The price volatility of Bitcoin (BTC) continues to pose a dilemma for investors. Early Monday, it plummeted to $54,200, wiping off gains from a weekend high of almost $58,500.

The previous several hours have been unusually volatile, with huge volatility and liquidations dominating the market.

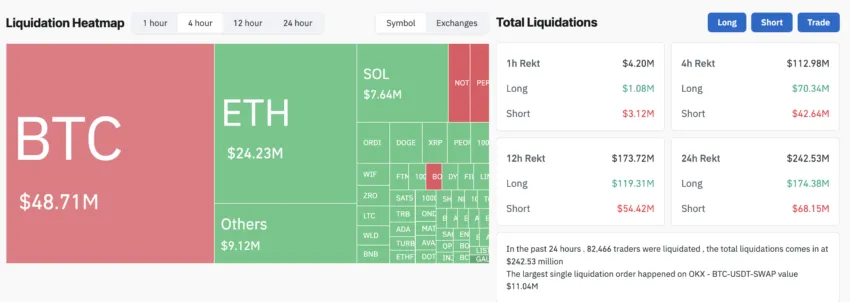

Bitcoin causes liquidations of over $100M in the last 4 hours

Despite a hopeful attempt at recovery on Sunday, Bitcoin (BTC) saw firm opposition, resulting in a steep fall. Within four hours, the market suffered $113 million in liquidations, including $70 million from long holdings and $42.64 million from short ones. In all, approximately $250 million in transactions were liquidated in the last 24 hours, showing that market conditions remained tumultuous.

In an interview, Avinash Shekhar, co-founder of the crypto derivative exchange Pi42, discussed the market’s volatility.

“Bitcoin’s price is locked in a tug-of-war between bulls and bears. Sellers pulled the price down to near $53,500 on July 5, yet lower levels attracted buying by the bulls. Then, bears again drove the price down from $58,300 to $54,200 in the morning of July 8,” Shekhar said.

Despite a hopeful attempt at recovery on Sunday, Bitcoin saw firm opposition, resulting in a steep fall. Within four hours, the market suffered $113 million in liquidations, including $70 million from long holdings and $42.64 million from short ones. In all, approximately $250 million in transactions were liquidated in the last 24 hours, showing that market conditions remained tumultuous.

In an interview with BeInCrypto, Avinash Shekhar, co-founder of the crypto derivative exchange Pi42, discussed the market’s volatility.

Meanwhile, Mt. Gox investors and the German government might apply selling pressure. According to recent allegations, Bitcoin addresses linked to German authorities moved 700 BTC, worth $40.47 million, to an undisclosed ‘139PoP’ account over the weekend, as spotted by Arkham’s on-chain analytics.

This conduct is part of a larger pattern of behavior by the German government, which has recently sent large amounts of Bitcoin to key exchanges such as Coinbase, Bitstamp, and Kraken. These actions followed the confiscation of 50,000 BTC earlier this year from the film pirate website Movie2k.

The mix of optimism and caution in the cryptocurrency market continues to spark discussion and conjecture among players. However, the attitudes lean more toward terror. The cryptocurrency fear and greed index shows a score of 28, which is in the fear zone.

Check Out the Latest Prices, Charts, and Data of BTC/USDT

Japan’s Metaplanet buys another Bitcoin dip, will the stock rally continue?

Metaplanet’s stock price rose 2.5% in post-lunch trade on the newest Bitcoin purchase announcement. The company’s Bitcoin holdings as a percentage of its market capitalization continue to increase.

Every week, Japan’s publicly traded corporations increase to their Bitcoin holdings. Metaplanet took advantage of the Bitcoin (BTC) price drop by purchasing an extra 42.47 Bitcoins valued 400 million yen, or $2.42 million. Interestingly, the Bitcoin buy occurred when the BTC price fell below $54,500 earlier today.

Metaplanet on Bitcoin accumulation spree

Metplanet, a Japanese corporation, has made a significant shift by implementing a Bitcoin accumulation strategy. As a result, it is also known as the MicroStrategy of Japan. Metaplanet is expanding its Bitcoin investing strategy by launching a new company in the British Virgin Islands. This action is intended to strengthen its position in the cryptocurrency market and build its Bitcoin reserves as part of a long-term financial plan.

*Metaplanet purchases additional 42.47 $BTC* pic.twitter.com/dPotWszW1Y

— Metaplanet Inc. (@Metaplanet_JP) July 8, 2024

Metaplanet has amassed a total of 203.734 Bitcoins during the previous month and more, with a total investment worth of 2.05 billion yen. Metaplanet’s market capitalization is now 14.5 billion JPY, with Bitcoin holdings on its balance sheet totaling 2 billion JPY. Bitcoin’s share of Metaplanet’s total assets continues to climb, with some market experts predicting it could surpass 100% in the near future.

Dylan LeClair, Director of Bitcoin Strategy at Metaplanet, is the mastermind behind all of these daring initiatives. In one of the most recent podcasts, Leclair stated that “Japan’s favorable environment for Bitcoin adoption presents a unique opportunity for corporate strategy and growth”. LeClair is also becoming known as Metaplanet’s ‘Michael Saylor’.

It was an honor to join the man who helped kickstart the #Bitcoin circular economy in El Salvador, Mike Peterson (@Bitcoinbeach), on his podcast.

We discussed the economical revival of El Salvador, global BTC adoption and the Metaplanet strategy.https://t.co/Xr2idqu3jl

— Dylan LeClair 🟠 (@DylanLeClair_) July 7, 2024

All eyes on the stock price

Metaplanet stock price has increased significantly when the business implemented a Bitcoin strategy. Following the Bitcoin purchase announcement, the stock price increased by 2.5% in Japan’s post-lunch trading session.

Metaplanet’s stock has risen by 382% since the beginning of 2024, with the company’s Bitcoin adoption strategy playing a significant role. Last month, Metaplanet’s share price peaked at 107 JPY. It will be fascinating to see if the rise can continue.

The Bitcoin price has dropped another 5.8% in the previous 24 hours, reaching an intraday low of $54,420. However, it has partially recovered to $55,500 as a result of Metaplanet’s Bitcoin acquisition today.

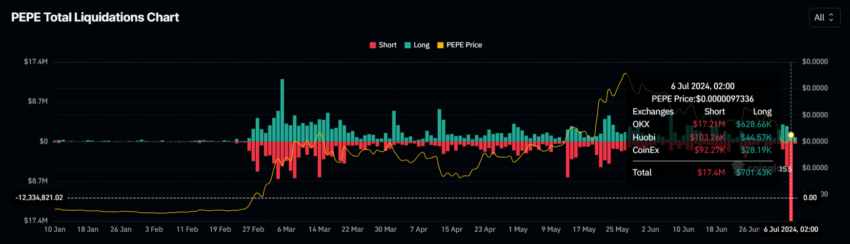

PEPE price rising by 9% causes largest liquidation in history

PEPE price was in the recovery zone, but even the possibly optimistic conclusion turned out to be unfavorable.

The investors suffered significant losses, but this may not discourage the huge wallet holders from continuing their buying binge.

PEPE hits the bears hard

The PEPE price rose by 9% in the previous 24 hours, shocking the market. Not because it resulted in the start of recovery, but because it caused large short liquidations.

According to Coinglass statistics, the meme currency recorded $17 million in short liquidations in a single day. This is the greatest liquidation in the meme coin’s history, indicating that bearish anticipated another drop in the PEPE price this weekend.

However, although this was bad news for bears, it was good news for other investors, particularly the top addresses, which included whales. Non-exchange addresses have the most PEPE compared to other individual addresses.

Over the previous three weeks, these investors purchased more than 1.5 trillion PEPE valued more over $13 million. This demonstrates that instead of becoming negative about the downturn, the top holders saw it as a chance to accumulate. This would be advantageous after the price has recovered.

PEPE price prediction: reclaiming the uptrend

However, although this was bad news for bears, it was good news for other investors, particularly the top addresses, which included whales. Non-exchange addresses have the most PEPE compared to other individual addresses.

Over the previous three weeks, these investors purchased more than 1.5 trillion PEPE valued more over $13 million. This demonstrates that instead of becoming negative about the downturn, the top holders saw it as a chance to accumulate. This would be advantageous after the price has recovered.

However, if this fails, a fall below $0.0000775 is probable, followed by consolidation below $0.00001000. This would undercut the bullish thesis.