The settlement resolves a civil lawsuit filed by the Securities and Exchange Commission after Terraform’s collapse in 2022.

Terraform Labs has agreed to pay approximately $4.47 billion to the U.S. Securities and Exchange Commission (SEC) as part of their settlement. The total penalties include around $3.6 billion in disgorgement fines, a $420 million civil penalty, and nearly $467 million in prejudgment interest.

This settlement follows a jury’s decision finding Terraform Labs and its co-founder liable for the collapse of the Terra ecosystem, which resulted in a $40 billion loss for investors.

According to the settlement plan, former Terraform Labs CEO Do Kwon is responsible for $110 million in disgorgement penalties, $80 million in civil penalties, and about $14.3 million in prejudgment interest fines. The settlement filing outlines the immediate and short-term steps to be taken.

The filing also mandated the transfer of all crypto assets held by the Luna Foundation Guard and all Pyth Network (PYTH) tokens from Kwon to cover the disgorgement fines and prejudgment interest. Any remaining proceeds from the sale of these assets will be applied to the civil penalties.

A Quick History of SEC v Terraform Labs

The SEC brought a lawsuit against Terraform Labs in 2023, charging the company and its founder, Do Kwon, with selling unregistered securities and defrauding investors following the collapse of the Terra ecosystem.

In 2022, the TerraUSD algorithmic stablecoin began to exhibit instability, causing a massive investor withdrawal from the Terra ecosystem, similar to a bank run.

Soon after, as fear spread throughout the market, TerraUSD lost its dollar peg and crashed, leading to billions in losses for asset holders.

Uncertain Future for Founder Do Kwon

Do Kwon’s future remains uncertain as the courts in Montenegro continue to debate his situation.

Montenegrin courts have repeatedly changed their stance on whether to extradite Kwon. His legal team claims that improper procedures and filings in lower courts have compromised the legal process in their numerous appeals.

Currently, the high court in Montenegro is still deciding whether to extradite Kwon to South Korea or to the United States to face charges.

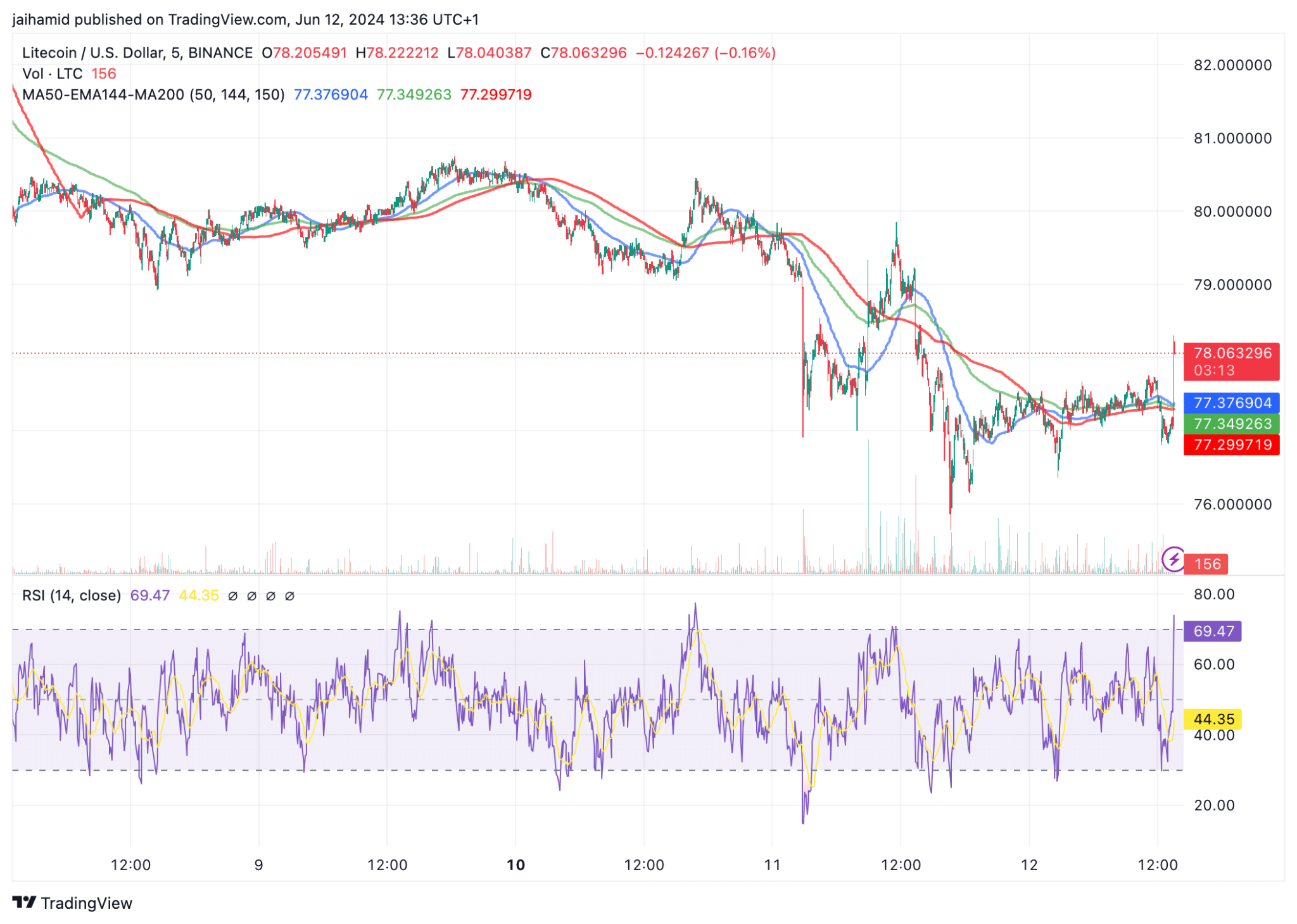

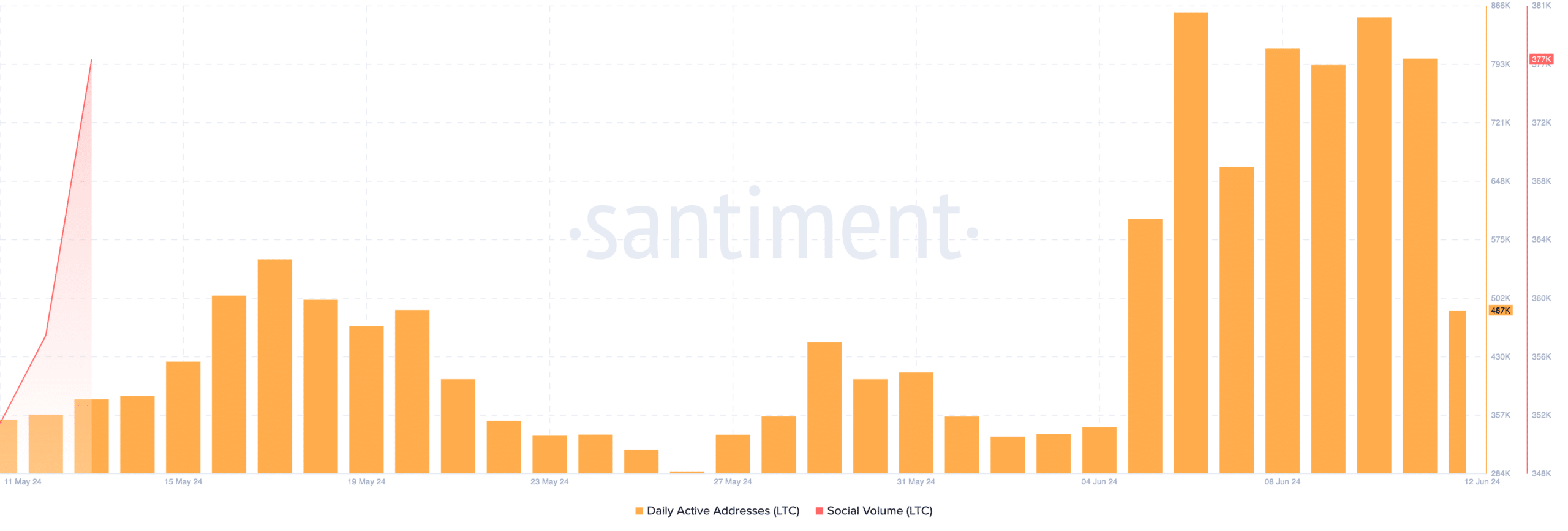

Litecoin stays under $80: What’s stopping LTC’s rise?

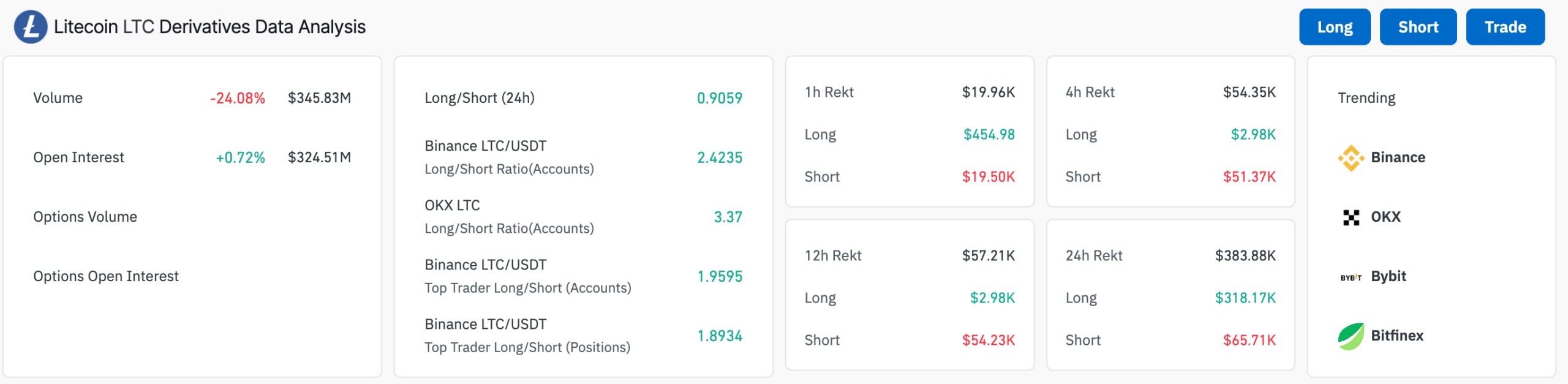

The overall long/short ratio was also bearish. But traders on Binance [BNB] and OKX remained bullish.

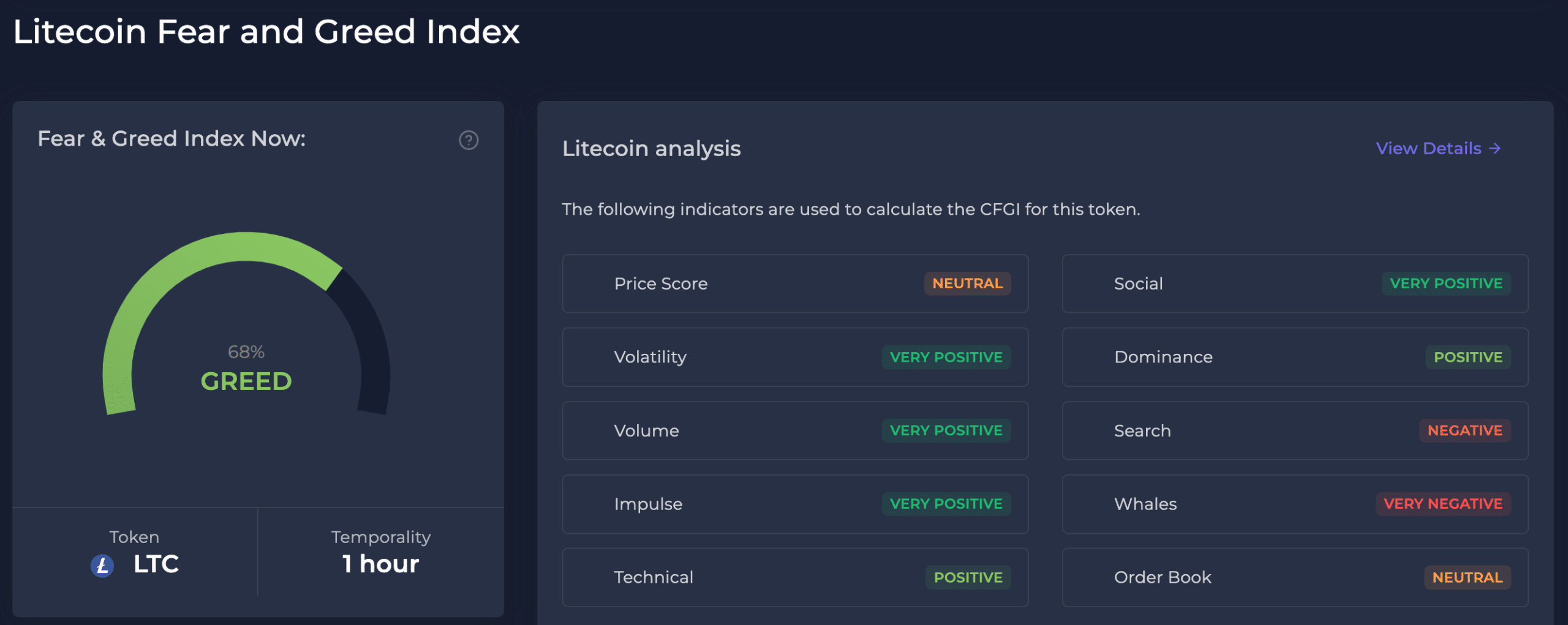

All in all, for LTC, while there was not overwhelming market participation, those involved were becoming slightly more bullish than bearish.