An eight-day pattern of successive inflows totaling $1.4 billion was reversed by the outflow.

Growing tensions in the Middle East seem to have alarmed institutional investors, as seen by the over $243 million withdrawal from US spot Bitcoin exchange-traded funds.

According to statistics from Farside Investors, there was a $242.6 million total outflow from the 11 US spot Bitcoin ETFs on Tuesday, October 1. This was the biggest withdrawal from BTC ETFs in over a month, following the $288 million that left on September 3.

In addition, it was the third-largest outflow day in the previous five months, breaking a run of eight straight trading days with inflows that peaked on September 27 at $494 million.

Spot Bitcoin (BTC) fell about $4,000 after Iran attacked Israel with missiles on October 1. At the time of writing, the asset had recovered to $61,620 from a two-week low of $60,315.

The nine US spot Ethereum (ETH) ETFs saw a day of withdrawals as well, with a total of $48.6 million leaving the instruments.

Grayscale’s Ethereum Trust, which lost $26.6 million on October 1, was still in the lead. A comparable $25 million was lost by the Fidelity Ethereum Trust, with the duo accounting for the majority of the losses.

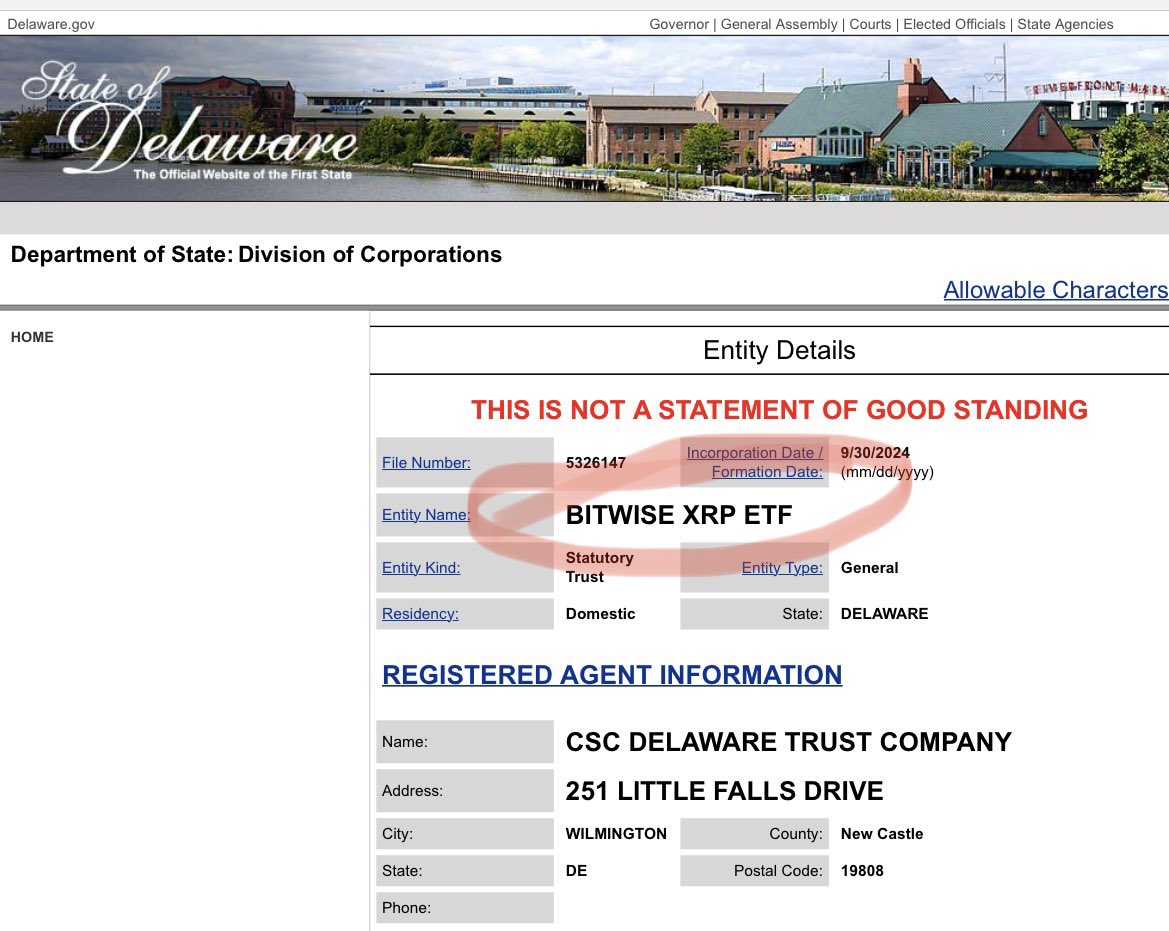

XRP price eyes $3 milestone as Bitwise files for Ripple ETF

With Bitwise’s recent filing for a Spot XRP ETF, the price of XRP has once again surpassed $0.63, which has encouraged the wider cryptocurrency market.

After previously declining to below the $0.59 level, the price of XRP has now surged beyond the $0.62 mark once more. Significantly, the price spike coincided with Bitwise’s filing for a Spot XRP ETF, which has generated a lot of market debate. With talks of a possible Ripple ETF launch in the US market gaining steam, many in the cryptocurrency industry are now projecting a spike to $3 in the next days.

Bitwise files for XRP ETF sparking optimism

On September 30, Bitwise, a well-known asset management company, registered as a Delaware statutory trust, a major step toward the creation of an XRP ETF. In the cryptocurrency industry, which has been anxiously anticipating the introduction of the ETF in the US market, the action, filed with Delaware’s Division of Corporations, has generated enthusiasm.

Notably, the registration was made at a time when interest in altcoin exchange-traded funds (ETFs) is strong, having just seen the successful US debut of Ether and Bitcoin ETFs. This development has stoked expectations that other prominent cryptocurrencies may shortly witness the release of their own ETFs.

Furthermore, talks in the market have already been sparked by Grayscales XRP Trust’s recent launch, especially in light of the ongoing legal dispute between Ripple and the US SEC. Many are now guessing whether the SEC will accept the ETF or concentrate on a possible last-minute appeal in Bitwise’s Ripple case in light of the latter’s filing.

The timing of this application only adds to the suspense around the future of Ripple’s native coin in the US.

XRP price eyes $3 milestone

The latest Bitwise filing has stoked expectations for a possible increase in the price of Ripple’s native cryptocurrency. As I was writing this, the price of XRP shot up about 5% and above the short $0.62 barrier. Notably, the cryptocurrency reached a high of $0.6336 after the ETF registration update, demonstrating the investors’ increased confidence.

Additionally, at the same time, the cryptocurrency’s trading volume increased 36% to $2.74 billion, demonstrating rising market confidence. A prominent cryptocurrency specialist, meanwhile, predicts that XRP will surpass $3 before Christmas, which has also caused speculation in the market.

That being said, the market now expects the cryptocurrency to rise much higher in the upcoming days. In addition, there is increasing talk over whether the cryptocurrency may continue its bullish run into the fourth quarter as the deadline for a possible US SEC appeal draws near.