Jeff Park, Head of Alpha Strategies at Bitwise Asset Management, believes that a prolonged tariff war might have a significant beneficial influence for Bitcoin over time.

Over the weekend, President Donald Trump placed tariffs on Canada, Mexico, and China.

Tariff War: Good for Bitcoin?

President Donald Trump has put a 25% tax on imports from Canada and Mexico. Additionally, a 10% tariff on Chinese imports and a 10% duty on Canadian energy resources have been applied. According to the BBC, Canada and Mexico have also issued retaliatory duties.

In a recent X article, Park discussed the Triffin issue and President Trump’s personal goals as explanations for Bitcoin’s long-term gain.

“Tariffs might be just a temporary tool, but the permanent conclusion is that Bitcoin is not only going higher—but faster,” Park wrote.

Park added that the Triffin conundrum derives from the US dollar’s role as the world’s reserve currency, which confers a “exorbitant privilege.” This advantage has three structural effects: an inflated dollar, a chronic trade imbalance, and cheaper borrowing costs for the United States government.

While the US benefits from lower borrowing costs, it also strives to address the imbalances caused by an inflated dollar and persistent trade deficits. As a result, Park believes that tariffs are being used as a negotiating tool to press for a new international accord. This, he claims, is identical to the 1985 Plaza Accord, which attempted to undermine the currency.

Furthermore, Park claims that Trump has a personal investment in the strategy. Given his large exposure to real estate, his major goal is to reduce the 10-year Treasury rate.

In the event of a weaker dollar and lower US interest rates, risk assets in the US may increase, while foreign countries suffer with increasing inflation and currency depreciation. In the face of financial turmoil, Park expects that global investors would gravitate to alternative assets.

“The asset to own therefore is Bitcoin,” Park noted.

He highlighted that if economic tensions rise, Bitcoin’s growth would increase.

President Trump’s tariffs sprark crypto market collapse

In the meantime, the cryptocurrency market crashed due to the possibility of a trade war. Ethereum went as low as $2,143 over the last few hours, while Bitcoin (BTC) momentarily plunged to a minimum of $91,281. As a result, the market has lost billions of dollars.

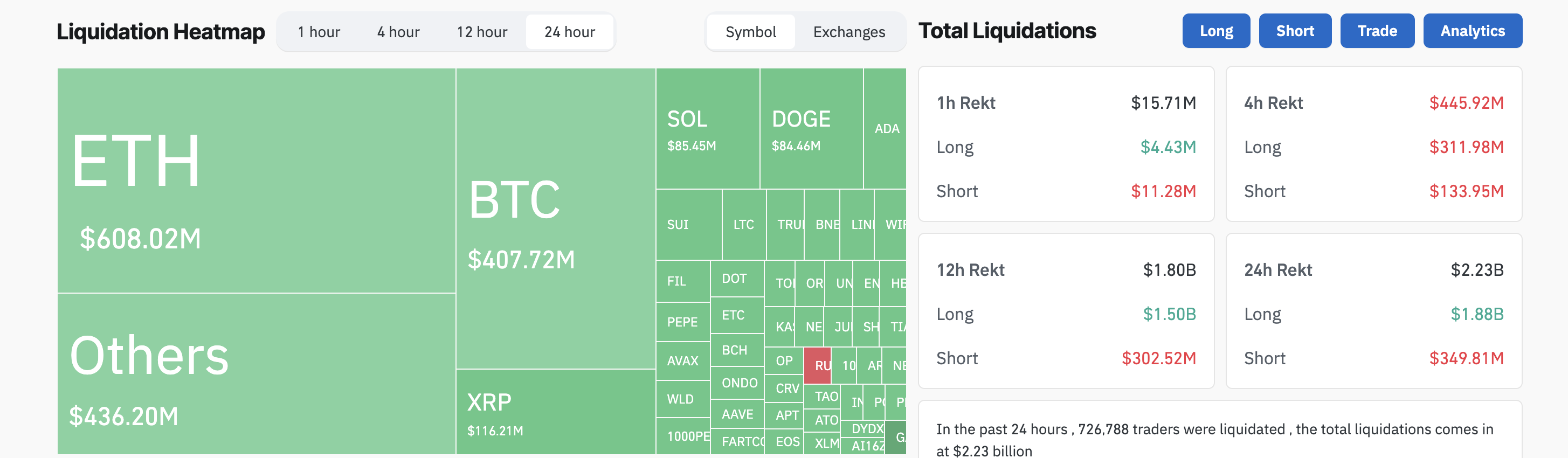

Over $2.23 billion has been liquidated in the last 24 hours, according to Coinglass.

$2.15b liquidated from the crypto market in the past 24 hours.

Worst liquidation event in history in a single day.

Worse than LUNA. Worse than FTX ($1.6b). pic.twitter.com/5yeQUtoHkR

— Miles Deutscher (@milesdeutscher) February 3, 2025

Deutscher went on to say that it was worse than the crashes of FTX and LUNA, which resulted in liquidations of $1.6 billion.

Long positions accounted for $1.88 billion and short positions for $349.81 million of the total liquidations. 726,788 merchants were liquidated in total.

Ethereum price crash: Key levels to watch & what this means for Altcoins?

Discover the main levels to monitor next and the reasons for the recent Ethereump rice fall. What would happen to altcoins if ETH bounces here?

Over the weekend, Ethereum (ETH) saw a significant sell-off and fell below the psychological $3,000 mark. In the last 30 hours, this fall has led to $613 million in liquidations. Let’s investigate why the price of Ethereum is plummeting and what lies ahead for ETH and other cryptocurrencies.

Why is Ethereum price crashing?

Crypto markets saw a huge sell-off over the weekend, primarily due to Bitcoin’s decline to $91K. The price of Ethereum fell 25% in the last 12 hours due to this abrupt decline, hitting a daily low of $2,125.

Following Trump’s signing of an order imposing 10% tax on China and 25% tariffs on goods from Canada and Mexico, the cryptocurrency market started to correct. On Tuesday, these modifications will go into effect.

In response to the state of the market, BitMEX co-founder Arthur Hayes stated,

“The beatings shall continue until moral improves. The pain stops when a TradFi outfit is on the verge of bankruptcy. Then the Fed reluctantly joins team Trump and prints dat money. And then you better be ready to buy #crypto like you have never bought before.”

Key levels to watch for ETH amid crypto market crash

The Ethereum price’s collapsing wedge structure has been undone by the collapse of the cryptocurrency market. ETH surged beyond the psychological milestone of $3,000 and overcame the September 6 low of $2,150. The swing low set by the weekend crash was $2,080.It’s interesting to note that the price of Ethereum is currently trading at over $2,500, up 20% from this swing low.

The price’s immediate support level as it rises is $2,341. Key resistance levels to keep an eye on on the upswing are $2,657, $3,057, $3,132, $3,592, $3,975, and $4,069, respectively.

What’s next for altcoins?

Can altcoins bounce back after Ethereum fell to $2,150 and Bitcoin crashed to $91K?

Popular analyst CryptoCapo, who predicted an ETH meltdown, hinted at the impending start of an alt season in a post on his Telegram.

The chart, however, indicates a recovery from $2,800 to $3,000, which was broken in the previous day when ETH made a swing down at the psychological level of $2,000 as well. In any case, the notion of an alt season endures and is reliant on an increase in the price of Ethereum.

Investors must realize that during the last few weeks, the majority of cryptocurrencies have experienced a 50% decline. Dogwifhat, Popcat, and others have fallen 90% from their highest point. Usually, these corrections only occur in bad markets.

Does this imply that there is a bear market in cryptocurrency? No. Not really. The long-term trend of Bitcoin is still bullish and is probably going to keep rising. Altcoins have a decent chance of recovering as long as this holds true. Additionally, historical evidence indicates that altcoins saw bullish post-halving years in February, which is consistent with Capo’s predictions.

Overall, the current fall has left the crypto market’s outlook bleak. Bitcoin is still robust, though, and the above-key BTC levels are still there. The Ethereum price forecast, which is currently neutral, might turn bullish if the price of Bitcoin rises.

Why are Dogecoin and Shiba Inu price crashing over 25% today?

This short article explains why, in light of general market trends, the prices of Dogecoin (DOGE) and Shiba Inu (SHIB) are plummeting by more than 25% in a single day.

As the week began, the price of Shiba Inu and Dogecoin, two well-known meme cryptocurrencies, showed a concerning decline, mostly due to general market trends. Notably, the intraday price of SHIB fell as low as $0.000012, while the price of DOGE fell to $0.2, which alarmed investors. The present downward trend in the aforementioned meme coins seems to be caused by a multitude of variables, such as investor apprehension and significant liquidations in the context of larger events.

Here’s the reason why DOGE and SHIB price are slumping over 25%

Some important causes that seem to be contributing to the top meme currencies’ 25% day-over-day decline are listed below.

1.Trump’s new tariffs cause the cryptocurrency market to crash due to trade war speculation.

Following the announcement of increased import tariffs by U.S. President Donald Trump, which sparked fears of a trade war, the worldwide cryptocurrency market just crashed. Global markets were rocked by the 47th president’s announcement of new, higher import taxes on China, Canada, and Mexico.

Even the cryptocurrency industry suffered as a result, with analysts predicting that a trade war might break out and impact international markets. At the same time, the new tariff hike has caused a market-wide drop, notwithstanding Trump’s pro-crypto stance. Altcoins experienced additional heat after Bitcoin fell as low as $91K. With DOGE and SHIB prices plunging, the meme coin industry even followed the pessimistic trend.

2. Increased Liquidations Affect Dogecoin and Shiba Inu Prices

The values of the meme currencies have also been under further pressure because to huge liquidations and general market instability. According to Coinglass data, Dogecoin had liquidations of $87.12 million over the previous day.

On the other hand, Shiba Inu had intraday liquidations of about $7.5 million. The current price collapse is further supported by these large liquidations, which put pressure on the asset to be sold.

3. Declining Futures OI Indicates Less Market Interest

Additionally, according to Coinglass data, DOGE futures OI fell 33% intraday to $2.44 billion. At the same time, SHIB futures OI fell by an astounding 46% intraday, hitting $155.01 million. All things considered, this data highlighted the decline in market activity around the meme coins, which reflected investor hesitancy in the face of general market conditions. One of the factors contributing to a price decline is this statistic.

What is the current performance of the tokens?

The price of Shiba Inu crashed by 22% at the time of publishing, and it is currently trading at $0.00001368. But the coin’s intraday low and high were $0.0000123 and $0.00001764, respectively, highlighting a day-long loss of over 25%. Notably, according to the most recent burn data, SHIB’s declining trend also coincides with a nearly 100% drop in its intraday burn rate.

The price of DOGE fell 21% intraday to $0.2394 in a same manner. $0.2117 was its 24-hour low, while $0.3061 was its 24-hour high. Because of the uncertainty surrounding previous trends, market observers are wary about potential future movements.