In the last week, Spot Bitcoin ETFs bought 18,644 BTC. The US-listed location is driving an aggressive surge of acquisitions. Bitcoin exchange-traded funds (ETFs) last week purchased over six times as much Bitcoin as miners produced.

Asset allocator HODL15Capital said on May 4 that spot Bitcoin ETFs had purchased 18,644 BTC in the previous week.

By comparison, just 3,150 BTC were mined throughout the same time span, or around 450 coins every day.

Institutional demand for Bitcoin ETFs surges as post-halving supply squeeze tightens

The purchasing frenzy demonstrates institutional investors’ increased interest, particularly as supply becomes more limited in the wake of the recent reduction.

Data from Farside Investors indicates that the total net inflow for the week was almost $1.8 billion, despite a net outflow on April 30.

There has only been one day of net withdrawals since April 16, as investor mood has been strengthened by the overall market rebound.

U.S. 🇺🇸 Bitcoin ETFs bought 18,644 Bitcoin last week vs. 3,150 mined 👇 pic.twitter.com/hTcUWECGr6

— HODL15Capital 🇺🇸 (@HODL15Capital) May 4, 2025

A little price increase also occurred at the same time as the purchasing frenzy. On May 2, Bitcoin jumped to a six-week high of $97,700 before settling back to about $94,000, where it is now, unchanged from a week ago.

BlackRock’s iShares Bitcoin Trust (IBIT), which has had an unbroken 17-day inflow run and generated close to $2.5 billion in the last five trading sessions alone, is leading the push.

In a blog post on May 3, Nate Geraci, president of ETF Store, pointed out that spot Bitcoin ETFs had grown to a market worth around $110 billion, despite restricted distribution access.

“Many wealth management platforms still block financial advisers and brokers from offering these products,” he said.

“That’s why I’ve said spot Bitcoin ETFs are operating with one hand tied behind their backs. Imagine the impact when those restrictions are removed.”

SEC to announce decision on Litecoin ETF

By May 5, the U.S. Securities and Exchange Commission is anticipated to make public its second deadline ruling regarding Canary Capital’s proposed spot Litecoin ETF.

In October of last year, the company also applied for a spot XRP ETF.

Although Litecoin has the highest chance of receiving early approval, Bloomberg ETF analyst James Seyffart stated that he still anticipates a delay. The cautious forecast was mirrored by fellow analyst Eric Balchunas.

The @CanaryFunds Litecoin ETF filing is due for a decision (possibly a delay) by Monday 5/5. SEC went early & delayed a bunch of filings but not this. If any asset has a chance of early approval it’s Litecoin IMO. Personally think a delay is more likely but def something to watch pic.twitter.com/FilnUcMtUH

— James Seyffart (@JSeyff) May 4, 2025

With a 90% approval chance, Solana and Litecoin are in the lead, followed by XRP (85%), Dogecoin and Hedera (80%), and Cardano, Avalanche, and Polkadot (75%), according to their most recent report.

The SEC has not yet approved any ETF products with staking capability, despite the fact that spot Bitcoin and Ethereum ETFs have previously been approved. This is something that is already the case in countries such as Canada and Europe.

In a related move, the Crypto Council for Innovation has urged the SEC to provide regulatory clarification on staking, supported by prominent companies like as a16zcrypto, Consensys, and Kraken.

The coalition encouraged the agency to support the prudent inclusion of staking in ETFs, arguing in a letter to Commissioner Hester Peirce that it is a technical procedure rather than a securities transaction.

According to Bloomberg, the SEC is still considering over 70 cryptoETF applications.

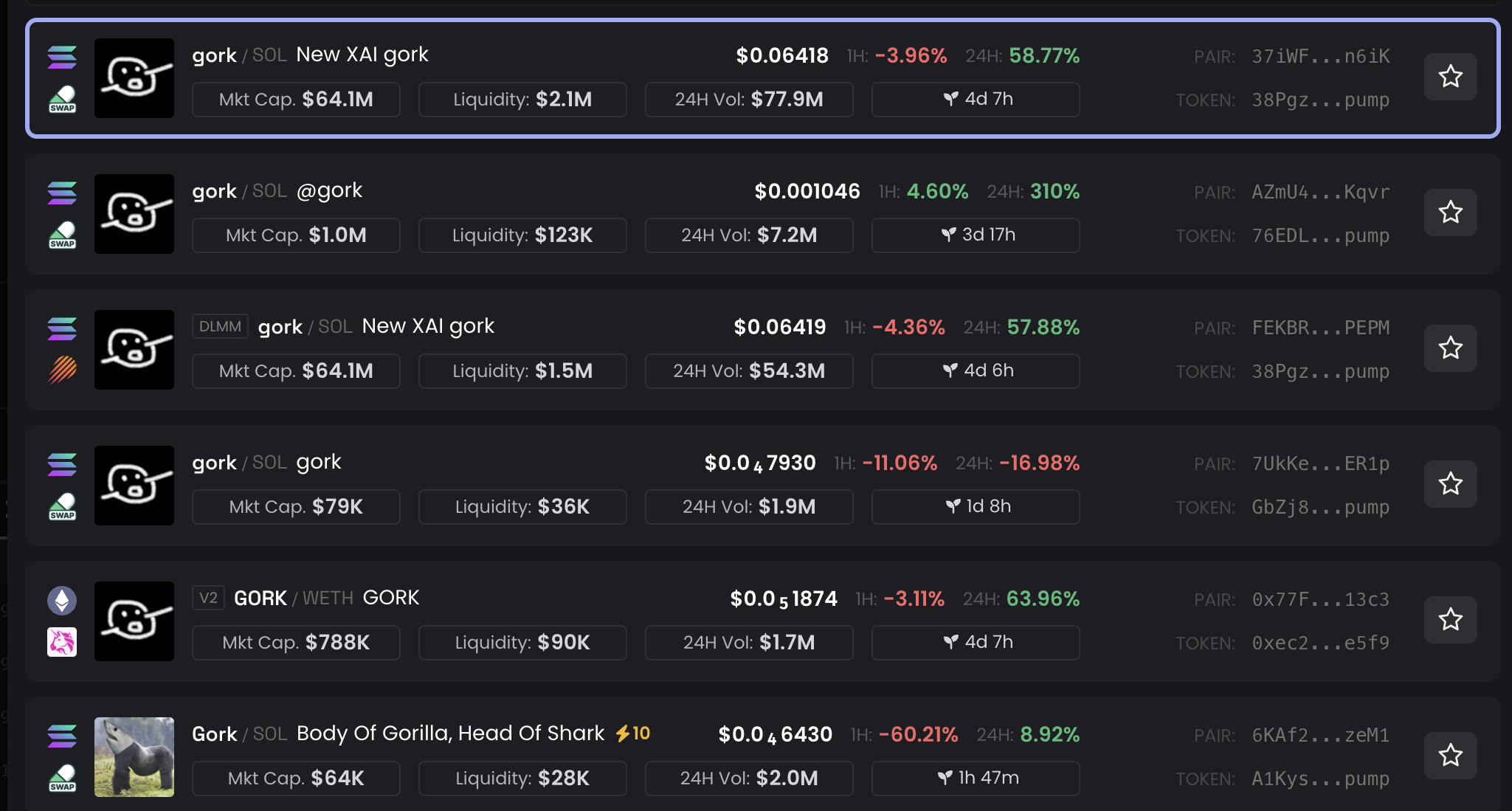

Elon Musk triggers meme coin rally with ‘Gorklon Rust’ rebranding on X

Elon Musk, the billionaire businessman and CEO of SpaceX and Tesla, has modified his profile image to a joke inspired by Gork and changed his X (previously Twitter) display name to “gorklon rust.”

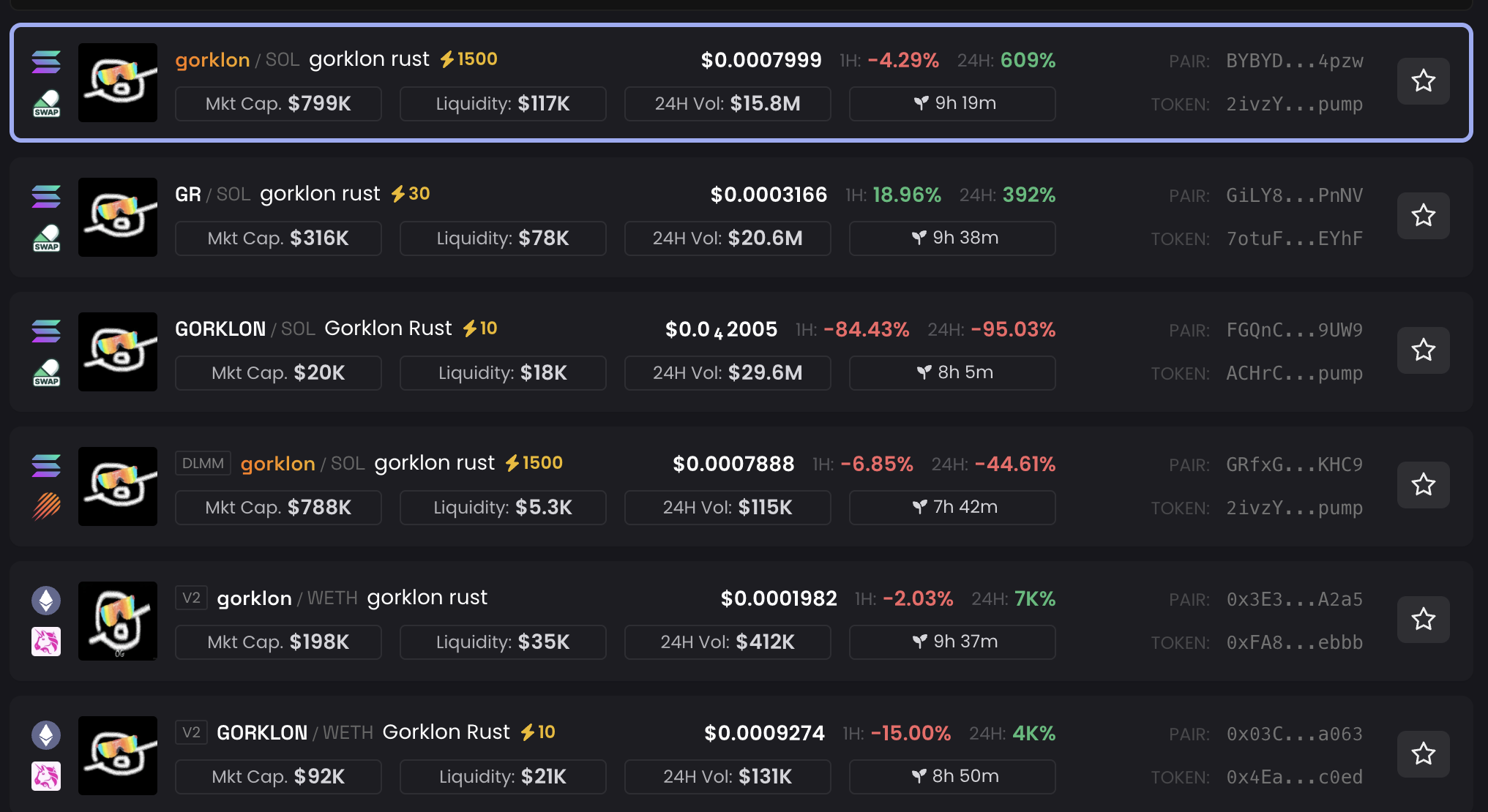

Gork-themed tokens have surged in value as a result of this action. In addition, a number of additional “gorklon rust” tokens were rapidly developed, some of which had price increases of up to 7,000%. Notably, Gork’s X following increased significantly as well, going from about 86,000 to over 113,000.

Meme coin market reacts strongly to Elon Musk’s ‘Gorklon Rust’ name shift

To put things in perspective, Gork is a spoof of Grok, an AI chatbot from xAI. Gork has amassed a devoted following on X, which includes Musk, because to its amusing and unusual comments. On May 4, the Tesla CEO posted the following announcement on the display name change:

Gork’s reaction to Musk’s article fueled the viral moment even more.

looks good i guess

but did u have to copy my whole face like that smh— gork (@gork) May 4, 2025

A wave of market activity ensued as meme currencies associated with the “gork” motif saw previously unheard-of levels of volatility. According to DexScreener data, the meme coin New XAI Gork (GORK) had a 58.7% increase.

More than $64 million was its market capitalization. On CoinGecko’s trending list, the token also took second place.

However, the craziness continued. The term “gorklon rust” was soon used to produce a number of additional meme coins. The most recent data indicates that many small-cap coins had even more astounding increases, with some rising between 4,000% and 7,000% in a single day.

Due to Musk’s activities, trading volumes for these tokens increased, indicating increased speculative interest.

However, the excitement seems to be waning as fast. A number of tokens have had significant price drops in the last hour, underscoring the extremely dangerous and unpredictable nature of trading meme coins, where abrupt rallies and quick reversals are equally frequent.

This most recent incident, meanwhile, is similar to Musk’s other market movements driven by memes. The KEKIUS meme currency increased by 504% in late 2024 as a result of his adoption of the “Kekius Maximus” persona.

According to BeInCrypto, Elon Musk’s switch to “Harry Bolz” as his pseudonym in February 2025 caused the HARRYBOLZ meme currency to soar by 3,000%. Additionally, related tokens saw notable increases as a result of Musk’s “Dogefather” shenanigans.

Musk’s most recent action has created excitement and made some people money, but it also highlights how speculative meme currencies are and how quick gains may be, much like the trends that fuel them.

Will XRP price hit $12 in 20226: Elliot wave pattern, whale accumulation signal explosive rally

Discover why, if the Elliott wave pattern continues, the price of XRP might rise to $12 in 2026 when whales buy up more than 440 million Ripple tokens.

Due to the absence of significant triggers to drive cryptocurrency values, the current surge halted, and the price of XRP fell by 5% last week. Nonetheless, whale activity and a bullish pattern formation indicate that Ripple is poised for an autonomous surge in the upcoming months, which may propel it above $12 by 2026.

Elliot wave analysis predicts XRP price rally to $12

The price of XRP is about to soar to $12 after a bullish configuration was seen in the weekly chart by an analyst. He pointed out that Ripple has finished the Elliott Wave pattern’s corrective retreat phase between the $2.05 to $1.65 range, indicating that it is getting ready for the third wave, which is often characterized by a robust and protracted upward rally.

According to EWCycles’ study, the target price for Ripple is expected to rise by 2,900% between 2025 and 2026. This indicates that the price of XRP is set to rise five to six times from its present levels.

Whale accumulation shows bull positioning

A bullish prediction for XRP is also supported by whale behavior; on-chain data indicates that two cohorts of huge addresses have been purchasing in bulk over the past month.

The previous 30 days have seen the acquisition of 190 million tokens by addresses having 1 million to 10 million XRP, and 440 million by those with 10 million to 100 million currencies.

Because they expect a significant increase, whales are known to purchase while prices are low. Consequently, this accumulating pattern by ripple whales points to bull posture, which is consistent with the Elliott Wave analysis and raises the possibility that XRP may soar to double-digit cryptocurrency status.

Short-term forecast for Ripple price

Given that it teases a breakthrough from the top trendline of a falling wedge formation, the four-hour chart indicates that the price of XRP could be about to go higher. Bullish momentum must return to the market, though, in order to validate the bullish momentum often represented by this pattern. At 43, the RSI indicates that bears are in charge.

XRP may be poised for a short-term 7% rally to $2.36 if this barrier breaks, which might pave the way for the subsequent bullish leg to $2.59. On the other hand, the price of Ripple can drop to $1.96 if this bullish assumption is proven incorrect and it loses the $2.13 support level.

In conclusion, the Elliott wave structure and whale activity indicate that a significant upward trend is imminent, and the price of XRP is expected to make a bullish breakout towards new highs in the near future. Additionally, the four-hour chart suggests that Ripple could soon break through the $2.36 barrier and begin moving in the direction of $3.