Just Monday, the BlackRock Bitcoin ETF (IBIT) added 5,613 BTC, valued at $530 million, continuing its 15-day inflows.

Following the asset manager’s acquisition of 5,613 BTC from the open market on Monday, BlackRock Bitcoin ETF inflows have once again surged. BlackRock iShares Bitcoin Trust (IBIT) has seen inflows for 15 days in a row, totaling $4.5 billion. However, the price of Bitcoin is still stable at $94,500, and institutional interest points to a potential increase to $100K and higher.

BlackRock Bitcoin ETF inflows on the rise

For 15 days in a row, BlackRock’s iShares Bitcoin Trust (IBIT) has dominated the market with total inflows. With a further 5,613 BTC worth $530 million on Monday, the asset manager’s total inflows since launch have now surpassed $44 billion once more.

Furthermore, data indicates that during the first quarter of this year, asset management BlackRock raised its holdings in the iShares Bitcoin ETF by 124%. In light of changing market conditions, this move increases BlackRock’s overall stake in the ETF to an outstanding $314 million, indicating a rising institutional desire for Bitcoin exposure.

The total amount of money invested in Bitcoin ETFs on Monday was $425 million. According to statistics from Farside Investors, yesterday saw net withdrawals from Fidelity’s FBTC, Bitwise’s BITB, Grayscale’s GBTC, and other stocks, while BlackRock’s IBIT received $530 million in inflows. Eric Balchunas, senior ETF strategist at Bloomberg, said:

BlackRock’s “IBIT in the top spots, just like last year when ‘beta with a side of bitcoin’ was the big theme. $IBIT now 8th in YTD flows (was out of Top 50 at one point) with +$6.4b. Been hoovering up btc like a madman ever since the decoupling”.

BTC price eyes $100K levels

As the price of Bitcoin hovers around $94,500 levels for the past week, BTC MVRV levels indicate that a lot of the froth has been eliminated, paving the way for rises to $100K levels. According to well-known cryptocurrency expert Kyledopps:

“The froth is gone — the reset is real. Bitcoin’s MVRV just touched its long-term mean at 1.74 — a classic sign of flushed-out unrealized gains. Hold this level? It’s a clean reset and a setup for recovery”.

Given that the Bitcoin price prediction indicator predicts that the commodity will hover around $94,600 over the course of the next month, it will be fascinating to observe how quickly BTC can restart its upward trajectory over $100K. Nonetheless, more inflows into Bitcoin ETFs may serve as a spur for the upcoming surge.

Tether mints $8 billion USDT in short time, crypto market rally soon?

In only one week, Tether has generated $8 billion in USDT over the Ethereum and Tron networks, igniting concerns of a cryptocurrency market boom.

With $8 billion worth of stablecoins added to the Tron and Ethereum blockchain networks in the last eight days, Tether has been on a massive USDT minting rampage over the past week. The wider cryptocurrency market rise may benefit from this new supply of USDT stablecoins, which might help it overcome the present consolidation stage.

Tether mints 1 billion USDT on Tron blockchain

Just four hours ago, Tether generated another $1 billion in USDT on the Tron blockchain, which is a noteworthy event. The company’s aggressive issuing strategy continues with this.

Additionally, on-chain data shows that the company has increased the amount of stablecoins it has on hand by an astounding $8 billion since April 28 across the Ethereum and Tron blockchain networks. This aids USDT in maintaining its advantage over rivals like as USDC, BUSD, RLUSD, and so on. Additionally, the trend highlights the growing need for liquidity and the use of stablecoins in trading and decentralized finance (DeFi) ecosystems.

The total amount of USDT issued on Tron has increased to $71.4 billion, according to the Tether transparency report. The Ethereum network now has $72.8 billion USDT in circulation. Tron may overtake Ethereum as the top network for the biggest stablecoin issuer in the world, a title it has held intermittently over the last two years, with just an extra $1.4 billion USDT.

With a circulating supply of $1.9 billion, Solana is the third-largest network for the USDT stablecoin, behind Tron and Ethereum. The total amount of USDT in circulation has increased by 8.6% since the year began, reaching an all-time high of $149.4 billion USDT.

Consequently, it currently holds an astounding 61% of the stablecoin market. Additionally, Tether CEO Paolo Ardoino thinks the Trump administration’s support for cryptocurrencies may help the company increase its market share in the coming years.

Ardoino also hinted at the release of a product driven by artificial intelligence (AI) and intended for decentralized applications. When it is released, the invention, known as “Tether AI,” is anticipated to cause a spike in the volume of Bitcoin and USDT transactions.

Crypto market rally ahead?

Given that the price of Bitcoin has been hovering around $94,500 for the past week and that altcoins are consolidating strongly, the latest USDT minting may serve as a trigger for future cryptocurrency market gains.

In addition, U.S. Treasury Secretary Scott Bessent fueled expectations of a significant cryptocurrency market boom while urging the Federal Reserve to lower interest rates.

Additionally, proposals to reduce tariffs on China have been revealed by U.S. President Donald Trump. According to Trump, the present 145% charge is too high and a trade barrier, and he intends to reduce it.

Litecoin down 5% after SEC delays ETF filing over fraud concerns

Canary Capital’s application for a Litecoin ETF was postponed by the SEC today, allowing the public to comment on whether the idea complies with regulatory standards. The statement caused a 5% decline in the price of LTC.

The Commission’s aims don’t seem to be communicated through the public comment component; this might just be a common delay strategy. However, the market saw it as a negative indicator right away.

Will the SEC reject Canary’s Litecoin ETF?

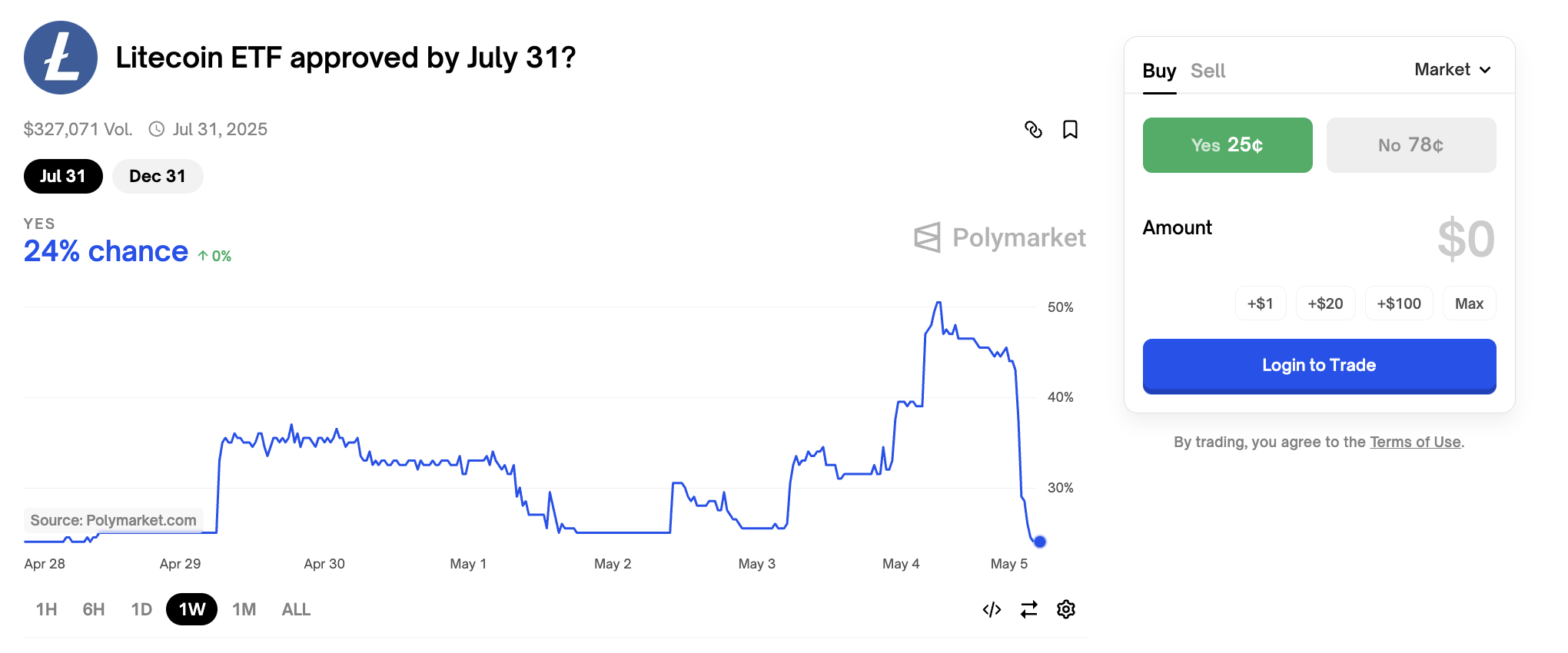

Analysts said a few months ago that the Litecoin ETF had a higher chance than any other cryptocurrency ETF of receiving SEC clearance. In February, its Polymarket odds momentarily hit 85%, and the SEC deadline today fueled even more community excitement.

Instead, the SEC chose to postpone this application and included a notice asking for public comments:

“The Commission seeks and encourages interested persons to provide comments on the proposed rule change. The Commission asks that commenters address the sufficiency of [whether] the proposal… is designed to prevent fraudulent and manipulative acts and practices or raises any new or novel concerns not previously contemplated by the Commission,” it read.

To be clear, this request does not always indicate a negative trend. The SEC recently postponed a number of the cryptocurrency ETF applications that it is currently considering.

In February, it even launched a public feedback period for a proposed Litecoin ETF. Put otherwise, this may be a common strategy for postponement. Regretfully, it has not been well received by the market.

After the Commission postponed this application, the price of Litecoin dropped rapidly, reaching its lowest point at 5%. The likelihood of a 2025 approval mostly stayed constant, while Polymarket’s chances of approving a Litecoin (LTC) ETF in Q2 2025 also fell.

The most optimistic projections were that cryptocurrency ETF approvals may occur in Q2, but this wager now appears improbable.

To put it another way, things might be far worse. ETF expert James Seyffart, who foresaw the Litecoin delay, remained silent on the subject of public criticism. The idea that the SEC is indicating that it would reject this or any other cryptocurrency ETF proposal sounds implausible.

However, traders are shifting their bets to the altcoin since the market may respond negatively to such occurrences in the near future.