We are witnessing a historic moment, and when the Bitcoin ETF is approved, it will have significant long-term implications for the entire crypto market. So, what are these impacts? Let’s explore them together in this article with FMCPAY.

👉 Read more: Bitcoin Spot ETF vs. Bitcoin Futures ETF

What is Bitcoin ETF?

ETF is short for Exchange Traded Fund, also known as a portfolio exchange fund. Essentially, ETFs operate by mimicking the fluctuations of a specific asset index that they use as a reference. This could be gold, silver, stocks, and in the case of a Bitcoin ETF, it will track the movements of the Bitcoin price in the market.

ETFs exhibit characteristics of both investment funds and retain the fundamental traits of ordinary stocks when listed and traded on traditional stock exchanges. This means that we have regulations regarding trading, and investors (participants) engaging in trading are legally protected. This is crucial, and we will delve deeper into this in subsequent sections.

The Acceptance of Bitcoin ETF Globally and in the U.S.

Bitcoin ETF is not an entirely new concept. To help FMCPAY readers better understand this issue, let’s explore the contrast in accepting Bitcoin ETF between the U.S. and the rest of the world in this section.

Bitcoin ETF Situation Worldwide

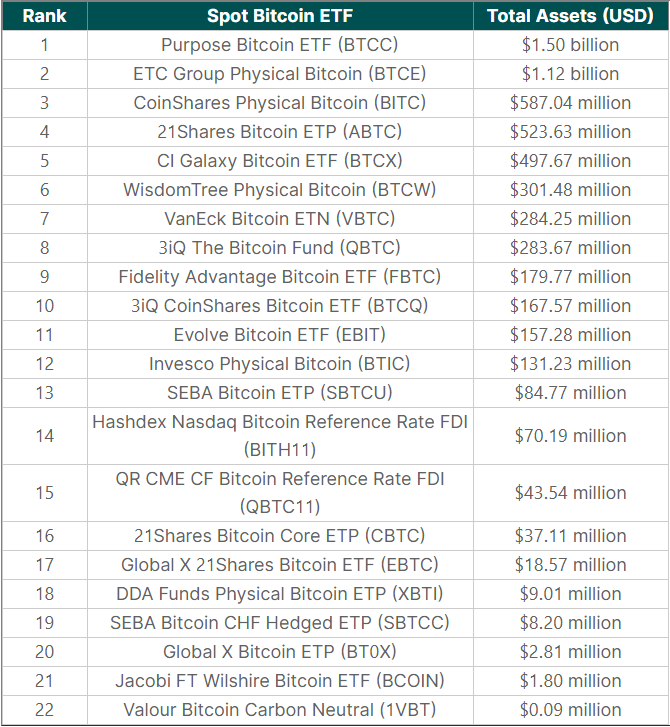

When it comes to Bitcoin ETFs, we cannot overlook Canada. The country has several ETFs focused on cryptocurrencies trading on the Toronto Stock Exchange, managing billions of dollars. 3iQ CoinShares, Purpose Bitcoin, and CI Galaxy Bitcoin are among the three largest funds. Purpose, in particular, is the largest with $1.2 billion in Assets Under Management (AUM) as of October 13, 2021.

Importantly, the top three Canadian ETFs all directly invest in spot Bitcoin. In contrast, the choice to invest in futures contracts represents only about $7.6 million in AUM, corresponding to 0.3% of the ETF market in Canada. According to FactSet, Purpose Bitcoin ETF is held by “undisclosed entities,” while about 28% of CI Galaxy ETF owners are institutions. This may imply that Purpose investors are individual investors.

Ranked by total assets in USD as of December 18, 2023, are as follows:

Bitcoin ETF Situation in the US

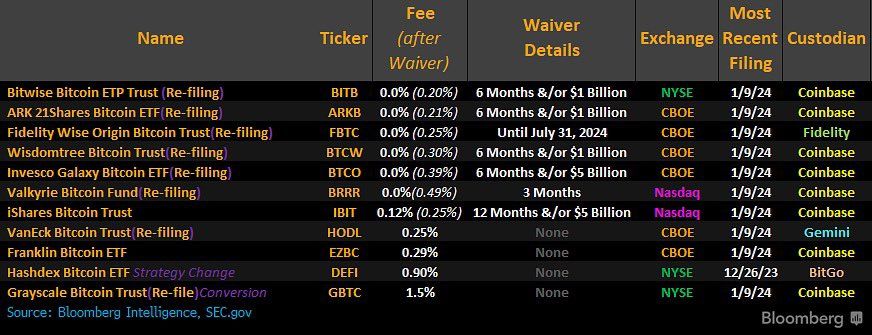

As of January 10, 2024, an announcement posted on the SEC’s official website outlined the approval of the 19b-4 registration application from ARK 21Shares, Invesco Galaxy, VanEck, WisdomTree, Fidelity, Valkyrie, BlackRock, Grayscale, Bitwise, Hashdex, and Franklin Templeton. This allows the listing and trading of Bitcoin spot ETFs on respective exchanges, starting from January 11. This marks a significant milestone after a decade-long struggle for a Bitcoin ETF in the crypto market.

The approval announcement aligns entirely with predictions from many industry experts. The crypto community is excited, driving rapid growth in the market. BTC is trading at $45,752, a 0.29% decrease in the last 24 hours. ETH, on the other hand, surged to $2,641, a 10% increase in 24 hours.

BTC had a victorious year with a 162.51% increase, starting from BlackRock’s entry into the ETF race in June. Despite a sudden drop due to news of the approval of a fake Bitcoin ETF on January 10, Bitcoin recovered afterward.

The spread of fake news further focused the community on the SEC’s announcement. Bitcoin ETF registrants such as BlackRock, Valkyrie, Grayscale, Bitwise, Hashdex, ARK 21Shares, Invesco Galaxy, Fidelity, Franklin Templeton, VanEck, and WisdomTree have been striving for a Bitcoin ETF for the past six months, making several amendments based on SEC requirements. This is the latest amendment detail in the transaction fee race:

Currently, all 11 Bitcoin Spot ETFs have appeared on the Bloomberg Terminal app (for Wall Street institutions):

Bitcoin ETF and Its Impact on the Crypto Market

The first day of ProShares’ Bitcoin ETF witnessed a trading volume of over $1 billion. However, what investors are interested in may not stop there. The addition of 11 Bitcoin ETFs today from the world’s largest funds promises to bring an explosion to the market.

Advantages of Bitcoin ETF

From a more positive perspective, Bitcoin ETFs can bring certain advantages to the market, including:

- Firstly, increasing traditional financial investors’ participation in the market: Investors accustomed to gold, silver, or stock markets may face barriers to investing in cryptocurrencies. Bitcoin ETFs can act as an intermediary bridge for them to gradually get used to this market. Risks related to storage issues may make investors lose their assets. Still, with Bitcoin ETFs, they can invest without worrying about management. Professional intermediaries will handle this issue.

- Secondly, cryptocurrencies are gradually recognized as part of the financial market. The listing of Bitcoin ETFs on exchanges indirectly proves the market’s prospects. The hypothesis that Bitcoin is a Ponzi scheme will disappear. No one will try to introduce a fraudulent model to deceive investors worldwide.

- Thirdly, Bitcoin ETFs will pave the way for the acceptance of other ETFs: If Bitcoin ETFs succeed, we may witness other ETFs such as Ethereum ETF, Cardano ETF, and more. Thus, the market will fundamentally become more vibrant. Investors will have more choices, meaning the market will be more open than before.

The approved Bitcoin spot ETF opens the door for large capital to enter the crypto market, with an inflow of $4 to $5 billion in just the first few weeks. Standard Chartered Bank estimates an investment of about $50 to $100 billion in Bitcoin ETF products in 2024.

BTC’s price could reach $100,000 in 2024 and $200,000 by the end of 2025. Additionally, Ethereum spot ETF has a chance of approval in Q2 2024.

Challenges of Bitcoin ETF

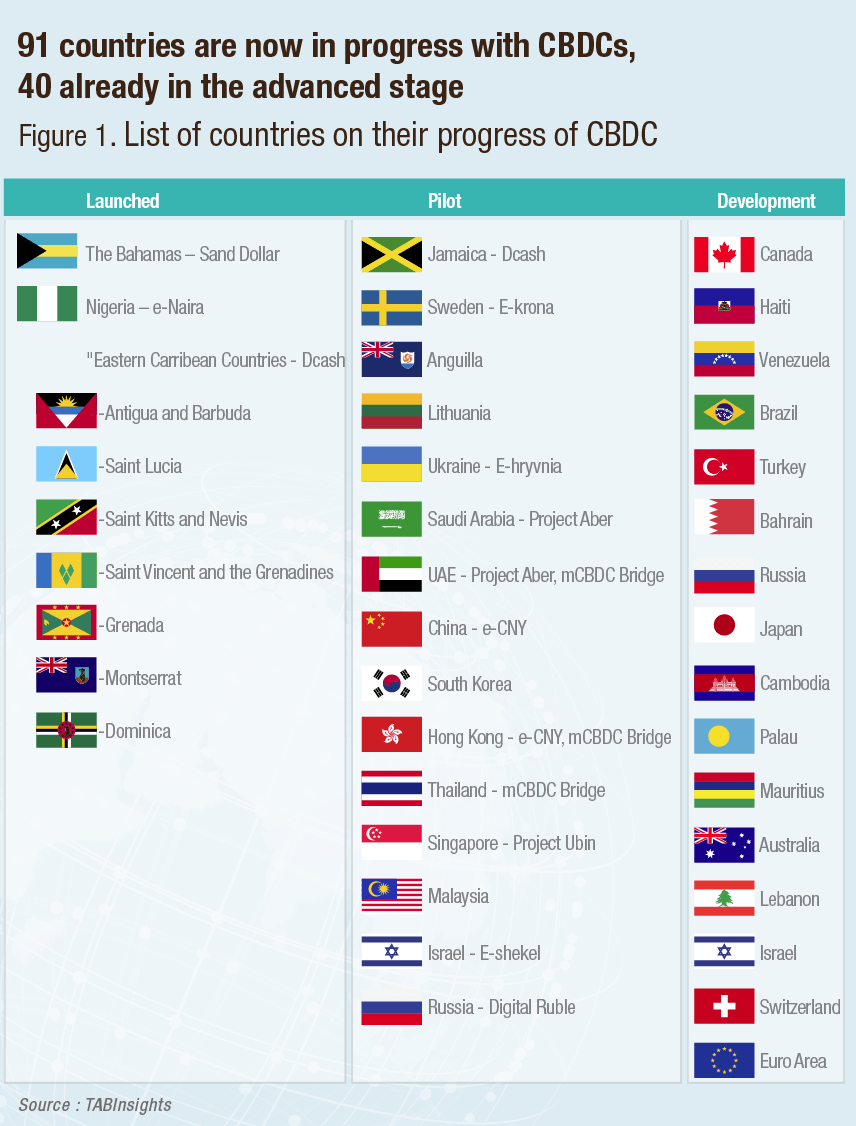

In reality, almost all countries worldwide lack a standardized legal framework for the cryptocurrency market. Every country is stuck between accepting or rejecting cryptocurrencies. For example, China, despite turning away from Bitcoin and other assets, actively introduces its own CBDC (Central Bank Digital Currencies). Recently, the second-most populous country, India, also plans to launch CBDC. On this journey, the idea of banning other cryptocurrencies is also forming.

It seems like banning other cryptocurrencies becomes an indispensable strategy for every country. Because the nature of this market is decentralized, no country can control it. If everything is left unchecked, undoubtedly the financial system and the national currency of that country will be affected. Just imagine if all individuals and businesses in the United States stop using the US dollar and switch to Bitcoin, what would happen to the US economy?

Conclusion

In the long term, Bitcoin spot ETFs will be highly favorable for the price of BTC, but in the short term, it is challenging to predict price volatility. Companies such as BlackRock, Ark Invest, etc., may have customers who have committed to buying BTC spot ETFs without publicly disclosing it. Therefore, predicting investor demand is difficult. Additionally, in the short term, there is both buying and selling pressure from Grayscale.

In the medium term, upon approval, companies, brokers also need to understand BTC spot ETFs before being ready to advise clients. Investment funds also need time to adjust their portfolios and inform clients, persuading them to invest. Therefore, money also needs time to penetrate the market.

Overall, I believe that approving Bitcoin ETFs will have a long-term impact on the cryptocurrency market. Bitcoin ETFs will help legitimize Bitcoin and bring broader acceptance from traditional investors.

FMCPAY RESEARCH (VINCΞ)