Reports from various sources indicate that Andreessen Horowitz has made a significant investment of nearly $90 million in Optimism’s OP token, underscoring its dedication to supporting the Ethereum layer 2 solution.

The acquisition is subject to a two-year vesting period, a common practice in the crypto sector for major investments, often involving the purchase of tokens at a discount.

Optimism has experienced a surge in activity, particularly with the growing adoption of its OP Stack, which plays a crucial role for developers in constructing and deploying layer 2 (L2) blockchains. A significant development occurred when the developers of the Celo blockchain selected the OP Stack for their new L2 project.

“Optimism has been performing impressively well. They’re still conducting airdrops,” commented one source regarding a16z’s investment.

“We are delighted with the momentum and enthusiasm that Optimism is garnering and are excited about the future,” stated an Optimism spokesperson.

As per CoinMarketCap, the value of the OP token stood at around $2.58 at 9:45 a.m. EDT, marking a 10.67% increase over the last 24 hours but reflecting a 27.8% drop over the past month.

The investment represents another strategic move into the crypto sector for a16z, which has previously backed major crypto entities like Coinbase. Coinbase’s Base, launched in 2023, competes with Optimism in offering an Ethereum layer 2 solution, vying for developers and projects within the Ethereum (ETH) ecosystem.

Earlier on March 7, the Optimism Foundation announced the sale of approximately 19.5 million OP tokens, valued at nearly $90 million at the time, to an undisclosed buyer. This sale comprises a 30% allocation from OP’s original treasury for the foundation’s operational budget.

The foundation clarified, “As this was a private sale, the terms and identity of the purchaser cannot be disclosed.

“Under the terms of the sale, the buyer has the option to delegate their tokens to third parties, allowing participation in Optimism governance, although specific details remain undisclosed.

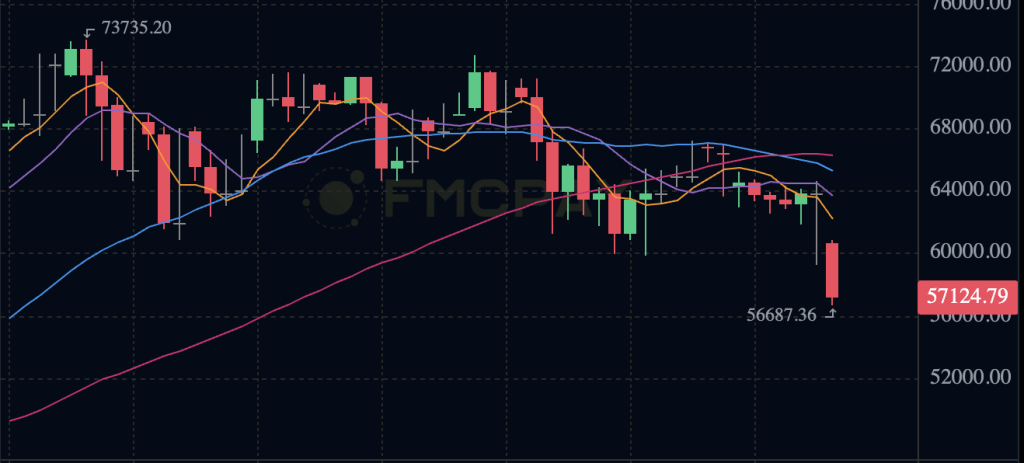

Bitcoin dropped to $56,600 as ETFs experienced 5 consecutive days without inflows.

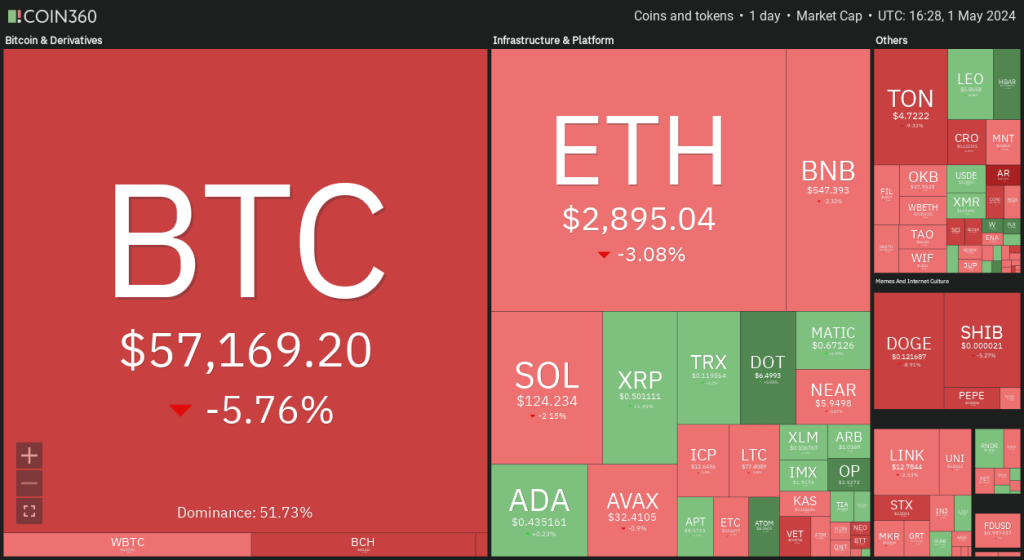

The cryptocurrency market continues its streak of price declines due to selling pressure from ETF funds. At the beginning of May, the price of Bitcoin suddenly dropped to $56,600.

Bitcoin experienced a sudden and sharp decline from $61,000 to just $56,600, the lowest level since late February.

BTC has decreased by 22% from its all-time high of $73,700 recorded in March. This morning, upon closing the April candle, the cryptocurrency saw a 14.7% drop, despite having a 16.8% increase in the previous month’s candle. Thus, Bitcoin has ended its streak of 7 consecutive months of growth, even recording the strongest monthly decline since November 2022 – the time of the FTX crash.

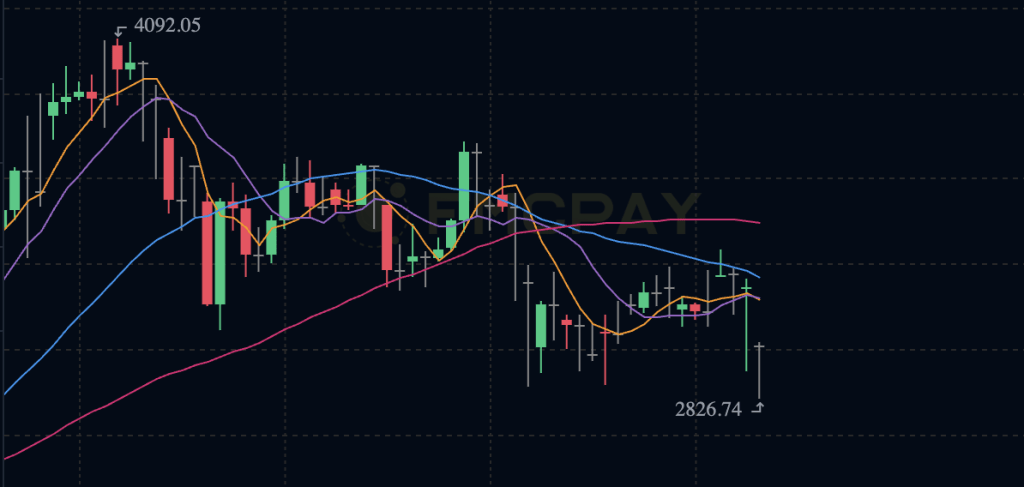

Following in the footsteps is Ethereum. ETH quickly lost its “top 3”, falling to only 2,817 USD.

16:27:37 UTC

Wednesday, 1 May 2024

When the two leading coins decreased by nearly 10%, the Altcoins behind were all in the same “blood-stained” situation.

The main reason is because Bitcoin ETFs have had no inflow for many days. If in the past ETF was the driving force driving the market price up, today the capital outflow from ETF is also the main pressure.

BlackRock’s IBIT has not recorded cash flow for 5 consecutive days and officially closed 71-day inflow series.

The newly traded ETF in the Hong Kong market, despite much anticipation, lacks the strength to uplift the market.

In May, we are likely to witness the SEC not approving the Ethereum spot ETF, adding to the overall pessimism prevailing across the industry, especially as this is a time when the “Sell in May and Go Away” adage dominates.

Additionally, another macroeconomic factor that could affect the market is the possibility of the Fed maintaining interest rates after the upcoming meeting in May 2nd.