The most recent Bitcoin news is that Mt. Gox transferred 11,501.4 BTC, around $1 billion. Traders anticipate volatility in the price of BTC.

The collapsed cryptocurrency exchange Mt. Gox recently completed a significant transaction by transferring an enormous 11,501.4 BTC, worth almost $1 billion, across two wallets. This is the most talked-about Bitcoin news in town. This is the exchange’s second significant transaction of this magnitude in March. Investors are keeping a careful eye out for any significant volatility in the price of bitcoin in the future.

Mt. Gox moves $1B worth of Bitcoin

The collapsed cryptocurrency exchange Mt. Gox is transferring a significant portion of its Bitcoin assets as part of the creditor payback process. The exchange transferred 11,501.4 BTC, or $1 billion, between two wallets earlier on Tuesday.

According to Spot On Chain, the transaction details show that 10,608 BTC, or $929.7 million, was transferred to a fresh wallet and 893.4 BTC, or $78.3 million, was sent to a warm wallet.

This action comes after 332 BTC ($25.5 million) was transferred from Mt. Gox to Bitstamp, a cryptocurrency exchange. According to market observers, the 893.4 BTC that was transferred to the warm wallet could soon be removed as well, which might have an effect on market dynamics.

Mt. Gox traded 12,000 Bitcoin earlier this month in March, when the price of the cryptocurrency was trading at over $92,000. Bitcoin has seen an almost 7% correction since this news broke in early March, and it is presently trading at about $86,500 levels. At $33.37 billion, the daily trade volumes of Bitcoin have increased by an astounding 97%.

BTC price volatility coming soon?

There is increasing conjecture that there will be significant volatility in the price of Bitcoin in the future due to the cryptocurrency exchange’s large Bitcoin movement. Ali Martinez, a cryptocurrency expert, has identified $89,000 as a crucial resistance level for Bitcoin (BTC). At this level, a declining trendline from Bitcoin’s all-time high and the 50-day moving average intersect.

Martinez’s study indicates that in order to stage a big positive momentum going forward, Bitcoin must break through this cluster. Bulls may attempt to restest this breakthrough once again, according to the latest Bitcoin price prediction. But if it isn’t surpassed, there may be more consolidation or even a possible decline in Bitcoin.

The analyst also discusses recent developments in the Bitcoin market, pointing out that the Relative Strength Index (RSI) has lately crossed into overbought territory. Bitcoin has had significant corrections the previous six times the RSI has moved into this area.

Bitcoin (BTC) may be approaching a short-term top, according to the TD Sequential indicator, which is renowned for its accuracy in spotting market reversals. This indicates that there may be some future profit-taking.

Analyst predicts XRP price could surge above $1400 as bull flag breaks

After emerging from a multi-year bull flag formation, which indicates strong long-term momentum, analysts anticipate that the price of XRP might rise to $1,452.

As cryptocurrency gurus lay out a bullish scenario that may see the altcoin rise to $1,452.81, a long-term technical pattern on the XRP price chart is attracting notice. A multi-year “bull flag” formation, which is often viewed in technical analysis as a continuation pattern that may precede upward momentum, is the basis for the prediction. This change occurs when market players reevaluate the price of XRP in relation to the larger landscape of digital assets.

XRP price could hit $1,452 as analyst spots bull flag breakout

On the X platform, analyst “Steph is Crypto” displayed a long-term positive chart for the price of XRP. The shared study indicates that the Ripple coin is emerging from a multi-year bull flag pattern that began in 2018. In technical analysis, this pattern indicates rising momentum following consolidation and is a continuation indication.

A change in the price structure is indicated by the breakout over the channel that slopes downward. According to Steph, the price of XRP may rise to $1,452.81 in the upcoming years. The length of the initial flagpole projected from the breakout point serves as the basis for this prediction.

Furthermore, after years of consolidation, the “Steph is Crypto” chart suggests that the price of XRP may be about to begin a new phase of movement.

I don’t even want to give you this #XRP price target

You’re definitely not bullish enough.. pic.twitter.com/twrWpzIrbr

— STEPH IS CRYPTO (@Steph_iscrypto) March 24, 2025

Likewise, according to a recent story, Michael Saylor could diversify MicroStrategy’s holdings by transferring $21 billion from Bitcoin to XRP. According to analysts, such a move would set off a parabolic spike in XRP’s price, which might send it close to $1,000.

Additional technical breakout around $2.48

Steph is Crypto pointed out a second technical breakthrough in a recent video update. This time, a falling wedge pattern—a structure linked to trend reversals—was found. At about $2.48, the price of XRP was seen to have crossed over the resistance level of the wedge.

This move can serve as a trading entry point, according to the analyst graphic. With a possible gain of 37.98% from current levels, $3.36 is the anticipated goal from the wedge breakout.

#XRP HOLDERS ABOUT TO GET FILTHY RICH!!!!!!!! (Price Prediction) pic.twitter.com/0L2b60UUc5

— STEPH IS CRYPTO (@Steph_iscrypto) March 24, 2025

Furthermore, expert Dark Defender expressed optimism about the cryptocurrency industry and predicted that the leading altcoin may hit $77.7 during the current bull cycle. His prediction, which calls for a multi-phase rise, is based on Elliott Wave theory and exponential Fibonacci levels.

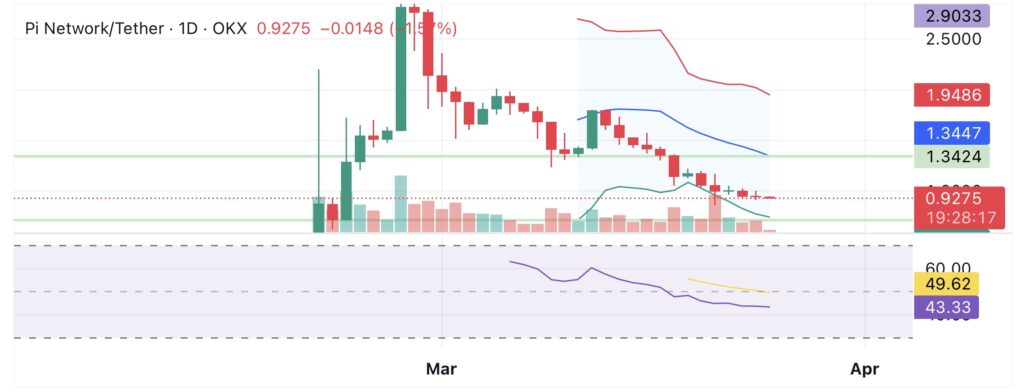

Why is Pi Network price down despite crypto market recovery?

Despite a rebound in the cryptocurrency market as a whole, the price of Pi Network has fallen below $1 and is currently trading at $0.92, a 4% decrease in the last day.

Pi is still having trouble; it is down almost 65% from its last high of $3 this year. One of the primary reasons for this drop is the increasing strain on the supply. Data from Pi Scan indicates that during the next 30 days, around 99.3 million Pi tokens—worth almost $91 million at prices as of March 25—will be unlocked.

During this time, an average of 3 million tokens will be released each day. The largest single-day unlock, which will release 6.8 million tokens into circulation, will occur on April 3. Even larger unlocks are expected in the future, with a total of 115.57 million in April, 182 million in May, and 222 million in June. This might lead to more selling pressure.

Investor mood has also been adversely affected by the uncertainty surrounding exchange listings. Since there has been no confirmation, many individuals who were expecting for a Binance listing are growing more and more irate. Centralization-related worries are also becoming more prevalent.

The Pi Core Team is in control of Pi’s SuperNodes, as opposed to other blockchains where nodes are operated autonomously. Pi Network has not disclosed how these nodes were selected, despite the fact that there are now 42 of them rather than the initial three.

Some claim that burning tokens might help stabilize prices. To balance the market, cryptocurrency specialist Dr. Altcoin suggested cutting the supply by 60–100 million Pi coins in a post on X on March 24. The price has not increased much despite Pi Network burning 10 million tokens recently, bringing the total amount in circulation down to 6.77 billion.

The CEXs have been flooded with unlocked Pi coins, and the PTC will need to burn another 60 to 100 million coins from the circulating supply in the coming days in order to bring Pi back to $1. I am now more confident that Pi is going to return to $1 soon.

DYOR! pic.twitter.com/PooqZX8SsY

— Dr Altcoin (@Dr_Picoin) March 24, 2025

Technically, PI is seeing a poor trend and is now trading at $0.9253. The price is struggling to stay above $1.00, which is acting as the immediate barrier, while support is at $0.70.

The Bollinger Bands show that sellers are in charge of the price fluctuations when the PI is near the bottom band. The relative strength indicator, at 43.27, shows a negative trend even if it hasn’t yet hit oversold levels. Selling pressure is indicated by significant moving averages (10, 20, and 30 periods), and the moving average convergence divergence is also negative.

If it falls below $0.85, the PI may fall to the $0.70 range. The next objective is $1.34, therefore a break over $1.00 would change the direction. Until buyers drive the PI higher, it is still weak.