In addition to his forecasts for Solana and Aptos, the creator of BitMEX stated that the most threat to the cryptocurrency sector would be the breach of a significant cryptocurrency custodian.

Arthur Hayes, the CEO of BitMEX, recently discussed his views on the direction that cryptocurrency will go in the future as well as which projects should get more attention. Apart from discussing Dogecoin exchange-traded funds, Hayes also mentioned that he anticipates significant competition from Aptos for Solana.

Aptos to flip Solana as no.2 layer-1 platform

BitMEX creator Arthur Hayes said that Aptos will surpass Solana to become the second most popular Layer 1 blockchain in a recent interview with Coin Bureau. It’s interesting to note that Hayes believes this change won’t occur for another one to three years. He did, however, state that by September 2024, he will have more information on his forecast.

Aptos is a Layer-1 Proof-of-Stake (PoS) blockchain that uses the Move smart contract programming language, much as Solana. Aptos appears to be bringing Web3 into the mainstream and enabling a dApp ecosystem to address real-world issues.

Arthur Hayes also discussed meme coins, stating that they are here to stay and referring to them as the “luxury brand” of cryptocurrencies. Arthur Hayes has stated that he thinks Dogecoin (DOGE) ETF may arrive by the conclusion of current market cycle. He also emphasized Dogecoin’s availability on well-known sites like Robinhood and its distinction as the first meme coin. He did, however, note that the meme currencies that are presently in use don’t have any lasting cultural significance.

Crypto custodians face the biggest risk

The most significant issue raised by Arthur Hayes was the increase of cyberattacks in the cryptocurrency industry. The possible attack of a significant cryptocurrency custodian is one of the worst threats to the cryptocurrency sector over the next two to three years, he continued.

As an indication of the end of the current market cycle, the creator of BitMEX estimates that such an event might include the loss of $50 billion to $100 billion in digital assets.

It will be fascinating to observe how long Aptos takes to truly flip Solana. There have also been previous demands for Solana to switch Ethereum at some point in the future.

Check Out the Latest Prices, Charts, and Data of DOGE/USDT

ZkSync defends Sybil measures as Binance offers own ZK token airdrop

As many people as possible would receive an allocation, according to ZK Nation’s Sybil filtering technique, but some Sybils would unavoidably slip through.

The Ethereum (ETH) zero-knowledge layer-2 scaling platform zkSync has persisted in addressing criticism directed at the requirements for the June 17 launch of its zkSync (ZK) token airdrop.

ZK Nation provided answers to 15 queries in a frequently asked questions (FAQ) document that was last updated on June 15. The majority of the answers explained why certain groups were qualified for the token while others weren’t.

The identification and prevention of Sybil assaults, which occur when a single entity creates and utilizes a large number of wallets to farm an airdrop, was the subject of one of its longest responses. As of last week, airdrop claimants were still experiencing difficulties with these attacks.

ZkSync reaffirmed that in order to guarantee that the greatest amount of organic users received rewards, it employed both “explicit” Sybil detection and a “unique airdrop design.” However, it also pointed out that this resulted in some Sybil wallets being leaked.

We were overwhelmed with the flow of information and emotions in the first days after announcement. We focused initially on listening, verifying the methodology to exclude any mistakes, collecting feedback and trying to systematize it.

We then started to write a comprehensive…

— ZK Nation (@TheZKNation) June 15, 2024

It clarified how some Sybils might use extremely complex computational techniques that make them appear identical to human beings.

“They fund accounts from many distinct exchange addresses, never interact with each other, use randomized amounts, and use software to randomize daily patterns of human behavior, and even perform activities unique to the project (for example, using zkSync paymasters),” it explained.

“The majority of such bots are completely undetectable, even with the most advanced anti-Sybil methodology.”

ZkSync decided to reward organic users with “high likelihood” by combining value scaling and multipliers since it claimed that being very strict with screening might remove some Sybils but also wrongly flag many genuine users.

In essence, this meant that wallets with limited funding—a hint of Sybil behavior—were given less qualifying points, but if there was onchain conduct that indicated human behavior, they would receive a doubling increase.

According to ZkSync, in order to maximize capital efficiency, Sybils usually opens a large number of accounts but funds each one with a tiny quantity of cryptocurrency.

Introducing the ZK Token

Checker → https://t.co/O2UonCvfzi

Announcement → https://t.co/hjgI14PHoi

Docs → https://t.co/taWBoCnfbcIt’s time to put the ZK token into the hands of the community. It’s your turn to govern ZKsync’s future. pic.twitter.com/VD3fZgH5bf

— ZK Nation (@TheZKNation) June 11, 2024

“Real people, on the other hand, tend to concentrate most of their wealth in just a few accounts, making their balances much larger compared to bots,” it explained.

“There will be Sybils in every airdrop,” it concluded. “However, for every example of Sybil that can be identified, there are hundreds that were excluded.”

Check Out the Latest Prices, Charts, and Data of ETH/USDT

Binance offers ZK listing and distribution amid “ongoing concerns”

It happens at the same time that cryptocurrency exchange Binance launched its own ZK airdrop, intended for anybody who missed out on the June 17 official airdrop.

Over 52,000 Binance customers would get 10.5 million ZK tokens from the exchange in “light of the ongoing concerns from the community around ZK token distribution,” according to the statement.

In order to be eligible for an airdrop, claim addresses must not have been a CEX, bridge, or contract address, have completed at least 50 transactions on zkSync Era between February 2023 and March 2024, and have done transactions for at least seven months during that time.

But the maximum amount that each Binance user will receive is 200 ZK.

Beginning on June 17, the exchange will now allow traders to swap the ZK token for Bitcoin (BTC), Tether USDT, and First Digital USD (FDUSD).

On June 17, the ZK token airdrop will begin. The ZK coin is presently trading pre-market for 36 cents, per Whales Pro.

Check Out the Latest Prices, Charts, and Data of BTC/USDT

Convex Finance price rallies 100%, traders bet on its downfall

Over the course of the previous day, Convex Finance’s (CVX) stock saw an amazing increase. Traders are already placing bets on its decline.

As of this writing, CVX is trading at $4.28, up 100% over the previous day. The last time this price level was observed was during a brief upswing in the overall cryptocurrency market at the end of March.

Additionally, CVX’s market capitalization increased to $415 million, positioning it as the 155th biggest cryptocurrency. The asset’s daily trading volume reached $150 million after rising by 2,800%.

According to data, the total value locked (TVL) in the decentralized finance (defi) protocol of Convex Finance increased by 1% in the last day and is presently at $1.31 billion.

Without placing the liquidity on Curve Finance, Convex Finance enables liquidity providers on Curve Finance to stake the tokens on the platform and get a portion of the trading fees in cvxCRV tokens.

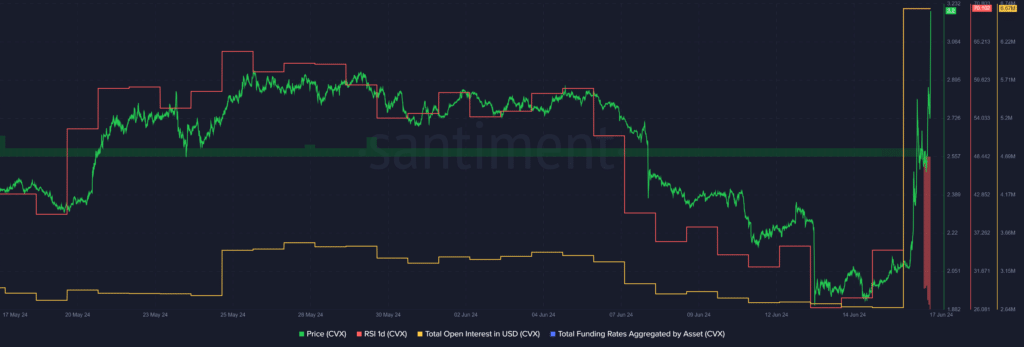

Santiment’s data indicates that within the last day, there was a 151% increase in the total open interest in CVX. This demonstrates that traders are driving up price volatility in an attempt to profit short-term from the asset’s abrupt changes.

The market intelligence platform’s data indicates that on the previous day, CVX’s total funding rate decreased from 0.01% to negative 0.17%. Based on the chart, traders are presently placing bets on a decline in the price of CVX.

According to Santiment, over the previous day, the CVX relative strength index (RSI) increased from 34 to 70. The signal suggests that there may have been whale manipulation and that CVX is overbought.

Since its open interest and RSI have suddenly increased, CVX is presently a very volatile asset.