This week, the quantity of Ethereum staked set a new high, accounting for about 30% of the total supply currently in circulation.

Staked Due to significant institutional accumulation, Ethereum’s price recovered a 12-day high, setting a new milestone.

Sunday saw a new high of 34.65 million Ethereum (ETH) staked on the Beacon Chain, surpassing the previous peak of 34.65 million ETH on November 10, 2024.

Over the past year, the amount of Ether staked has remained relatively constant at over 33 million. The network explorer Beaconcha.in claims that it began to tick up once more in June.

The higher staking level suggests that more holders would rather stake for a dividend than sell at current prices.

Almost 30% of supply staked

The record amount was verified by a Dune Analytics dashboard, which states that as of Monday, 34.8 million ETH has been staked, compared to 34.7 million reported by Ultrasound.Money.

Additionally, according to the analytics portal, since issuance went back to normal in February, the current amount staked is equal to 28.7% of the 120.8 million Ether in circulation.

ETF staking coming soon?

The industry is also waiting for the US Securities and Exchange Commission to approve spot Ether ETF staking, which coincides with the milestone.

Staked Ether ETFs may launch “within the next few weeks,” according to analysts, after ETF supplier REX Shares recently filed a report using “regulatory workarounds.”

According to Farside Investors, BlackRock’s market-leading iShares Ethereum Trust (ETHA) has been actively accumulating the asset for 23 straight trading days without an outflow.

ETH price at 2-week high

Despite Ethereum’s poor price performance over the last two years—it has gained about 50%, but has not come close to reaching a new all-time high—the amount of Ethereum staked has increased by 77%.

On Tuesday, however, the price of Ethereum recovered $2,700, its highest level since May 29, about two weeks ago, after gaining over 8% on the day.

For momentum to continue, the $2,700 price zone must be breached since it has been resistance four times in the last month.

Is Pepe Coin price set for 50% crash as whale dump 1,000,000,000 tokens?

Examine the Pepe Coin price analysis as a technical pattern predicts a 53% drop to a crucial support level as whales sell trillions of PEPE tokens.

As of June 9, the price of Pepe Coin (PEPE) has increased by 15% over the last four days, rising from a low of $0.00001040 to $0.00001200. With whales reducing their shares and technicals displaying a negative pattern, the meme coin based on frogs is in danger of undergoing a correction.

Pepe Coin price at risk as whales dump 1 trillion tokens

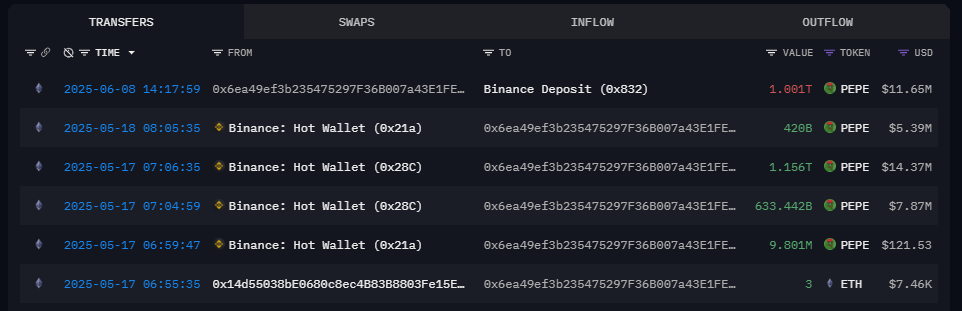

After moving their PEPE tokens to Binance, one whale might have sold one trillion of them. An address sent $11.65 million worth of meme coins to Binance, according to on-chain expert The Data Nerd. The Data Nerd points out that the entity would realize a loss of $867K if the whale sold their interests, though it is unclear if this happened.

According to Santiment statistics, other whales have been selling Pepe Coin. This cohort’s holdings have declined from a year-to-date high of 165 trillion tokens to 134.98 trillion tokens, reaching November 16 levels, according to the Supply Held By Whales metric. This bearish development implies that these investors lack confidence in Pepe Coin’s future price action and are thus not holding the tokens.

The token has also been dumped by smart money investors, according to Nansen figures. On May 21, they had 259 trillion tokens; today, they had 247 billion. These investors, according to Nansen, are those with success and experience.

Additionally, the Network Realized Profit/Loss indicator presents a negative outlook. This figure indicates that investors lost -3.83 million when they sold their assets. This is an indication of capitulation that happens when the price changes significantly in a short period of time.

What does technical analysis say about the token when blockchain data indicates unfavorable investor signs? A possible recovery that defeats the downward trend or crash brought on by the whale selling frenzy?

PEPE Technical analysis hints 50% crash

The Pepe coin price has dropped from its peak of $0.00001632 last month to $0.00001200 today, according to the three-day chart. This decline accompanied the current sell-off in the cryptocurrency market.

Despite Pepe’s recent four-day increase, there is a chance that it has created a multi-year head-and-shoulders pattern, which is a typical bearish reversal setup. The head of this technical formation is currently at its highest point ever, $0.00002838. Additionally, it has a neckline at $0.000005716, which was its lowest point in August and April of last year as well as March of this year. The estimated value of the two shoulders is $0.00001632.

The price of Pepe Coin will confirm a breakout if it generates a clear three-day candelstick close below the neckline. The setup predicts a 53% drop to $0.000001011 in such a scenario. The head’s height from the neckline to the breakout point is added to arrive at this theoretical goal.

Even though the technicals and on-chain data suggest a gloomy outlook for the price of Pepe Coin, the head-and-shoulder pattern will be challenged if it turns the resistance of $0.00001632 into a support floor. A clear three-day candelstick close above this level might push the PEPE token up to $0.000002170, another 30% increase.

SEC eyes exemption framework to boost crypto innovation

Paul Atkins, the chair of the Securities and Exchange Commission, likewise criticized the previous administration’s stance on cryptocurrency under former SEC Chair Gary Gensler.

According to Paul Atkins, chair of the Securities and Exchange Commission, the US securities regulator is developing a “innovation exemption” to encourage the development of more onchain goods and services.

During the SEC’s crypto task force’s DeFi and the American Spirit event on Monday, Atkins, a veteran crypto lobbyist, stated that he has instructed staff to take into account a conditional exemption relief structure.

Exemptions could speed up innovation

If certain qualifications are met, these temporary exemptions would release businesses from certain regulatory obligations to promote innovation in nascent digital areas.

While the SEC staff reviews changes to the Commission’s rules and regulations, Atkins stated that it will expedite the launch of onchain goods and services.

I have directed the staff to consider a conditional exemptive relief framework or “innovation exemption” that would expeditiously allow registrants and non-registrants to bring on-chain products and services to market.

— U.S. Securities and Exchange Commission (@SECGov) June 9, 2025

Atkins added that he has urged staff to think about whether changing the commission’s rules and regulations will give issuers and intermediaries the necessary accommodations to manage onchain financial systems.

“Most current securities rules and regulations are premised upon the regulation of issuers and intermediaries, such as broker-dealers, advisers, exchanges and clearing agencies,” he said.

“The drafters of these rules and regulations likely did not contemplate that self-executing software code might displace such issuers and intermediaries.”

Crypto framework is still a work in progress

Acting SEC chair Mark Uyeda established the agency’s Crypto Task Force on January 21 with the goal of creating a practical crypto framework for the agency.

In his testimony to the Senate Appropriations Subcommittee on Financial Services on June 3, Atkins disclosed that the SEC will refine its crypto policy through “notice and comment” rather than relying on the courts to shape its regulations.

He earlier stated that the Crypto Task Force would publish its initial report within the next six months during an appearance before parliamentarians on May 20.

New approach at SEC

Atkins also criticized the previous administration, which was led by former SEC Chair Gary Gensler, and its stance to cryptocurrency during Monday’s crypto roundtable.

The cryptocurrency industry harshly attacked Gensler for allegedly establishing policy through litigation and settlements rather than rulemaking.

The SEC has taken a different stance on cryptocurrency after Gensler’s resignation on January 20th, dropping long-running enforcement efforts against cryptocurrency companies.

Along with information about how federal securities laws may apply to cryptocurrency, SEC staff have also issued guidance regarding the most popular crypto staking activities, stating that they do not contravene securities rules.