Strive stated that it wants to purchase 75,000 Bitcoin from claims associated with Mt. Gox to get the cryptocurrency at a reduced price.

Starting with claims linked to 75,000 Bitcoin at the defunct cryptocurrency exchange Mt. Gox, Strive, led by Vivek Ramaswamy, aims to expand its Bitcoin holdings by acquiring distressed Bitcoin claims at a discount.

In a regulatory filing on May 20, Strive stated that it had teamed up with 117 Castell Advisory Group LLC to focus on Bitcoin (BTC) claims that have been the subject of final court decisions but have not yet been distributed.

Before its anticipated reverse merger with Asset Entities, which is expected to be finalized early this year, the business stated that purchasing the claims will enable it to buy Bitcoin at a discount and increase its Bitcoin per share ratio.

Strive says it will have fewer constraints on buying Bitcoin than companies going public through mergers with Special Purpose Acquisition Companies, although it hasn’t revealed any Bitcoin holdings.

Strive stated that in order to pursue Mt. Gox claims, shareholder consent would be required. The business stated that it plans to submit a document outlining the specifics of the potential deal to the Securities and Exchange Commission. After that, shareholders would receive a proxy statement asking for their support.

Given that Mt. Gox is anticipated to pay its creditors in full by October 31, Strive would need to secure shareholder approval somewhat quickly.

Before it crashed in 2014 due to a security vulnerability that led to the loss of almost 750,000 Bitcoin, the biggest Bitcoin exchange was Mt. Gox, situated in Japan.

As more businesses seek to hold Bitcoin on their balance sheets as a long-term strategic asset, Strive’s decision to transform into a Bitcoin treasury company is indicative of a larger trend in the sector.

Another recently established Bitcoin treasury company, Twenty One Capital, has support from Tether, SoftBank, and Cantor Fitzgerald. After completing a blank-check merger with Cantor Equity Partners, the Jack Mallers-led company intends to debut with 42,000 Bitcoin.

Asset Entities shares rise again on Mt. Gox plans

According to Google Finance statistics, the shares of Asset Entities (ASST), a social media marketing firm that Strive said it will merge with on May 7 to form a Bitcoin investment company, closed May 20 trading up 18.2% to $7.74.

Since Strive revealed its merger intention, ASST has increased 1,170%, and the most recent share price increase has raised its market capitalization to $122.1 million.

After the reverse merger is finished, Strive is anticipated to possess 94.2% of the combined company, with Asset Entities holding the remaining 5.8%.

The combined businesses will continue to trade under the ASST ticker and be referred to as Strive and Asset Entities.

Jim Cramer calls Bitcoin a safe haven amid growing US debt concerns

Amid market volatility and record open interest, Jim Cramer supports Bitcoin and gold as safe havens and calls for composure as concerns about U.S. debt grow.

After Moody’s cut the U.S. government’s debt rating, investor anxiety surged once more, but Jim Cramer of CNBC suggested a different course of action. Instead of panicking, he advised investors to control their emotions, pointing out that digital assets like Bitcoin might be a safe haven during unpredictable times.

Jim Cramer warns against fear-driven selling

The anchor of CNBC’s Mad Money, Jim Cramer, spoke to investors on Monday after Moody’s decided to lower the U.S. debt rating. Following Friday’s market closure, the announcement set off a tumultuous start to the week. The Dow Jones dropped 300 points and the S&P 500 fell 1% in early trade as markets began the day down.

Markets bounced back during the day despite the initial decline. The S&P 500 gained 0.09%, the Nasdaq increased 0.02%, and the Dow ended the day up 0.32%. Jim Cramer advised investors to avoid anxiety, describing it as a recurring trend after other downgrades, including those by Fitch in 2023 and S&P in 2011.

“You are being given an early warning to invest more—not more aggressively—but more of what you can save,” Jim Cramer said. He added that selling after a downgrade has not been a reliable strategy in the past.

Bitcoin and Gold suggested as safety nets

Jim Cramer suggested looking at assets outside of traditional markets for individuals worried about the nation’s growing debt. In particular, he cited Bitcoin and gold as options in uncertain fiscal times. “If you want to be a good investor, you must tame your fear,” he added, stressing that panic frequently results in bad choices.

In recent days, Bitcoin in particular has proven resilient. The price of Bitcoin fluctuated after the downgrade news, although it remained above important support levels. For anyone who are concerned about excessive government borrowing, digital assets like Bitcoin may provide a cushion, according to Cramer.

Additionally, he proposed that some fear tales are fueled by people or organizations who have financial interests of their own.

“The people who write these are either fools who know nothing or incredibly shrewd short sellers who really need to spread fear because of their business model,” Jim Cramer said.

Bitcoin OI soars price hits $107K

Coinglass data shows that the open interest in Bitcoin in the futures market was $74 billion. This indicates increasing trader activity and is among the highest levels observed in recent weeks.

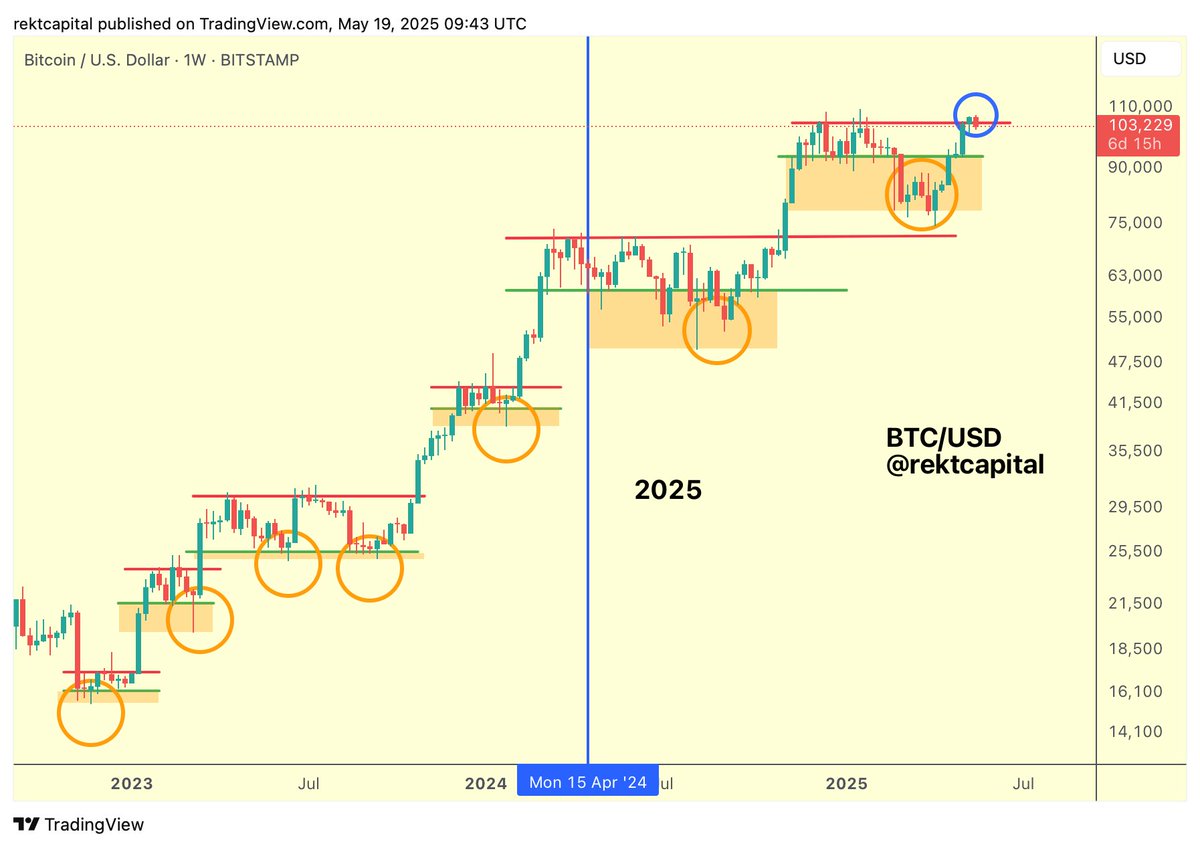

After briefly rising above $107,000, the price of bitcoin is currently trading at about $105,000. It has shown resistance by rejecting that level twice in the last sessions. The asset finished the previous weekly candle over $103,000, which had been a significant barrier point, according to cryptocurrency expert Rekt Capital, notwithstanding the volatility.

Analysts attribute the activity to the belief that inflation will moderate and interest rates will decline, both of which are positive for assets like Bitcoin. Some also attribute Bitcoin’s stability to the growing number of financial institutions increasing its exposure to the cryptocurrency space, such as Michael Saylor’s Strategy.

XRP momentum stalls near $2.35 support as SEC delays 21Shares XRP ETF decision

Due to a slowdown in market activity and uncertainty surrounding the Securities and Exchange Commission’s assessment of the 21Shares XRP spot ETF, XRP’s recent surge has paused.

After a big surge earlier this month, the token’s momentum appears to be decreasing as it is currently trading at roughly $2.35, down 1.4% over the past day and 8.3% over the last seven days. The volume of trading has also drastically dropped. Spot trading for XRP has been $2.67 billion during the last day, which is a 15.9% drop from the previous day.

The image painted by derivatives data is similar. According to Coinglass data, futures traffic dropped 28.45% to $4.24 billion, while open interest in XRP dropped 3.14% to $4.58 billion. The rapid decline in volume indicates cooling speculative activity, while the drop in open interest indicates traders are closing positions rather than creating new ones, which is often a sign of diminished confidence in short-term price action.

Just as the SEC postponed making a decision on the proposed 21Shares Core XRP Trust, the market impetus began to wane. The agency announced in a May 20 filing that it was extending the assessment period to determine if the ETF conforms with the Exchange Act’s Section 6(b)(5), which mandates safeguards against market manipulation and fraud.

The Trust aims to track the CME CF XRP-Dollar Reference Rate and will keep its assets using Coinbase Custody. The SEC emphasized that the postponement does not constitute a final judgment, but rather allows for additional analysis and public feedback. There will be a 21-day comment period following the Federal Register publication, and rebuttals must be made within 35 days.

Early approvals for any cryptocurrency spot ETFs, such as those for XRP or Solana (SOL), are doubtful before late June or early July, and more realistically predicted in early Q4, according to Bloomberg ETF analyst James Seyffart, who described the delay as “expected” in a May 20 X post.

Delays on spot crypto ETFs are expected. A bunch of XRP ETPs have dates in next few days.

If we’re gonna see early approvals from the SEC on any of these assets — i wouldn’t expect to see them until late June or early July at absolute earliest. More likely to be in early 4Q.

— James Seyffart (@JSeyff) May 20, 2025

XRP’s technical indicators suggest ambivalence. The price of XRP is currently in the lower band of the Bollinger indicator, which suggests cautious market action. The relative strength index has a neutral value of 52. Weakness is indicated by short-term moving averages.

The 10-day EMA and the SMA both indicate bearish pressure. However, MAs with longer and medium time horizons are more positive. The lengthier trend remains intact despite the recent downturn, as indicated by the flashing buy signals on the 20-day to 200-day EMAs and SMAs.

Targeting higher resistance zones, a breach above $2.38 and sustained momentum past $2.61 may indicate additional potential. XRP may test support at $2.26 or maybe $2.06 if it drops below its 20-day SMA at $2.34, which would increase the probability of bearish pressure.

The market is currently in a wait-and-see phase as technical and regulatory signals give contradictory indications about XRP’s next big move.