The next frontier of expansion, programmability through decentralized finance (DeFi), is being investigated by Bitcoin developers. According to recent advances, Bitcoin’s adaptability may soon catch up to Ethereum’s, which might lead to a large market growth.

Bitcoin developers work on enabling programmability

The focus now is on DeFi’s ability to turn Bitcoin into a more dynamic, programmable platform rather than just digital gold. The co-founder of the Ordinals project, OrdinalsBot, Toby Lewis, thinks the Bitcoin DeFi ecosystem has the potential to become the biggest in the whole cryptocurrency space.At present, the total value locked (TVL) of Bitcoin is $1.137 billion.

“It is possible that the Bitcoin DeFi ecosystem could grow to trillions of dollars of market cap over the next few years, and it appears to be one of the major drivers of growth in crypto this cycle.”

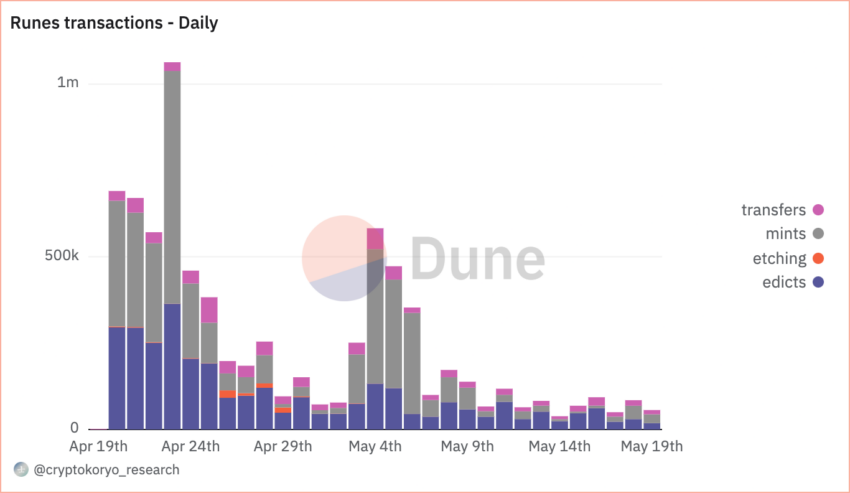

Bitcoin has always been perceived as a store of wealth with little use outside of investing. Bitcoin has not been able to enable smart contracts or an extensive ecosystem of apps like Ethereum can. Nonetheless, engineers are now working hard to close this gap with creative fixes.The emergence of Bitcoin layer 2 networks, like Lightning, which seek to improve Bitcoin’s scalability and usefulness for applications like payments, is one of the most talked-about developments. In spite of past failures and weaknesses, the community’s unwavering search for reliable and safe solutions has produced innovative protocols.A major milestone was reached in 2023 when the Bitcoin Ordinals protocol made it possible to create non-fungible tokens (NFTs) directly on the Bitcoin network. The suggestion of BRC-20 coins by Domo, an unidentified developer, broadened this even more. By utilizing a comparable inscription technique, these tokens greatly improve the programmability of Bitcoin.Other options are also being investigated by developers. One such option is OP_CAT, a prospective software update that would make programmability on the Bitcoin network easier to execute. This idea has received strong support from the developer community and is now being reviewed.Nonetheless, there are difficulties in incorporating programmability into the Bitcoin network. The enthusiasm around the recent release of the Runes protocol, which makes it easier to create altcoins on the Bitcoin blockchain, subsided after a brief spike in activity.

On April 23, the Runes transaction reached a million at its highest point. But as of May 19, there had only been 56,372 transactions.

Check Out the Latest Prices, Charts, and Data of BTC/USDT

Layer Zero identifies 800,000 possible sybil addresses, reduction from 2 million at first

800,000 addresses in total have been flagged by LayerZero Labs as possible sybil addresses, excluding them from receiving the whole token allotment.The group first recognized more than two million addresses as possible sybils, but they subsequently improved their standards to reduce false positives.The outfit in question, known as “airdrop farming,” recently declared on X that the sybil self-reporting phase of their campaign to counter sybil activities has come to an end.The project intends to solve the problem of users using several fictitious accounts in order to obtain unfair benefits while allocating tokens.As per LayerZero, addresses that satisfy the given requirements will get 15% of their anticipated token distribution, with the remaining 85% being awarded to qualified users.

800,000 addresses in total have been flagged by LayerZero Labs as possible sybil addresses, excluding them from receiving the whole token allotment.The group first recognized more than two million addresses as possible sybils, but they subsequently improved their standards to reduce false positives.The outfit in question, known as “airdrop farming,” recently declared on X that the sybil self-reporting phase of their campaign to counter sybil activities has come to an end.The project intends to solve the problem of users using several fictitious accounts in order to obtain unfair benefits while allocating tokens.As per LayerZero, addresses that satisfy the given requirements will get 15% of their anticipated token distribution, with the remaining 85% being awarded to qualified users.

LayerZero reveals list of sybil addresses

The full list of addresses—which includes those that were self-reported as well as those found during the preliminary investigations carried out by LayerZero, Chaos Labs, and Nansen—is available to the public.In order to encourage honesty within a specified 14-day timeframe, LayerZero launched a self-reporting mechanism on May 3rd, rewarding Sybil users with 15% of their intended token allotment.The researchers explained that the released list intends to exclude large-scale industrial sybil clusters from eligibility for bounty hunting, while the first investigation sought to detect such clusters.It should be mentioned that addresses may be added or removed as computations are adjusted, therefore the list should not be regarded as complete until the final report is released.

The sybil self-report phase has now concluded. Each self-reported address will receive 15% of its intended token allocation, with the remaining 85% returning to qualified users.

Between the sybil self-report and analysis by LayerZero, @chaos_labs, and @nansen_ai, 803,093… pic.twitter.com/wH9eFcMWV5— LayerZero Labs (@LayerZero_Labs) May 18, 2024

Beginning on May 18 at 2:00 PM UTC and running until May 31, at 11:59 PM UTC, is the Sybil bounty seeking procedure.For each reported Sybil address, participants will get 10% of the planned token distribution as a reward if they submit a minimum of 20 addresses and a documented methodology.The first qualified reporter of a given address will receive the rewards.While the LayerZero team is always striving to make their approach more accurate, the initial list of discovered addresses will not alter during the course of the bounty search.Bounty seekers do not need to worry about the preliminary list; when the bounty search is over, the definitive and final list will be released.

Sybil farming becomes prevalent

The practice of “sybil farming,” which involves making several fictitious accounts in order to get tokens or prizes unjustly, has become a major problem for decentralized financial systems.These protocols frequently use airdrops, which provide newly produced coins to early users in an effort to increase user involvement.In September 2023, LayerZero’s ZRO became the first Hyperp (a Perp exclusive to Hyperliquid) to be launched on the HyperLiquid perpetual futures decentralized market. Sybil farming has been documented in the cryptocurrency world in the past.Approximately 17,000 wallets that were suspected of engaging in sybil behavior were excluded from Optimism’s airdrop in 2022, making up 6.83% of wallets that were eligible.Similar to this, in September 21,877 wallets engaged in sybil farming were found by a network called ZkSync Era. The wallets were using a secret decentralized exchange to transfer a closed-source coin among themselves.

Ethereum price: Whale moves $46M ETH amid price rally

Significant whale activity has been sparked by Ethereum’s recent price spike, raising questions about the token’s potential future direction. Discover the most recent advancements and industry research in this thorough summary. In the larger crypto market, Ethereum (ETH) has drawn the interest of investors and enthusiasts alike once more. The cryptocurrency has become the center of attention after a significant price increase that has been seen over the last week, with on-chain statistics indicating increased participation from institutional investors. A notable change in the cryptocurrency environment has occurred as a result of the price of Ethereum rising again. This has sparked a wave of whale behavior.

In the larger crypto market, Ethereum (ETH) has drawn the interest of investors and enthusiasts alike once more. The cryptocurrency has become the center of attention after a significant price increase that has been seen over the last week, with on-chain statistics indicating increased participation from institutional investors. A notable change in the cryptocurrency environment has occurred as a result of the price of Ethereum rising again. This has sparked a wave of whale behavior.

Ethereum whale activity sparks market speculation

The second-largest cryptocurrency by market capitalization worldwide, Ethereum (ETH), has garnered attention once more following a notable price rebound over the last day. During this rebound, on-chain data has shown significant activity by large holders—also known as whales—which may indicate changes in the market structure. One such example is the whale known as 0x7f1, who just placed 15,000 ETH into the Kraken exchange at a price of $3,065, which is worth about $45.98 million.Crypto fans are speculating on where the price of ETH will go in the future in response to this significant transaction. A dispute between investors who see Ethereum as a profitable investment opportunity and others who could be profiting from recent price changes has been reflected in the market sentiments sparked by the surge of these transactions. Remarkably, in early September 2022, the same whale had already transferred 120,874 $ETH from Kraken at an average price of $1,645. The whale currently owns 105,874 $ETH, valued at $326 million, and has made a total profit of $173 million, or an incredible +87%.

Analyzing ETH price movement and market dynamics

The price of Ethereum has increased somewhat over the last 24 hours (by 0.51%) and significantly over the last week (by 7.23%). ETH is trading at $3,126 right now, with a price range that fluctuates between $3,135.70 and $3,056.20. According to Coinglass market statistics, there has been a slight fall of 1.55% in ETH’s open interest, coupled by a significant drop of 51.55% in options volume.

Check Out the Latest Prices, Charts, and Data of ETH/USDT The observed volatility in Ethereum’s price movement may be attributed to these swings in trading activity. However, Ethereum is still able to maneuver through difficulties with cautious optimism, even in light of market uncertainty around regulatory hurdles and the postponed anticipation of an ETH exchange-traded fund (ETF).With the Relative Strength Index (RSI) at 57.35 right now, it indicates a growing positive attitude that may put short-term pressure on the price of ETH. Furthermore, Ethereum is still in a position to profit from emerging market trends as the larger cryptocurrency market waits for the possible altcoin comeback that follows the Bitcoin halving event.

The observed volatility in Ethereum’s price movement may be attributed to these swings in trading activity. However, Ethereum is still able to maneuver through difficulties with cautious optimism, even in light of market uncertainty around regulatory hurdles and the postponed anticipation of an ETH exchange-traded fund (ETF).With the Relative Strength Index (RSI) at 57.35 right now, it indicates a growing positive attitude that may put short-term pressure on the price of ETH. Furthermore, Ethereum is still in a position to profit from emerging market trends as the larger cryptocurrency market waits for the possible altcoin comeback that follows the Bitcoin halving event.

Join the FMCPAY Affiliate Program now!