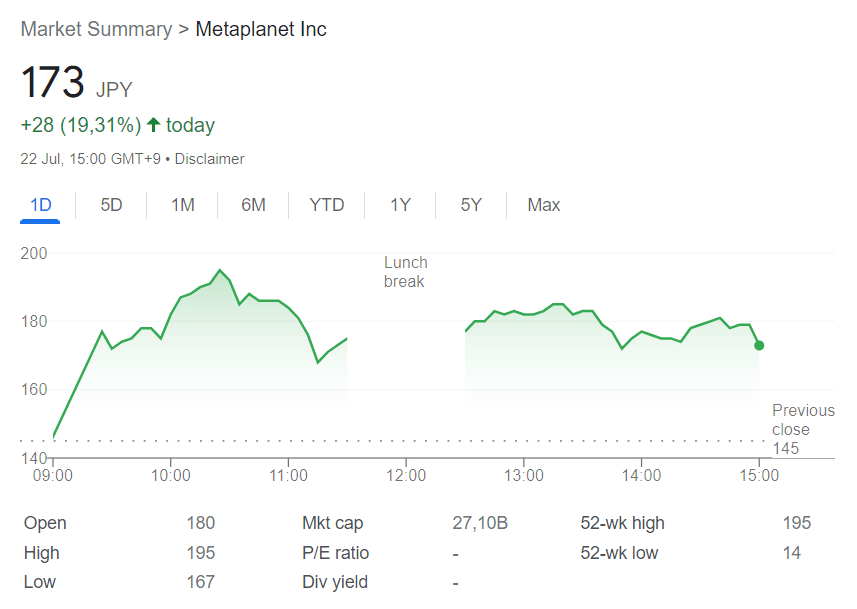

In the wake of Metaplanet’s most recent acquisition of Bitcoin, the company’s shares on the Tokyo Stock Exchange increased by more than 20%.

Amidst ongoing economic hardship in Japan, Japanese investment firm Metaplanet continues to double down on its long-term holding strategy by investing over $1.2 million to purchase another set of Bitcoin (BTC).

*Metaplanet purchases additional 20.38 $BTC* pic.twitter.com/xt1AjSWPNL

— Metaplanet Inc. (@Metaplanet_JP) July 22, 2024

The Tokyo-listed financial firm said in an X post on Monday that it had added 20.38 BTC for ¥200 million, or about $1.2 million, to its total reserves of Bitcoin, which now stand at 245.992 BTC (or more than $16.6 million at current market values).

According to statistics from Google Finance, Metaplanet’s shares on the Tokyo Stock Exchange quickly surged by more than 20% to $1.1, following the news. Following Metaplanet’s recent allocation of approximately $6.2 million for Bitcoin through the issuing of a second series of ordinary bonds via EVO FUND, the purchases are scheduled to maturity on June 25, 2025, and have an annual interest rate of 0.5%.

The most recent transaction was made just one week after the company said that it had purchased an extra 21.8 BTC as part of a strategy to safeguard the company against Japan’s economic difficulties, which include a large level of public debt, persistently negative real interest rates, and a “consequently weak yen.”

Since starting to buy Bitcoin on April 23, Metaplanet has grown the value of its assets by 766% in US dollars, according to statistics from BitcoinTreasuries.NET. According to research, Metaplanet is currently ranked 21st, only below Advanced Bitcoin Technologies, following the most recent acquisition.

Meme coins tumble as Joe Biden announces withdrawal from US presidential race

President Joe Biden’s announcement on Sunday that he will not be running for president in 2024 sent Biden-themed meme coins plunging. The market for meme coins and prediction websites like Polymarket were significantly impacted by the verdict.

As the Democratic contender to replace him, Vice President Kamala Harris received Biden’s endorsement.

Kamala Horris (KAMA) meme coin continues to surge

My fellow Democrats, I have decided not to accept the nomination and to focus all my energies on my duties as President for the remainder of my term. My very first decision as the party nominee in 2020 was to pick Kamala Harris as my Vice President. And it’s been the best… pic.twitter.com/x8DnvuImJV

— Joe Biden (@JoeBiden) July 21, 2024

As a result, Polymarket experienced a surge in activity. Some traders made significant gains because they had predicted Biden’s departure.

For instance, as word of Biden’s decision spread, one trader made an incredible 100x profit. Another made an initial wager of $38,160 and got a return of almost $196,102 on Biden’s departure.

Not all traders, though, were successful; one user going by the handle “AnonBidenBull” lost about $2 million on bets on Biden’s eventual candidacy.

Additionally, there was a more than 60% decline in Biden-themed meme coins, including ones bearing his family members’ names. After his statement, the “Jeo Boden” (BODEN) token dropped 60.11% in a single day. Its market valuation, which was over $15 million only a few days prior, was roughly $10 million less after this fall.

On the other hand, amid rumors that Vice President Kamala Harris would be the next Democratic nominee, tokens connected to her, including the “Kamala Horris” (KAMA) token, increased by 80%.

The speculative character of meme coins—which frequently respond sharply to news and public opinion—is shown by this sudden market reaction. These coins carry enormous risks for investors because of how quickly their value may change in response to news cycles and political situations.

Despite having just contracted COVID-19, Biden did not cite health concerns as a factor in his choice, but the political ramifications are evident. Kamala Harris’s odds of winning the US presidential race have now increased to 29%.

Based to data from Polymarket, Donald Trump is still the front-runner with 64% chance of winning the election.

Litecoin (LTC) price recovery could find a threat from profit-taking

Remarkably, the glacial rate of recovery in Litecoin’s (LTC) price has not yet made investors more pessimistic.

It is possible that holders of LTC may start selling now even with steady support from new investors.

Litecoin investors seem negative

Very little of the recent losses in Litecoin’s price have been recouped. The Market Value to Realized Value (MVRV) Ratio, which gauges investors’ profit and loss, might, however, cause this to alter.

The 30-day mean volatility ratio (MVRV) of Litecoin is at 20%, suggesting profitability and possible selling pressure. In the past, LTC has historically corrected when the danger zone, or MVRV, is between 10% and 28%.

However, fresh investors continue to exhibit encouraging signals. The number of new addresses executing transactions on the network relative to the active addresses is remains significant, as demonstrated by the new adoption rate.

Nearly all of the investors—68%—are new addresses, indicating steady network expansion. This will operate as a buffer against the pessimism that some long-term LTC investors have fostered.

LTC price prediction: Recovery is difficult

The price of Litecoin (LTC) is probably going to be stable in the near future. There are two reasons for this. The first is that the previously listed components have a bullish-neutral stance.

The second is that the 23.6% Fibonacci Retracement line has been turned into support by LTC. The bear market support floor is this level; it tends to avert any downside. The same will reinforce sideways momentum and the consolidation in the $79–$71 range.

If the price of Litecoin breaks below the $71 support level, a slump might push it down to $69. If this level is lost, the bullish-neutral thesis will be refuted, and the price will fall to $61.