 242,652 ETH in 7 days, according to Lookonchain. That amounts to $561 million.

Abraxas Capital Heka Funds wallets removed Ethereum from many significant exchanges, most notably Binance, according to data from Arkham Intelligence. The prices of the transactions, which varied from 2,100 to 6,497 ETH per instance, ranged from $5.44 million to $17 million. The organization’s aggressive accumulation approach is demonstrated by the 189 transactions in 10 hours.

With $561 million worth of ETH holdings, Abraxas Capital is a significant whale. They could have an impact on ETH price movements soon.

Shift from BTC to ETH

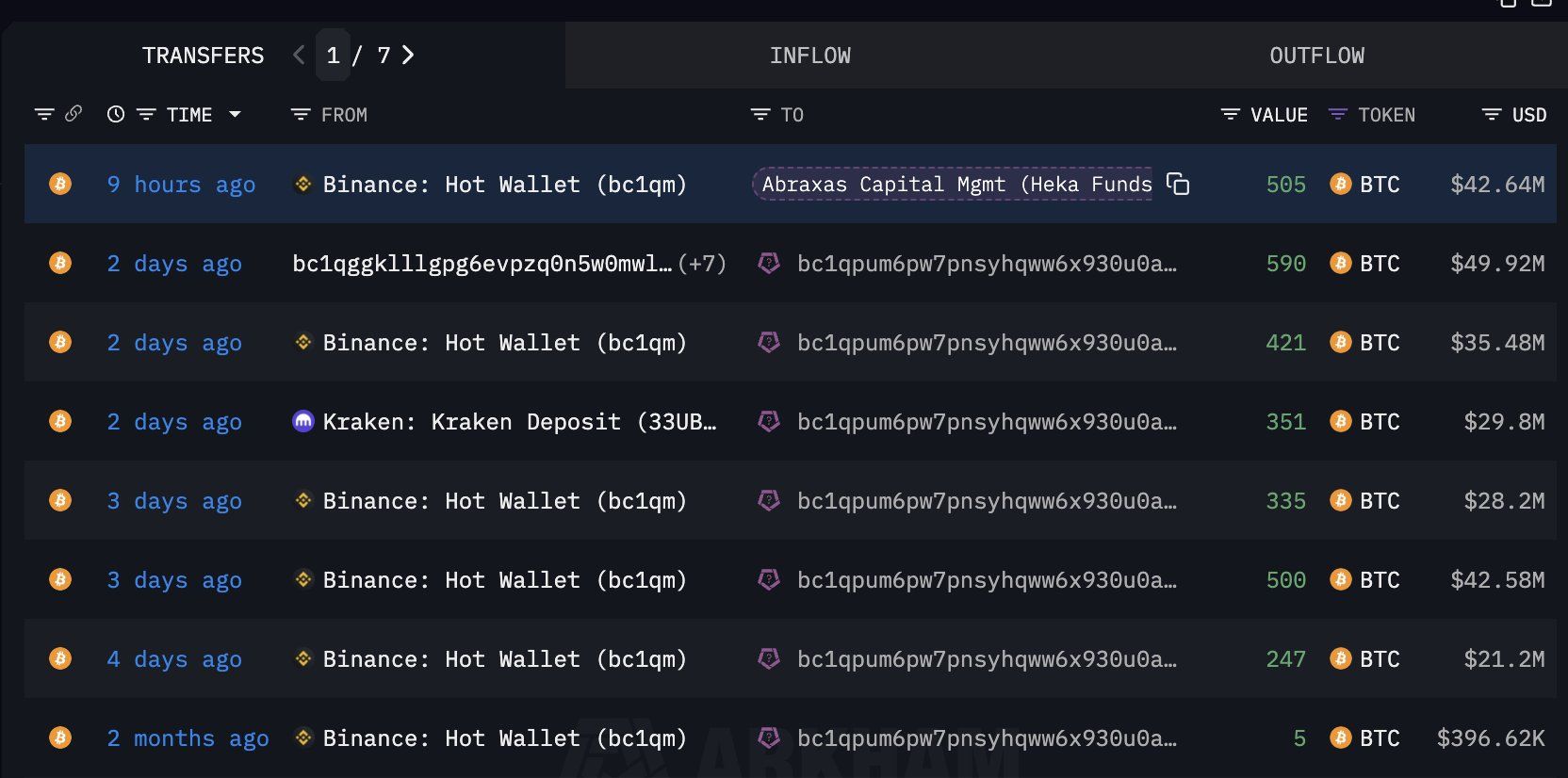

Abraxas’s move from Bitcoin (BTC) to Ethereum (ETH) is another noteworthy development. According to Lookonchain, a wallet associated with the group took out $250 million, or 2,949 BTC, from many exchanges.

OnchainDataNerd, however, stated that the company had sent Kraken 1,000 BTC by May 8, 2025. Only 983 Bitcoin, or $98 million at today’s exchange rate, is in their possession. With ETH holdings rising to $561 million at the same time period, this suggests that Abraxas drastically cut its BTC position in order to concentrate on ETH.

Abraxas’s trust in ETH’s long-term prospects may be reflected in this change, especially as the Ethereum ecosystem flourishes with DeFi and NFT applications. Given that ETH recently crossed the $2,500 level, the decrease in BTC holdings and the increase in ETH investment raise the possibility that they are getting ready for a new Ethereum growth cycle.

ETH is a bet on fundamentals.

Ethereum dominates on developers, stablecoins, RWAs and NFTs. pic.twitter.com/FOhr4qbOs7

— Nick Tomaino (@NTmoney) May 14, 2025

Analysts think Ethereum has the ability to overtake Bitcoin in the near future. It is anticipated that Ethereum’s strategic reserve would reach 10 million ETH by 2026.

Will XRP price hit $10 if ETF is approved tomorrow?

The price of XRP is anticipating a breach from the resistance of a bull flag to $10. If a spot XRP ETF is approved tomorrow, would this goal be met?

As investors question if the coin can hit $10, the Ripple (XRP) community waits for the SEC to approve a spot XRP ETF in 2025. Ripple will overtake Ethereum and become the second-largest cryptocurrency if XRP hits double digits. However, assuming a spot ETF is authorized tomorrow, how long would it take for XRP to hit $10, and is this price objective realistic?

How spot ETF approval will impact XRP price

A bull run for Ripple’s XRP coin might propel it above $10 if the SEC authorizes a spot XRP ETF tomorrow. This is due to the fact that Ripple will probably have a first-mover advantage as the first cryptocurrency produced in the USA to appear on Wall Street, just like spot Bitcoin ETFs did. This will generate enough bullish momentum and capital inflows to propel the coin to new heights.

As the price of Bitcoin increased by 55% in the first two months of trade, $6.4 billion was invested in spot ETFs. The price of an XRP ETF may rise from $2.51 to $3.90 in the first two months if Ripple continues to follow the same path once the SEC approves it tomorrow.

Additionally, JPMorgan predicts $8 billion in inflows to XRP ETFs, according to a prior study. According to experts, the price of XRP might rise to $15 if these inflow forecasts are combined with the market cap multiplier idea.

According to the research above, if the SEC approves a spot XRP ETF tomorrow, XRP can easily hit $10. With this increase, Ripple will be the biggest altcoin with a market valuation of $589 billion.

Since the SEC’s lawsuit against Ripple was dropped, the likelihood that the XRP ETF would be approved shortly has increased. According to experts at Bloomberg, the chances of approval are 85%, but on Polymarket, they have risen to a record-breaking 80%.

Would love to hear directly from Atkins, but all good chance of happening. Here’s our latest odds of approval for all the dif spot ETFs via @JSeyff https://t.co/nLhYJJmO9U pic.twitter.com/4AcJVwhics

— Eric Balchunas (@EricBalchunas) April 30, 2025

Based on these projections, it is probable that the SEC will approve a spot XRP ETF shortly, and the $10 XRP price objective will then be verified.

Bull flag shows $10 target is possible

Once a spot XRP ETF begins trading in the US, traders could expect a significant breakout for the price of XRP in the near future. Ripple’s technical outlook, which formed a bull flag pattern as the price consolidates after a 5x increase between Q4 2024 and January 2025, supports the possibility that such gains may occur.

According to the flag pole’s height, XRP saw a 518% rally between October 2024 and January 13; if it can overcome the resistance of the flag and record a comparable rally, it might reach $17.

A breach from the flag’s resistance is probable since the weekly RSI is already rising and the number of 57 indicates that bullish momentum is there. Traders should be aware of the downward-sloping ADX line, which indicates a weak trend and might impede a significant higher breakthrough for the price of XRP.